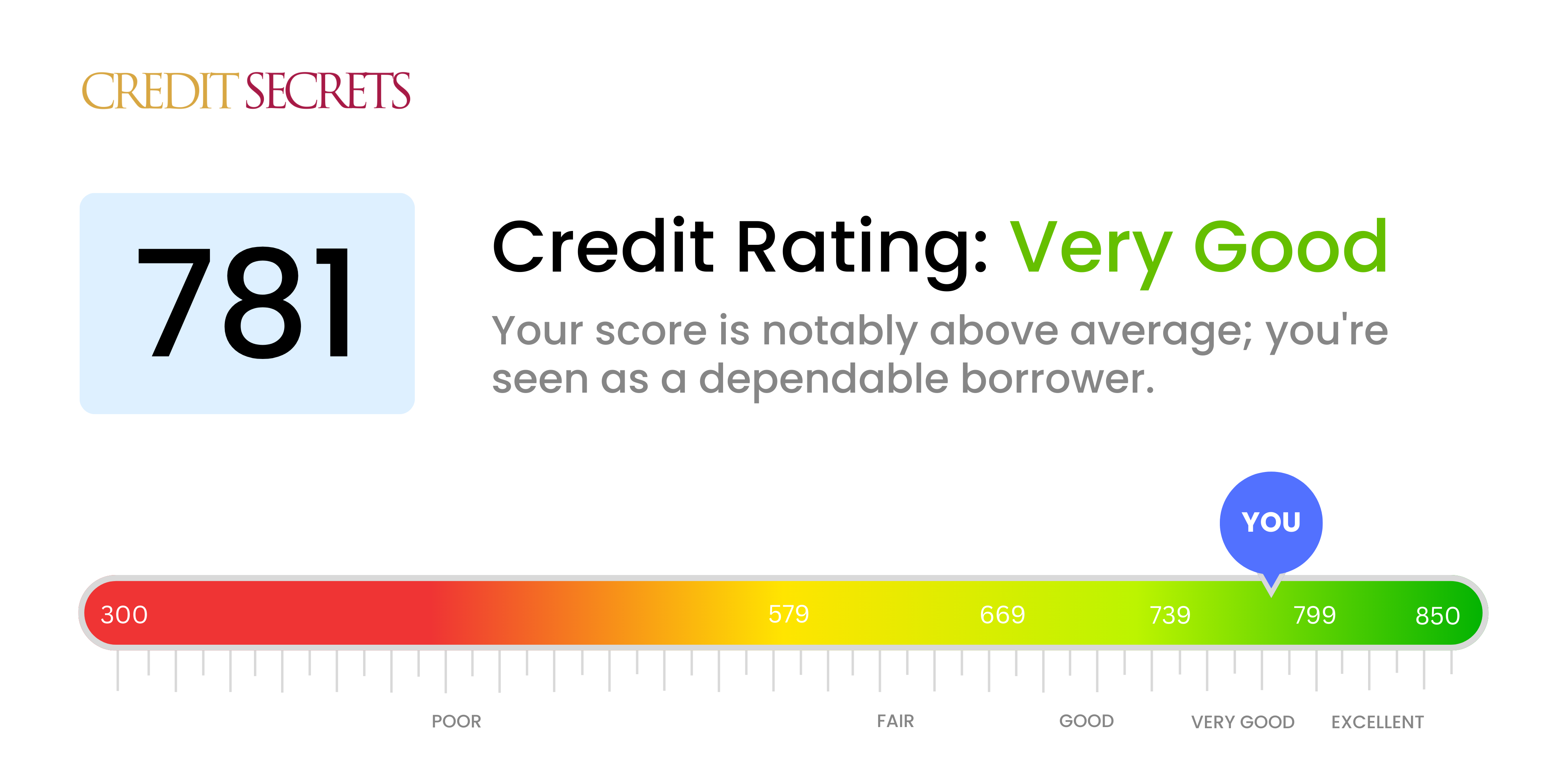

Is 781 a good credit score?

Your credit score of 781 falls into the 'Very Good' category. With such a score, the future seems promising as you are more likely to be approved for credit, and possibly with lower interest rates on loans and credit cards.

More doors are open for you with this score; lenders see you as a low-risk borrower, and therefore, it could be easier for you to rent an apartment, get utilities without deposits, and even secure a job in some industries. Remember, maintaining this score or pushing it to 'Excellent' could potentially save you thousands of dollars over the course of a loan. Stay responsible with your finances, and you’ll likely enjoy the benefits that come with having a Very Good credit score.

Can I Get a Mortgage with a 781 Credit Score?

If your credit score is 781, you are highly likely to be approved for a mortgage. This is a strong score and demonstrates to lenders that you have a history of being reliable and responsible with your debt obligations. Your healthy credit score reflects prudent financial habits, like paying bills on time and keeping credit card balances low.

During the mortgage approval process, keep in mind that the higher your credit score, the better interest rate you're likely to secure on your loan. This can mean significant savings over the life of your mortgage. Having a credit score of 781 not only increases the chance of your mortgage application getting approved, but it may also open up a wider range of mortgage options for you. However, it's important to remember every lending institution has its own specific set of standards and a high credit score doesn't guarantee approval. Always make sure to research and prepare thoroughly.

Can I Get a Credit Card with a 781 Credit Score?

With a credit score of 781, you are in an excellent position for credit card approval. This score suggests you've demonstrated responsible behavior in managing your finances and meeting your obligations. Lenders view such a high score as a strong sign of creditworthiness, increasing your chances of approval for a wide variety of credit cards.

Given your high credit score, you can take advantage of the best credit cards in the market. This includes premium travel cards that offer numerous perks like airline miles, hotel points, and other travel benefits. Other options involve cash-back and reward cards that give you a chance to earn as you spend. However, remember to keep an eye on the interest rates associated with different cards. Even though you are considered low-risk due to your high credit score, rates can vary significantly between different card providers. Always take the time to understand the terms and conditions before you proceed."

With a credit score of 781, you're in an excellent position to secure a personal loan. This score is far above the benchmark set by most traditional lenders, reflecting a strong history of responsible financial behavior. Being considered a low risk by lenders, you would likely be approved for a personal loan with better terms and lower interest rates.

As you navigate the personal loan application process, expect most lenders to view your profile favorably. Because of your high credit score, you may be able to negotiate for better terms, and you'll likely have your pick of lenders. However, it's important to shop around and compare rates and terms as not all loans are created equal. Keep in mind, while a good credit score increases your chances of approval, it doesn’t guarantee it. Lenders may also consider other factors like income and debt-to-income ratio. Remember, making informed decisions about your finances is key to maintaining your high credit score.

Can I Get a Car Loan with a 781 Credit Score?

Having a credit score of 781 is generally considered excellent and places you in the top tier of borrowers. This opens up doors for you as it indicates that you've managed your credit well in the past. For car loans, you're most likely standing on favorable grounds. Lenders use credit scores to assess the potential risk posed by lending money, and a score of 781 signals a low risk.

However, keep in mind that while a high credit score significantly improves your chances of approval, it doesn't guarantee it. Other factors such as your income and existing debt can also impact the lender's decision. That said, your impressive score should help facilitate a smoother and more straightforward process. Additionally, lenders are likely to offer you more attractive interest rates compared to borrowers with lower scores. Being financially conscientious has its rewards, and you're in the perfect position to discover this as you navigate through the car buying process.

What Factors Most Impact a 781 Credit Score?

Understanding your credit score of 781 is key to building on your financial strengths and identifying areas for enhancement. In all likelihood, your score indicates good financial behaviors. However, it's always helpful to be attuned to those factors that may subtly impact your score.

Payment Habits

Timely bill payment is crucial to good credit. Any slight payment delays could slightly affect your otherwise strong score.

How to Check: Peruse your credit report for any instances of late payments. Consider your payment habits and any potential areas for improvement.

Credit Usage

See if your credit card balances are low relative to your overall credit limit, ideal for maintaining a healthy score.

How to Check: Take a look at your recent credit card statements. Aim to keep balances well within your overall credit limit.

Credit History

It's beneficial to have longstanding and varied types of credit. Even a smooth track record might be improved with more variety and age in your credit history.

How to Check: View your credit report for the types and ages of your credit accounts. Reflect on recent changes, such as opening or closing accounts.

Public Records

Even with a good score, it's worth checking for any public records that could be lurking on your report, as they can have a negative effect.

How to Check: Review your credit report for any public records. If found, these should be resolved as soon as possible.

New Credit Applications

Frequent applications for new credit can lower your score. Be mindful about regularly applying for new credit.

How to Check: Check your report for frequency of new credit applications. Consider if you have applied for multiple accounts in a short period of time.

How Do I Improve my 781 Credit Score?

A score of 781 is categorized as an excellent credit score. However, there are always minor tweaks that can be made to place you in an even stronger financial position. Here’s what you can do at this level:

1. Review Your credit reports

Even if you’re in the ‘excellent’ category, there may still be potential errors on your credit reports. Regularly request copies of your credit reports from each bureau and comb through the details for any discrepancies. Fixing any errors ensures your credit score evaluates your genuine financial behaviour.

2. Maintain Low Credit Utilization

Just because you have a high credit limit, it does not mean you need to utilize it fully. A good rule of thumb is to keep your credit utilization under 30% of your total credit limit. This signals to lenders that you manage credit responsibly.

3. Long-term Credit Management

The length of your credit history impacts your credit score. Instead of closing unused credit cards, keep them open. This can lengthen your overall credit history and potentially improve your credit score. But, be mindful of any annual fees that may apply.

4. Stay Consistent

Consistency is critical. Make sure to promptly pay all your bills – not just credit cards or loans. Late payments on any account may detract from your otherwise impeccable score.

5. Diversify cautiously

Diversifying your credit can potentially boost your score. However, at your score level, be cautious about opening unnecessary credit lines which may not only lead to additional debt but may also cause temporary dips in your score due to hard inquiries.