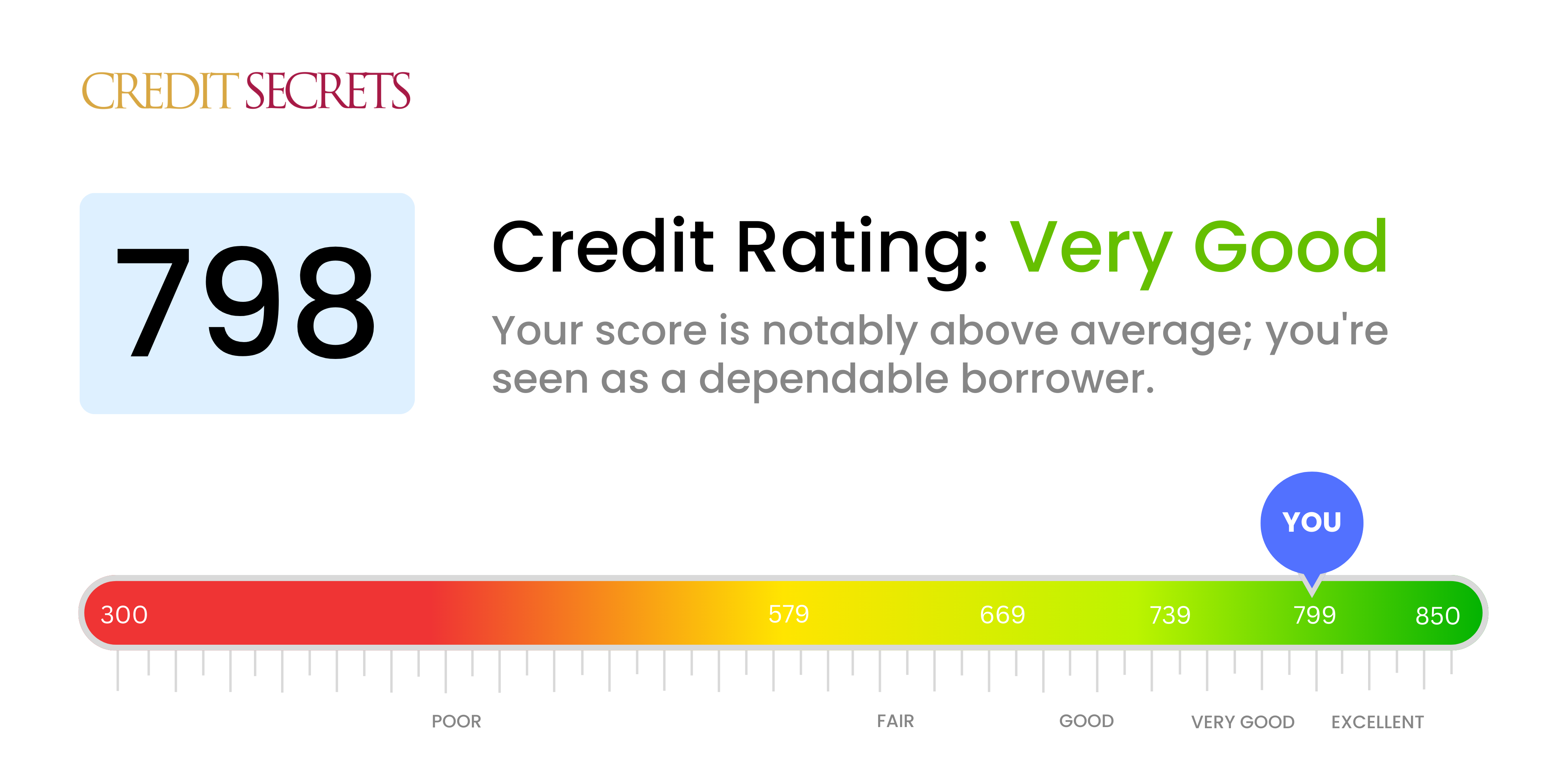

Is 798 a good credit score?

With a score of 798, your credit standing falls into the 'Very Good' range. While you're just short of the 'Excellent' rating, a very good score still opens many doors in the financial world. This score is likely to grant you access to some of the best interest rates and credit card offers, and most lenders will consider you a low risk borrower. However, there's always room for improvement, and pushing your score into the excellent range could bring even more benefits.

Take pride in your score, but remember that maintaining it requires continued financial responsibility. Keep on time with payments, manage your debt wisely, and monitor your credit reports to rectify any potential errors. These practices will ensure your score stays robust, helping you achieve and uphold your financial goals.

Can I Get a Mortgage with a 798 Credit Score?

With a credit score of 798, you stand a very high chance of being approved for a mortgage. This score is significantly above the average and sends a signal to lenders that you are a trustworthy borrower with a strong history of responsible credit usage and on-time payments. This high score is a result of diligent financial behavior and responsible decision-making.

In the process of mortgage approval, be prepared for lenders to delve deeper. They will scrutinize your overall financial health, including your income, employment status, and your overall debt. But with your high credit score, you can expect great advantages. Lenders are likely to not only approve your application, but also offer you lower interest rates on your mortgage loan. This is because a high credit score like yours significantly reduces the risk for lenders, and they pass on those savings to you in the form of lower interest rates. Rest assured, your diligent financial behavior is very likely to pay off in your journey to homeownership.

Can I Get a Credit Card with a 798 Credit Score?

A credit score of 798 is indeed quite impressive. This score attracts a high probability of being approved for a credit card. You've shown remarkable responsibility with your financial management and lenders see this as a positive sign of your ability to handle credit effectively. The outcome gives you a broad selection of options when it comes to choosing the right credit card for your lifestyle.

Given your high score, premium cards with added perks such as travel rewards or cashback could be worthwhile considering. These cards often require good to excellent credit scores, and your 798 falls well within that category. Other cards, like low-interest credit cards, might also be a great fit for you because the lower your credit score is, the lower the interest rates you'll be offered. Be sure to thoroughly assess your daily habits, spending patterns, and goals before deciding on the most suitable card to ensure that the benefits align with your financial goals.

With a credit score of 798, you're in a great position when it comes to personal loans. Your score is well above average and falls within the 'excellent' category. Most lenders will see this high score as an indication of your strong financial responsibility. As a result, you'll likely have a high likelihood of approval for a personal loan.

On the journey of applying for a personal loan, having a high credit score like yours not only increases your chances of approval but also makes you eligible for more attractive terms. Lenders are inclined to offer you a lower interest rate, which can save you considerable money over the life of the loan. It might also streamline the application process, making it smoother and faster. Don't forget, however, to shop around for the best terms and not just accept the first offer that comes your way. Always read the entire agreement, making sure you understand all the terms before signing to protect your credit score and overall financial well-being.

Can I Get a Car Loan with a 798 Credit Score?

A credit score of 798 is quite impressive and reflects a responsible credit history. This score definitely puts you in a comfortable spot for acquiring a car loan. Lenders generally prefer a score above 660 for approving loans, so having a score of 798 is likely to work in your favour.

With such a strong credit score, you can expect some advantages when purchasing a car. In the eyes of the lenders, a high credit score indicates less risk, which could lead to more favorable loan terms and interest rates. Remember, the higher your score, the more likely it is you'll be offered lower interest rates. Take some time to shop around and compare loans from different lenders. You have an excellent chance of securing a car loan with desirable terms, but always ensure you understand all the details before signing any agreements.

What Factors Most Impact a 798 Credit Score?

Unraveling a credit score of 798 allows you to understand the elements that have positively impacted your score. This understanding can guide your steps in maintaining your excellent score.

Effective Management of Credit Card Balances

With a score of 798, you likely have a low credit utilization rate. This means you're not pushing your credit limits, which positively impacts your score.

What to Do: Continue to keep your account balances low in relation to your available credit.

Timely Bill Payments

Paying your bills on time consistently can lead to a high credit score. This reflects positively on your ability to manage debts.

What to Do: Maintain this habit of making payments before the due date.

Mature Credit History

A long credit history tends to improve your score. If you've been managing credit for a considerable period, it helps boost your score.

What to Do: Keep your oldest credit account open to maintain a longer credit history.

Varied Credit Types

If you have a mix of credit - like credit cards, retail accounts, installment loans, this understanding tends to provide a boost to your score.

What to Do: Manage these different types of credit responsibly to keep your credit score in the healthy range.

No Negative Public Records

No presence of negative items such as bankruptcies or tax liens on your credit report can result in a high credit score.

What to Do: Stay clear of actions that can result in these negative entries on your credit report.

How Do I Improve my 798 Credit Score?

With a credit score of 798, you’re already in a fantastic position. However, there are still some strategies that can be important to help elevate your credit score even further:

1. Maintain Low Balances

Your credit card balances play a crucial role in determining your credit score. While you’re doing a good job, aim to keep your balances as low as possible and never exceed 30% of your credit limit on any account.

2. Pay Bills Before Due Date

Meeting your payment deadline is key, but paying your credit card bills before the due date can leave a positive impact on your credit score. This strategy shows financial responsibility and is looked upon favorably by lenders.

3. Regularly Monitor Your Credit Report

Errors in your credit report can negatively affect your score. Regularly review your credit reports from all three credit bureaus to spot and rectify any inaccuracies promptly.

4. Use Old Credit Cards

Keep old credit cards open and occasionally use them for small purchases as long as there’s no annual fee. This helps maintain the length of your credit history, which can boost your credit score.

5. Maintain diverse mix of credit

You’ve most likely diversified your credit mix, but continue focusing on maintaining a balance between revolving credit and installment loans to show lenders you can handle different types of credit.