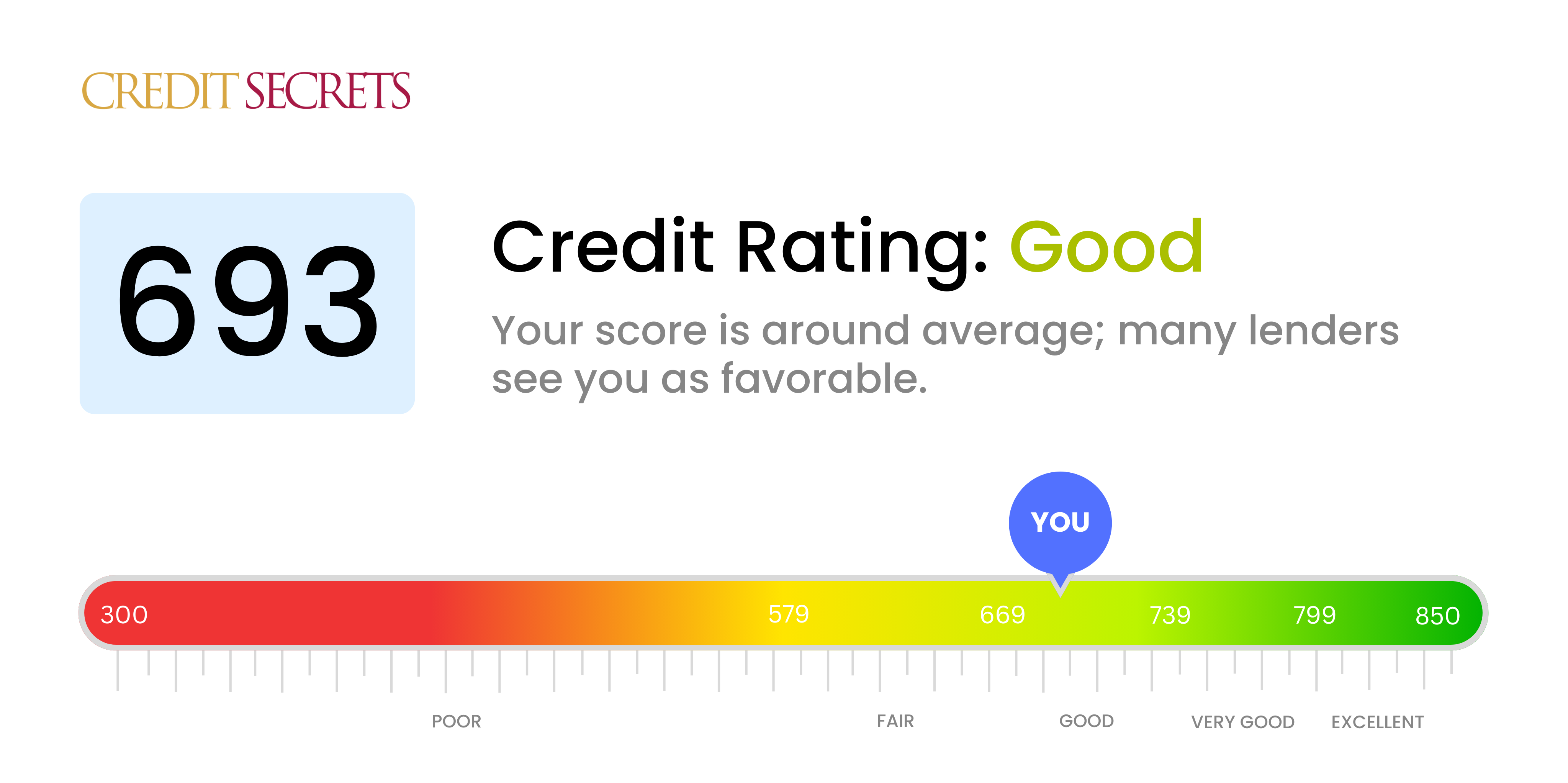

Is 693 a good credit score?

Your credit score of 693 is considered good, which is a positive achievement in terms of your financial health. A score in the good category typically means lenders and creditors regard you as a lower risk, so you can likely expect better rates and terms compared to those with lower credit scores.

Keep in mind that while a 693 is a good credit score, slightly higher scores may secure even better opportunities. Therefore, continue your established healthy credit habits, such as paying bills punctually and keeping credit balances low, to potentially further enhance your score and financial possibilities.

Can I Get a Mortgage with a 693 Credit Score?

With a credit score of 693, you stand a fair chance of being approved for a mortgage. This score falls within the "fair" range in most credit rating scales, although it's inching closer to the "good" territory. This indicates that you've been fairly consistent with your financial obligations, but there's still room for improvement. Because every lender's requirements differ, there isn't a guarantee, but many do approve applications from individuals in your credit score range.

As you go through the mortgage approval process, remember that while your credit score is an important factor, it's not the only thing lenders consider. They'll also look at your income, debt-to-income ratio, and employment history. It's important to prepare for these evaluations as well. Keep in mind, your interest rates may be slightly higher due to this being a fair credit score, so be sure to shop around for the best rates and terms accessible to you. Continuing to make timely payments and responsibly manage your debts will keep you on the right track.

Can I Get a Credit Card with a 693 Credit Score?

With a credit score of 693, obtaining a credit card is largely possible. This score clearly shows responsible financial behavior and a reasonable credit history. Quite assuredly, lenders see this score as fairly low-risk and it generally breeds confidence in your ability to manage credit productively. While there's always room for improvement, it's vital to celebrate the strides made so far. Embracing your current financial status is a crucial part of progressing towards even greater financial stability.

Tailoring the choice of credit card to suit the unique situation of a 693 credit score is key. Looking into the spectrum of options, from starter cards to premium travel cards, might be of great benefit. Starter cards can be supportive in maintaining and gradually improving your credit score, while premium travel cards offer exciting rewards but require careful management. Interest rates for your score range tend to be competitive, giving you an edge in enjoying your credit facility without incurring excessive costs. Remember, with a 693 score, your financial journey is already on a positive track.

Your credit score of 693 is just on the edge of what lenders typically consider as good credit, which ranges from 700 to 749. While this score is not ideal, it might be enough to secure a personal loan, depending on the specific lender's guidelines. However, bear in mind that your credit score is a key determinant of both your approval odds and the interest rate you'll receive. Even a few points can make a significant difference.

Should you decide to apply for a personal loan, prepare yourself for a process that scrutinizes your financial history and overall ability to repay the loan. Lenders will likely focus on factors like your income, employment status, and debt-to-income ratio, in addition to your credit score. With a score of 693, it's probable that you'll face higher interest rates compared to those with excellent credit scores. Nevertheless, don't let this discourage you. While the process may be challenging, it's a step toward achieving your financial goals.

Can I Get a Car Loan with a 693 Credit Score?

Having a credit score of 693 means you're in a better position than many when it comes to securing a car loan. Having this credit score typically falls into the "good" category and lenders are more likely to consider you as a less risky borrower. However, you must be mindful that it isn't considered excellent yet, thus, your interest rates might not be as favorable compared to those with higher scores.

Should you decide to proceed with getting a loan for a car, it's important to understand that your credit score will play a pivotal role in the purchasing process. Lenders will use this score to determine your interest rate, loan amount, and the loan term. While it's more likely that you'll get approved compared to those with lower scores, it can still affect the overall cost of the loan due to potentially higher interest rates. Keep in mind though, with proper financial planning, you can successfully navigate through this process.

What Factors Most Impact a 693 Credit Score?

Having a credit score of 693 is a stepping stone to achieving excellent financial health. A few adjustments could potentially elevate your score to above 700, vastly improving your financial opportunities. Key factors behind this score may include:

Payment History

Your ability to make payments on time is a significant aspect of your credit score. Timely payments show financial responsibility, hence why this metric holds much weight.

How to Check: Go over your credit report for any late or missed payments. Rectify these mistakes moving forward.

Credit Utilization Ratio

The proportion of your credit limit that you use, otherwise known as your credit utilization ratio, could drop your score. Aiming to utilize less than 30% of your credit limit is advisable.

How to Check: Assess your credit card statements. If your balances are above 30% of your limit, consider managing them strategically.

Length of Credit History

The length of your credit history is highly impactful. The longer you've successfully managed credit, the better your score.

How to Check: Go through your credit report and evaluate the age of your accounts. Recently opened accounts may temporarily lower your score.

Credit Mix

Having diverse credit types (credit cards, mortgage, car loans, etc.) demonstrates your capacity to manage different types of credit, positively affecting your score when done right.

How to Check: Examine your credit report and determine your credit mix. Aspire for an array of credit types balanced with your budget.

Negative Marks

Collections, bankruptcies, or tax liens are red flags that will lower your score considerably.

How to Check: Browse your credit report for any negative elements. If you find any, investigate further and work towards resolution.

How Do I Improve my 693 Credit Score?

Having a credit score at 693 places you in the “fair” score range, with room to grow towards an excellent credit standing. Here are 5 broad actions you can tailor to your situation for significantly improving your credit score:

1. Maintain Timely Bill Payments

Keeping up with your bill payments is essential. Demonstrating that you can handle your monthly expenses proves your reliability to future lenders. Make sure to pay all of your bills including utilities, rent, and phone bills on time to improve your creditworthiness.

2. Limit New Credit Inquiries

Avoid applying for unneeded loans or credit cards, as this can temporarily impact your credit score. Keep your credit inquiries limited to those that are necessary and will add value to your financial profile.

3. Keep Credit Balances Low

Try to keep your credit card balance below 30% of your credit limit at all times, even lower if possible. It’s important to monitor your spending to maintain a low credit utilization ratio, which positively impacts your credit score.

4. Regularly Monitor Your Credit Report

Regularly review your credit report to inspect for any errors. Incorrect information can harm your credit score. Should you discover an error, request a dispute with the credit bureau to correct it.

5. Keep Old Credit Accounts Open

Older credit accounts convey a long-standing history of credit, which can boost your credit score. Rather than closing these accounts, consider keeping them open – especially if they’re in good standing with a record of on-time payments.