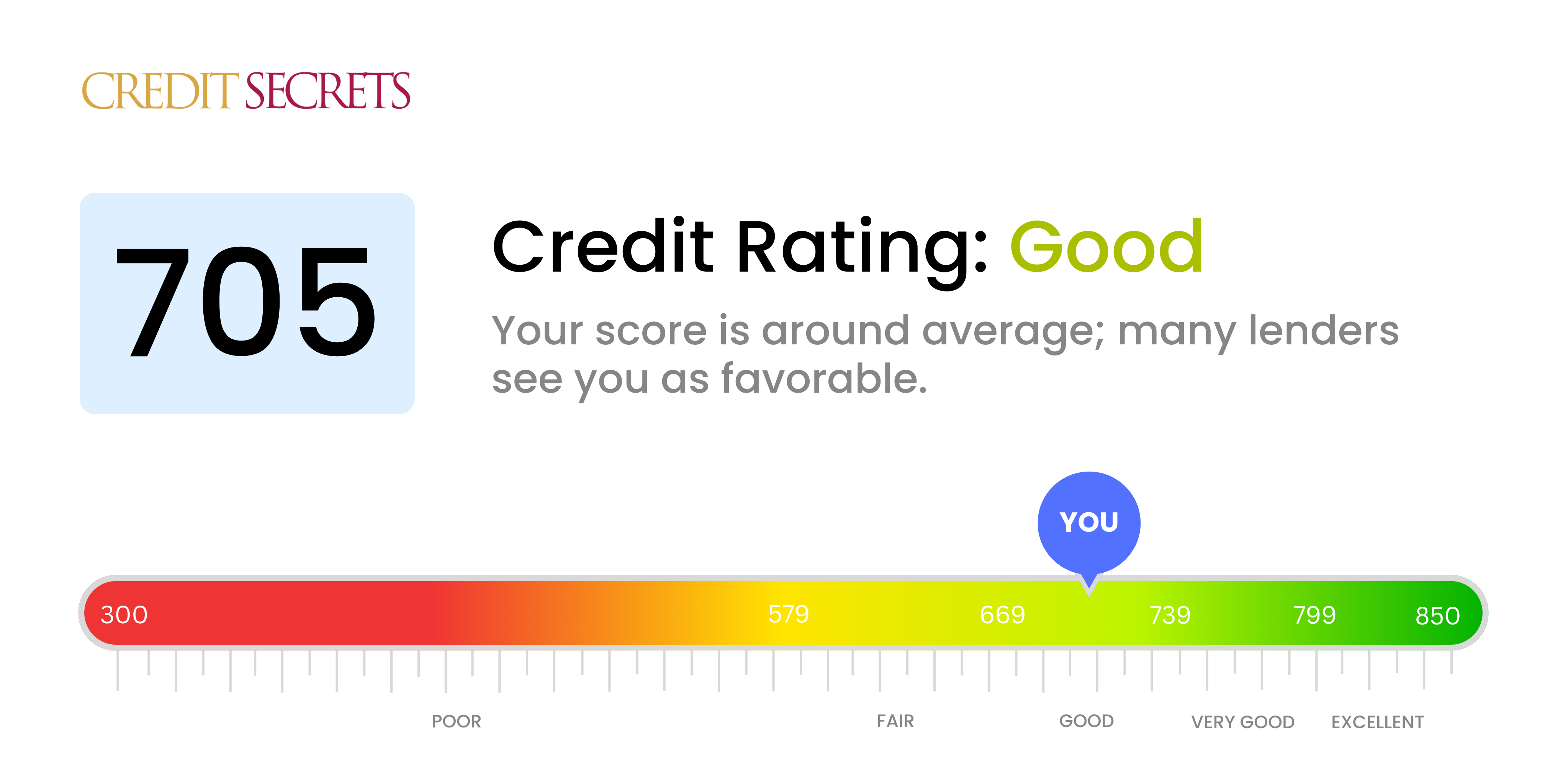

Is 705 a good credit score?

Your credit score of 705 falls into the 'Good' range, meaning you have done a solid job managing your credit to date. Generally, individuals with this score can anticipate lower interest rates and higher chances of approval when applying for credit cards, loans, and other types of credit, which shows just how beneficial your efforts to maintain good financial habits have been.

While your score is commendable, there's still room for improvement. With continued focus on timely payments and careful handling of your credit balance, you could potentially elevate your score into the 'Very Good' or even 'Excellent' range, greatly expanding your opportunities for better financing deals. This is entirely within your reach and is a reasonable goal for your financial journey.

Can I Get a Mortgage with a 705 Credit Score?

With a credit score of 705, you stand a fair chance of being approved for a mortgage. This score falls in the range deemed good by many lenders, reflecting a consistent record of on-time payments and responsible borrowing habits. However, it's important to understand that other factors are also considered during the mortgage approval process.

Whether you get approved for a mortgage depends not only on your credit score, but also on other criteria such as your income, employment status, and existing debt levels. Even though your score is decent, having too much existing debt or an unstable employment history may still affect your chances. While a 705 credit score is likely to qualify you for a mortgage, the interest rates offered might be slightly higher than the ones offered to borrowers with excellent credit, which typically starts from 740. However, with careful planning and responsible financial habits, attaining a mortgage with a favorable interest rate is well within your reach.

Can I Get a Credit Card with a 705 Credit Score?

As someone with a credit score of 705, your financial circumstance is seen favorably by many lenders. This score is generally considered good, showing a history of handling credit responsibly. It's important to appreciate your position, and understand that you have a fairly strong chance of being approved for a credit card.

With a score of 705, a variety of credit card options is available. You could be eligible for unsecured credit cards, which does not require a security deposit and often come with benefits like cash-back or travel rewards. A step further would be a premium travel card, offering substantial mileage and international privileges. Be aware, even though you qualify for these cards, it's crucial to continue handling your credit sensibly. Regularly review your credit report and stay vigilant about your spending habits to maintain or even enhance your score. While interest rates should generally be lower with good credit scores, they can vary based on the individual card company's policies, so be sure to compare terms before deciding.

Your credit score of 453 is considered well below the average, which may make approval for a personal loan more challenging. Lenders view low scores like yours as symbolic of high-risk borrowers, which can make them hesitant to approve your application. It's not an easy position to be in, but acknowledging what this score means in terms of your loan possibilities is crucial.

You may want to explore alternatives such as secured loans, which require collateral, or co-signed loans, where another person with better credit stands as your guarantor. Another option might be peer-to-peer lending platforms, where the credit requirements aren't as strict. However, it's important to remember that these alternatives typically come with higher interest rates and less favorable terms due to the increased risk presented to the lender.

Can I Get a Car Loan with a 705 Credit Score?

If you have a credit score of 705, you're in a solid position to be approved for a car loan. A score above 670 is generally considered “good” by most lenders and is likely to help secure more favorable loan terms. Your credit score of 705 falls comfortably within this range, increasing your chances of loan approval.

With a good credit score like yours, you can expect to receive lower interest rates on your car loan. Lenders use credit scores as a way of determining how likely someone is to repay a loan. A higher score, like your 705, tells lenders you have a history of managing your debts responsibly. While every loan application consideration can be different, your 705 credit score often results in a more streamlined approval process and advantageous interest rates. Remember, securing a car loan is always dependent on multiple factors, your credit score being one of them. Stay confident and ready to pursue your goals, your hard work in maintaining your credit is making the journey easier.

What Factors Most Impact a 705 Credit Score?

A score of 705 is seen as 'good' by most lenders, but there's always room for improvement on your financial journey. Let's look at the factors that might impact your score.

Past Delinquencies

While a score of 705 suggests a mostly positive payment history, some past delinquencies could be holding your score back.

How to Check: Review your credit report for any signs of late payments. Every single delayed payment can subtly impact your score.

Percentage of Credit In Use

Even though it's not over the limit, if you're using a notable amount of your credit, it could be suppressing your score.

How to Check: Calculate your credit utilization ratio by dividing your current total debt by your total credit limit. Aim to keep it below 30% to favor your score.

Credit Account Age

If the average age of your credit accounts is low, this could be impacting your score.

How to Check: Inspect your credit report for the age of your oldest and newest accounts. The longer your credit age, the better effect it has on your score.

Credit Type Diversity

Handling a mix of credit types (credit cards, car loans, mortgage, etc.) can positively affect your score. A narrow credit mix could limit your score's potential.

How to Check: Examine your credit report for the different types of account or credit you currently have. A diversified credit portfolio reflects positive creditworthiness.

Hard Inquiries

Repeatedly applying for new credit could lead to multiple hard inquiries on your report, which might have a small negative impact on your score.

How to Check: Your credit report will list any hard inquiries. If there are multiple recent ones, this could be impacting your score.

How Do I Improve my 705 Credit Score?

Although a score of 705 falls within the ‘good’ credit score range, there are still steps you can take to boost it into the ‘excellent’ range. Here are the most impactful, relevant actions you can take at this credit score level:

1. Monitor Your Credit Utilization

One of the key factors affecting your score is credit utilization, which is the ratio of your credit card balances to your credit limits. Try to keep your credit utilization below 30% to positively impact your credit score, with an ultimate goal of getting it below 10%. Pay off the balances with the highest utilization rates first.

2. Regularly Review Your Credit Reports

It’s important to regularly check your credit reports for any inaccuracies. Schedule a review at least once per quarter. If you find any errors, promptly report them to the credit bureaus. Correcting these inaccuracies can give your credit score a quick boost.

3. Maintain a Healthy Blend of Credit

Having a healthy mix of different types of credit can raise your score. Consider diversifying by responsibly managing both revolving credit (like credit cards) and installment loans (like auto or personal loans).

4. Create a Prompt Payment Culture

Since payment history is the most significant factor in determining your credit score, you should prioritize paying all your bills on time. Set up automatic payments or reminders to avoid missing any payment deadlines.

5. Beware of Hard Inquiries

Avoid too many hard inquiries in a short period, as these can cause your credit score to fall. Each hard inquiry typically brings down your credit score by a few points and stays on your record for two years.