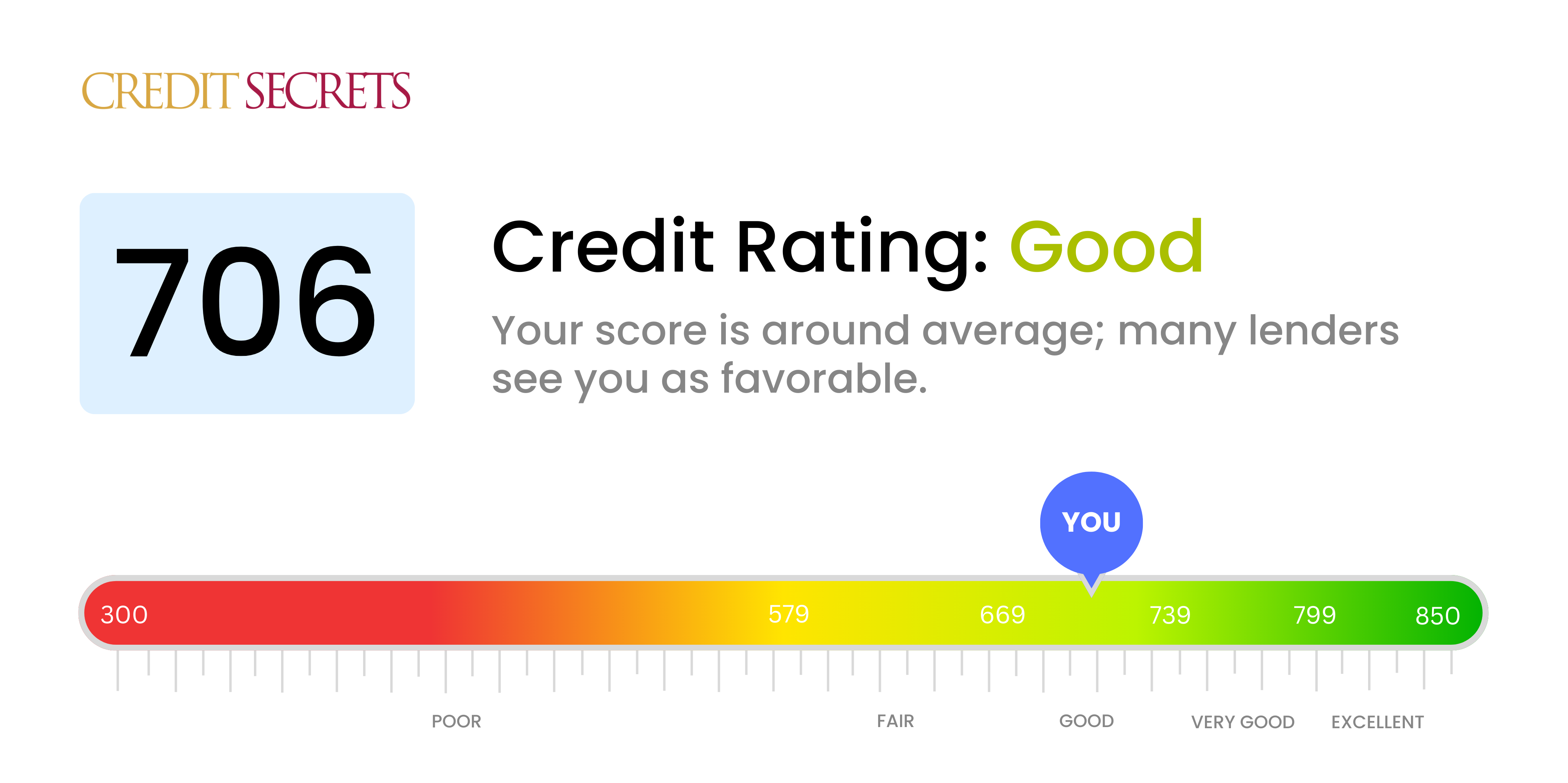

Is 706 a good credit score?

Your credit score of 706 falls into the 'Good' category. This means you're likely able to secure loans and credit cards easily, yet you might not get the best interest rates possible. There's certainly room for improvement, but with smart financial habits, you can enhance your score over time. A higher credit score allows for more and better financial opportunities, so keep working towards improving your score.

Remember, lenders not only consider your credit score but also other details such as income, employment, and debt. While a 706 credit score is a great place to be, striving for an even higher score will bring you financial benefits and peace of mind. The journey to an excellent credit score may seem long, but with discipline and focus, it's entirely within your reach.

Can I Get a Mortgage with a 706 Credit Score?

With a credit score of 706, your chances of being approved for a mortgage are relatively high. This score signifies a responsible financial history with a reliable pattern of timely payments and a good management of your credit. Nonetheless, lenders typically consider additional aspects such as income and existing debts when making their decision, so there isn't an absolute guarantee.

During the pre-approval process, lenders will offer terms which will most likely include a higher interest rate compared to those with excellent credit. It’s helpful to shop around among different lenders to secure a mortgage that best fits your budget and long-term financial plans. Keep in mind that reducing your debt and increasing your income before applying can position you for a better interest rate and broader mortgage options. While a 706 credit score is generally seen as good, striving for an even higher score can open up more favorable opportunities in the lending market.

Can I Get a Credit Card with a 706 Credit Score?

With a credit score of 706, you're in a good position to be approved for a credit card. This score reflects a history of responsible financial management and lenders see this as a lower risk. It makes lenders more comfortable and confident in your ability to repay borrowed money, which is certainly a cause for optimism.

Given your credit score, you could potentially qualify for a variety of credit cards, including rewards cards and lower-interest cards. Rewards cards allow you to earn points, mileage, or cash back on purchases. This would be ideal if your lifestyle aligns with the category of rewards offered. Lower-interest cards are great if you sometimes carry a balance because they typically come with a lower Annual Percentage Rate (APR), reducing the amount of money you pay in interest over time. Remember, the right card for you ultimately depends on your financial needs and habits.

A credit score of 706 is considered good and generally falls within the range that most lenders find acceptable for approving a personal loan. This score suggests a level of responsibility and reliability that lenders appreciate. Despite the challenges of managing your credit, you've managed to maintain a healthy score, and it's likely that this will contribute positively to your loan approval process.

In relation to personal loan application procedures, a credit score of 706 may positively affect your interest rates. Lenders usually offer beneficial interest rates to borrowers who have shown a consistent credit history. However, please keep in mind that your credit score isn't the only factor lenders consider. Your income, existing debts, and employment status also play a part in determining the terms of your loan. Be prepared to present these details when you apply, and keep focusing on the responsible financial behaviors that helped you achieve this credit score.

Can I Get a Car Loan with a 706 Credit Score?

With a credit score of 706, you stand on solid ground when you're hoping for approval on a car loan. Lenders generally consider credit scores above 660 to be pretty good, and yours is comfortably above that line. That means you're likely to be deemed a lower risk by many car loan providers, which can open the door to greater flexibility in your terms and possibly a more favorable interest rate.

As you embark on your car purchasing journey, it's important to be diligent. Just because you likely qualify for a loan doesn't mean you should accept the first offer that comes your way. Interest rates and repayment terms can vary quite a bit between lenders, so comparing a few different loans could save you a significant amount of money in the long run. So, while your credit score of 706 is a powerful tool, always remember to use it wisely and consider all options on your path to your new vehicle.

What Factors Most Impact a 706 Credit Score?

Recognizing what a credit score of 706 represents is the initial step in enhancing your financial status. Uncovering and responding to factors affecting this score may guide you towards a better financial future. Remember, your financial journey is special, filled with progress and learning opportunities.

Credit Utilization

While a score of 706 is relatively solid, there could still be room for improvement in your credit utilization. This refers to the percentage of your available credit that you’re currently using. The lower this percentage, the better for your score.

Suggestion: Scrutinize your credit card statements, keep an eye on the ratio of your balance to your card’s credit limit. If it's high, bringing it down could improve your score.

Length of Credit History

The length of your credit history could be impacting your score, even if all your payments are up-to-date. The longer your history of responsible credit usage, the more confident lenders can be in your ability to repay loans.

Suggestion: Review your credit report to see the ages of your oldest and newest accounts and the average age of all your credit lines. If they're on the shorter side, just continuing to make payments on time will help your score improve.

New Credit Inquiries

Frequent hard inquiries for new credit can have a negative impact. They could be keeping your score from being even higher.

Suggestion: Try to limit hard inquiries by only applying for credit that you really need.

Mix of Credit

Your mix of credit could also be effecting your score of 706, as lenders like to see that you can handle a mix of different types of credit.

Suggestion: Consider diversifying types of credit, like installment loans or retail accounts, but only where it makes financial sense for you.

How Do I Improve my 706 Credit Score?

With a credit score of 706, you’re in the ‘good’ credit score range. However, making slight improvements can shift your score into the ‘excellent’ credit range. Here are some tailored strategies:

1. Routinely Check Your Credit Report

Make it a habit to review your credit report regularly. Look for inaccuracies or inconsistencies that could potentially be dragging your score down. Contact the relevant credit bureau to dispute any errors you spot.

2. Watch Your Credit Card Balances

Keep your credit utilization – that is how much of your available credit you’re using – as low as possible. Aim for under 20% utilization. For instance, if you have a credit limit of $5,000, aim to maintain a balance under $1,000.

3. Keep Old Debt

It might seem logical to eliminate old debt from your credit report, but good debt – debt that you’ve handled well and paid as agreed – is good for your credit. So, make sure to leave those well-managed debts on there.

4. Limit New Credit Applications

While you’re improving your score, resist the urge to open new credit accounts. New inquiries on your credit can actually pull down your score.

5. Maintain Variety in Your Credit Types

The credit score models favor a mix of credit types. If all your credit is through credit cards, consider diversifying with an installment loan. Just be sure to manage any new credit responsibly.