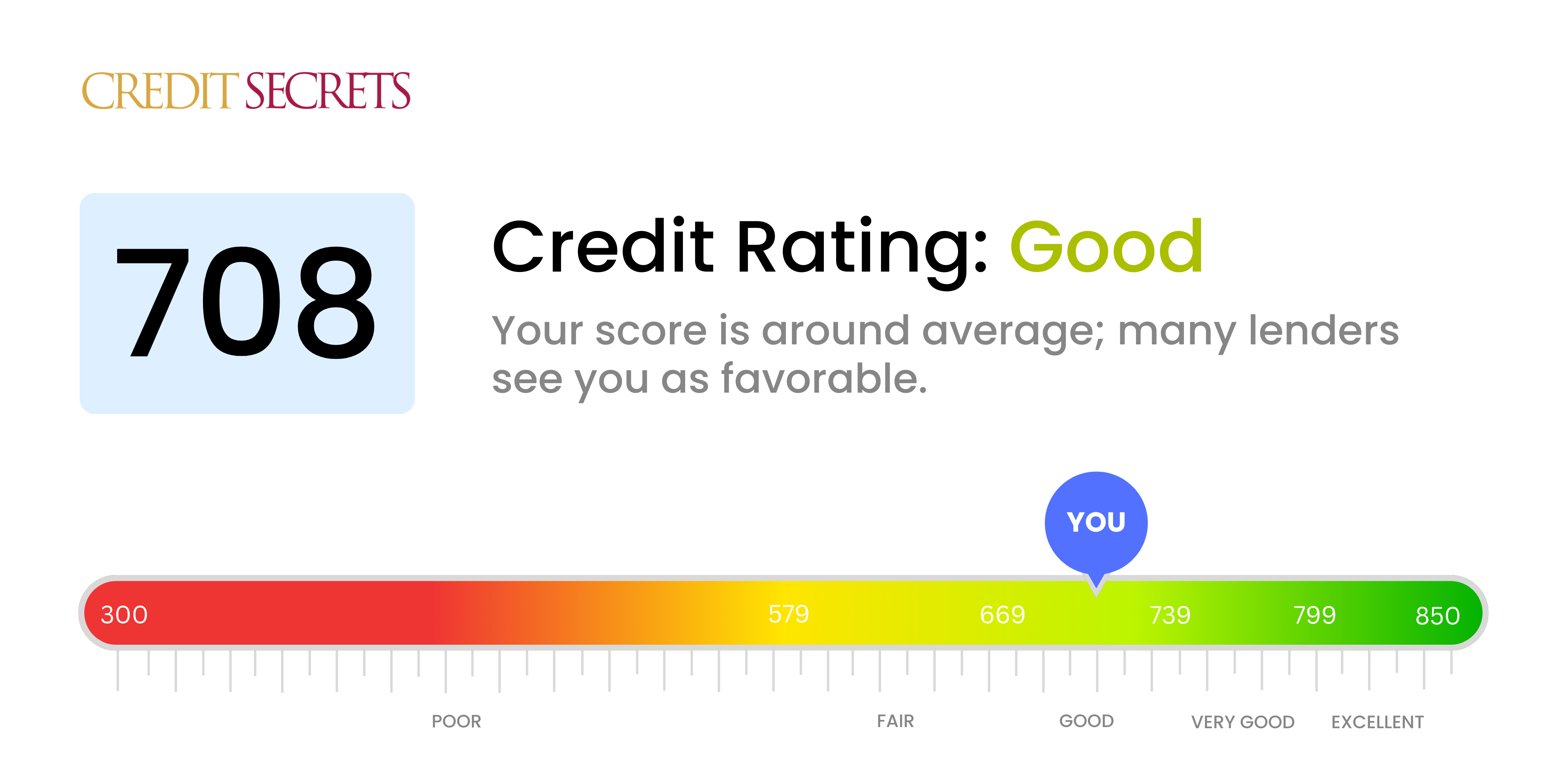

Is 708 a good credit score?

Your current score of 708 falls within the 'Good' range of credit scores. This typically means you're seen as a reliable borrower and should have a relatively easy time securing loans or credit, though you might not get the very best interest rates. By taking consistent and strategic action, there's great potential for you to improve this score even further.

Remember, creditors also consider factors like income and job stability when assessing your creditworthiness. So, while a 'Good' score helps, it's just one piece of your financial picture. Being diligent about timely payments and careful oversight of your credit usage can push your score towards the 'Very Good' or even 'Excellent' ranges.

Can I Get a Mortgage with a 708 Credit Score?

If your credit score is 708, you stand a good chance of successfully securing a mortgage loan. This score reflects your responsible credit management over time, making lenders more comfortable providing you with significant credit lines, like a mortgage. Nonetheless, credit is just one aspect of the mortgage approval process.

Once you submit an application, lenders also consider income, employment history, and existing debt levels. Alongside these, your credit score holds significant weight. Your healthy credit history not only paves the way for approval but also could result in a more favorable interest rate. It's crucial, however, to continue timely payments on your debts to maintain this credit score or even to improve. Every step you take towards financial responsibility will help you to achieve your goal of securing a mortgage.

Can I Get a Credit Card with a 708 Credit Score?

With a credit score of 708, it's highly probable that you'll be approved for a credit card. This score is seen as good in the credit world and shows potential lenders that you manage your finances responsibly. This is a favorable position to be in and something to feel good about. Your creditworthiness is evident, but it's still essential to choose the right card that best suits your financial needs.

For a credit score of 708, you have a wide range of credit cards available - from rewards cards to low-interest ones. If you're a frequent traveler, you might benefit from a travel card that offers substantial rewards for every dollar spent. However, if you anticipate carrying a balance month-to-month, a card with a low interest rate might be a better choice. Remember, even with a good credit score, the annual percentage rates (APRs) offered can vary widely between cards. So, take the time to compare your options to ensure you're getting the best rate and benefits.

With a credit score of 708, fact of the matter is that you are in a good position when it comes to applying for a personal loan. Most traditional lenders deem such a score as both sufficient and sustainable for loan approval, representing a lower risk in the lending process. This is encouraging news, offering you some reassurance in your financial journey.

In terms of the application process, remember that while your credit score is a vital component, other factors may also be taken into consideration. Lenders can look at your employment status, your debt-to-income ratio, along with your credit history. Be prepared to provide documentation to support your personal information. Your good score can also positively influence the interest rates offered to you, resulting in potentially lower rates which is beneficial for you in the long run. However, different lenders have varying policies, so it's advised to shop around and find the most favorable terms for your specific needs.

Can I Get a Car Loan with a 708 Credit Score?

With a credit score of 708, you have a fairly good chance of getting approved for a car loan. Lenders typically consider a score above 660 as prime, and your score of 708 lands you comfortably in this zone. This means lenders see you as a lower risk borrower, which can lead to more favorable loan terms.

During your car purchasing journey, you might find that having a good credit score like yours opens the door to attractive interest rates. While it's true that the final rate you get offered will depend on a range of factors, a score of 708 typically leads to a more affordable loan. That's because lenders associate higher credit scores with a lower risk of defaulting on repayments, and this trust can translate into better loan conditions for you. Remember, it's always important to review the terms of any loan agreement carefully to make sure it suits your needs and budget. This car purchasing experience should speak to your financial diligence, not become a burden.

What Factors Most Impact a 708 Credit Score?

Evaluating a score of 708 is essential in determining the most effective ways to boost your credit health and reach your financial goals. It's critical to understand the factors contributing to this score.

Payment Consistency

With a credit score of 708, it's possible occasional late payments may have affected this score.

How to Check: Examine your credit report for late payments history. Think about times when you might have missed due dates, these likely influenced your score.

Credit Card Balance

Your credit utilization - the sum of your outstanding balances versus your total credit limit - could be a contributing factor.

How to Check: Look over your credit card statements. Are you using a substantial portion of your available credit? Lowering this ratio can improve your score.

Duration of Credit History

The length of your credit history may be negatively impacting your score, particularly if you've recently opened new accounts.

How to Check: Check your credit report to see the tenure of your oldest and newest accounts, and the average age of all your accounts. Think if you've opened new accounts recently.

Varied Credit Portfolio

A diverse mix of credit accounts like credit cards, retail accounts, and mortgage loans is beneficial for your credit score.

How to Check: Review your credit mix and assess if there's room for improvement.

Public Record Impact

Public records such as tax liens or judgments can affect your score. Ensure you address any public records listed on your credit report.

How to Check: Review your credit report for any public records. Seek resolution for any items listed.

How Do I Improve my 708 Credit Score?

With a credit score of 708, you’re in a pretty healthy credit range. However, your financial future can benefit from even higher credit scores. Here are practical steps tailored for your current situation:

1. Maintain Consistent Payments

Ensure on-time and full payments for all your bills. Your payment history has a profound impact on your credit score. Consistent payments portray you as a reliable borrower to credit bureaus.

2. Focus on Balancing Credit Utilization

Your credit utilization ratio, that is, the total debt you have compared to your credit limit, is another substantial factor. Aim to keep the ratio below 30% – this shows lenders you’re not over-reliant on credit.

3. Review Your Credit History Regularly

Grab your free yearly credit reports and check for any discrepancies. An error can inadvertently lower your credit score. Swiftly dispute any inaccuracies you may find.

4. Keep Your Accounts Open

Having credit accounts open for long periods can enhance your credit score. This contributes to your credit length history, so resist the urge to close old accounts that you’ve managed well.

5. Limit Hard Inquiries

Each time you apply for new credit, a hard inquiry is recorded on your credit report, temporarily reducing your score. Limit such applications only when necessary, to keep your score from unnecessary dips.

Remember, credit improvement is a gradual process, but with careful management, your credit score will continue to strengthen over time.