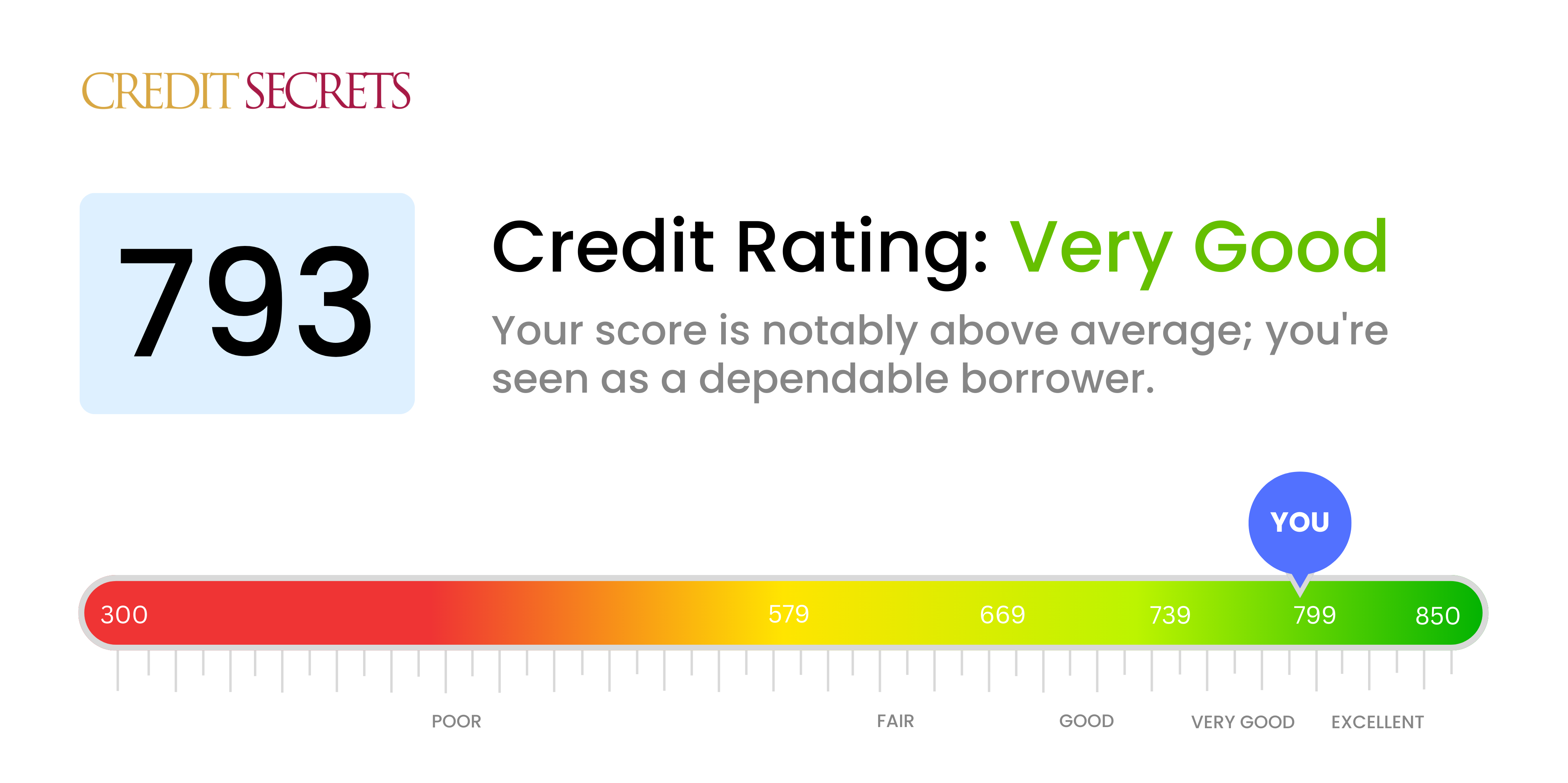

Is 793 a good credit score?

You're on the right track with a credit score of 793, as it is considered 'very good'. This level of score likely marks you as a dependable borrower, offering access to advantageous financial opportunities like lower interest rates and favorable loan approval. It's a solid starting point to making the leap to an 'excellent' credit rating.

Despite the strong standing your 793 score grants you, don't forget that credit scores fluctuate based on decisions you make. It's important to continue making sound financial decisions, like paying all your bills on time and keeping credit card balances low, to maintain or even improve your current standing. Work with a positive outlook, knowing that with your very good score, the journey to financial success is clear and attainable.

Can I Get a Mortgage with a 793 Credit Score?

With a credit score of 793, your chances of being approved for a mortgage are very high. This score is well above the average and notably higher than the minimum requirements of most lenders. This implies that you have a positive history of managing your financial obligations effectively, setting you in good standing for favorable mortgage terms.

As you start initiating the mortgage approval process, you can expect thorough reviews of your financial and credit history. Lenders will scrutinize your income, existing debts, and ability to manage mortgage payments. Remember, while a stellar credit score like 793 is highly advantageous, it’s only one of the crucial factors lenders consider during the mortgage application process. Nevertheless, with such a desirable credit score, you may also be offered more attractive interest rates, potentially saving you a significant amount over the life of your mortgage. The road may seem long, but with your robust credit, you begin this journey in a position of strength.

Can I Get a Credit Card with a 793 Credit Score?

With a credit score of 793, you're likely to be approved for a credit card. This score is generally viewed by lenders as a sign of responsible credit habits and financial stability. However, it's important to approach this matter in a sober and realistic manner. Knowing your credit standing gives you a well-informed perspective in handling your finances.

A variety of credit card types could suit your situation. These range from premium travel cards, which offer rewards for frequent flyers, to cash back cards, which offer a percentage of cash returned on purchases made. Regardless of the type of card that you may be considering, remember to look into the interest rates. With a strong credit score like yours, you should qualify for a card with a competitive rate. Just make sure to pay off your balances on time and maintain your good credit habits to take advantage of this great position you're in.

If you have a credit score of 793, you are in an excellent position to be approved for a personal loan. Lenders see this score as indicative of a responsible borrower, greatly increasing your chances of loan approval. Remember, your high credit score isn't just a ticket to approval, it's also key to unlocking favorable loan terms with potential lenders.

While applying for a personal loan, you can expect smooth transactions owing to your impressive credit score. Lenders are more likely to offer you the lowest possible interest rates, as your score reduces the risk associated with lending to you. However, while your credit score greatly aids in your loan approval chances, it's still important to provide all necessary documentation requested by lenders. Continued responsible credit behavior will ensure that your credit score remains robust.

Can I Get a Car Loan with a 793 Credit Score?

With a credit score of 793, the chances of obtaining approval for a car loan are high. Lenders typically consider those with scores above 660 to be favorable candidates, and your score is well above this threshold. This confirms your responsible credit behavior, as higher credit scores indicate lower risk to lenders and an excellent track record in managing borrowed money.

No doubt, a score of 793 puts you in a great position when it comes to car purchasing. A stellar score like yours can make the process smoother and more beneficial for you. It can lead to lenders offering you favorable loan terms, such as lower interest rates. That's because lower risk to lenders often translates into reduced costs for borrowers. With this high score, striding into a dealership can be less stressful and more empowering knowing you're more likely to have car loan approval in your pocket.

What Factors Most Impact a 793 Credit Score?

Having a credit score of 793 means you're generally demonstrating excellent credit behavior. A few important factors likely contributed to your score being in this high range.

Timely Payments

For a score as high as 793, it is likely there is a long history of promptly made repayments. Keeping up with your obligations shows financial institutions that you're reliable.

How to Check: You can verify this by closely examining your credit report for evidence of punctual payments.

Moderate Credit Utilization

Your credit utilization ratio, how much of your available credit you're using, likely rests at a moderate or low level to bolster such a credit score.

How to Check: Take a look at your credit card statements. If your spending is low in relation to your limits, this supports your high score.

Lengthy Credit History

If your credit history spans a significant length of time, it can positively shape your credit score, and is probably a factor in your score of 793.

How to Check: Review your credit report to determine the age of your oldest and most recent accounts, along with the average age of all your accounts.

Diverse Credit Blend

Your score indicates you likely possess a diverse mix of credit, with various types being managed responsibly.

How to Check: Review your credit report to see the types of credit (credit cards, installment loans, etc.) in your name.

No Public Records

Your score suggests you don't have public records like bankruptcies or tax liens, which can lower credit scores.

How to Check: Review your credit report for any public records, to confirm none are present.

How Do I Improve my 793 Credit Score?

A credit score of 793 is excellent and you are well on your way to achieving even greater financial success. Given your current situation, here are a few next steps that can help you go even further:

1. Maintain Low Credit Utilization

Your credit utilization ratio—the percentage of your available credit that you’re using—impacts 30% of your credit score. Even with a high score of 793, ensuring your utilization stays below 30% can help safeguard it, with an aim for below 10% for the best impact.

2. Pay Bills on Time, Every Time

Late payments can seriously damage an otherwise great credit score. Continue making every single payment on time to maintain your fantastic score. You may want to set up automatic payments to ensure you never miss a due date.

3. Keep Old Credit Accounts Open

The length of your credit history counts for 15% of your score. Hold onto old accounts, even if you’re no longer using them regularly, to keep your average account age high.

4. Limit Hard Inquiries

Each time you apply for new credit, a hard inquiry is recorded on your credit report, potentially lowering your score slightly. Minimize your applications for new credits to preserve your score.

5. Continue to Monitor Your Credit Report

Regularly review your credit reports to check for any errors or inaccuracies that could negatively affect your score. High-score individuals like yourself are prime targets for identity theft. Stay vigilant and report any suspicious activity immediately.