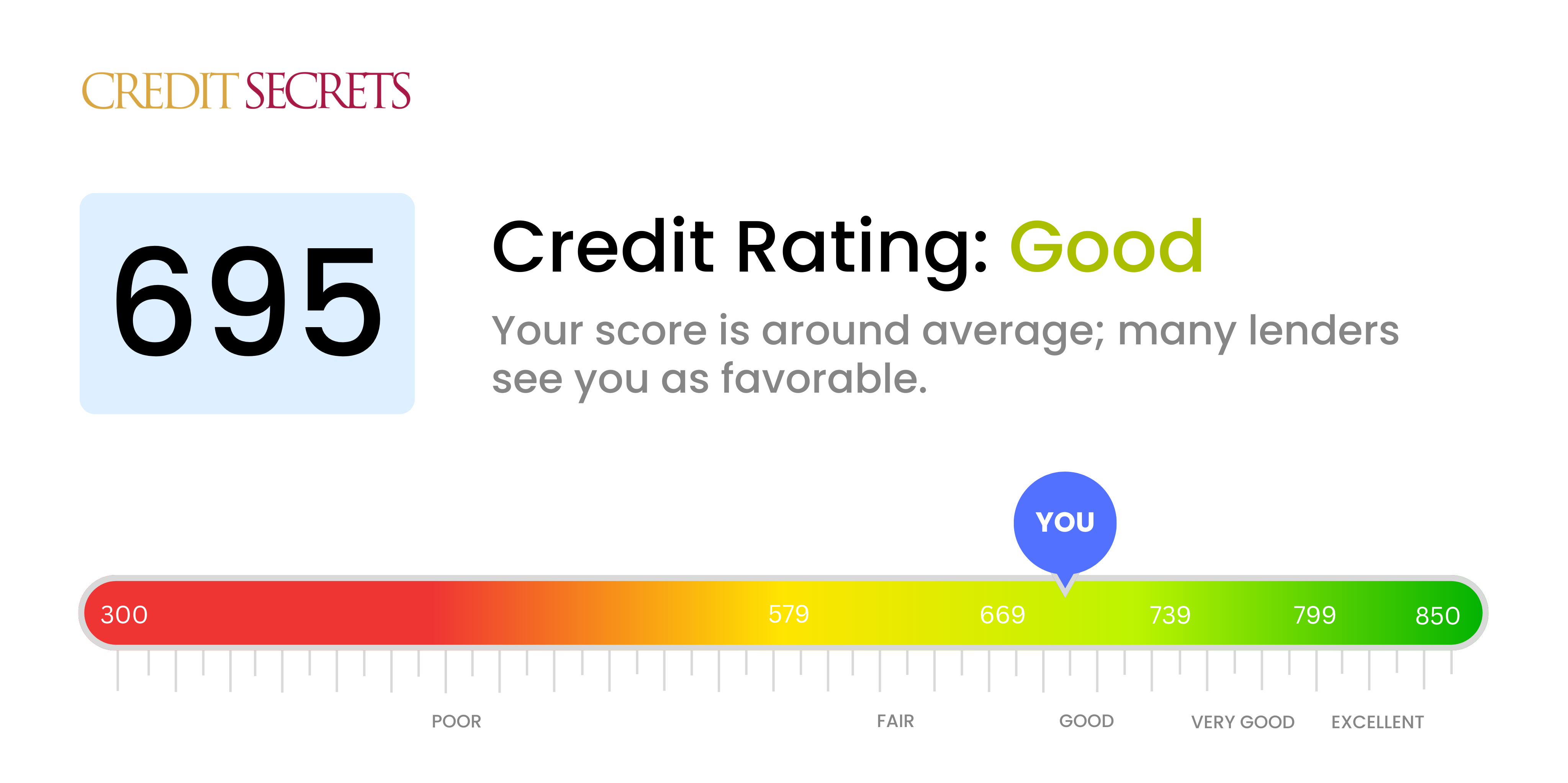

Is 695 a good credit score?

With a credit score of 695, you're on the upper end of the 'Good' range. This means lenders tend to view you as a generally reliable borrower, giving you access to a fairly broad range of credit offerings, decent interest rates, and loan terms. However, there's still room to improve your score, which may unlock additional financial opportunities.

By consistently making on-time payments, limiting debt, and maintaining long-standing credit accounts, you're on the right path to progress further. Remember, while a score of 695 can easily meet most of your credit needs, striving for a 'Very Good' or 'Excellent' credit score would offer even better circumstances. Make informed credit decisions, and remember that every step towards a better credit score brings you closer to achieving your financial goals.

Can I Get a Mortgage with a 695 Credit Score?

With a credit score of 695, you stand a fair chance of being approved for a mortgage. While this is not the highest possible score, it still falls within the "good" range for many lenders. It demonstrates a history of largely responsible credit use, and creditors may see you as a relatively low-risk borrower.

During the mortgage approval process, you can expect lenders to thoroughly review your financial situation, including your income, debts, and other financial obligations. They aim to ensure that you can comfortably afford the mortgage payments. Although your credit score is well within the acceptable range, you might not qualify for the best interest rates. The better your credit score, the lower the interest you are likely to be offered. It is still a significant achievement to secure a potential mortgage approval, but continuing to work on improving your credit score could result in even more favorable terms in the future.

Can I Get a Credit Card with a 695 Credit Score?

With a credit score standing at 695, you're in a relatively good position to be approved for a credit card. This score reflects seriousness about financial responsibilities, which lenders usually appreciate. This allows the conversation to shift towards choosing the most suitable credit card for your particular situation.

As someone with a credit score of 695, credit card possibilities are quite diverse. Starter cards, for example, can provide solid ground for credit-building. These often come with lower interest rates, so it can be a good place to start. Alternatively, secured credit cards are also within reach, necessitating a deposit that sets the maximum for the available credit. Although the deposit might feel like a drawback, they are proven credit-building tools. If seeking rewards or travel benefits is a top priority, some lower-end premium travel cards could also be options. Remember, each card has its pros and cons and it is crucial to evaluate what works best for your financial scenario.

With a credit score of 695, you are likely to be approved for a personal loan. Such a score is in the 'fair' credit range, not considered ideal by most traditional lenders but still high enough for most loan options. But remember, while your credit score is a vital factor, lenders may evaluate other aspects of your financial standing as well.

While applying for a personal loan, be prepared for a thorough financial review. It includes your income, existing loans, assets, and of course, your credit history. It's to ensure that you are capable of meeting the repayment obligations. As your score is hovering around the average mark, you might not receive the most favorable interest rates on your loan. Nonetheless, it will still be a competitive rate compared to higher-risk borrowers. With each timely payment you make, your credit score will gradually improve, paving the way for better loan terms in the future.

Can I Get a Car Loan with a 695 Credit Score?

Having a credit score of 695 can feel like a gray area when it comes to applying for a car loan. It's not exceptionally high, but it's not low either. If you're looking to finance a new car, the good news is that this score gives you a pretty solid chance of approval. Lenders tend to favor borrowers with scores above 660, so you're in a decent position.

However, keep in mind that while you're likely to get approved, you may not be offered the most favorable interest rates. Lenders reserve the best rates for those with scores in the 700s and above. Nonetheless, your credit score of 695 does signify to lenders that you are relatively reliable when it comes to repaying borrowed money. So, while your car purchasing journey could include slightly higher interest rates, it's certainly within reach to drive off the lot in a car financed with a loan that fits your budget.

What Factors Most Impact a 695 Credit Score?

With a credit score of 695, you are on the cusp of achieving a 'Good' credit rating. Yet, several factors might be keeping your score below this benchmark. Let's delve into possible causes and address them effectively.

Occasional Late Payments

Even a few late payments can impact your credit score. If you've missed a payment or paid late, this could be dragging your score down.

How to Check: Scan your credit report for any late or missed payments. Understand your missed payments and create a strategy to ensure timely payment in those scenarios.

Moderate Credit Utilization

Your balances may be hovering around the middle, rather than the low end, of your credit limit. Lowering your credit utilization can enhance your credit score.

How to Check: Analyze your credit card statements. How much of your total credit limit are you using? Keeping your balances at a third of your limit or lower can boost your score.

Age of Credit History

Though your credit history might not be new, it may not be long enough to boost your credit score into the 'Good' range.

How to Check: Check your credit report to determine your oldest and newest accounts' age. Patience is key, as a more extensive credit history is favorably received.

Minority of Credit Types

Even if you've done a good job managing credit cards, your score might not be maximized if you lack variety in your credit mix.

How to Check: Review your credit report and look for diversity in credit account types. A balanced mix of credit cards, retail accounts, installment loans, and more can contribute positively to your score.

How Do I Improve my 695 Credit Score?

With your credit score at 695, you’re already nearer the threshold of ‘good’ credit status. Yet, with a few tactical steps, you could elevate this score even further. The following strategies are custom-made for your situation:

1. Keep an Eye on Credit Utilization Ratio

Efficient credit management is pivotal to a higher score. Aim to keep your credit card balances as low as possible, ideally below 30% of your available credit limit. This could boost your score as it will improve your credit utilization ratio.

2. Don’t Ignore the Smallest Debt

Pay attention to even the smallest amounts of debt. Clearing any outstanding balances, no matter how small, can help remove potential negative marks from your credit reports. It can also set the groundwork for better financial habits in the future.

3. Maintain Old Credit Cards

Age of credit factors into your score. By keeping your old cards active and in good standing, you demonstrate a longer positive credit history. However, ensure you manage these cards well, as any mismanagement can negatively impact your score.

4. Limit Hard Inquiries

Too many credit applications can lead to multiple hard inquiries on your credit report, which might lower your score. Only apply for new credit when necessary to avoid these potential negative effects.

5. Regularly Monitor Your Credit Report

Regularly monitoring your credit report can help you spot any errors or discrepancies that could be dragging your score down. If you find any, dispute them with the respective credit bureau promptly to safeguard your score.