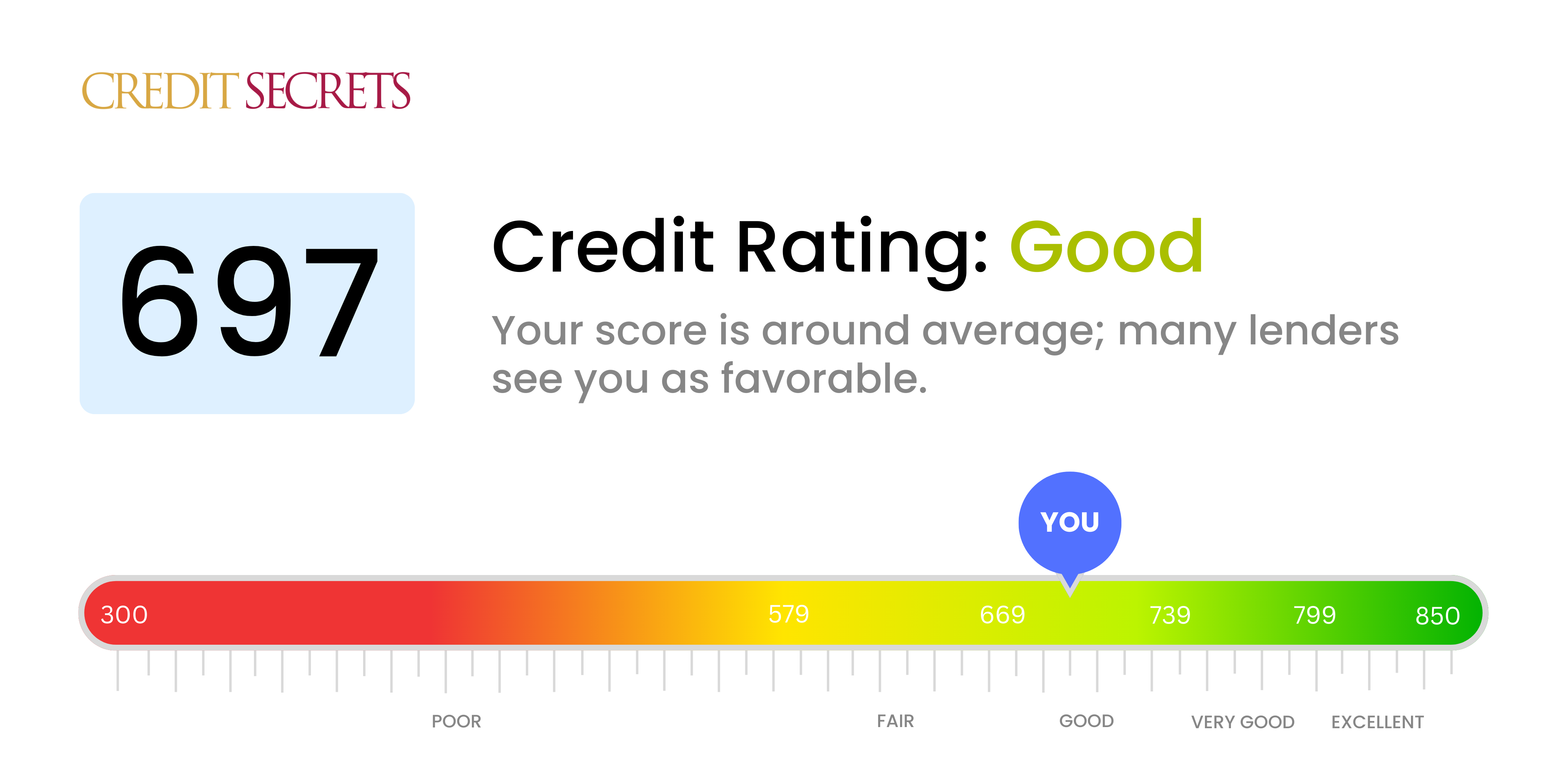

Is 697 a good credit score?

A credit score of 697 falls into the 'Good' category. With this score, you can expect to be approved for most loans or credit lines, although the interest rates you receive may not be the most competitive. While you've made commendable efforts in managing your credit, there's still room for improvement to aim for a 'Very Good' or 'Excellent' score, which could unlock better financial opportunities.

Though being in the 'Good' range means you have done many things right, striving for a higher score may allow you to get lower interest rates and access to a broader range of financial offers. It's important to understand what's determining your score in order to identify areas for improvement - typically these include payment history, the amount of credit you are using compared to your available limit, and the length of your credit history. The path to improving your score may involve diligent payment of any debts, avoiding new debt, and consistently making bill payments on time. You have the power to make changes and the potential to improve your financial future.

Can I Get a Mortgage with a 697 Credit Score?

A credit score of 697 is by no means a poor score, but it may put you on the edge when it comes to mortgage approval. Some lenders may consider this score as satisfactory and extend mortgage approval, however, it's not the most appealing score to majority lenders. It's a truism that everyone's financial situation is unique and factors beyond credit scores can impact mortgage approvals.

Should you be approved for a mortgage with this score, prepare yourself for the complexities of the mortgage process. The lender will look into your income stability, debt to income ratio, and potentially any legal issues that could impact your ability to repay the loan. Additionally, an interest rate may be slightly higher than those with excellent credit, but it will comparably be reasonable. Remember, a 697 credit score is a stepping stone and with diligent financial practices, an improvement is most certainly on the horizon.

Can I Get a Credit Card with a 697 Credit Score?

With a credit score of 697, you stand a fair chance of being approved for a credit card. This score is seen as near-good by most lenders, and generally indicates a history of fairly responsible credit management. However, there's always room for improvement, and being aware of where exactly your credit stands is a large step towards maximizing your financial well-being.

Credit card options for someone with a 697 credit score may include starter cards, which are designed especially for those looking to continue improving their credit. Look for those with lower interest rates and no annual fees. While premium or travel cards may still be slightly out of reach, with continued diligent credit management, those opportunities can become a reality. Remember, while this credit score unlocks some beneficial credit options, improving your score even further can open doors to even better interest rates and credit card offerings.

A credit score of 697 can be seen as fair in the eyes of most traditional lenders. While it's not excellent, it's still within the acceptable range, increasing your chances of being approved for a personal loan. Being honest, this score might still present a slight risk for lenders, so approval isn't guaranteed, but your odds are significantly better than someone with a lower score.

As you start your personal loan application process, it's crucial to understand that your credit score will likely affect the interest rates you're offered. Lenders might see your fair score as a slight risk, so they might charge higher interest rates to compensate. However, don't be disheartened. Carefully compare the loan terms and interest rates from different lenders, because some might offer more favorable terms. It's a sobering reality, but your commitment to improve your credit health is half the battle won.

Can I Get a Car Loan with a 697 Credit Score?

Having a credit score of 697 gives you a fairly good chance of being approved for a car loan. Lenders often look for applicants with a score of 660 and above and your score is comfortably in this range. This is a reflection of your past financial responsibilities, indicating a likely ability to meet future loan repayments. However, don't forget that a credit score isn't the only factor that determines approval. Other factors like income and employment history also play a part.

So, what can you expect from the car purchasing process with this credit score? For one, you can likely look forward to competitive interest rates. A higher credit score tends to yield lower interest rates because it reduces the risk to the lender. Secondly, with your score, you may have the advantage when negotiating loan terms. Remember, though, every lender is different, and rates and terms can vary. Always read the fine print and understand your loan agreement thoroughly before signing. A bit of diligence now can pay off in the long run.

What Factors Most Impact a 697 Credit Score?

Understanding your credit score of 697 is the first step to improving your financial well-being. A few factors might be playing a role in keeping your score below that 700 mark.

Paying Bills On Time

Keeping up with bill payments can have a considerable impact on your credit score. If you've occasionally missed or been late on payments, it could be affecting your score negatively.

What to do: Ensure to review all credit accounts and ascertain there are no late payments.

Credit Use Rate

Your credit utilization could also be a factor. If you're close to maxing out your credit limits, it might be dragging down your score.

What to do: Review your credit balances. If they're close to the limit, paying them down can significantly improve your score.

Length and Diversity of Credit History

The duration of your credit history and its diversity also plays a part. The age of your oldest and newest accounts, as well as the average age of all accounts might need improvement.

What to do: Review your credit report. Look at the age of each credit line and the variety of credit you hold—credit cards, auto loans, mortgage, etc.

Application of New Credit

Applying for new credit frequently might be affecting your score. Such actions may imply financial distress which lowers your score.

What to do: Take a look at your recent credit enquiries. Remember, making fewer credit applications can improve your score.

How Do I Improve my 697 Credit Score?

With a credit score of 697, you’re situated in the middle of the fair range, teetering on the edge of being a good credit score. A few accessible and impactful steps can take you to the “good” and beyond:

1. Examine Your Credit Report

Monitoring your credit report is vital at this stage. Look for any discrepancies or errors that may be unnecessarily pulling down your score. If any are found, dispute them right away.

2. Utilize Credit Smartly

Even with a fair credit score, you should have access to credit cards. Use them wisely – don’t exceed 30% of your limit and ensure payments are made on time each month. These meticulous habits demonstrate responsible credit usage and can positively influence your score.

3. Repay Critical Debts

If any, focus on eliminating high-interest debts first to limit additional accrual of interests. Swift repayment bears positive implications for your credit rating.

4. Clear Collection Accounts

Collection account records are damaging for your credit score. Consider settling them as promptly as possible. Reach out to the collection agency and negotiate a plan that helps get these accounts closed without wrecking your finances.

5. Maintain Old, Positive Credit

Long-standing credit accounts with good standing can greatly benefit your credit score. Even if you’re not using an old credit card, keeping it open will demonstrate a longer credit history and lower credit utilization.

Remember, discipline and consistency are key to maintaining and improving your credit health.