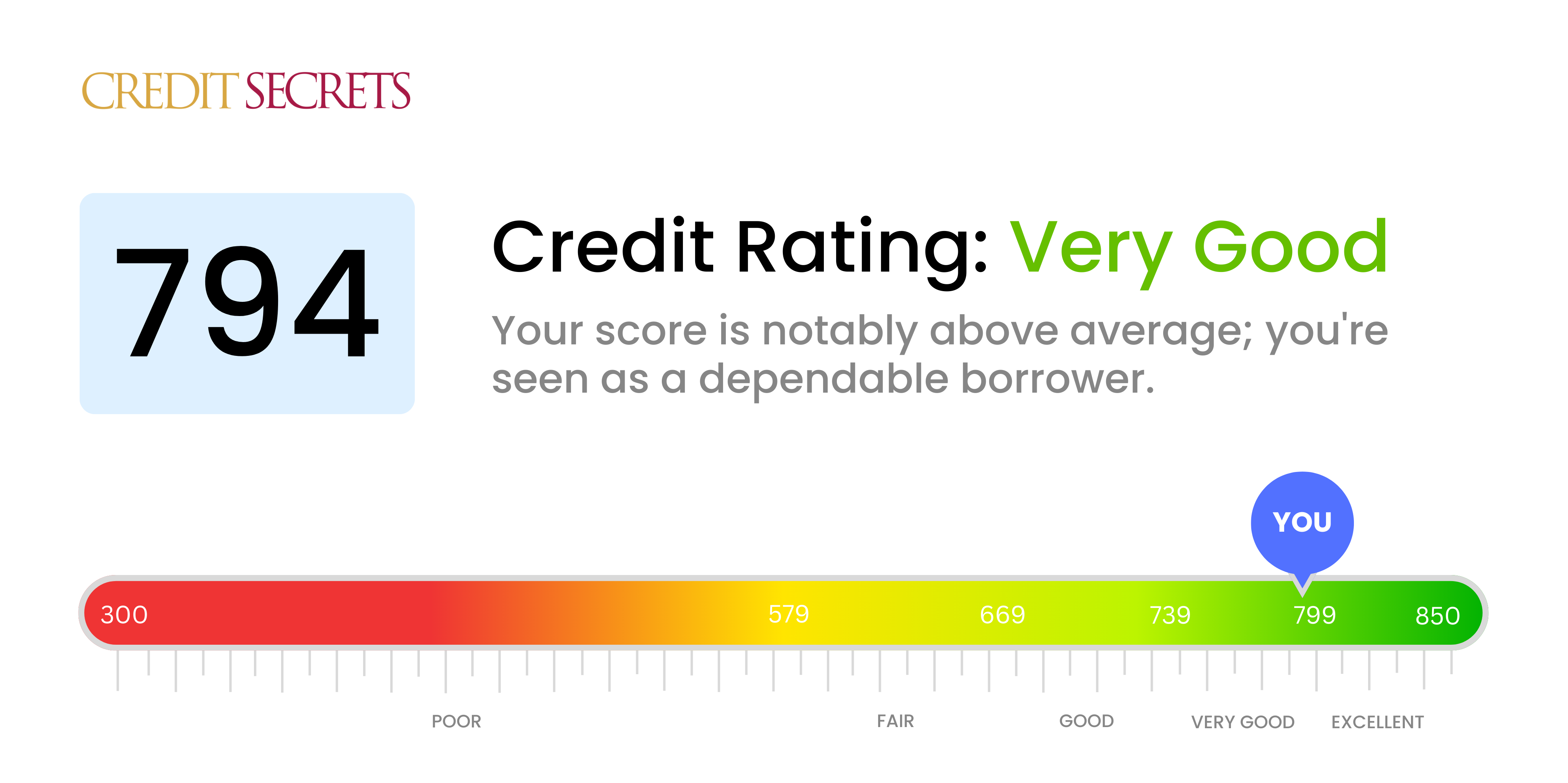

Is 794 a good credit score?

With a credit score of 794, you're rightly placed in the 'very good' category. This means any applications for credit cards or loans will likely be met with approval, as lenders will see you as a trustworthy borrower. You'll likely be eligible for lower interest rates and favourable terms. This strong financial position might be the result of responsibly managing your credit, but there's still a bit of room for you to reach the 'excellent' credit score range. With the same care and strategic financial management, you can aspire to get into that top tier.

Even with a high credit score, it's crucial to continue practicing good financial behaviors. These include regularly reviewing your credit report, paying your bills on time, and not maxing out your credit cards. Keep in mind that credit scores can fluctuate due to various factors, and a few minor missteps could potentially pull your score down. Remember, maintaining a very good credit score is a continual process, not a destination. Stay diligent in your financial habits, and you'll be poised to keep enjoying the benefits that come with a very good credit score.

Can I Get a Mortgage with a 794 Credit Score?

With a credit score of 794, you stand a remarkably high chance of being approved for a mortgage. A credit score such as yours is well above the average and is viewed positively by lenders as it signifies a consistent history of responsible financial management and on-time payments. This is a strong position to be in and opens up numerous financial opportunities for you.

As you move forward in the mortgage approval process, it's important for you to know what to expect. Initially, lenders would carefully review your credit report to ensure there are no significant issues such as a recent bankruptcy or outstanding debts. In addition, with such a strong score, you can expect to qualify for some of the best interest rates on the market, effectively saving you potentially thousands over the lifespan of your loan. Remember, maintaining this score will serve as a strong influence on your financial future.

Can I Get a Credit Card with a 794 Credit Score?

With a credit score of 794, chances of getting approved for a credit card become quite favorable. This score reflects a strong history of responsible credit management, instilling confidence within potential lenders. Yet, it is essential to keep up these good habits, as maintaining such an impressive credit score requires dedication and discipline.

For individuals boasting a score like this, a world of credit card options becomes accessible. Secured cards or starter cards may no longer be necessary. Instead, consideration can be given towards premium cards. Some of them offer lucrative rewards programs, extensive travel perks or cash back options, letting you gain additional benefits from your responsible credit usage. Even with such a high score, remember that interest rates still matter. Best is to explore all options, compare interest rates, and select a credit card that's best suited to your financial needs and habits. Remember, while this score opens multiple doors, it's crucial to continue managing your credit judiciously. It's your responsible use of credit that got you here in the first place.

Having a credit score of 794 is excellent news! You've shown a good history of managing your credit, and lenders see this as a positive sign that you will be a responsible borrower. When applying for a personal loan, being in this credit score range means you're likely to be approved. Lenders will have a lower perceived risk when issuing you a loan.

With such a high credit score, not only are you more likely to be approved for a loan, but you may also benefit from more favorable loan terms. These could include lower interest rates, as lenders reward those who display good credit behavior. On your part, you can anticipate a smooth application process, but always remember to continue managing your credit wisely and making payments regularly to maintain your score. Nevertheless, always read the terms and conditions carefully to ensure you're getting the best deal.

Can I Get a Car Loan with a 794 Credit Score?

If your credit score is 794, you're likely on solid ground when it comes to being approved for a car loan. This score typically indicates a responsible record of borrowing and repaying money, which is exactly what lenders like to see. Your score is well within the range that is generally considered 'prime' and way above the subprime category.

With this favorable score, you can expect an easier process securing a car loan. You're likely to be offered loans with competitive interest rates, reducing your overall borrowing costs. Keep in mind though, while your credit score is a key factor, there are other aspects lenders will consider, such as income and debt-to-income ratio. But with a credit score of 794, you are starting the car shopping process on the right foot.

What Factors Most Impact a 794 Credit Score?

Navigating a score of 794 may seem complex, but understanding the influencing factors can guide you towards even better financial health. Your score is unique and so are the lessons you can learn from it.

Credit Utilization

Your credit utilization rate is key at this stage. Regularly maxing out your cards or carrying a high balance may harm your score.

How to check: Scrutinize your monthly card statements. How close are you to your credit limit each month? Strive to lower your utilization rate for a healthier score.

New Credit

Although less impactful for your score, taking on new credit can potentially cause a slight dip, especially if done frequently.

How to check: View your credit report. Have you recently applied for multiple credit cards or loans? Limiting new credit activities can help maintain your score.

Payment History

A flawless payment history contributes significantly to your high score. Any delay or missed payments can affect it negatively.

How to check: Review your credit report. Have there been any missed or late payments? Regular, timely payments help keep your score high.

Length of Credit History

Longer credit history generally implies better credit reliability, benefiting your score.

How to check: Check your credit report for the age of your oldest and newest accounts and the average age of all your accounts. Avoid opening multiple new accounts in a short period.

Credit Mix

Diversified credit types contribute positively to your score, indicating your ability to manage different types of credit.

How to check: Examine your credit profiles, such as credit cards, mortgages, and auto loans. A diverse mix of credit can enhance your credit profile.

How Do I Improve my 794 Credit Score?

With a credit score of 794, you’re already in a fantastic position, but there are always ways to further enhance your financial health. Here are some specific, achievable methods you may consider to boost your current score:

1. Maintain Timely Payments

Continuing to pay all your bills on time is crucial. Ensure your utilities, loans, and credit cards are paid promptly, maintaining your payment history, which heavily impacts your credit score.

2. Monitor Credit Utilization

Keep an eye on your credit utilization rate. Strive to keep it below 30% of your available limit. You are doing well, but lowering it to 10% could help to increase your score.

3. Regular Credit Check-ups

Regularly review your credit reports to ensure there are no errors or inaccuracies. If there are, dispute them promptly as they can unnecessarily bring down your score.

4. Limit Credit Applications

Avoid applying for new credit unless necessary. Each application results in a hard inquiry on your credit report which can cause a small, temporary dip in your score.

5. Maintain Long Credit History

Aim to keep your oldest credit account active. Length of credit history factors into your credit score. It showcases your reliably long-standing relationship with credit which can help boost your score.

Every incremental move counts in credit management, even if your score is already in a great shape. Remember, you’re on the right path towards excellent financial health!