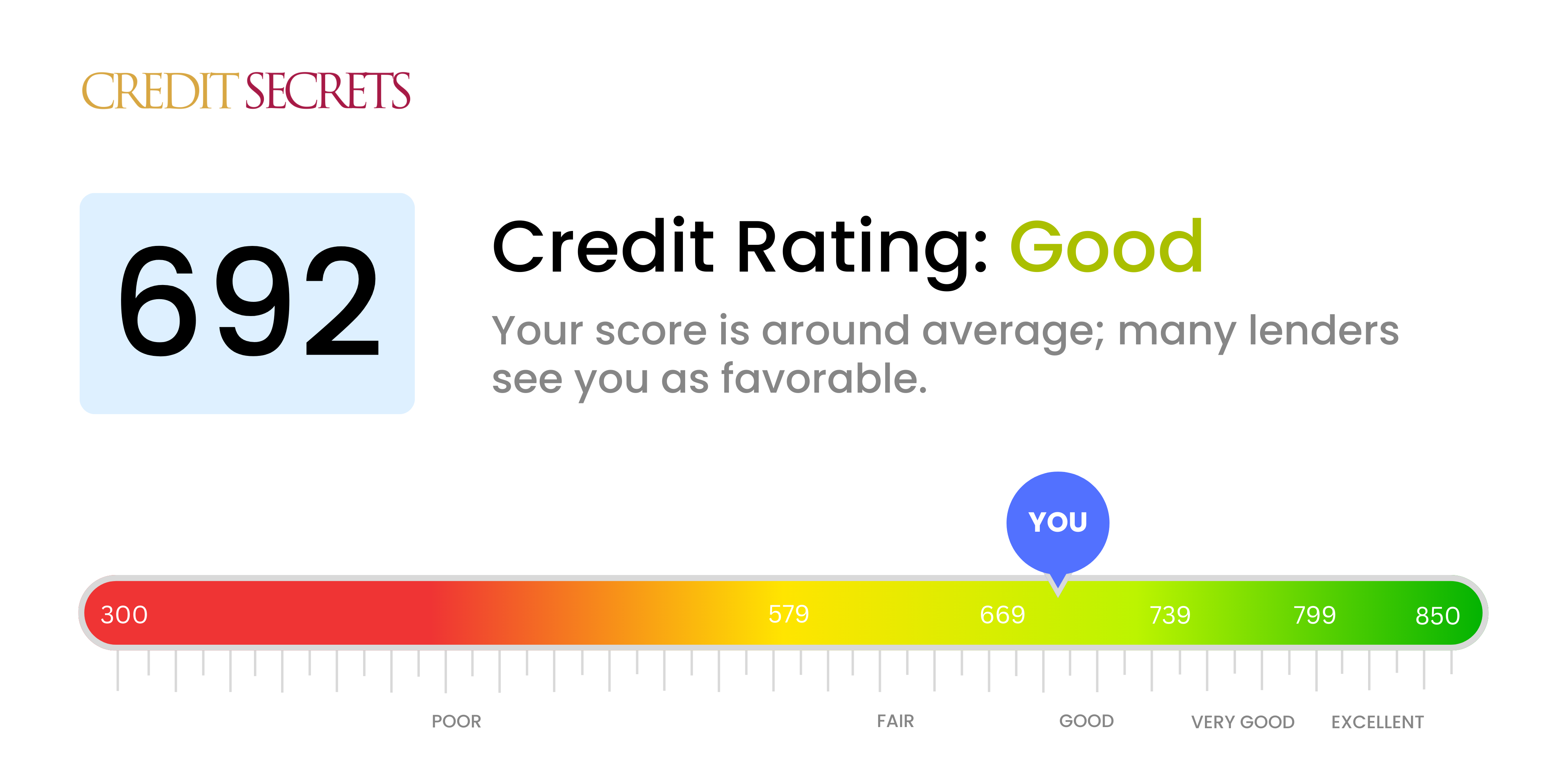

Is 692 a good credit score?

Your credit score of 692 falls into the 'Good' category. This typically means you have been somewhat consistent in managing your credit, paying bills on time and not having significant debt. However, there are still opportunities for improvement to help you secure better loan terms or qualify for exclusive credit offers.

With a score of 692, you'll likely be approved for credit facilities, however, the premium you pay on top of borrowed money might be higher than that for an individual with 'Excellent' or 'Very Good' credit. Further consistency with bill payments, reducing your debt where possible, and being mindful of your credit usage can help boost your credit score. Keep working on making financial decisions that prove your creditworthiness and trustworthiness to lenders.

Can I Get a Mortgage with a 692 Credit Score?

With a credit score of 692, you are in a fair credit range. This score can possibly result in a lender’s approval for a mortgage, but it certainly is not guaranteed. A score at this level does not clearly reflect poor credit habits, but it's also not in the very good to excellent range that lenders prefer. It's right on the edge of the cusp, and various factors could tip the scales in either direction.

Having this credit score, you might experience higher interest rates compared to those with excellent credit scores. Remember, the lower the risk you present to lenders, the lower the interest offered, meaning less cost over the life of your loan. Your focus should now be on maintaining diligent payment habits and minimizing debt. Progress may seem slow, but each step you take brings you closer to a stronger financial future.

Can I Get a Credit Card with a 692 Credit Score?

Having a credit score of 692 is likely to open up opportunities for being approved for a credit card. This score is typically viewed by lenders as a reflection of responsible financial management. It's understandable to question your financial standing, but with this score, optimism is well-placed. Bear in mind that your credit status helps dictate your financial pathway.

With this score range, most standard credit cards may be within reach. Secured cards or credit builder cards are good options, mainly if you're interested in increasing your score to further accommodate your financial goals. Premium cards, however, might still remain just out of grasp as they typically require excellent credit. As with all credit cards, imperative to consider the associated interest rates, which with a score of 692, should be fairly reasonable. These are all considerations to keep in mind as you navigate your financial journey.

With a credit score of 692, you are considered as having a fair credit rating. This score can make applying for a personal loan a bit challenging, but it's not impossible. Whilst it may not open the door to the most competitive interest rates, this score is typically within the range that many lenders find acceptable. To be clear, every lending institution has its own criteria, so a 692 may be deemed low for some, yet satisfactory for others.

In your case, understanding what the specific lenders require can save you time and effort during the application process. If you're approved, expect that interest rates might be higher compared to those with excellent credit. You may also be asked to provide more documentation to verify your income or employment. It's important to read the terms carefully and make sure you can meet the repayments, as failure to do so could impact your credit score further.

Can I Get a Car Loan with a 692 Credit Score?

If your credit score is 692, you're in a decent position to secure a car loan. Typically, lenders begin to offer more favourable terms to individuals with scores above 660, and your score of 692 falls comfortably within this range. This indicates to lenders that you pose a lower risk when it comes to repaying borrowed money.

With a credit score like yours, you can walk into the car buying process with a certain level of confidence. However, be prepared to face some negotiations. While approval is likely, the exact terms of your loan, including the interest rates, may depend on other factors such as your income and financial reliability. Remember, your credit score gives you a strong bargaining power. So, make sure to understand all the details of your loan before making an agreement. You've got this.

What Factors Most Impact a 692 Credit Score?

Having a 692 credit score is an essential stepping stone towards a better financial future. Acknowledging the factors that influence this score can guide you to financial wellness. Each financial situation is unique; thus, this is a learning and growth opportunity.

Payment History

Your payment history greatly impacts your credit score. The presence of late or missed payments could significantly contribute to your score of 692.

How to Check: Request a copy of your credit report and scrutinize it for any late or missed payments. Think about if there were times when your payments were delayed or not made, as these instances can affect your score.

Credit Utilization Ratio

How much of your available credit you're using, known as your credit utilization ratio, can affect your score. If you're frequently maxing out your credit cards, this could be impacting your score.

How to Check: Evaluate your credit card statements. Are your card balances typically near or at their limits? Make an effort to keep your balances low compared to your credit limits.

Length of Credit History

A shorter credit history might be negatively influencing your score.

How to Check: Look over your credit report to determine the length of time your accounts have been active. Take into account any recently opened accounts, as these can reduce your average account age.

Type of Credit Used

Having a diverse range of credit types (credit cards, personal loans, auto loans etc.) and managing all responsibly is crucial for optimizing your score.

How to Check: Examine your mix of credit types. Consider if you have frequently applied for new credit, which can be a red flag to lenders.

Public Records

Public records, such as tax liens or bankruptcies, can cast a large shadow over your score.

How to Check: Refer to your credit report for any public records. Act on resolving any items listed that could be damaging your score.

How Do I Improve my 692 Credit Score?

A credit score of 692 is not far from the ‘good’ category, thus, the room for improvement is manageable. Let’s focus on some practical steps you can take to boost your score:

1. Review Your Credit Reports

Make sure all your transactions, credit lines, and personal details are accurate on your credit report. Discrepancies, no matter how minor, can have an impact on your credit score. If you see inaccuracies, contact the relevant creditors or the credit bureaus to get them corrected.

2. Lower Credit Usage Ratio

Maintain your credit card balances below 30% of your total card limits. While you’re not overextended at a score of 692, reducing this ratio can help you achieve the ‘good’ score category more quickly.

3. Consistent Timely Payments

Payment history greatly impacts your credit score. Ensure all your financial obligations are paid on time. Apart from loans or credit cards, this includes rent, utility bills, or any invoices. Missed or late payments can set you back.

4. Consider Credit-Boosting Programs

Seek out credit-boosting programs, for example, Experian Boost or UltraFICO. These programs take into account your bank account information and utilities payment history to give your score a little extra lift.

5. Avoid New Debts

Hold off on taking out new loans or credit cards. Each new credit application can cause a small, temporary dip in your credit score. By avoiding new debt, you can keep your score from going in the wrong direction.