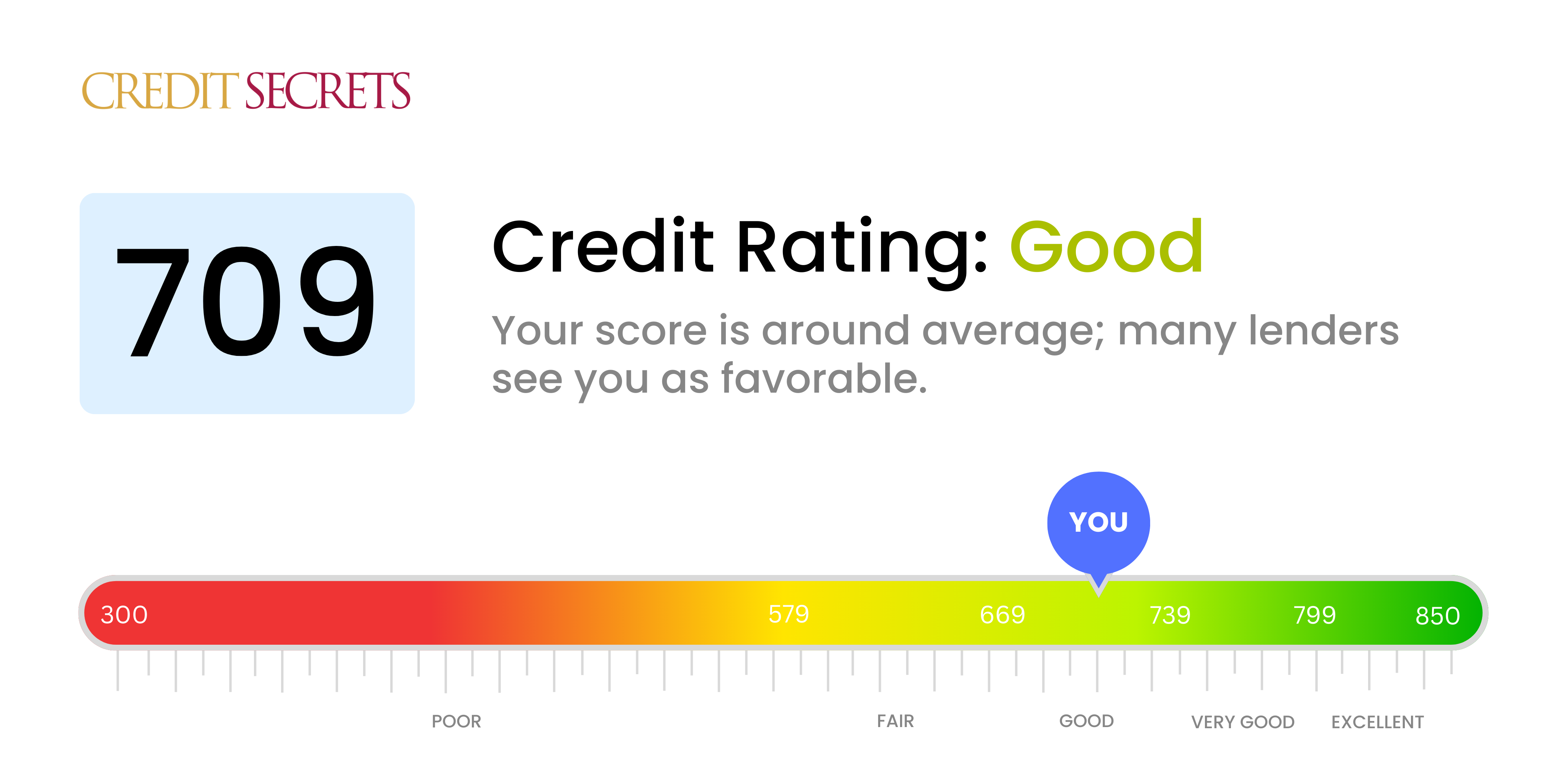

Is 709 a good credit score?

A credit score of 709 falls within the 'Good' category according to standard credit score ranges. You can generally expect fair treatment from lenders, access to loans and credit cards with reasonable rates, although they may not be the very best offered. There's always room for improvement to unlock even better financial opportunities.

While your score is solid, further growth can lead you towards the 'Very Good' and 'Excellent' credit score range. Remember, good financial habits like timely payments, low credit utilization, keeping older credit accounts open, and restricting hard inquiries can help lift your credit score. It's never too late to aim higher, and boosting your credit score could mean better loan terms, lower interest rates and more financial flexibility for you in the future.

Can I Get a Mortgage with a 709 Credit Score?

The good news is that with a credit score of 709, you have a fair chance of being approved for a mortgage. This score situates you in the 'Good' credit category, which lenders generally deem as being lower risk. However, you'll still want to ensure that your other financial credentials are in acceptable order as lenders also take into account factors such as income and existing debt.

As you move forward, be prepared for the mortgage approval process. It can be complex and time-consuming, involving various steps like pre-approval, property appraisal, and documentation. Remember, the interest rate you receive will be influenced by your credit score. With a 709 score, you can expect to receive a decent interest rate, although it won't be the best possible rate. Nevertheless, it's important to shop around various lenders to find a mortgage rate and terms that fit your financial needs best.

Can I Get a Credit Card with a 709 Credit Score?

If your credit score is 709, you're likely to be approved for a credit card. This score is viewed favorably by lenders and typically indicates smart financial practices. It's important, though, to maintain your credit health and continue to make smart financial decisions. Getting approved for a card is the first step, but managing it wisely is the real challenge.

With a score in this range, you have a decent choice when it comes to credit cards. Starter cards and premium travel cards may be within your reach. These options often come with favorable interest rates and beneficial rewards like air miles or cash back on purchases. However, every card varies, so take time to explore choices and confront things like annual fees, balance transfer fees, and intro APR periods. Remember, always manage your card responsibly to keep your credit score climbing. It’s more than just your financial credibility; it's peace of mind for you.

If your credit score is 709, you'll be pleased to know that this is considered a good score, significantly above the average. From a lender's perspective, this score suggests that you are a reliable borrower and therefore more likely to be approved for a personal loan. Your diligent financial discipline to reach a score of 709 is a testament to your creditworthiness.

As you apply for a personal loan, lenders are likely to offer you loans with better terms and lower interest rates compared to those with a lower credit score. This is because your credit score of 709 poses a lower risk to lenders. Nevertheless, remember that a high credit score does not guarantee approval, as lenders also consider additional factors such as income, employment status, and debt-to-income ratio. However, a credit score of 709 puts you in a strong position in the application process and increases the likelihood of securing a personal loan.

Can I Get a Car Loan with a 709 Credit Score?

With a credit score of 709, securing a car loan is fairly plausible. Generally, lenders consider scores over 660 as favorable, so your 709 score should make the path to approval smoother. This score indicates to lenders that financial responsibilities have been handled well in the past, making it more likely for them to have confidence in your ability to handle loan repayments.

While moving forward with the car purchasing process, it's important to understand how your credit score of 709 could influence the terms of your loan. With this score, you can expect more favorable interest rates compared to those with a lower credit rating. However, remember that it's still essential to shop around for the best deal. Don't just settle for the first offer that comes your way. By comparing different loan offers, you'll ensure that you're getting the most bang for your buck.

What Factors Most Impact a 709 Credit Score?

As you evaluate a score of 709, it's important to understand the key factors impacting it so you can better strategize for your financial health. Like a unique fingerprint, everybody has a unique financial journey punctuated with lessons to be learned and growth to be achieved.

Credit Utilization Rate

An important contributor to your credit score is the credit utilization rate. Are your credit cards often close to their limits? This could be affecting your score.

How to Check: Inspect your credit card statements. Are the balances near their maximums? Strive to keep your balances lower than your credit limits.

Payment Punctuality

Your payment punctuality carries a significant weight in your score. Having late payments or defaults may be a primary reason behind your current score.

How to Check: Review your credit report. Look for any late payments or defaults. Think over any cases of delayed payments that could be impacting your score.

Age of Credit History

Shorter credit history can affect your score. If you've not been in the credit system for long, that could be a factor.

How to Check: Assess your credit report for the age of your oldest and newest accounts, and the average age of all your accounts. Reflect on whether you've recently opened new accounts.

Variety in Credit

Maintaining a variety of credit types positively impacts your score. If you don't have a healthy mix, your score might be affected.

How to Check: Review your mix of credit accounts, including credit cards, retail accounts, installment loans, and mortgage loans. Consider if you're managing new credit conservatively.

Public Records

Public records such as bankruptcies or tax liens can greatly impact your score.

How to Check: Check your credit report for any public records. Resolve any listed items if needed.

How Do I Improve my 709 Credit Score?

With a credit score of 709, you’re on the right track. Let’s explore some focused steps to help you elevate your score even higher:

1. Regularly Review Your Credit Reports

Mistakes in your credit reports can detract from your score. Regularly reviewing your reports can help spot and resolve these inaccuracies. Ensure to request your free annual copies from all three bureaus – Equifax, Experian, and TransUnion – and pay detailed attention to any discrepancies.

2. Maintain Low Credit Utilization Ratio

Your credit utilization ratio is a significant factor in determining your score. Keeping your credit utilization ratio under 30% should be your goal. If your utilization is high, aim to repay outstanding balances to bring it down.

3. Timely Bill Payments

Your history of paying bills on time plays a fundamental role in your credit score. Pay all your bills, not only loans and credit card bills, but also utilities and rent, on time to continue maintaining a favorable payment history.

4. Limit Hard Inquiries On Your Credit Report

New credit applications can lead to hard inquiries, which could decrease your credit score. Try keeping such applications to a minimum.

5. Age Of Credit History

Longer credit history has a positive impact on credit scores. Try to keep old accounts open and in good standing to improve your credit age. Remember, good credit isn’t built in a day, it requires discipline and persistence.