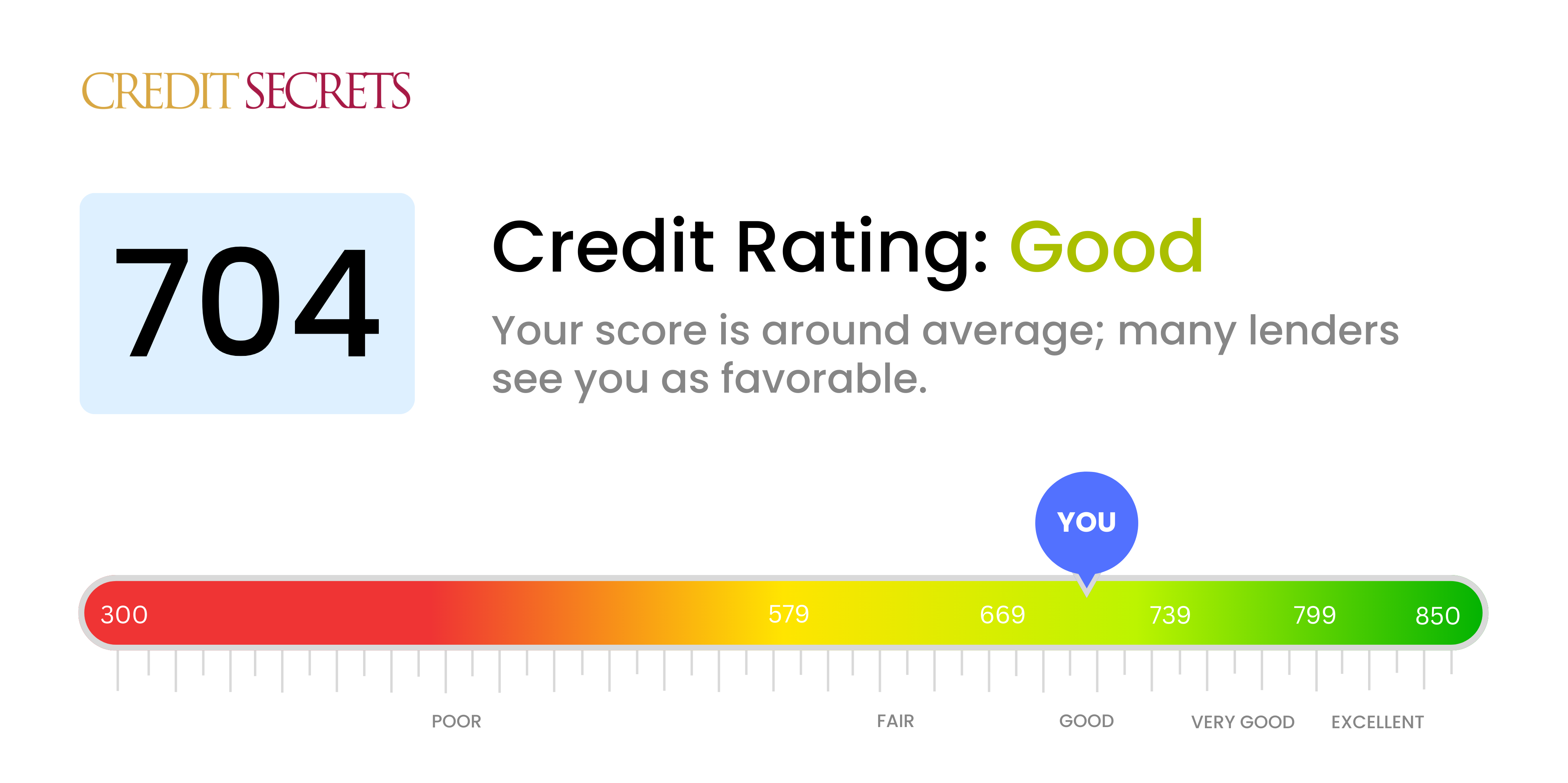

Is 704 a good credit score?

With a credit score of 704, you fall into the 'Good' category. This score indicates that you have managed your credit decently, showing lenders that you are generally reliable when it comes to repaying loans and credit card bills.

A credit score in this range can open the door to various financial opportunities. While you might not get the best interest rates like the ones offered to those with 'Very Good' or 'Excellent' scores, you should still be able to qualify for most loans and credit products without much difficulty. However, making consistent on-time payments and reducing any outstanding debts might improve your credit score even more, so you can secure even better financial terms in the future.

Can I Get a Mortgage with a 704 Credit Score?

With a credit score of 704, you stand a reasonable chance of being approved for a mortgage. This score aligns with the "fair" or "good" credit rating categories and many lenders view this as an acceptable credit score for mortgage applicants. However, the decision isn't solely based on your credit score and lenders will consider other factors in your financial profile too.

Anticipate the mortgage approval process to be detailed and stringent, even with a good credit score like yours. Lenders will review your income, employment stability, debt-to-income ratio, and your credit report to get a comprehensive understanding of your ability to repay your mortgage. Although a good credit score might not guarantee you the best interest rates in the market, it does increase your chances of getting a mortgage with competitive rates. It's advisable to shop around for mortgage deals, as different lenders may offer different rates and terms. With sound financial practices and stable income, homeownership is within your reach.

Can I Get a Credit Card with a 704 Credit Score?

With a credit score of 704, there's a fair probability of being approved for a credit card. This score shows lenders that there's a level of financial responsibility and creditworthiness. It is necessary, however, to be mindful of the requirements for each type of credit card and choose wisely based on personal circumstances and financial goals.

At this credit score range, it might be wise to consider starter cards or premium travel cards. Starter cards are excellent for those looking to build or improve their credit. They often have lower credit limits but can help to establish a positive payment history. Premium travel cards, on the other hand, are typically designed for individuals with good credit and offer benefits like air miles or travel insurance. Regardless of the type, it's crucial to make payments in a timely fashion, as interest rates can potentially be higher with this score. Remember, every financial move impacts a credit score, and wise credit card use can help push your score to new heights.

With a credit score of 704, there's a good chance you may get approved for a personal loan. This score falls within the "good" range of credit scores, hence many lenders would view you as a reliable borrower. However, it's important to realize that while your score positions you favorably, it doesn't promise loan approval.

During your loan application process, lenders typically scrutinize your credit report beyond your score. They consider factors like your payment history, your income, your current debts, and the amount of credit you've utilized. Therefore, ensure these aspects are also in good shape to boost your chances for loan approval. In terms of interest rates, with a 704 score, expect to get rates comparatively lower than those with poor credit, but likely a bit higher than those with excellent credit.

Can I Get a Car Loan with a 704 Credit Score?

With a credit score of 704, approval for a car loan is promising. Lenders generally prefer scores that are 660 and above, so a score of 704 is seen favorably. This score is a strong sign to lenders that you've handled borrowed money responsibly in the past, which can lead to more favorable loan terms.

Being on this side of the credit score spectrum could make the car purchasing process a bit smoother. You can reasonably expect better interest rates, which will make your car loan more affordable over time. Remember, your past financial behavior has earned you this credit score and the advantages that come with it. However, while your chances of approval are good, the final decision always rests with the lender, and scores are just one of the factors they consider. So, it is important to ensure other aspects of your financial life are in good standing as well.

What Factors Most Impact a 704 Credit Score?

Having a credit score of 704 demonstrates responsible credit behavior. Let's explore the various elements that might have led to this number and understand how you can continue to optimize your financial management.

On-Time Bill Payments

The regular and timely payment of bills often plays a significant role in maintaining a good credit score. This is indicative of being a reliable borrower.

How to Check: Inspect your credit report thoroughly for any missed or late payments that might be affecting your score.

Credit Utilization Ratio

Your credit utilization ratio, or the proportion of your available credit you're using, also influences your score. A lower ratio generally means a better credit score.

How to Check: Check your credit card balances. Are they consistently low compared to your limits? This could be boosting your score.

Credit History Duration

The length of your credit history could also be impacting your score. Longer credit histories typically lend themselves to higher scores, if managed well.

How to Check: Look over your credit report to find the age of your oldest and newest credit accounts, keeping in mind that a mature credit history might be favoring your score.

Credit Variety

The diversity of your credit, in terms of both installment and revolving credit, could be contributing to your score.

How to Check: Assess your credit types on your credit report. A good mix of credit types might be helping improve your score.

Public Records

An absence of negative public records such as bankruptcies or tax liens can significantly help achieve a good credit score.

How to Check: Scrutinize your credit report for any public records. The lack of significant negative records could be enhancing your score.

How Do I Improve my 704 Credit Score?

With a credit score of 704, you’re on the cusp of the ‘good score’ range. Here’s how you can boost your score:

1. Maintain Low Credit Utilization

Try to keep your credit card balances no more than 30% of your total credit limit. Of course, the lower, the better. If possible, you should aim to pay off your balance in full monthly.

2. Review Your Credit Report Regularly

Even with a decent score like 704, errors on your credit report could be holding you back. Make sure to regularly check your credit report for any inaccuracies or discrepancies. If you spot an error, dispute it immediately.

3. Monitor Your Hard Inquiries

Hard inquiries occur when lenders check your credit for extending credit. These can slightly lower your credit score. Try to limit these to when they’re absolutely necessary, like when you’re shopping for a mortgage or auto loan.

4. Grow Your Credit History

The longer your credit history, the better. Think twice before closing old credit accounts, even if you rarely use them. Keeping them open can positively influence your score.

5. Diversify Your Credit Types

If all your credit comes from credit cards, consider adding other types, such as installment loans or retail accounts, to demonstrate that you can handle different types of credit responsibly.

In conclusion, continue to make on-time payments, responsibly use your credit, while also diversifying the types of credit you hold, and your credit score will see a boost.