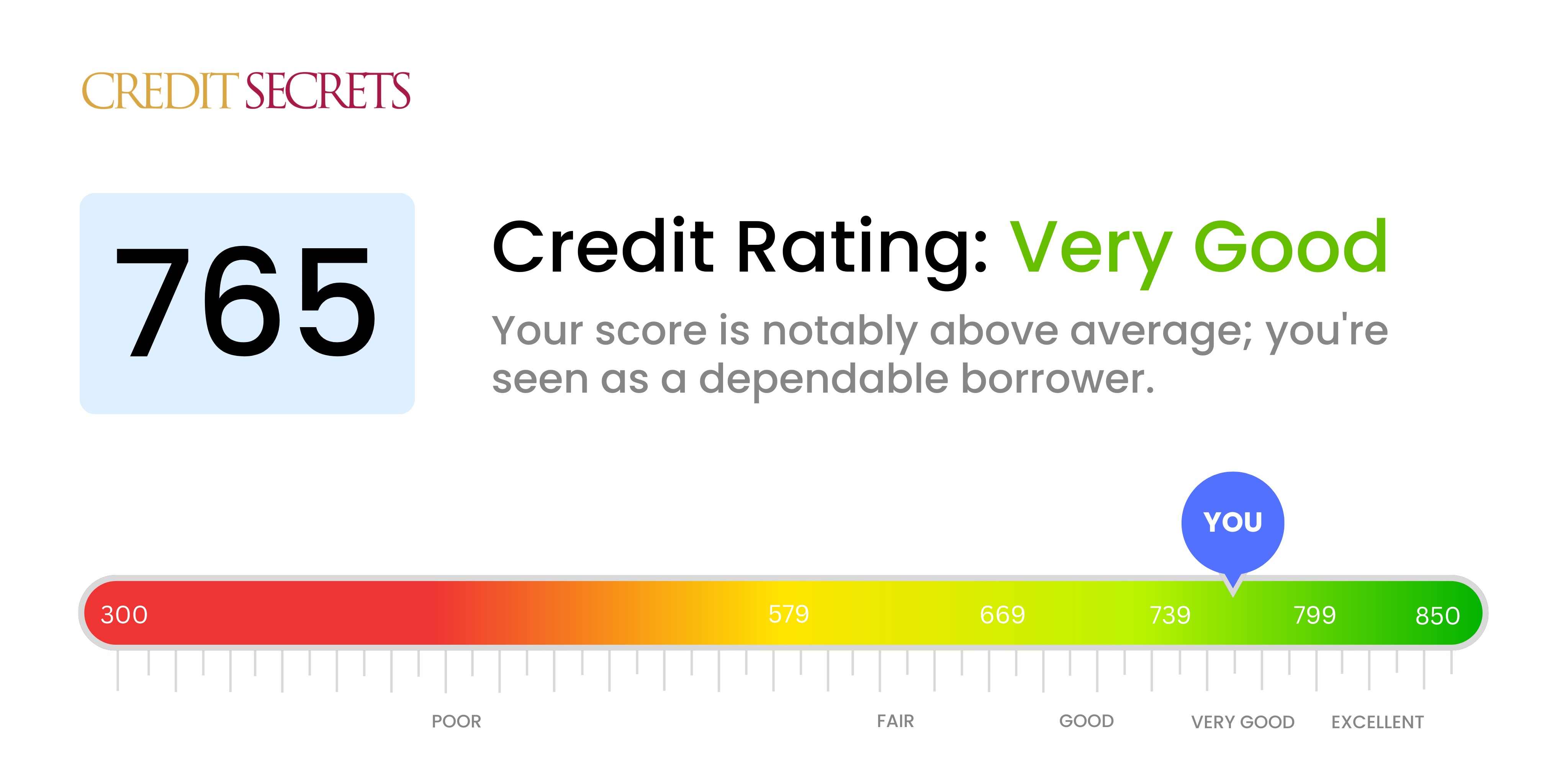

Is 765 a good credit score?

With a credit score of 765, you are doing well as this falls into the "very good" category. Having such a score often implies that you are likely to receive favorable interest rates and terms when it comes to borrowing, however, continuing to monitor and improve your credit can provide even more benefits.

A score of 765 can set you up for future success, giving you a strong financial foundation. Remember, maintaining good habits like paying your bills on time, keeping balances low, and only opening new credit lines when necessary will serve to uphold and gradually enhance your score over time.

Can I Get a Mortgage with a 765 Credit Score?

With a credit score of 765, you are likely to be granted approval for a mortgage. This is a solid score well above average which implies a dependable payment history and responsible credit utilization. Lenders view applicants with such scores as low-risk candidates, leading to an increased probability of mortgage approval.

In the mortgage approval process, anticipate lenders to critically evaluate your credit history, income level, and debt-to-income ratio. While a credit score of 765 is a noteworthy strength, ensure that these other factors also portray a healthy financial profile. It's important to note that with a higher score like yours, you may also qualify for lower interest rates on your mortgage. This is because lenders view you as a lower risk borrower. Though the mortgage approval process can feel lengthy, remember that your strong credit score puts you in a prime position for approval and advantageous terms.

Can I Get a Credit Card with a 765 Credit Score?

With a credit score of 765, chances are high for approval when applying for a credit card. This score is often seen as very good, indicating financial responsibility and consistent bill payment. It's a reflection of dependability which places you in good standing with prospective lenders. It's positive news, and a credit to your financial history and ongoing efforts.

This advantageous score opens the door to a variety of credit card options. Premium travel cards, often earmarked for those with high scores, can provide perks like air miles and global entry. Cashback cards are also a solid choice, offering a return on everyday purchases. However, do remember that despite your strong score, interest rates can still vary significantly based on the lender and type of card. Still, with your 765 score, odds are on your side for not just approval, but favorable rates as well. Remember to carefully review all card conditions and benefits to choose the most suitable option.

A credit score of 765 is generally considered an excellent rating. With a score this high, you're likely to receive positive feedback when you apply for a personal loan. Lenders view this score as a strong indicator of responsible financial behavior, creating a sense of confidence in your ability to repay borrowed funds.

The application process for a personal loan should be straightforward. However, maintaining your high credit score while applying for a loan is essential. Consequently, the application process is crucial. Since a high credit score like yours often leads to lower interest rates and more flexible repayment terms, you should shop around for the best offer. While it's never a guarantee, your excellent credit score significantly increases the likelihood of being approved for a loan. You have every reason to feel hopeful about your prospects.

Can I Get a Car Loan with a 765 Credit Score?

With a credit score of 765, there is a very high likelihood of approval for a car loan. Lenders generally see a score like this as a sign of good financial responsibility. This score is well above the typical minimum of 660 that is often preferred by lenders, placing you in an excellent position when seeking to finance a vehicle purchase. It's a testament to your creditworthiness, showing that you have a solid history of responsibly managing your finances.

Once approved, the process of buying a car with your impressive credit score can be smoother and more advantageous to you. Your excellent score might not just guarantee approval, but also obtain more favorable loan terms, like lower interest rates. This reflects the trust that lenders have in you to pay back the loan in a timely manner. So, as you navigate your car purchasing journey, take comfort in the strength of your credit score and the financial opportunities it reassures.

What Factors Most Impact a 765 Credit Score?

Understanding a credit score of 765 is critical in guiding you on your financial course. With a score like this, you're doing well, but there is always room for improvement. Let's delve into several factors that can impact your score.

Credit Utilization Ratio

This indicates how much of your available credit you're currently using. Keep this ratio low because high utilization may affect your score.

How to Check: Look at your credit card balances compared to their limits. Endeavor to keep this ratio below 30% to maintain your score.

Payment Consistency

Despite having a good score, the key to pushing it higher is to ensure you're consistently making payments on time. Late payments can significantly impact your score.

How to Check: Monitor your credit report regularly to see if there are any late payments. Aim for consistent, timely repayments to boost your score.

Length of Credit History

A longer credit history usually translates into a higher score because it demonstrates financial responsibility over a longer period.

How to Check: Review your credit report to find out the length of your credit history. Be cautious when considering closing old accounts, as this can shorten your credit history.

Types of Credit

An optimal mix of various types of credit can enhance your score, such as car loans, mortgages, and credit cards.

How to Check: Look at your current types of credit. Aim for a diversified mix to maintain a healthy score.

Frequency of Applications

Frequently applying for new credit can prompt hard inquiries, which can lower your score. Limiting these inquiries can help maintain your 765 score.

How to Check: Check your credit report for recent inquiries. If they are many, consider limiting new credit applications for a while.

How Do I Improve my 765 Credit Score?

With a credit score of 765, you’re on track with your financial health. Your main focus should be on maintaining this healthy score and taking steps to push your score into the excellent range. Below are some strategies catered to your situation:

1. Keep Low Credit Utilization

One of the powerful influences on your credit score is how much of your available credit you are using, known as credit utilization. Aim to keep your credit utilization ratio below 30%, and ideally, under 10%. If you have to carry a balance forward, consider spreading it across multiple cards to keep the utilization low on each individual line of credit.

2. Monitor Your Credit Regularly

Being vigilant about your credit score and reports is essential at this stage. Sign up for credit monitoring services that alert you about significant changes or irregular activity. It can help you detect any fraudulent activity that could potentially harm your credit score.

3. Maintain Older Accounts

The length of your credit history affects your score. So, maintain your older credit card accounts even if you’re not using them. Closing them could shorten your credit history and lower your total available credit, which might hurt your score.

4. On-time Bill Payments

Make sure you pay all your bills, not just credit card or loan payments, on time. Late payments can significantly affect your credit score. Set up automatic payment reminders to avoid missing due dates.

5. Limit New Credit Applications

Every new credit application has a temporary negative effect on your credit score. So, unless absolutely necessary, limit applying for new credit. Instead, improve your score through responsible management of existing credits.