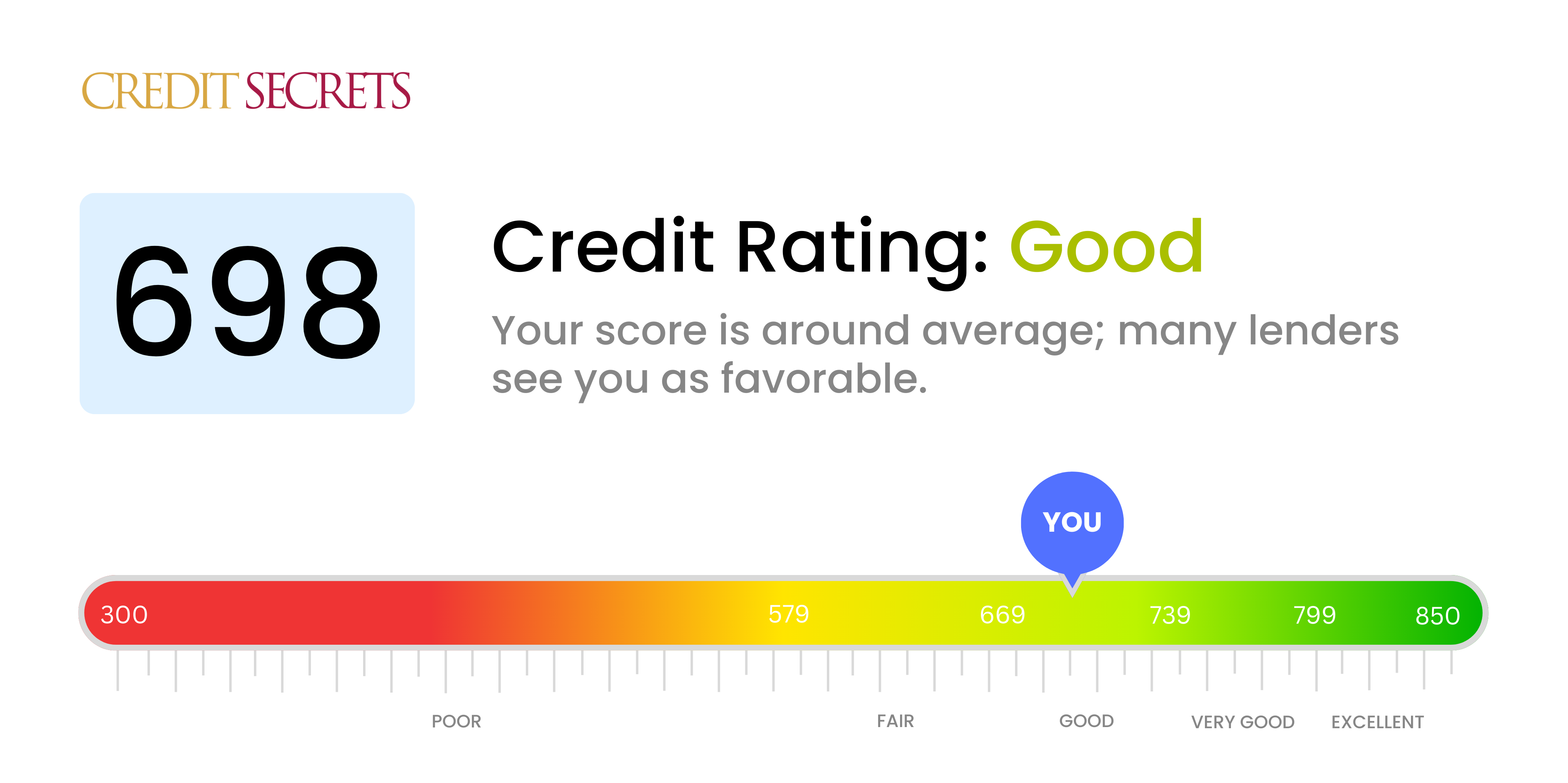

Is 698 a good credit score?

With a score of 698, your credit is considered to be in the 'Good' category. This score indicates a fairly established credit history with few or no major blemishes, paving the way for the potential approval of credit cards or loans, though perhaps not at the lowest interest rates.

However, it's important to remember that even within this 'Good' score range, continuous work on responsible credit management could help you move up to the 'Very Good' or even 'Excellent' ranges. Every improvement in your credit score, no matter how small, can potentially lead to better financial opportunities in the future.

Can I Get a Mortgage with a 698 Credit Score?

If your credit score is 698, your chances of being approved for a mortgage are fair but not guaranteed. This score is positioned on the cusp between "fair" and "good" according to credit score evaluation. Lenders may see you as less risky compared to someone with a lower score, but this doesn’t guarantee approval.

Mortgage approval isn't solely dependent on credit scores. Lenders consider several factors, such as debt-to-income ratio and employment history. If your other lending factors are solid, you stand a decent chance of approval. However, keep in mind that while you may be approved, your terms or interest rates might not be as favorable as those with higher scores.

Now might be a favorable time to review your credit report. Identify and address any outstanding issues such as late payments or high credit utilization, as these can significantly impact your scores. By improving these areas, you'll also improve your chances of getting better terms on your mortgage.

Can I Get a Credit Card with a 698 Credit Score?

With a credit score of 698, there's a good chance you'll be approved for a credit card. This score reflects a history of fairly responsible credit management. It's vital to face this reality with a grounded mindset, remembering that having a good credit score is a vital part of achieving financial stability.

With a score like yours, consider a variety of credit card types. Starter cards could be a good option for you: they often come with lower interest rates and fewer penalties, making them a less risky choice. Secured cards might also be a fit, as these cards require a deposit that then becomes your credit limit. Finally, if you travel frequently, you may be eligible for some premium travel cards. While these cards often have higher interest rates, they also offer perks like travel points and hotel benefits. Becoming aware of your options is an important step in your financial journey. Regardless, remember that while a credit score is an important factor, lenders also consider other aspects before granting approval.

With a credit score of 698, you stand a fair chance of qualifying for a personal loan. It's clear that you have demonstrated a reasonable level of financial responsibility. However, it's crucial to remember that every lender has different requirements, and your score doesn't guarantee approval.

In the loan application process, your credit score may affect the interest rate you are offered. Lenders view a higher credit score as an indicator of less risk, which can translate to lower interest rates. Therefore, while your score of 698 may get you through the door, bear in mind that it could impact the terms of your loan, including how much you are able to borrow and at what rate. It is also possible you might not receive the absolute best interest rates on the market, as these are often reserved for borrowers with extremely high credit scores.

Can I Get a Car Loan with a 698 Credit Score?

If your credit score is 698, chances are high that you'll be approved for a car loan. This score falls within the fair to good range, making it more attractive to lenders. When lending institutions evaluate your credit situation, this score generally indicates a lower risk, as it reflects a history of mostly on-time payments and responsible credit usage. However, it's important to bear in mind lenders do not only consider your credit score, but also your monthly income and the amount you wish to borrow.

Being on good standing with your credit, you may experience a smoother ride while navigating the car purchasing process. For instance, this can mean you are likely to be offered relatively lower interest rates compared to those with lower scores. However, it's essential to shop around and compare car loan terms for the best deal. Remember, a lower interest rate equates to lesser repayment amounts over the loan term, so it's in your best interest to get the most favorable deal out there.

What Factors Most Impact a 698 Credit Score?

With a credit score of 698, you're not too far from the threshold of very good credit, which begins at 740. Below, we discuss the major factors you should consider in improving your score from good to very good.

On-Time Payments

Punctual payments are fundamental to a strong credit score, so it's critical to make payments on time. Any delayed payments could have pulled down your score slightly.

How to Check: Look at your credit report for any late or missed payments and make a note of how recent they are since their impact declines over time.

Credit Card Balances (Utilization)

Your credit utilization, the amount of your available credit you're using, could be too high. Lower utilization is generally better for your score.

How to Check: Review your credit card statements. If your balances are higher than 30% of your limits, this could be having a negative impact.

Length of Credit History

If you're relatively new to credit or recently opened a new account, it can lower your score temporarily.

How to Check: Assess the age of your oldest and newest accounts in your credit report. If your credit history is short or you have a new account, it may account for your current score.

Mix of Credit Types

A diverse mix of credit accounts - credit cards, retail accounts, installment loans - reflects positively on your score.

How to Check: Take a look at your mix of credit accounts on your report. A lack of variety could be holding your score back slightly.

How Do I Improve my 698 Credit Score?

With a credit score of 698, you’re on the verge of “Good” credit status. The right actions can quickly help refine your score. Here are some key strategies tailored to your credit situation.

1. Review Your Credit Report

It’s pivotal to know what’s influencing your credit. Obtain a free credit report and scrutinize it for any inaccuracies – a wrongly reported late payment, for example. If uncertain, dispute it. Correcting a simple mistake could leverage your score.

2. Keep Credit Utilization Low

A key aspect that impacts your credit score is your credit utilization ratio, or the percentage of your available credit that you’re using. Keep this as low as possible, ideally below 30%, to see potential improvements in your credit score.

3. Be Consistent with Payments

Your credit history is a major factor in your score. Maintaining consistent, on-time payments will demonstrate responsible behavior and can boost your rating.

4. Be Mindful of New Credit

New credit has a short-term negative impact. You’re almost at the 700 benchmark, so avoid applying for new credit unless absolutely necessary.

5. Long-term Strategic Credit Management

Maintaining a variety of credit types responsibly, such as installment and revolving credit, can help improve your score over time. Start with a secured card, then consider adding a mix of credit types, as long as you can manage them sensibly.