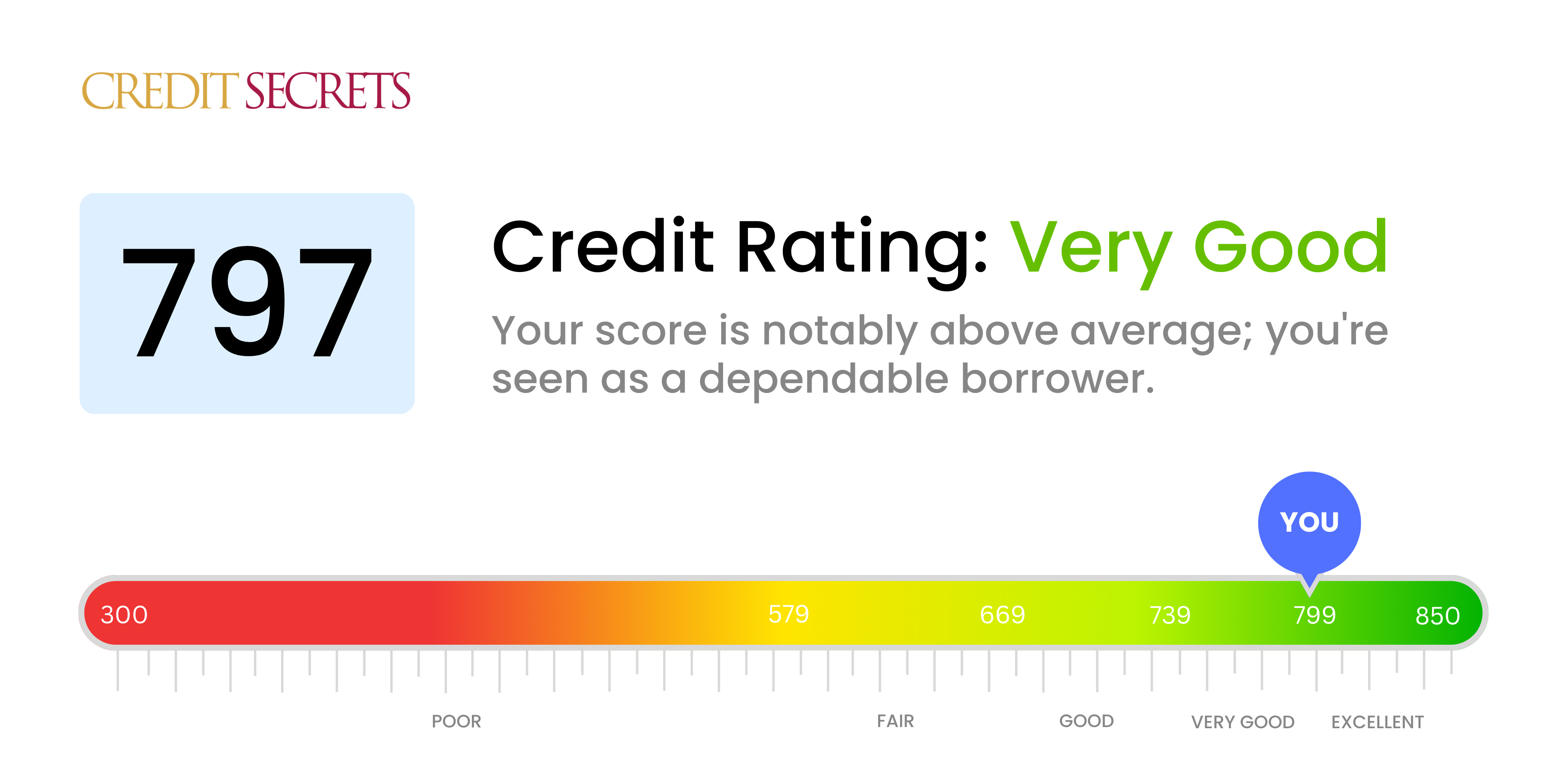

Is 797 a good credit score?

Your credit score of 797 is categorized as very good. This is a strong score, meaning you're likely to get approved for loans and credit, and on the higher end of interest rates. Most people will trust you financially, making it easier for you to reach your financial goals. Just a little more effort might even bump you up to the excellent range!

Always remember, your credit score is not fixed and it's entirely possible for it to change. Consistent and responsible credit habits, such as making payments on time, and keeping your credit utilization low, can help increase your score over time. It's crucial to keep an eye on your financial habits to maintain, or even improve, your good score.

Can I Get a Mortgage with a 797 Credit Score?

A credit score of 797 tells most potential lenders that you've demonstrated good financial habits and a strong history of on-time payments. This places you in an advantageous position to be approved for a mortgage. Bear in mind, while the chance of approval is high, it doesn't guarantee all doors will be open. Other factors such as income and existing debt play a role in the final decision.

Moving ahead with the mortgage approval process, the lender will have a detailed look at your creditworthiness that goes beyond your credit score. It's quite possible you have not just access to more loan options but also favorable interest rates, as lenders reserve their best offers for low-risk borrowers. Keep maintaining your healthy credit habits, as they will make this process smoother for you.

Can I Get a Credit Card with a 797 Credit Score?

With a credit score of 797, it's highly probable that most credit card companies will view you as a valued customer. This score demonstrates a responsible history of managing finances and paying bills on time. However, it's crucial to maintain realistic expectations and understand that better credit does not automatically guarantee approval, as lenders review other factors such as income and current debt level.

In your situation, with such a high credit score, a myriad of credit card options are within your reach. Depending on your lifestyle and financial goals, you may want to consider a premium travel card which could earn you significant rewards like travel miles. Alternatively, a card offering cashback or rewards based on your regular spending habits could also be a good fit. Keep in mind, while these cards often come with excellent benefits, they may also carry higher annual fees or interest rates, so it's important to assess your ability to manage these costs. Remember, maintaining a responsible use of credit is key to preserving your high credit score.

A credit score of 797 is considered excellent. With such a high score, you would likely be approved for a personal loan. Lenders view this level of creditworthiness as a strong sign of financial responsibility and reliability, implying that you have a history of consistent, on-time payments and wisely managed debt. Consequently, you pose less of a risk to lenders, which increases your chances of approval.

When it comes to the personal loan application process with a credit score of 797, you should be prepared for lenders to offer you their best terms, including lower interest rates. This score can potentially provide you with a significant advantage when negotiating the terms of your loan. However, it's important to note that your credit score isn't the only factor considered during the application process. Your income, employment status, and other financial details will also be evaluated to make a comprehensive lending decision.

Can I Get a Car Loan with a 797 Credit Score?

With a credit score of 797, you're in a strong position when it comes to securing a car loan. This score indicates that you've been a good borrower in the past, making it likely that you'll be approved for a car loan with a competitive interest rate. Lenders consider scores above 660 as favorable and your score of 797 significantly surpasses this benchmark, qualifying you for prime rates.

You can expect a smooth car purchasing process given your high credit score. Since lenders see less risk in lending to you, they are willing to offer lower interest rates and better loan terms. The lower your interest rate, the less you'll pay over the life of the loan. This allows you to either save money or afford a more expensive car. Just remember to review all terms carefully and ensure that your loan is affordable within your personal budget constraints.

What Factors Most Impact a 797 Credit Score?

A credit score of 797 is quite commendable. It indicates that most of the significant factors affecting credit score - payment history, credit utilization, length of credit history, and mix of credit types - are being well managed. However, to understand and maintain this score, it's essential to recognize the factors that might still be impacting it.

Credit Utilization

Credit utilization i.e., how much of your available credit you're using, still matters for high scores. It's ideal to keep this below 30% of your available credit limit.

How to Check: Monitor your credit card balance regularly. Ensure that you're not edging towards your credit card limit constantly.

Length of Credit History

The age of your credit accounts contributes to your score. Long-lasting credit with good history can act in your favor.

How to Check: Refer to your credit report to check the average age of your accounts. Be wary while opening new ones as they could drop your average age.

Credit Mix

Even high scorers should maintain a healthy mix of different credit types — revolving, installment, and open.

How to Check: Examine your credit report for the kind of credit accounts you have. If lacking diversity, consider adding another type of credit to your portfolio cautiously.

Recent Applications

Recent credit applications could have a slight impact on your score due to hard inquiries.

How to Check: Check your credit report for recent hard inquiries. Strategize your credit applications to minimize their impact.

How Do I Improve my 797 Credit Score?

A credit score of 797 is exceptional, yet there’s room for progression to reach perfection. With strategic steps and consistent effort, elevating your credit score is attainable. Here, we outline the vital strategies suitable for your current score:

1. Maintain Low Credit Utilization

Minor changes can influence your score at this level, so be conscious of your credit utilization. Keep your credit card balances under 10% of your total credit limit to sustain your impressive score.

2. Pay Attention to Your Payment History

Consistency is key. Continue to make all payments on time, as even a single late payment can considerably impact your high score. Setting up automatic payments can avoid late payments and keep your record immaculate.

3. Be Cautious About New Credit

Even though you’re likely to be approved for new credit easily, be vigilant. Every application generates a hard inquiry on your report, which may lower your score. Adopt a strategy of applying for credit sparingly.

4. Ensure Credit Card Balances are Low

Keep your respective credit card balances low. Despite having a high total available credit, it’s crucial to keep individual card balances admittedly modest to avoid adverse effects on your score.

5. Stick to Your Credit Plan

Achieving a 797 credit score suggests you have been managing your credit well. Continue to follow your existing credit strategy while making minor adjustments to enhance your credit management efficiency.