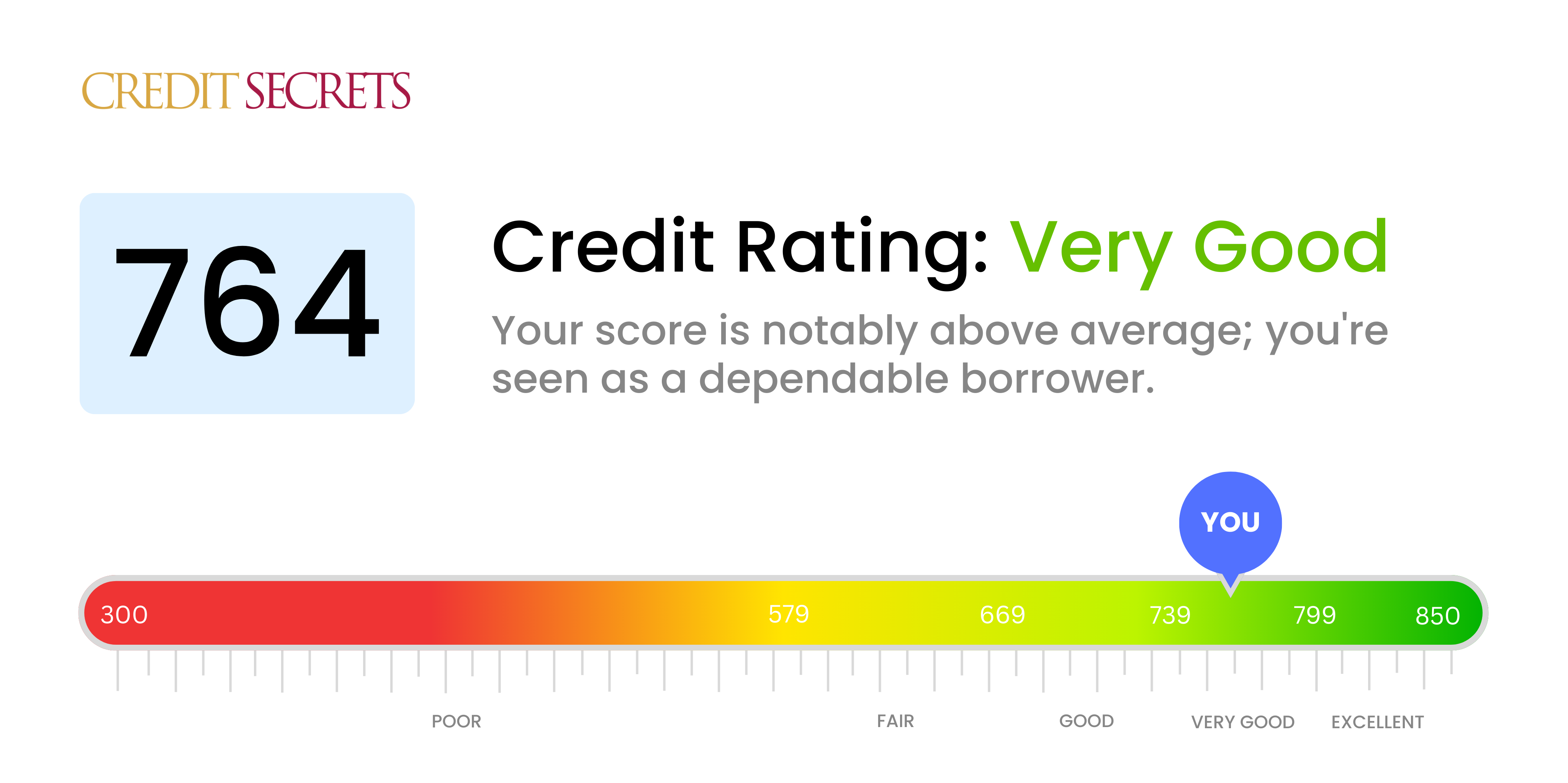

Is 764 a good credit score?

Your credit score of 764 falls within the 'Very Good' category. You have done a commendable job at managing your credit and are likely to be considered positively by lenders. This can open doors for loans with lower interest rates and better terms, setting you up for a robust financial future.

However, there's always room for improvement to bring your credit score even further into the 'Excellent' range. This may mean staying consistent with timely payments, keeping your credit usage low, and being cautious about opening new credit accounts. Be aware that there's no magic quick-fix to increasing a credit score, it's all about maintaining good habits and patience.

Can I Get a Mortgage with a 764 Credit Score?

With a robust credit score of 764, your likelihood of mortgage approval is excellent. This score represents a solid credit history and responsible financial management, which are key components lenders look for when assessing creditworthiness.

In the mortgage approval process, your commendable credit score will usually mean more favorable interest rates. Lenders see you as a lower risk, thus often offering lower rates which can save you significant amounts over the life of your mortgage. However, remember that while having a high credit score increases your chances, approval isn't guaranteed - factors like debt-to-income ratio and employment history are also considered. Regardless, with a credit score of 764, you're in a strong position as you head into the mortgage process.

Can I Get a Credit Card with a 764 Credit Score?

With a credit score of 764, chances are high that you'll be approved for a credit card. This score is considered good and depicts a history of responsible credit usage and debt handling. Lenders likely see you as a low-risk borrower, which could broaden your credit card options. It's meaningful to acknowledge your healthy financial stance and understand what it means for your credit possibilities.

Because of your solid credit score, you might want to explore premium credit cards, which often come with perks like high reward rates, travel rewards, and exclusive benefits. Options may include travel cards, cash back cards, or high-value reward cards. These types of cards often require good to excellent credit scores - the realm you're currently in. However, be mindful of higher interest rates that sometimes accompany premium cards. Remember, having a good credit score gives you an advantage, enabling you to compare various credit card offers and choose the one that fits your lifestyle and spending habits best.

A credit score of 764 is undoubtedly solid, placing you well within the range lenders consider good. This robust credit score suggests to financial institutions that you've shown diligent financial responsibility in the past. As such, your chances of getting approved for a personal loan are significantly higher compared to those with lower scores. Creditors deem a score like yours as representing low risk, making them more likely to lend you the money.

In terms of the personal loan application process, having a 764 credit score may potentially help you leverage better loan terms and interest rates. Lenders are often more inclined to offer competitive rates to applicants with healthier credit scores, as this demonstrates less risk for them. Nevertheless, be sure to review the terms and features of each loan offer carefully. Always remember that different lenders have different criteria for loan approvals, and your credit score is only one of the several factors considered.

Can I Get a Car Loan with a 764 Credit Score?

With a credit score of 764, getting approved for a car loan is much more likely. Scores in this range are generally seen as low risk by lenders. Your 764 credit score reflects a history of responsible financial behavior and puts you in good standing to negotiate favorable loan terms.

In the car purchasing process, this positive score provides several advantages. You can expect affordable interest rates and flexible loan options, as lenders have confidence in your ability to repay the borrowed money on time. Nevertheless, it's beneficial to shop around to ensure you're getting the most suitable deal. Remember, while your credit score is a key factor, some lenders might look into other aspects of your financial health as well. Maintain your performance to continue receiving such favorable terms for any future loans.

What Factors Most Impact a 764 Credit Score?

A credit score of 764 implies you're managing your credit well, but there might be areas that need improvement. Let's look into what factors might be affecting your score.

Credit Utilization

Keep a close eye on credit utilization, which is the percentage of available credit you're using. Ideally, keep this rate below 30%.

How to Check: Examine your credit card statements to see how close your balance is to your credit limit. If it's high, consider paying off some of your debt.

Payment History

Payment history is very impactful on your credit score. Late payments, even if infrequent, can negatively affect your score.

How to Check: Review your credit reports to identify any late payments. Avoid making late payments in the future.

Type of Credit

The types of credit you have are important. This mix might include credit cards, mortgages, or installment loans. Having a variety can suggest good credit management.

How to Check: Evaluate your credit report to see the variety of credit accounts you have. If it's limited, consider diversifying but do it responsibly.

Length of Credit History

An extended credit history can contribute to a higher credit score. It's about how long you’ve had accounts and the average age of all your accounts.

How to Check: Check your credit report for the age of your oldest and newest account and the average age of all accounts.

New Credit

Pursuing new credit opportunities too aggressively may cause lenders to view you as a credit risk, thus lowering your score.

How to Check: Review whether you have recently applied for or opened several new credit accounts. If so, consider slowing down.

How Do I Improve my 764 Credit Score?

A credit score of 764 is classified as “very good.” However, with careful steps, achieving an “excellent” credit score status is within reach. Here are the most crucial and doable steps at this score level:

1. Maintain Credit Card Balances

Make sure to keep your credit card balances as low as possible. The lower the ratio of your outstanding balance to your credit limit, the better for your rating. Typically, a ratio below 10% is ideal to boost your credit score. Small, manageable purchases, paid in full on a regular basis, will assist in this step.

2. Promptly Address Errors in the Credit Report

Analyze your credit report from the bureaus and promptly address any errors you spot. An accurate credit report plays a pivotal role in maintaining your high score. Rectifying mistakes can make considerable difference to your score.

3. Hold off on Opening New Credit Lines

Avoid opening unnecessary credit lines. While new credit can diversify your credit mix, numerous inquiries or new accounts can harm your score, giving the message of potential credit risk.

4. Lengthen Your Credit History

One significant aspect that affects your credit score is the length of your credit history. Continue using your old credit accounts in good standing to add more credibility to your credit history. A longer positive credit history can raise your score.

5. Pay Installment Loans

Punctual payments on installment loans like mortgages, student or car loans help reinforce your credit worthiness, and maintain or improve your existing credit score. These payments are strong indicators of your financial reliability.