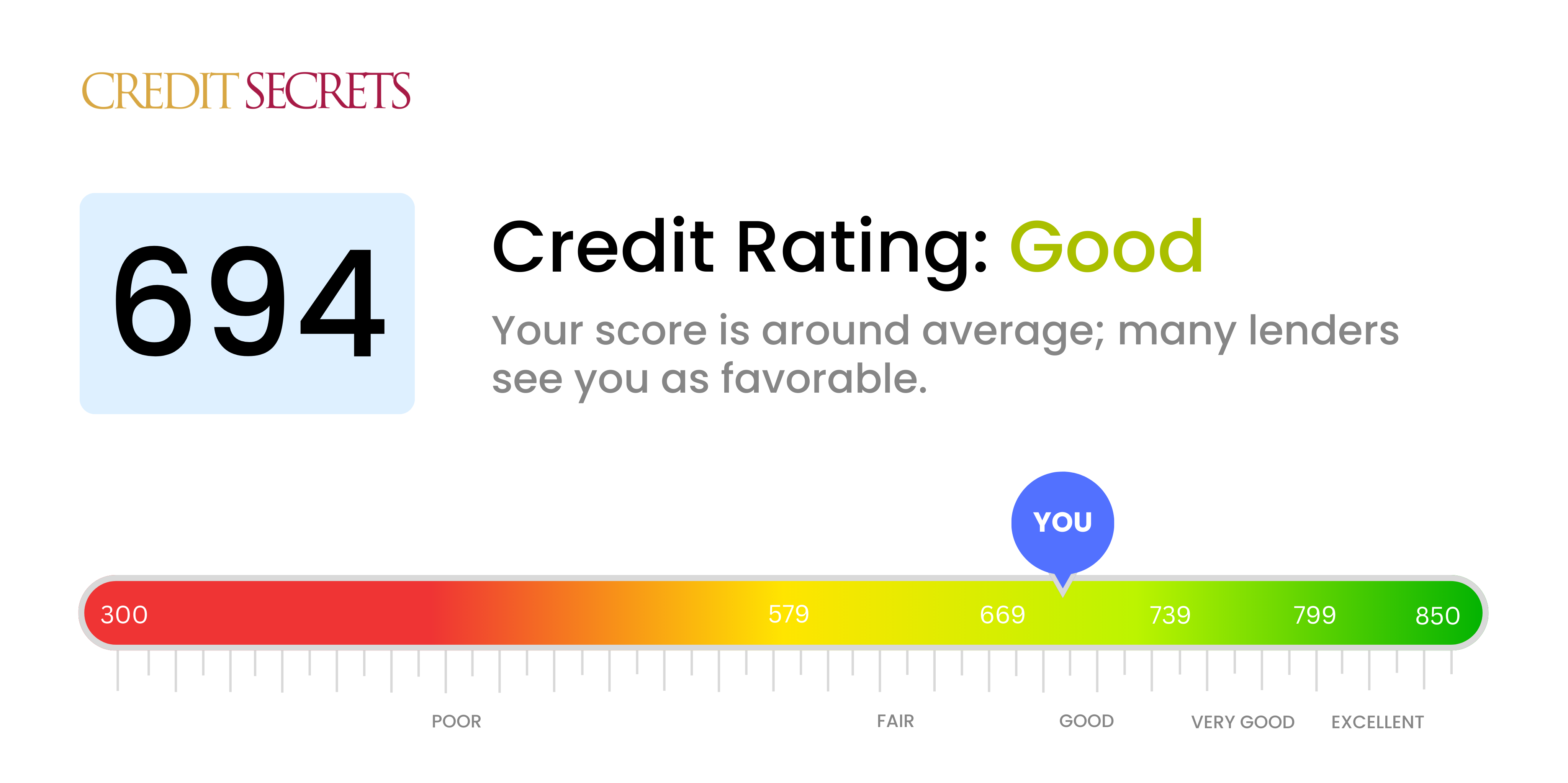

Is 694 a good credit score?

Your score of 694 is categorized as a good credit score. This means you have established a solid credit history and displayed responsible borrowing behavior. However, there may be room for improvement to boost your score further.

With such a score, you would likely qualify for a number of different loans. It's also probable you can secure decent interest rates. This score is a great starting point, but it might be worth exploring ways to improve it even more, as achieving a higher credit score could unlock opportunities for better terms and rates in the future.

Can I Get a Mortgage with a 694 Credit Score?

With a credit score of 694, you stand a fair chance of getting approved for a mortgage. This score, while not excellent, is within the range that many lenders find acceptable for mortgage approval. However, it's important to remember that other factors like your income and amount of debt also play a significant role in the decision.

In terms of what to expect during the mortgage approval process, be prepared for potential lenders to critically review your financial portfolio, including your income, existing debts, and the stability of your employment. Because your credit score is not in the 'excellent' range, the offered interest rates may be slightly higher. But, don't be dissuaded. A mortgage with a slightly higher interest rate is often manageable with careful budgeting and responsible financial planning. Remember, your credit score is not set in stone. It can, and will, change as you continue to show responsible financial behavior.

Can I Get a Credit Card with a 694 Credit Score?

A credit score of 694 shows that you have a fair financial history but there is still room for improvement. It is likely that you may get approval for a credit card, but the terms might not be the most favorable. Banks and lenders might view your score as slightly risky, resulting in higher interest rates on your credit card. Nevertheless, knowing your credit status is vital. Facing this situation with practicality and understanding is the first step to financial betterment.

Considering a credit card that suits you becomes critical at this point. You might find secured credit cards and starter cards beneficial. Secured credit cards operate on a deposit that controls your credit limit. These cards might be easier to obtain and can assist in enhancing your credit score gradually. Starter credit cards are designed for people new to credit, or those trying to rebuild their credit. While the immediate benefits might not seem vast, they serve as effective tools on your journey towards sound financial wellness. Be mindful that whatever credit option you choose, interest rates may be slightly higher due to your credit score. But don't be disheartened, with time and consistent efforts, you will see improvements.

With a credit score of 694, you're in the range that many lenders deem 'fair.' This score suggests a decent history of handling credit responsibly, but there could be areas where improvement is needed. Still, obtaining a personal loan is possible, although terms might not be as advantageous as if your score were higher. Don't lose heart though - many have successfully secured personal loans with this score.

When you approach lenders for a personal loan, they're likely to see you as a moderate risk. Therefore, while approval is viable, the interest rates offered to you might skew slightly higher compared to those extended towards people with excellent credit score. While you go through the application process, remember to review terms meticulously, paying close attention to not just the interest rates, but also the repayment terms and potential charges. It's important to feel confident that you can meet the obligations attached to the loan comfortably.

Can I Get a Car Loan with a 694 Credit Score?

With a credit score of 694, being approved for a car loan is definitely feasible. Usually, lenders see scores above 660 as favorable, and your score pleasantly fits into this category. This is good news! It indicates to potential lenders that you're relatively low risk and that you've shown responsibility in repaying borrowed money in the past. However, keep in mind that having a good credit score won't guarantee approval - lenders will consider other factors, too.

As you navigate the car purchasing process, it's important to know what to expect. With a credit score of 694, you're likely to be offered moderately favorable interest rates. Remember, though, rates aren't solely dependent on credit score - they may fluctuate based on market conditions or the specific policies of lenders. Understanding this will help you be better prepared and make informed decisions as you strive towards purchasing the vehicle that best suits your needs.

What Factors Most Impact a 694 Credit Score?

A 694 credit score falls in the fair category that is close to good. There are a few key factors that might be influencing this score. Recognizing and managing these elements can pave the way to a brighter financial status.

Payment History

Your credit score can be impacted by any delays or defaults in your payment history. This may be one of the key reasons influencing your score.

How to Check: Review your credit report for any late payments or defaults. Reflect on your payment habits and identify whether they need improvement.

Credit Utilization Ratio

When usage of your available credit is high, it can be a contributing factor pulling your credit score down.

How to Check: Analyze your credit card statements. Make sure the balances aren't near their limits, as maintaining a lower balance is recommended.

Length of Credit History

The age of your credit history can contribute to your score. A limited credit history might be a contributing factor to your 694 score.

How to Check: Dedicate time to review your credit report, taking note of the age of your earliest and newest accounts, plus the mean age of all accounts.

Credit Mix

Having a range of credit types can aid in improving your credit score. If you lack diversity of credit, it could be influencing your score.

How to Check: Review your credit report and identify the types of credits. Variety of credits such as credit cards, installment loans or retail accounts could foster your credit health.

Derogatory Marks

Derogatory marks like bankruptcies, tax liens, or collections can significantly affect your score.

How to Check: Review your credit report to see if there are any derogatory marks. Resolving these issues may improve your score.

How Do I Improve my 694 Credit Score?

Having a credit score of 694 is within fair range, not bad at all, but there’s still room for improvement. Here’s how you can boost your credit score from where you stand now:

1. Maintain Consistent Payments

Keeping up with your bill payments on time is crucial for scoring higher. Missed or late payments can substantially hurt your score. So, ensure all payments, whether loans or utility bills, are paid before the due date.

2. Evaluate Your Credit Report

Check your credit report for any errors or discrepancies. Misreported information on your credit report can negatively impact your credit score. If you find any, dispute it with the respective credit bureau promptly.

3. Check Your Credit Utilization Ratio

Strive to keep your credit utilization ratio — the amount of credit you’re using versus your total credit limit — at or below 30%. If it’s above 30%, work on reducing it.

4. Explore Longer Credit History

Longer credit history can contribute positively to your credit score. Don’t close your older credit accounts, as they help show a long history of credit use.

5. Limit New Credit Inquiries

Avoid applying for new credit excessively, as each hard inquiry can dock a few points off your score. Only apply when necessary, and aim to space out your credit applications.

Your credit score won’t improve overnight. But with consistent efforts, and by following these steps, you’re on the right path to push your score higher.