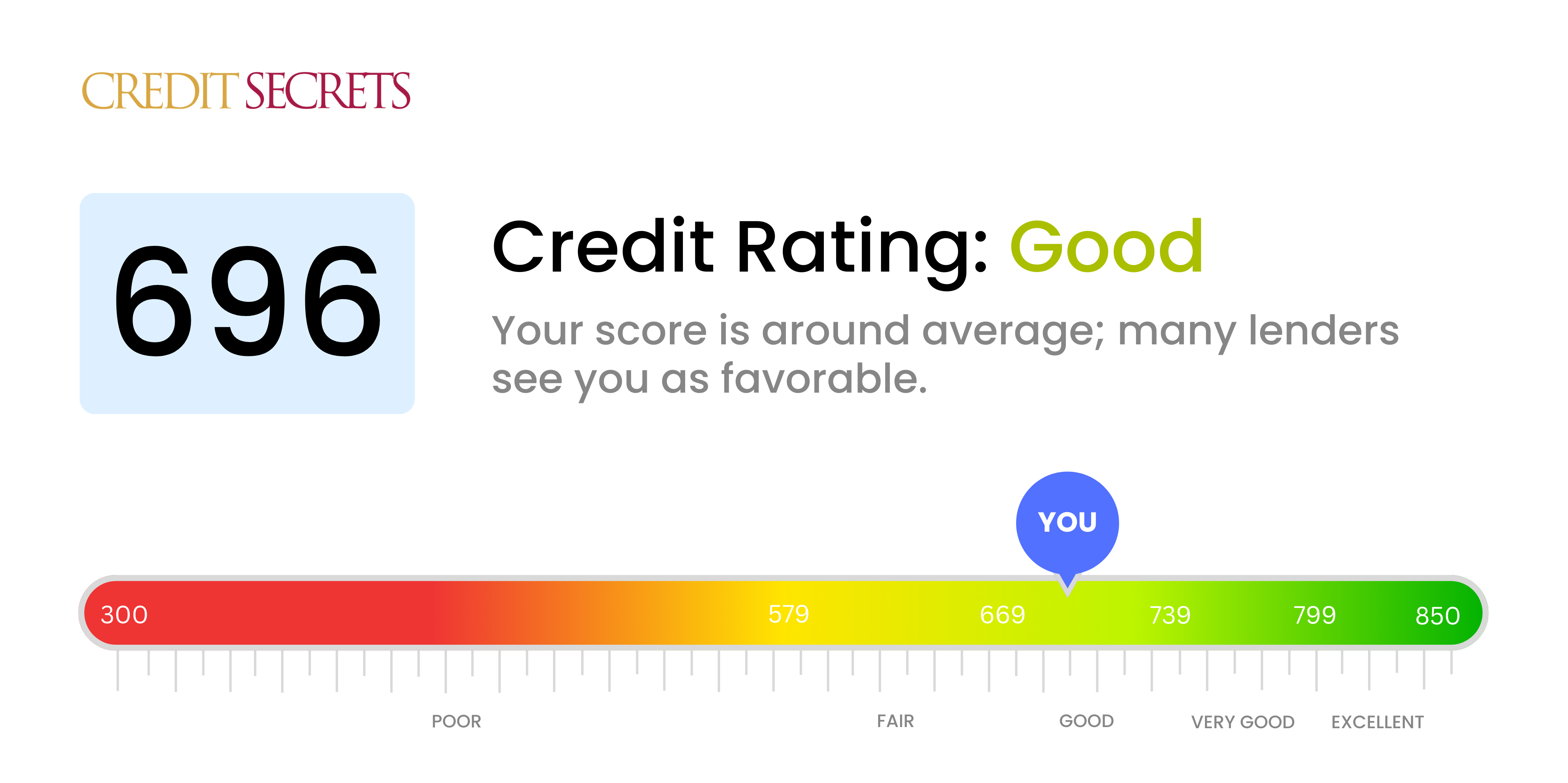

Is 696 a good credit score?

Your credit score of 696 falls into the 'Good' category. Being in this range means you've managed your credit fairly well and are likely to have increased access to loans and credit card approvals, usually at moderate interest rates.

It's worth noting that different lenders may have slightly different criteria in determining your creditworthiness, but a score of 696 generally demonstrates healthy financial habits. However, improving your credit score into the 'Very Good' or 'Excellent' range could yield better financial options and lower interest rates. This progress can be achieved by consistent on-time payments, low credit utilization, and maintaining a diverse mix of credit accounts.

Can I Get a Mortgage with a 696 Credit Score?

With a credit score of 696, you stand in a fairly good position to be approved for a mortgage. This score is above the average and well within the range that most lenders consider acceptable for a loan. However, it's crucial to remember that a credit score, while important, is just one aspect that lenders consider when deciding on mortgage approval.

You can expect the mortgage approval process to be detailed and thorough. Lenders will carefully review your financial history, particularly focusing on your debt-to-income ratio, employment stability, and overall creditworthiness. Having a score of 696 can also place you in a more favorable position in terms of the interest rate on the loan. But it's crucial to do your research and be prepared. Knowing more about the process will only serve to strengthen your application. Being proactive and informed is the key to successfully navigate mortgage approval. Keep in mind, maintaining and even improving your credit score will further enhance your prospects.

Can I Get a Credit Card with a 696 Credit Score?

With a credit score of 696, you have a fair credit rating, and you're in a solid position to be approved for a credit card. This score indicates to lenders that you're capable of managing your finances responsibly. It's a good benchmark, reflecting a balanced financial history. While it might not be perfect, it's important to remember that financial journeys are full of peaks and valleys.

Not all credit cards are created equal though, and with a score of 696, you'll want to be selective. Look for cards with reasonable interest rates and rewards that suit your lifestyle. Eplore options such as low-interest cards or reward cards, which have a good balance between cost and benefits. Cash-back cards or travel cards could also be a good fit, depending on your spending habits. Keep in mind that while your current score opens doors, the aim should always be improvement and progress towards greater financial stability. Remember, every financial decision you make today shapes your financial profile for tomorrow.

With a credit score of 696, it's likely you will be approved for a personal loan. This is because a credit score in this range is seen as good in the eyes of most lenders. While it's not the highest score achievable, it still represents a satisfactory level of creditworthiness and reliability for loan repayment. However, keep in mind that while you may be approved, the terms of your loan, including interest rates and repayment period may vary.

As you begin the loan application process, there are a few things to keep in mind. Your credit score can influence the interest rate you're offered. A higher score may often attract better rates. Additionally, lenders may look further than just your score, considering factors such as your income, debts and employment history. So, a holistic approach to maintaining good financial health is beneficial. Be sure to thoroughly review any loan agreement before signing, to fully understand the terms and your obligations.

Can I Get a Car Loan with a 696 Credit Score?

With a credit score of 696, there's a good chance of securing approval for a car loan. Keep in mind, lenders ideally look for scores above 660. Fortunately, your score sits comfortably above this baseline, which is a hopeful sign. This score reflects a decreased risk to lenders, as it is indicative of a history of responsible borrowing and diligent repayment.

In the car purchasing process, lenders will assess your credit score to determine the terms of the loan. With your score, they are likely to offer conditions that are more in your favor, possibly with lower interest rates. Remember, lower interest rates mean lower monthly payments, which can save you money over the lifespan of your loan. Nevertheless, it's still important to understand the complete terms of any loan agreement before making a commitment, ensuring it aligns with your personal budget and long-term financial plans.

What Factors Most Impact a 696 Credit Score?

Gauging a 696 credit score is pivotal for crafting your path towards better financial health. Identifying and tackling the elements contributing to your score can help navigate your way towards a stronger financial future. It's essential to remember that everyone's financial journey differs and presents numerous chances for enrichment and education.

Consistency in Payments

Consistency in making payments impacts your credit score significantly. If your score is low due to missed or late payments, resolving this could markedly improve your score.

How to Check: Examine your credit report for any missed or late payment service details. Think back to any times you may have postponed payments, as this could have influenced your score.

Debt-to-Income Ratio

Higher debt relative to your income can negatively affect your credit score. If your ratio is high due to balances on credit cards and loans, addressing these could improve your score.

How to Check: Look at your total outstanding debt versus your income. Are you struggling to make payments? Working towards reducing your debt level can boost your score.

Credit Tenure

A shorter credit history can impact your score negatively.

How to Check: Scrutinize your credit report to determine the age of your oldest and newest accounts, along with the mean age of all your accounts. Reflect on whether you have recently opened any new accounts.

Varying Credit Accounts and Responsible Management

Possessing diverse credit types and efficiently managing fresh credit are vital for a favorable credit score.

How to Check: Understand your range of credit accounts which can include credit cards, retail accounts, installment loans, and even mortgage loans. Limit new credit applications and manage responsibly.

Presence of Negative Marks

Public records like legal judgments or collections can dramatically lower your score.

How to Check: Investigate your credit report for any listed negative mark. Take the necessary steps to resolve any items listed that may require action.

How Do I Improve my 696 Credit Score?

With a credit score of 696, you’re on the verge of having a good credit standing. Here are a few targeted strategies to help you improve from here:

1. Verify Your Credit Report Accuracy

Error entries on your credit report can lower your score. Regularly check your credit report for outdated or incorrect information and dispute them immediately.

2. Maintain a Balance-to-Limit Ratio

Referred to as credit utilization, your balance-to-credit limit ratio significantly impacts your score. Aim to keep your utilization below 30% of your available credit. It’s even better if you can keep it below 10%.

3. Pay Off Non-Revolving Debt

Non-revolving debt, like a car loan or student loan, can weigh heavily on your credit score. Consider paying down these debts faster to improve your creditworthiness.

4. Avoid Excessive Credit Applications

Multiple hard inquiries in a short time can lower your credit score. Only apply for new credit when necessary to avoid unnecessary hard inquiries on your report.

5. Consistent and Timely Payments

Your payment history is a significant factor in your credit score. Ensure all your payments, including utilities and rent, are made consistently and on time.

Remember, climbing to a fantastic credit score is achievable with conscious and consistent efforts. You are on the right track.