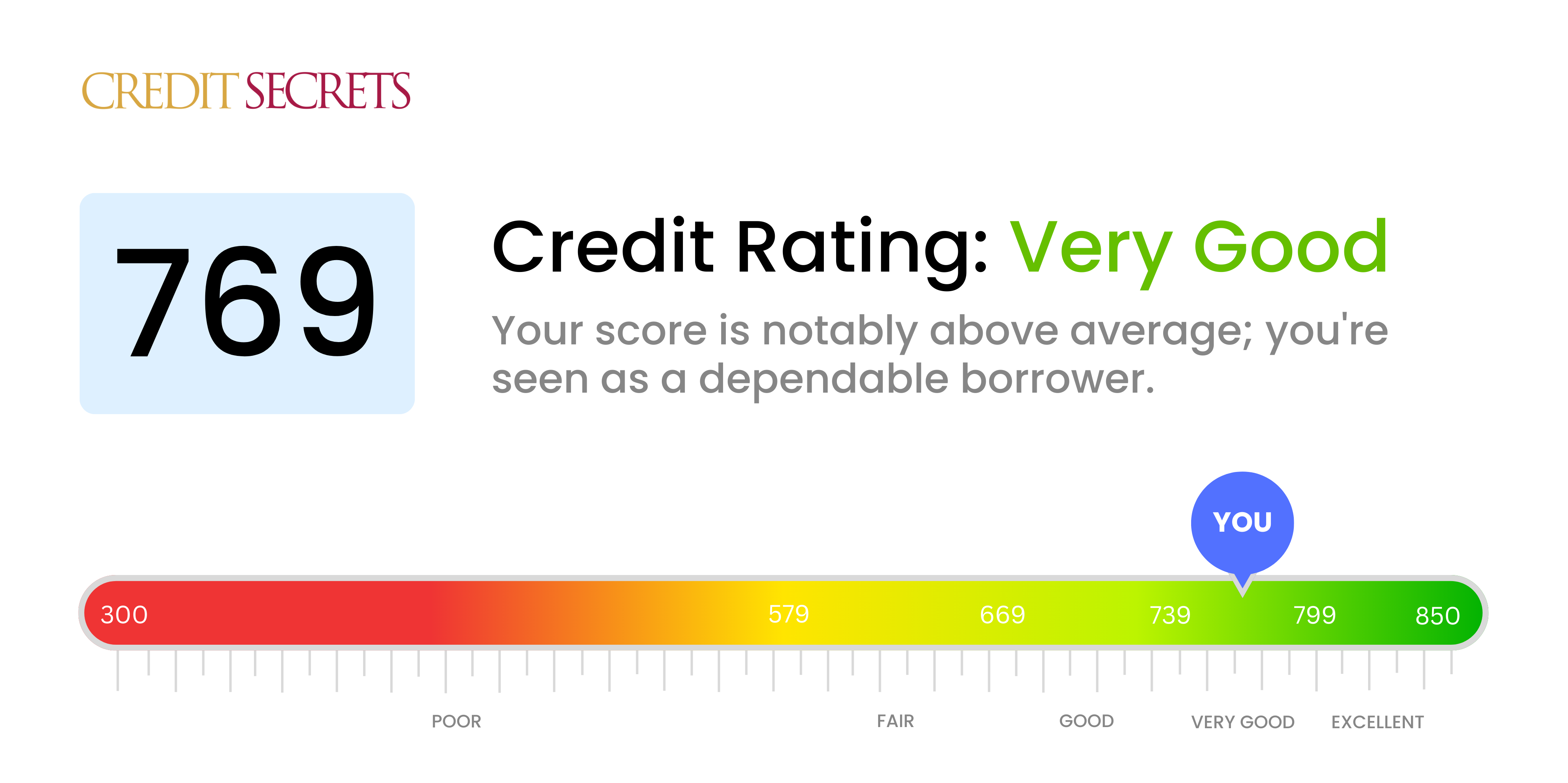

Is 769 a good credit score?

If your credit score is 769, that means it's considered very good. It's an encouraging sign of your financial health, meeting and even exceeding the expectations of many lenders and financial institutions.

With a score in this range, you're often viewed as a lower risk to lenders, which means you're likely to experience a smoother process when applying for credit cards, mortgages, or loans. You can expect better interest rates, greater borrowing limits, and more favorable lending terms. Keep maintaining your credit habits to potentially push your score into the excellent range.

Can I Get a Mortgage with a 769 Credit Score?

With a credit score of 769, you're in a strong position to be approved for a mortgage. This score is significantly above the minimum most lenders require and reflects a history of consistent, responsible credit usage.

As you proceed with the mortgage approval process, please keep in mind that while a high credit score improves your chances of approval, lenders also take into consideration other factors like your income, employment status, and debt-to-income ratio. Your favorable credit score may also help you qualify for lower interest rates, potentially saving you a significant amount of money throughout the term of your mortgage. That being said, always ensure you can comfortably afford the mortgage before proceeding. Financial security and well-being should always be your top priority.

Can I Get a Credit Card with a 769 Credit Score?

If you're in possession of a 769 credit score, there's good news. This is a remarkably solid score and shows to lenders that you've handled your credit obligations well. This means that your chances of approval for a credit card are high. It's critical to be mindful of this advantage; it reflects your hard work and financial discipline.

With such an impressive credit score, several options open up for you in terms of the type of credit card you could apply for. Premium travel cards, cards with high rewards rates, or even cards that offer special perks for small businesses might be within your reach. Bearing in mind though, it's important that you choose a credit card that is apt for your lifestyle and spending habits. For example, travel cards can provide real value only if you travel frequently, and rewards cards are most beneficial if you're able to offset any annual fees through the rewards you earn. Always remember, while a higher credit score grants you better options, it's vital to make choices that keep your financial situation sturdy.

With a credit score of 769, you're in a great position for securing a personal loan. This score falls within the 'excellent' credit range, indicating you have consistently demonstrated responsible credit management. It signifies to lenders that you're a low-risk borrower, thus increasing your likelihood of loan approval. Remember, though, every lender has different criteria and a high credit score doesn't guarantee approval.

When applying for a personal loan with this credit score, you can anticipate favorable interest rates and terms due to your low risk status. Your application process should be smoother, as lenders would likely view you as a reliable borrower. Keep in mind that lenders will also look at other factors like your income and employment status. Nonetheless, with your impressive 769 credit score, you can confidently approach the lending process with optimism. Keep demonstrating responsible financial habits to continue enjoying these benefits.

Can I Get a Car Loan with a 769 Credit Score?

With a credit score of 769, you're in an excellent position for approval when it comes to a car loan. Lenders often look for credit scores above 660 for prime lending terms, and your score well exceeds that threshold. This impressive score means a lender is likely to see you as low risk—the kind of borrower who's reliable in repaying borrowed money.

Additionally, such a robust score can provide you with a smoother car buying journey overall. You can expect potentially lower interest rates on your loan, thanks to the reduced financial risk you represent. And compared to lower scores, you'll likely find a greater selection of lending options and more flexible terms. Remember, your credit score is a key factor in the lending process, but it's always important to research, understand all the terms, and ensure the loan you opt for supports your overall financial goals.

What Factors Most Impact a 769 Credit Score?

Maintaining your credit score of 769 requires an understanding of the factors that can influence it in an impactful way. Let's explore what might be contributing to your current score and how to keep it strong.

Length of Credit History

Given your score, it's likely that you have a long history of responsible credit use. The age of your oldest account, the overall average age of your accounts, and how recently you may have opened new credit can affect your score.

How to Check: Assess the age of your credit accounts by reviewing your credit report. Keep in mind that opening new credit could reduce the average age of your accounts.

Credit Utilization Ratio

Your score suggests you likely maintain a healthy credit utilization ratio. This refers to the percentage of your available credit that you're currently using. Ideally, this ratio should be below 30%.

How to Check: Examine your credit card balances compared to their limits. Keeping your balances well under the limits is beneficial.

Payment History

Your score suggests you have been making your payments on time. Consistency in payment reflects positively on your credit score.

How to Check: Look through your credit report for any late or missed payments. Continued on-time payment is important for your score.

Credit Mix

Having a variety of different types of credit — such as credit cards, installment loans, and mortgage — can be a positive factor for your credit score.

How to Check: Review your credit report to see the mix of your credit accounts. Try to maintain diversity in your credit types.

Public Records

Your score suggests you might not have negative public records, such as bankruptcies or tax liens, which can drastically affect your score.

How to Check: Examine your credit report for any public records. Promptly address any items you find.

How Do I Improve my 769 Credit Score?

With a credit score of 769, you’re already in the ‘very good’ bracket — kudos! Here’s how you can step up your game to reach an ‘exceptional’ credit score.

1. Continue Timely Payments

Maintaining a perfect record of punctual payments is critical for your credit score at this stage. Make sure you pay all bills on time, every time.

2. Moderate Hard Inquiries

Multiple hard inquiries – like applying for multiple loans or credit cards – can subtly harm your credit score. Limit these inquiries unless absolutely necessary.

3. Carefully Expand Credit Portfolio

A broader blend of different credit types — like home loans, personal loans, or car loans — displays trustworthiness to creditors. But remember, apply only for credit you need and can afford.

4. Monitor Your Credit

Keep a close eye on your credit reports. Look out for any discrepancies or signs of identity theft that could pull your score down.

5. Maintain Low Credit Card Balances

Even though you’ve been managing your credit well, keep your credit card balances low. High balances could impact your credit utilization ratio negatively.

Every little step towards maintaining and improving your credit health makes a difference. With careful management, reaching an ‘exceptional’ credit score is well within your grasp.