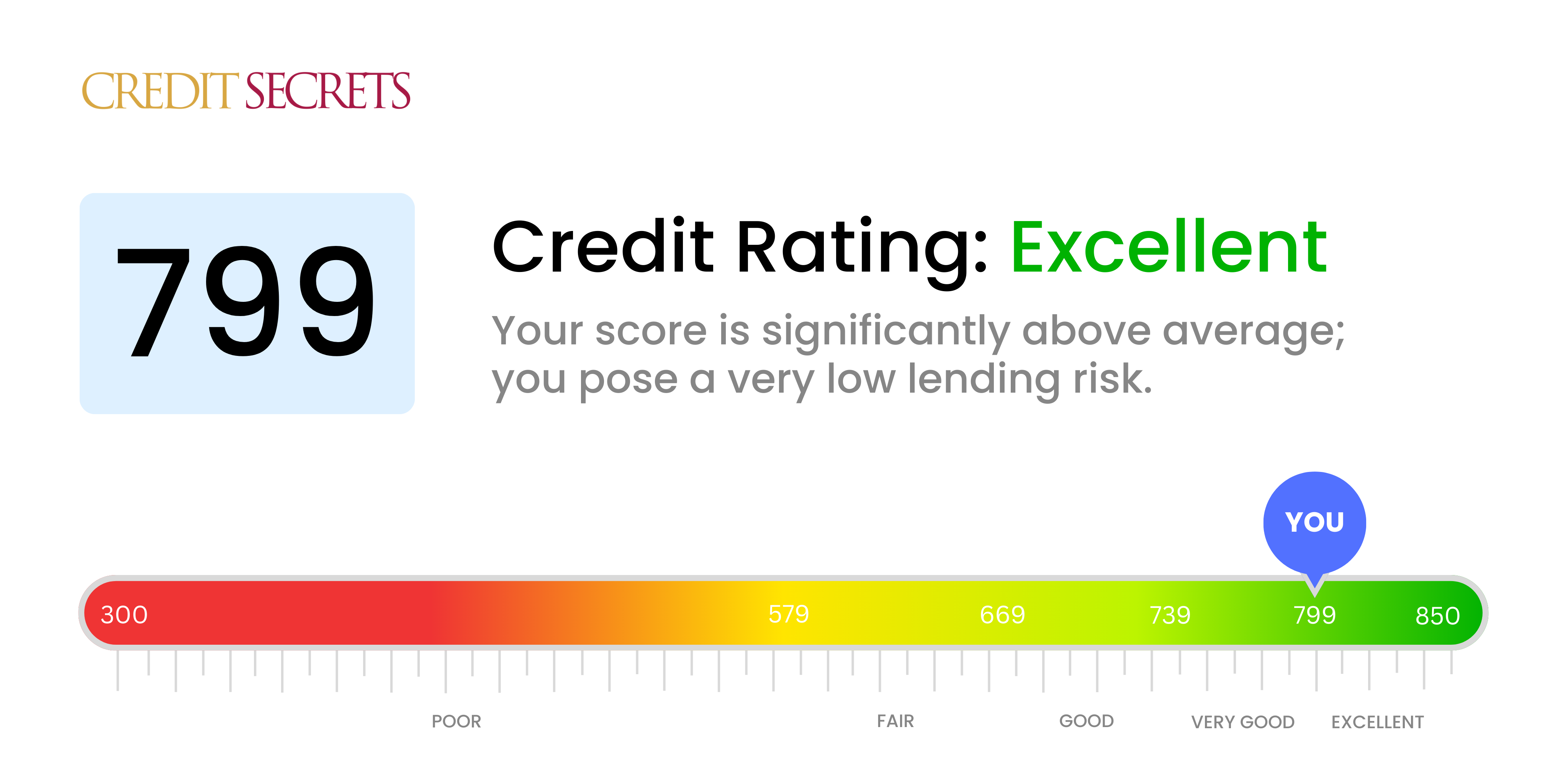

Is 799 a good credit score?

Your credit score of 799 is classified as very good, nearing the line of excellence. With this score, you're likely to gain access to better interest rates and terms when applying for loans and credit cards, and it will be easier for you to qualify for most types of credit.

Keep in mind, maintaining this high score requires responsible financial habits, such as making payments on time, keeping credit utilization low, and periodically reviewing your credit reports for any errors. While no score can guarantee approval on credit applications, your score of 799 places you in a favorable position for most lending decisions.

Can I Get a Mortgage with a 799 Credit Score?

With a credit score of 799, you are likely to be approved for a mortgage. A credit score in this range shows prospective lenders that you're reliable on financial obligations. This score is far above the average and within the realm of 'exceptional', giving you a higher chance of loan approval and advantageous terms.

Once you apply for a mortgage, you can generally expect to go through a series of steps. First, your credit history and income will be evaluated to ensure you can afford to repay the loan. You'll also undergo a home appraisal to assess your property's worth. With your high credit score, you will likely be offered competitive interest rates which can save you significant amounts over the lifetime of your loan. As part of the mortgage approval process, you will be provided with relevant lending documents to review and sign. Make certain to understand all the terms before proceeding. Remember, a high credit score like yours opens up more possibilities for your financial future.

Can I Get a Credit Card with a 799 Credit Score?

Having a credit score of 799 is indeed an excellent position to be in. This high score represents great financial discipline and credit management. It instils confidence in lenders, making it fairly likely to secure approval for a credit card. In fact, such a robust credit score often opens up the possibility for benefits that more average scores don't receive.

With a credit score of 799, you have access to a wider range of credit card types, including premium and travel cards. These types of cards often come with considerable rewards such as cash back, air miles, and low-interest rates. However, it's always important to assess the terms and conditions carefully across different cards, making sure that the benefits align with your lifestyle and spending pattern. Low-interest rates, high credit limits and extensive rewards programs are significant advantages linked to a high score like yours, but applying and using your credit cards wisely can help maintain your commendable credit health.

A credit score of 799 is indeed impressive. This high score escalates your chances of being approved for a personal loan. Being in this credit score range proves to potential lenders that you've been responsible with your credit, hence lessening their risk. Most lenders view you as creditworthy and dependable, thus being comfortable with offering you a personal loan.

As you apply for a personal loan, you can generally expect a smoother and quicker process compared to someone with a lower score. Lenders, understanding your stellar credit score, will most likely extend offers with lower interest rates, reflecting their trust in your ability to repay. However, it's imperative to remember, while a high credit score enhances your chances of approval, it doesn't guarantee it. Other factors like income and job stability can also weigh on the final decision from lenders.

Can I Get a Car Loan with a 799 Credit Score?

You have a credit score of 799, which is excellent! That number puts you in good standing for approval of a car loan. Lenders typically consider scores above 660 to be favorable, and your score is well above that threshold. This suggests that you have a history of responsible credit behavior, giving lenders confidence that you will reliably repay your potential car loan.

Having a high credit score like yours can afford you the leverage to negotiate better terms, such as lower interest rates. Due to your high credit score, you're considered a low-risk borrower, which might result in an easier, smoother car purchasing process. However, remember to thoroughly review all loan terms before signing anything. It's crucial to be aware of all aspects of the loan, including interest rates and payment terms, to ensure a comfortable and manageable commitment. Your strong credit position can certainly make that dream car of yours an achievable reality.

What Factors Most Impact a 799 Credit Score?

Understanding your credit score of 799 is a critical step toward maintaining your strong financial health. Though it indicates you are managing your finances well, certain elements might be holding you back from a perfect score. It's essential to pinpoint these areas to maintain and even improve your financial position.

Payment Diligence

You've likely been persistent with your payments, as your high score suggests. Continue to make sure all bills are paid on time, as late or skipped payments can influence your score negatively.

How to Check: Scrutinize your payment history in your credit report, and remember to consider all accounts, not just credit cards.

Credit Utilization

Low levels of credit utilized can help keep your score high. However, even sporadic high balances can negatively affect your score.

How to Check: Regularly monitor your balances. Strive to keep them as low as possible, well below your credit limits.

Age of Credit

Your credit history's length can have a significant influence on your score. Older accounts tend to show financial stability, which positively impacts your score.

How to Check: Look at your credit report for the age of your oldest account, then your newest, and evaluate the average age of all your accounts.

New Credit

Ensure to apply for new credit sparingly. Multiple credit inquiries can negatively impact your score.

How to Check: Assess your recent credit report for hard inquiries or signs of new credit applications.

Public Records

At this score, it's unlikely any serious public records such as bankruptcies or tax liens are impacting your score. Still, it's always wise to verify there are no erroneous public records on your credit report.

How to Check: Review your credit report for any public records, and quickly address and dispute any errors found.

How Do I Improve my 799 Credit Score?

Your current credit score of 799 is excellent but there is still some room for improvement. Even at this level, there are still steps you can take to maximize your creditworthiness. Here are the most beneficial and feasible strategies for your current situation:

1. Maintain Low Balance-to-Limit Ratio

Continue to keep your credit card balances low relative to your credit limits. Always aim to maintain them below 10% of your credit limit, if possible. If you tend to carry a balance on your cards month-to-month, try to pay it down sooner.

2. Stay Vigilant with Bill Payments

At your credit level, one overlooked utility or credit card bill could cause a dip in your score. To prevent this, try automating all of your bill payments so you never miss a due date.

3. Monitor Your Credit Regularly

Regular monitoring of your credit reports can help identify any changes or potential errors that might negatively impact your score. Many financial institutions provide regular credit updates for free.

4. Limit Hard Inquiries

Limit the number of hard inquiries to your credit, as excessive submissions can lower your score. Only apply for new credit when it’s absolutely necessary.

5. Keep Old Credit Accounts Open

Even if you don’t use them, keep your oldest credit card accounts open. This helps maintain your credit history length, which is a positive factor in your credit score.