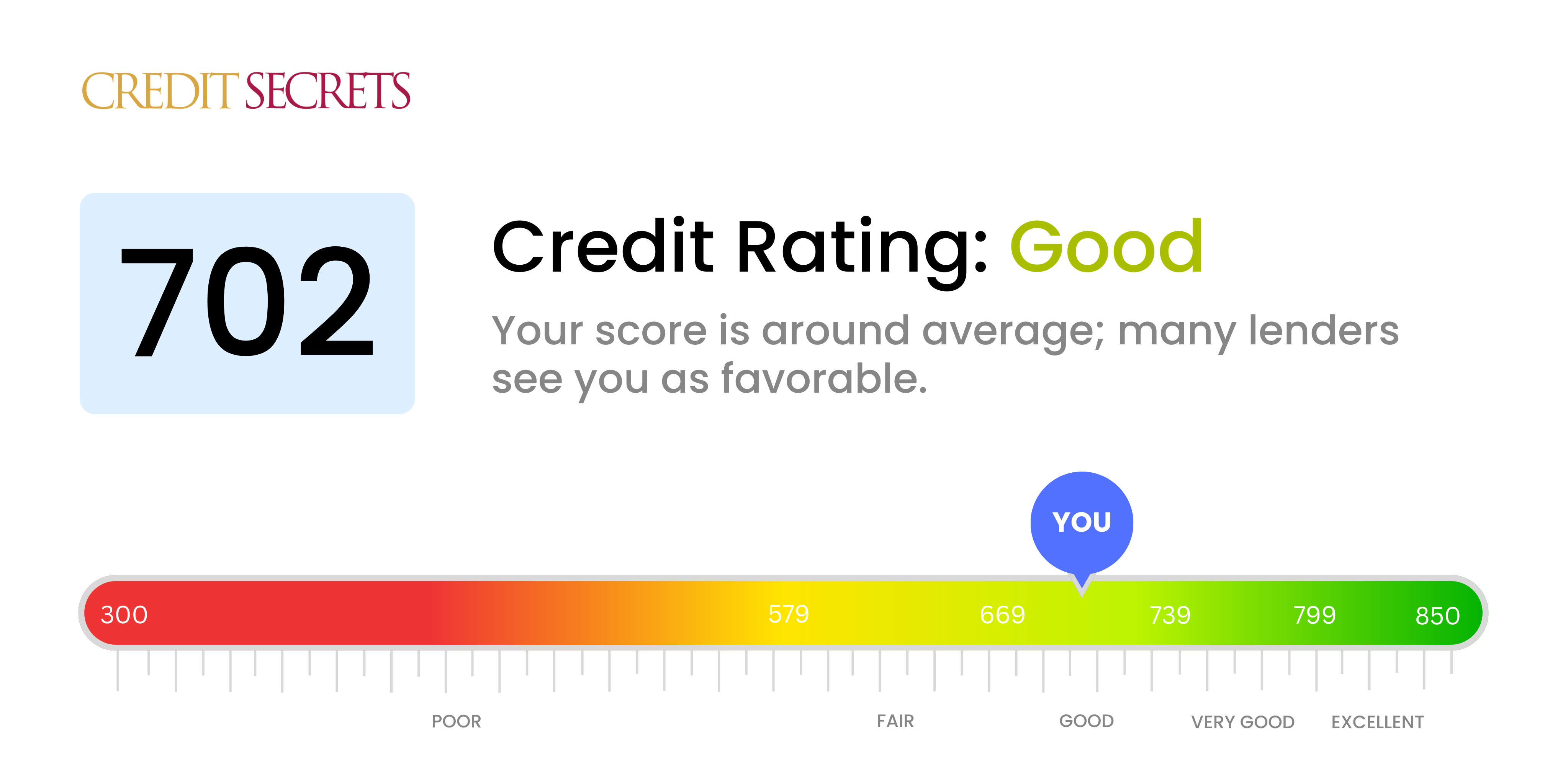

Is 702 a good credit score?

Your credit score of 702 falls into the 'Good' category, based on the credit score range. This score opens you up to a set of reasonable financial opportunities, including getting loans or credit cards with attractive interest rates. Also, the likelihood of your loan applications getting approved is highly promising due to your decent credit score.

However, don't rest on your laurels. Even while you may pay less for credit than those with lower scores, you can still aim higher, striving for an excellent credit score. Keep paying off your debts regularly, and always meet your financial obligations on time. Rest assured, with careful planning and disciplined spending, you can enhance your credit score even further. This will ultimately open up an even wider range of financial possibilities for you.

Can I Get a Mortgage with a 702 Credit Score?

If your credit score is 702, there is a fair chance for you to get approval for a mortgage. This score is generally regarded as a "good" score by most lenders, demonstrating a history of creditworthiness and responsible borrowing. However, it's crucial to remember that credit score is just one factor lenders consider. They will also look at your income, employment history, and debt-to-income ratio.

In terms of the mortgage approval process, patience and preparation will be key. You'll need to gather essential financial documents, such as tax returns, bank statements, and pay stubs, as preparation. Also, expect the lender to analyze your financial situation thoroughly before deciding on approval. It's essential to understand that while your 702 credit score may get you the mortgage approval, the interest rate offered may not be the lowest available. To secure the best rates, a score of 760 or above is typically needed. Nevertheless, your credit score of 702 should still qualify you for a reasonably favorable rate.

Can I Get a Credit Card with a 702 Credit Score?

With a credit score of 702, you stand a good chance of being approved for a credit card. This score indicates to lenders that you are a reasonably low risk, having demonstrated a history of responsible credit management. It's important to understand your credit score and what it reflects about your financial health.

For a credit score of 702, consider applying for a card that has low interest rates and added advantages. Starter cards with lower limits might be a good fit, as they often come with the benefit of lower interest rates. Premium travel cards could also be a consideration, if you are a regular traveler, as these often come with benefits like travel insurance and reward miles. Secured credit cards are another option; although they require a deposit, they can be a good choice if you’re looking to keep your utilization low. Always remember to review any credit card's terms, conditions and interest rates carefully before applying to ensure it aligns with your financial goals and capacity.

If you're carrying a credit score of 702, you are likely to be approved for a personal loan when needed. For most traditional lenders, a score around 700 is seen as fair to good credit, which gives credence to your financial responsibility. Remember, though, your credit score is just one factor lenders assess. They'll also consider your income, existing debts, and lending history before fully making a creditworthiness decision.

When it comes to the personal loan application process, anticipate the lender to thoroughly examine your credit history. Keep in mind your interest rate may be slightly higher than someone with exceptional credit, but it will generally be lower than those with poor scores. Rest assured, you're in a relatively good spot to secure a personal loan for your financial needs. However, remember to shop around and compare loans to make sure you're getting the best possible terms for your situation.

Can I Get a Car Loan with a 702 Credit Score?

If you're looking at a credit score of 702, you're in a reasonably strong position to be accepted for a car loan. Sure, it may not be in the 'excellent' range above 760, but it's certainly above the 660 threshold that many lenders look for. With a score of 702, you're typically seen as a reliable borrower who's likely to maintain regular repayments.

As you head into the car buying process, it's important to be prepared for what lies ahead. While a score of 702 should secure loan approval, the interest rates might be slightly higher than those with an excellent credit score. However, they'll still be more favorable than loans designed for individuals with lower credit ratings. Make sure to shop around for the best terms. While your score of 702 doesn't guarantee the absolute best rates, there's no harm in negotiating to secure the most affordable repayment plan for your new car.

What Factors Most Impact a 702 Credit Score?

Deciphering a score of 702 is key to your financial journey. It's time to examine the potential factors contributing to this score so you can work toward enhancing your credit health. Keep in mind, your progress is unique and offers opportunities for growth.

Credit Utilization

A crucial factor affecting your credit score is credit utilization. If a large portion of your available credit is in use, this may have influenced your score negatively.

How to Check: Review your credit card statements to check if your balances are near their credit limits. Keeping balances low in relation to your credit limit is favorable.

Payment Consistency

Consistent timely payments can positively impact your score. If your payment history is inconsistent, it could have contributed to a 702 score.

How to Check: Carefully analyze your credit report for any missed or late payments. Reflection on regularity of your previous payments can shed light on your score.

Length and Type of Credit

Your score responds to the length and variety of credit history. A mix of credit types and a longer credit history can improve your score.

How to Check: Check your credit report to evaluate the age of your oldest and newest accounts, the average account age, and the variety of account types.

New Credit Requests

Applying for numerous new lines of credit in a short period can negatively affect your score.

How to Check: Review your credit inquiries on your credit report. Remember, frequent new credit applications can lower your score.

Credit Report Errors

Inaccurate information on your credit report may be affecting your score.

How to Check: Thoroughly check your credit report for any inaccuracies or discrepancies and dispute these with the credit bureau in question.

How Do I Improve my 702 Credit Score?

A credit score of 702 is considered good, but with intention, you can elevate it to the next level. Here are the most effective steps you can take given your current credit score:

1. Monitor Your Credit Report

Regularly check your credit reports for any inaccuracies that might negatively affect your score. Any errors should be disputed with the credit bureau directly.

2. Maintain Low Credit Utilization

Keeping your credit card balance below 30% of your credit limit positively impacts your score. Aim for even lower, ideally keeping it below 10%, to further boost your rating.

3. Make Timely Payments

Your payment history contributes significantly to your credit score. Continue paying all your bills on time to maintain a good payment history.

4. Limit Credit Inquiries

Applying for multiple credit cards or loans in a short time implies risk to lenders, and each application lowers your score slightly. Limit new credit inquiries as much as possible.

5. Maintain Long-standing Accounts

The length of your credit history makes a difference. Keeping your older credit accounts open and active contributes to a higher score. Don’t close credit cards unless absolutely necessary.

With your current score, you’re on the right path. But with disciplined and smart choices, you can still optimize your credit profile and reach your financial goals.