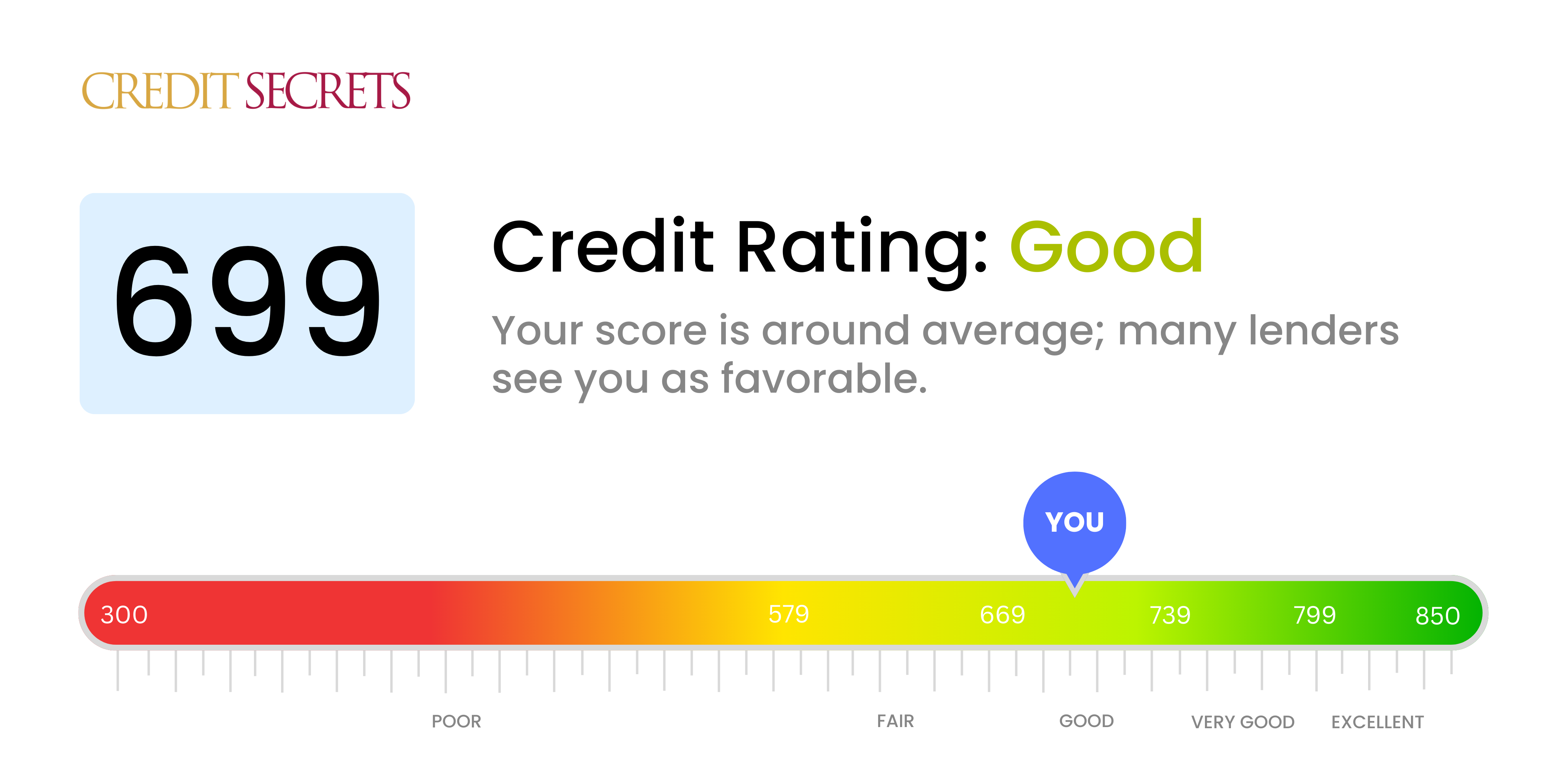

Is 699 a good credit score?

With a credit score of 699, you're just on the cusp of a 'Good' credit rating. It's not quite time to celebrate, but know that you're on the right track and you should stay motivated to keep improving.

Those with a 699 credit score are fringe candidates for better-than-average interest rates from lenders. This credit score might not get you the best deals on mortgages or car loans but it does show your potential creditors that you are somewhat responsible in managing your credit. There is still room for improvement, so keep making timely payments and minimize your debt to push your score further into the 'Good' range.

Can I Get a Mortgage with a 699 Credit Score?

With a credit score of 699, it's likely that you'll be approved for a mortgage, given that this score typically suggests responsible credit usage. This score is close to the threshold of good and fair credit, so it can be viewed as promising by mortgage lenders. However, keep in mind that other factors may influence the final decision such as your debt-to-income ratio or your employment history.

Upon mortgage approval, prepare for a somewhat complex process. You'll be required to provide extensive documentation regarding your financial history and current status. Be prepared for potential negotiation regarding interest rates as well. Rates may be slightly higher than those provided to borrowers with credit scores above 700, though they're typically reasonable. Securing a mortgage is a significant financial decision. Though your score of 699 suggests you're on the right path, it's always beneficial to continue striving to improve your credit score for the best terms and rates.

Can I Get a Credit Card with a 699 Credit Score?

With a credit score of 699, you are on the brink of attaining a 'good' credit status. This level of credit score positions you fairly well when applying for a credit card. Lenders typically see borrowers with such scores as being responsible and less risky, which positively impacts your chances of approval. Be sure to acknowledge that your financial situation is moving in the right direction, yet there is always room for improvement.

Considering the current credit score, opening an account with a rewards credit card could be an option. These cards provide cash back, miles, or other rewards based on your spending. Starter cards, which are designed for individuals with moderate credit scores, can also be a good choice. Be aware, though, that interest rates might present a bit higher than premium cards offered to people with razor-sharp credit scores. Making payments on time and adhering to the card’s terms and conditions can help to lower that rate over time and improve your credit score to secure even better financial opportunities.

With a credit score of 699, you find yourself on the cusp of being categorized as having "good" credit. However, in the lending world, thresholds matter. Although you're very close, falling just slightly under the 700 threshold may impact your chances of securing a personal loan. Remember, financial institutions are managing their risk when they extend credit.

Despite this, it's not all bad news. Some lenders may still take into account other factors, like steady income or employment history, when determining your eligibility. If you're approved with a 699 credit score, it's worth noting that your interest rates may be higher than those offered to borrowers with more robust credit scores. The personal loan application process may include proof of financial stability such as pay stubs or tax returns. Strive for clarity in understanding your loan terms, including the full cost of repayment.

Can I Get a Car Loan with a 699 Credit Score?

With a credit score of 699, you're on the verge of entering the desired zone as most lenders prefer scores above 670 to offer favorable finance terms. Despite the fact that you're just below this threshold, this doesn't mean you won't get approved for a car loan. Lenders don't only focus on credit scores, they also consider other factors like your income and debt levels.

Although you're likely to get approval for a car loan, what may be a bit of a sting with your 699 credit score is the interest rate you're offered. Because your credit score falls just below the ideal range, lenders might perceive you as slightly riskier, thus offering a slightly higher interest rate. But don't despair; with careful shopping around for the best finance deal and a solid track record of repayment, you will soon be on your journey towards a better credit score and more favorable auto loans in the future.

What Factors Most Impact a 699 Credit Score?

Recognizing that a score of 699 suggests potential for improvement is the first step towards achieving a healthier financial life. By understanding and addressing the main factors contributing to this score, you can begin to foster financial growth.

Payment Consistency

For a score of 699, payment consistency may be a influencing factor. Making payments on time can positively influence your score.

To Investigate: Review your credit report for any signs of missed or late payments. Any inconsistency may influence your score negatively.

Level of Credit Use

Maintaining lower credit utilization rates can boost your credit score. If you frequently use the bulk of your available credit, this could contribute to your current score.

To Investigate: Check your credit card balances against your spending limits. If your balances are often close to the limit, aim for lower utilization to help improve your score.

Age of Credit

Longer credit history can help increase your credit score. A shorter credit history may be affecting your score.

To Investigate: Look closely at the age of your oldest and newest accounts on your credit report. Recently opened new accounts can reduce the overall age of your credit history.

Composition of Credit

Having a diverse blend of credit types - credit cards, retails accounts, installment loans, etc. - can be favorable for your credit score.

To Investigate: Evaluate the diversity of your credit accounts. Concentrating on enhancing your credit mix can be beneficial.

Accurate Credit Report

Ensure that there are no errors or discrepancies in your credit report. These can negatively impact your score.

To Investigate: Scrutinize your credit report for any inaccuracies. Reach out to the credit bureau if any discrepancies arise.

How Do I Improve my 699 Credit Score?

A credit score of 699 neatly falls under the good category, but improvements can still be made. Let’s consider the most consequential and applicable steps to further boost your score:

1. Monitor Your Credit Report

Ensure to regularly review your credit report for any errors or inaccuracies. The earlier you detect and rectify mistakes, the more stable your credit score will be. Request your free annual report from Equifax, Experian, and TransUnion, the three major credit bureaus.

2. Keep Your Debt-to-Income Ratio in Check

This ratio measures the percentage of your monthly income that goes towards debt payments. Keep this ratio low by limiting new debt and committing to incremental repayments on existing debt. A lower debt-to-income ratio improves your creditworthiness in the eyes of lenders.

3. Maintain Older Credit Accounts

Longer credit history generally improves your credit score. Instead of closing older, unused credit accounts, consider using them for small transactions and paying off the balance immediately. This way you can add positive information to your credit history.

4. Keep Credit Utilization Rate Low

Your credit utilization rate is the amount of your credit limit in use. Aim to keep this below 30%, as higher rates can suggest to lenders that you’re overly reliant on credit.

5. On-Time Payments Count

Timely bill payment contributes significantly to your score; hence, make every effort you can to pay all your bills on time. Consistency helps build a strong payment history, which is beneficial for a good credit score.