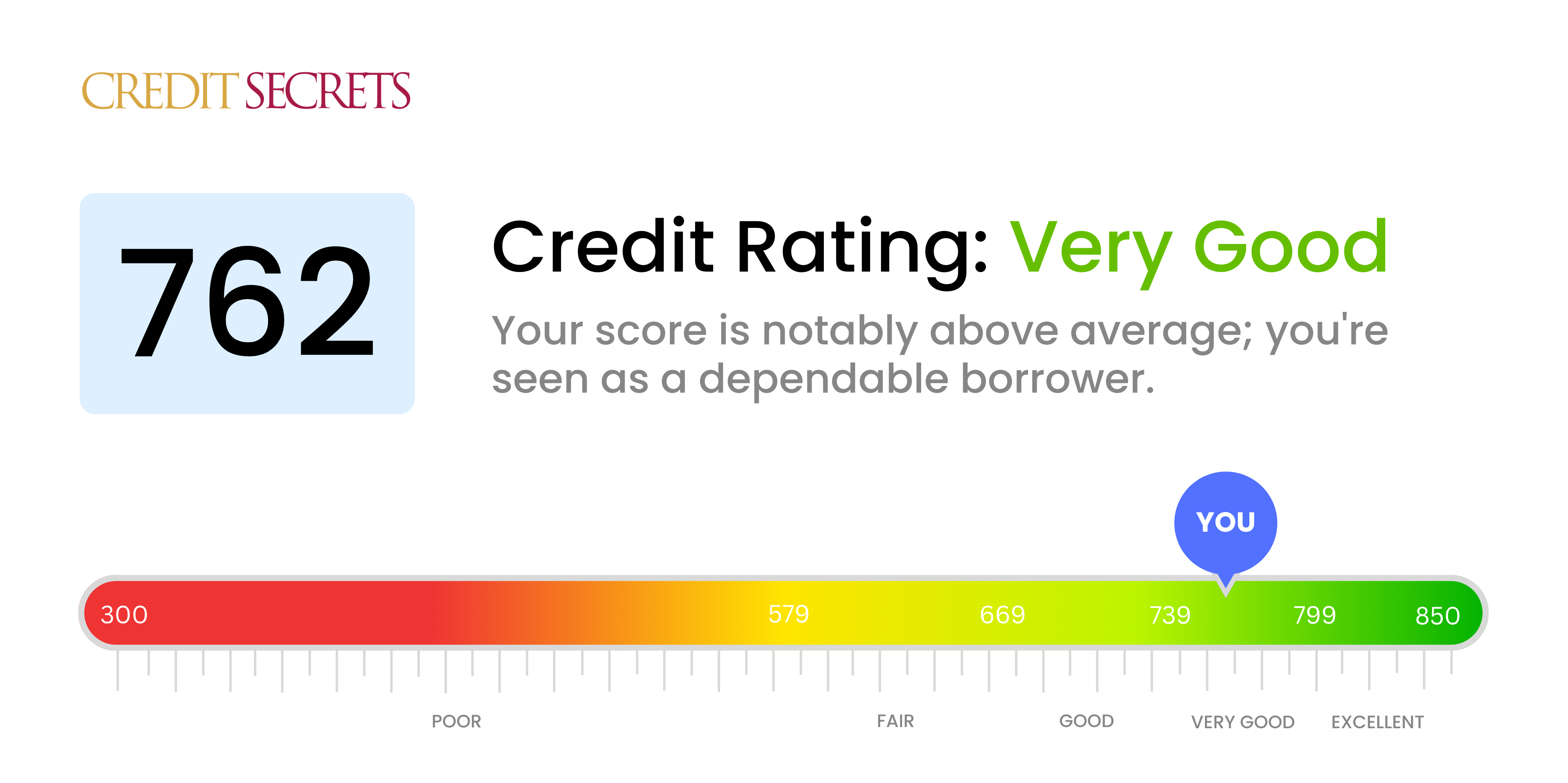

Is 762 a good credit score?

With a credit score of 762, you are in the realm of 'very good' according to typical credit score rankings. This means lenders will regard you as a low-risk borrower, giving you a great chance of being approved for credit at competitive interest rates.

You can expect to have no issues when it comes to getting accepted for credit cards, loans, or mortgages, along with advantageous terms. However, there's still room for a little improvement to reach the 'excellent' category; so don't stop your hard work of keeping up with timely payments, maintaining a low balance, and monitoring your credit regularly.

Can I Get a Mortgage with a 762 Credit Score?

With a credit score of 762, you are very likely to be approved for a mortgage. This is a strong score and clearly demonstrates a responsible approach to managing credit and a record of timely payments. Typically, lenders see individuals with this credit score as low risk, increasing your chances of mortgage approval.

As you navigate the mortgage approval process, understand that although your credit score plays a big role, lenders will also consider your income, job stability, and overall financial situation. Make sure you're prepared with all necessary documents and information. Furthermore, a high credit score not only increases the chances of your mortgage application being approved but it can also potentially lead to better interest rates being offered. Remember, being proactive and prepared can help smooth the process.

Can I Get a Credit Card with a 762 Credit Score?

If you have a credit score of 762, your chances of approval for a credit card are high. Lenders generally regard this score as excellent, demonstrating your responsible financial behavior. This good credit rating can be a significant asset in your financial journey, suggesting that you have a solid history of handling credit well.

Since your score is impressive, you’re likely to be eligible for some of the most rewarding credit card offers available. You can consider applying for premium travel cards, for instance, which come with perks like air-miles, hotel discounts, and more. Additionally, you may be eligible for cards with low interest rates and high credit limits. Remember to carefully review each offer and choose a card that fits your spending habits and lifestyle. This can help optimize the benefits you receive from your good credit score without falling into unnecessary debts.

With a credit score of 762, you are in a strong position to be approved for a personal loan. As lenders view this score as a positive indication of creditworthiness, you are likely to enjoy better terms and opportunities on personal loan offers. Your high score demonstrates your consistent history of responsible credit management, which lenders recognize and reward.

During the loan application process, lenders may offer you lower interest rates compared to someone with a lower score. This is a reflection of the confidence they place in your ability to repay. However, remember that your credit score is just one part of the picture. Lenders will also take into account your income, employment stability, and debt-to-income ratio before making a final decision. But rest assured, a credit score of 762 is a compelling starting point in the loan application process.

Can I Get a Car Loan with a 762 Credit Score?

If you have a credit score of 762, you're in a pretty solid position when it comes to applying for a car loan. Lenders often consider scores above 660 as favorable, and your score surpasses this threshold significantly, indicating to lenders that you're a lower-risk borrower. This all culminates in a higher probability of your car loan being approved.

The process of buying a car with good credit, like yours, generally involves getting pre-approved for a loan, which will allow you to walk into the dealership knowing exactly how much you can afford. You should expect a smoother process with potentially lower interest rates, due to your high credit score. Remember, it's crucial to review all the terms carefully to be sure you're getting the best deal possible. The better your credit, the more room you have to negotiate terms and to possibly secure a lower interest rate. So, the power is in your hands!

What Factors Most Impact a 762 Credit Score?

Understanding your credit score of 762 is the first step towards maintaining excellent credit. Analyzing the major contributing factors can augment your financial foresight. Like all financial journeys, yours is distinct and a learning experience.

Near-Perfect Payment History

Your payment history is likely excellent, as this is a heavily weighted component of your score. Few, if any, late payments will be found on your record.

How to Check: Examine your credit report for any missed or late payments. Continued punctuality will keep your score high.

Optimal Credit Utilization

Your credit utilization is most likely in the ideal range. This means your credit card balances are low compared to your overall limits.

How to Check: Review your credit card statements. Consider if you’ve been maintaining a balance lower than 30% of your credit limits.

Long Credit History

You likely have a significant credit history, favoring your score. Long-term account holders are seen as less risky, rewarding you with higher scores.

How to Check: Look at your credit report to gauge the age of your accounts. Older accounts suggest responsible, stable credit use.

Diverse Credit Mix

Your score suggests a diverse mix of credit, from credit cards to loans. This variety exhibits your ability to manage different types of credit.

How to Check: Review your credit accounts. A diverse mix positively impacts your credit score.

Minimal Hard Inquiries

A good credit score like yours implies limited hard inquiries. These are the results of applications for new credit, which can temporarily drop your score.

How to Check: Review your report for recent hard inquiries. Future applications should be made cautiously.

How Do I Improve my 762 Credit Score?

While a credit score of 762 is seen as extremely good, you may still aim for perfection. Here are some specialized steps to further improve your credit standing from this advantageous position:

1. Maintain Existing Accounts

With such an impressive score, it’s clear you’ve been responsibly managing your existing credit. Keep up the excellent work by paying all your account balances on time and avoiding late payments. Be very cautious about closing any credit lines as this can reduce your credit history length and potentially lower your score.

2. Scrutinize Your Credit Report

Being proactive about checking your credit report can avoid unexpected credit score changes. Regularly review it for discrepancies or mistakes, and if found, contact the appropriate authorities to rectify the situation.

3. Limit Credit Applications

New credit enquiries can affect your credit score. So, if you want to keep that score glowing, minimize new credit applications to only when it’s necessary.

4. Keep Utilization Low

Your score indicates you’re likely already doing well here, but it’s crucial to continue keeping your credit utilization low. Always aim to keep it below 30% of your credit limit for all cards.

5. Variety of Credit

Exhibit your ability to manage various types of credit. If your credit portfolio is not diverse, consider adding a different type of credit, such as an auto loan or personal loan, but only if they align with your financial goals.