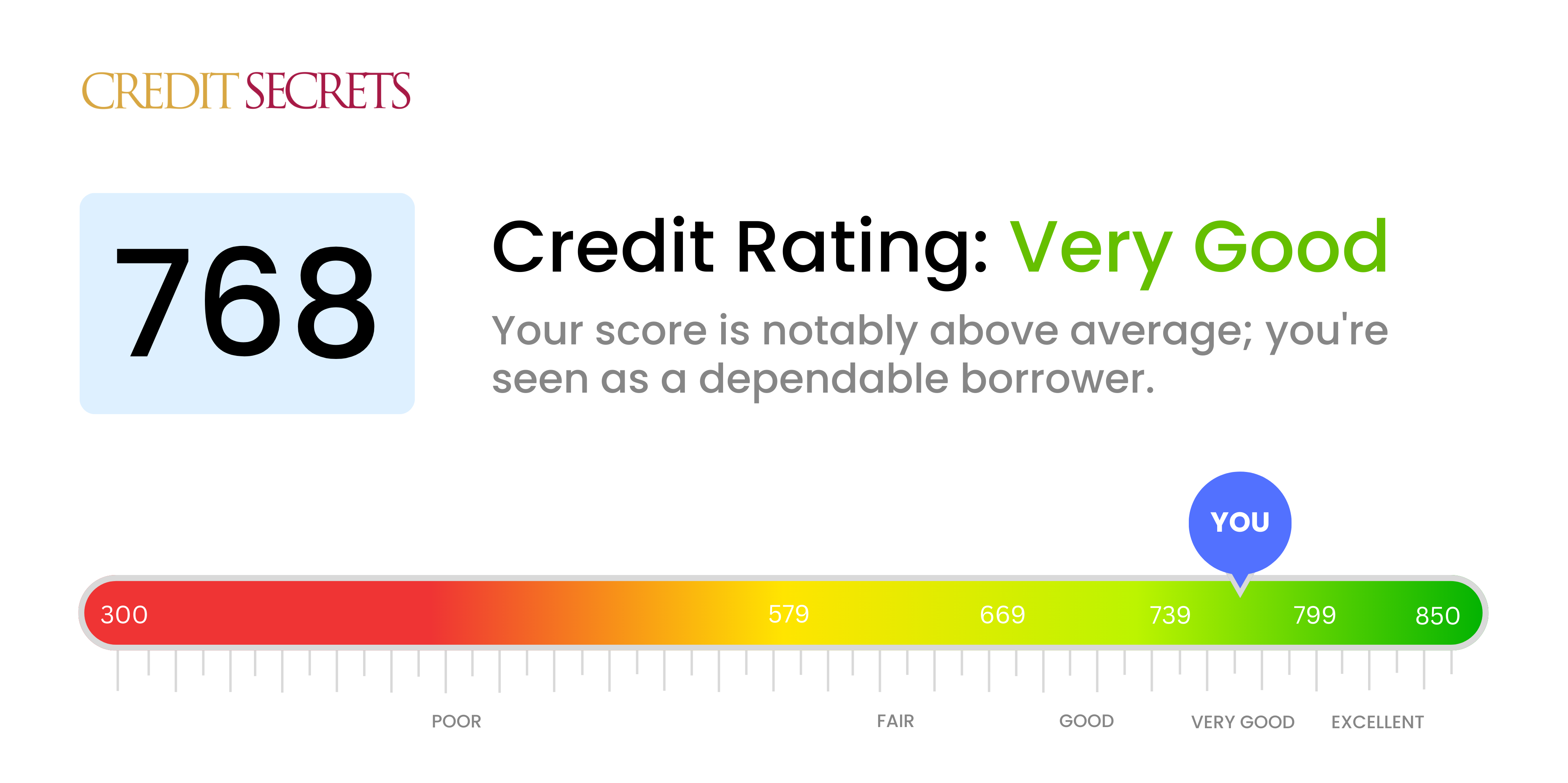

Is 768 a good credit score?

Your credit score of 768 is considered to be very good. With this score, you're likely to have a relatively easy time securing loans or credit, usually with favorable interest rates, as well as have a higher borrowing limit because lenders see you as a low-risk borrower. However, maintaining and even improving your score can further enhance your financial opportunities. Stay vigilant about your credit habits and make sure to keep up with your payments as regularly as you do now.

Can I Get a Mortgage with a 768 Credit Score?

Boasting a credit score of 768, you're in excellent standing to apply for a mortgage. This score is well above average and lenders will likely perceive you as a very low risk candidate. An exemplary score like this indicates a history of timely payments, responsible credit usage, and overall sound financial management. This places you in a prime position for loan approval.

During your mortgage approval process, you can expect that lenders will offer you favorable terms and conditions. Due to your high credit score, you're likely to secure lower interest rates, which can save you thousands of dollars over the life of your loan. Keep in mind, though, the mortgage approval process also considers factors like your income stability, your debt-to-income ratio, and your employment history. So while your excellent credit score is a significant advantage, ensure the rest of your financial profile is equally strong for a smooth mortgage approval process.

Can I Get a Credit Card with a 768 Credit Score?

Possessing a credit score of 768 is a sign that you've shown responsibility when it comes to managing your financial affairs. This score, which is quite positive, is often regarded favorably by lenders. When it comes to applying for a credit card, these lenders are more likely to give a thumbs-up. This is because a high credit score typically correlates with lower risk for the lender, translating into a higher likelihood of credit approval.

Lenders are likely to offer you a multitude of credit card options, each with its own unique benefits. You might want to consider premium travel cards, that tend to offer generous reward schemes, often in the form of travel points or cash back. Another option is low-interest cards, which could be particularly beneficial as they usually offer lower APR. It's important, to think about your spending habits and financial goals before opting for a card. Don't hesitate to shop around and compare cards to identify the one which best fits your lifestyle and objectives. Remember, although a high credit score opens more doors, it's still essential to use credit responsibly.

With a credit score of 768, you're in an excellent position to apply for a personal loan. Lenders view this score as an indicator of financial responsibility and trustworthiness, enhancing your chances of loan approval. However, keep in mind that while your credit score is a critical factor, lenders may also consider aspects like income, job stability, and your overall debt-to-income ratio.

In terms of the loan application process, be prepared for the lender to conduct a hard inquiry ñ a process that can slightly reduce your credit score temporarily. Don't be alarmed, though; this is a standard part of the loan application process. Because your credit score lands you in the 'excellent' category, the interest rate on your loan is likely to be quite favorable. This is because lenders believe that the likelihood of you paying back the loan on time is very high. However, remember to read the fine print and fully understand the terms of your loan before making a final decision.

Can I Get a Car Loan with a 768 Credit Score?

Having a credit score of 768 is quite promising if you're aiming for a car loan. This score is well above the average, often considered 'good' to 'excellent', which means lenders are likely to view you as a trusted borrower. This high score signifies a history of responsible, timely financial actions which can increase your chances of approval when applying for a car loan.

In the context of a car purchasing process, your impressive score of 768 can translate to more favorable conditions. You might find that you're offered lower interest rates in comparison to individuals with lower scores. This is because your high credit score suggests less risk to the lender, which can lead to more competitive loan terms. While nothing in finance is a guarantee, your credit score puts you in a strong position to navigate the car buying journey.

What Factors Most Impact a 768 Credit Score?

Decoding a score of 768 is essential in mapping your financial path. It's an exploration into the possible reasons behind your healthy credit tally and helps you maintain or boost your score. Remember, your financial journey is unique, offering countless opportunities to learn and evolve.

Credit History Length

Your credit score suggests a commendable credit history length, as it is one of the significant factors for this score range.

How to Check: Comb through your credit report and calculate the average age of your accounts. Check the age of your oldest and newest account.

Credit Utilization Ratio

Managing your credit utilization ratio is important. With a score of 768, it is likely you are doing well in using your credit reservedly.

How to Check: Take a closer look at your credit card statements. How close does your balance get to the limit? Keeping this ratio low is recommended.

Payment History

Timely repayments significantly impact your credit score. It is likely that your score reflects a positive payment history.

How to Check: Go through your credit reports for any indication of late payments or defaults. Remember, consistent prompt payments keep your score healthy.

Public Records

No public records such as bankruptcies, judgments or tax liens could be another reason behind your good score.

How to Check: Scan your credit report for any public records. Address immediately if any items listed for resolution.

Credit Mix

A diverse mix of credit types, including credit cards, retail accounts, installment loans, and mortgages, helps maintain a good score.

How to Check: Review your credit report to evaluate your mix of credit accounts. Avoid applying for new credit frequently.

How Do I Improve my 768 Credit Score?

A credit score of 768 is classified as good, however, there’s always room for enhancement to move into the excellent range. Here are some effective steps to elevate your credit score further:

1. Limit Hard Inquiries

While applications for new credit are sometimes necessary, each application results in a hard inquiry that can temporarily lower your credit score. Try to limit these inquiries to maintain your present score.

2. Maintain Low Utilization Rates

Maintaining a small amount of debt relative to your total available credit, known as credit utilization, can favorably impact your credit score. Aim to keep your utilization rates below 10%, while ensuring on-time payments for all credit accounts.

3. Opt for Automatic Bill Payments

Credit score calculations deem payment history very important. To avoid missing any payments, consider setting up automatic bill payments. This can ensure timely payments and assist in the steady growth of your score.

4. Regularly Review Credit Report

Regularly review your credit report for any inaccuracies that could be negatively impacting your score. If such inaccuracies exist, make sure to dispute them right away with the relevant credit bureau.

5. Maintain Older Credit Accounts

One aspect of a credit score is the length of your credit history. If possible, keep your older credit accounts open and in good standing to enhance your credit history and improve your score over time.