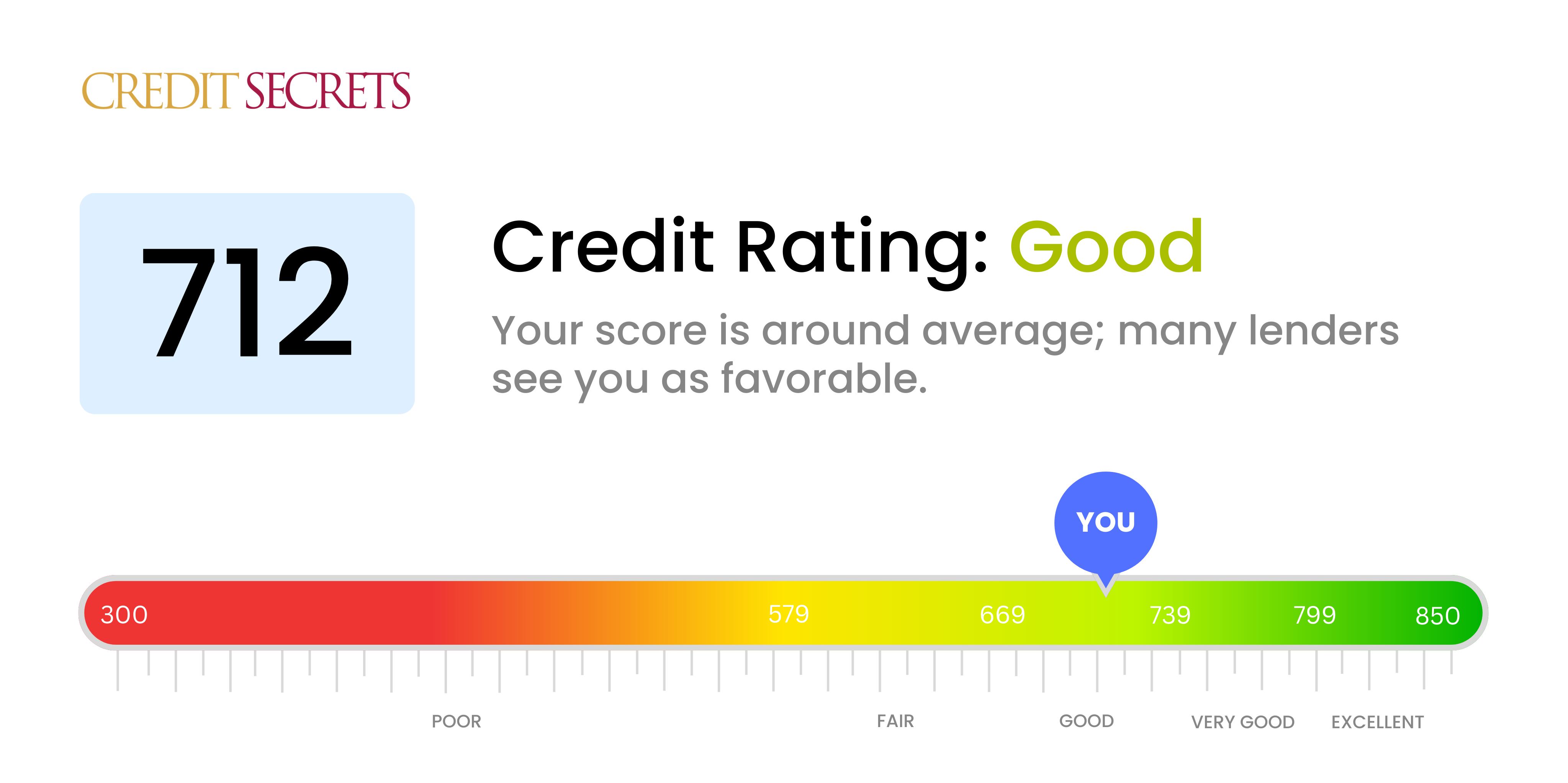

Is 712 a good credit score?

A credit score of 712 falls within the 'Good' category. This suggests that you are generally responsible in meeting your credit obligations, and lenders are likely to view you as a low risk borrower.

With this score, you can generally expect to be approved for loans or credit, though perhaps not with the best interest rates or terms reserved for those with 'Very Good' or 'Excellent' scores. Developing healthier financial habits can help you increase this score over time, opening up more and better lending opportunities.

Can I Get a Mortgage with a 712 Credit Score?

With a credit score of 712, you are in a fairly good position to be approved for a mortgage. This score demonstrates to lenders that you have a history of responsible credit management and timely repayments. However, obtaining a mortgage isn't only about credit scores, lenders will also review your debt-to-income ratio, employment status, and more.

The mortgage application process typically includes submitting your financial details and undertaking a thorough credit analysis by the lender. During this process, the lender will assess your ability to repay the mortgage based on your income, debts and credit history. While a score of 712 could secure mortgage approval, it's not a guarantee of the most favorable interest rates. Generally, the best mortgage rates are often provided to borrowers with credit scores over 740. Overall, understand that every lender may have different criteria and may operate slightly differently, hence, it's advised to do your own research to ensure you find a mortgage that best suits your needs.

Can I Get a Credit Card with a 712 Credit Score?

Having a credit score of 712 tends to be viewed quite favorably by lenders. This score indicates that you've done a reasonably good job managing your credit and making payments on time. Still, like any financial matter, it's important to approach it with continued care, focus, and understanding. Awareness of your credit standing allows for smart financial decisions going forward.

Given your solid credit score, a variety of credit card options could potentially be available to you. These might include rewards credit cards, which offer points or cash back on purchases. If you travel a lot, premium travel cards could also be a suitable option, offering airline miles and other travel benefits. Interest rates for individuals with your credit score would typically be lower compared to those with lower scores, reflecting the lower perceived risk to lenders. Remember, while this is great news, it's important to continue responsible financial habits to keep your credit score in good standing.

A credit score of 712 is seen favorably by most loan providers and signifies a good credit standing. Chances are high that you'd be approved for a personal loan with this score as it portrays you as a responsible borrower. It tells lenders that you're reliable, making them more likely to trust you with their money. It's still serious business, though, so it's essential to put your best foot forward when making your application.

While a good credit score like 712 can get your foot in the door, the application process also pertains to your personal financial situation. You'll likely be asked about your income, employment status, and your existing debt commitments. Lenders want to see that you can comfortably manage the loan repayments. A high credit score might fetch you a loan at a lower interest rate compared to someone with a poor score, but terms and conditions will still depend on the lender's policies.

Can I Get a Car Loan with a 712 Credit Score?

A credit score of 712 should put car loan approval well within your reach. Lenders typically favor scores above 660, and your score of 712 falls nicely above this threshold. This is because a score in this range portrays you to the lender as a less risky borrower, with a strong history of responsibly repaying borrowed money on time.

As you navigate the car purchasing process, the higher credit score can result in some lenders offering you more favorable terms. For example, this might include lower interest rates which can ultimately make the overall cost of the car lower for you. Remember that each lender may have slightly different terms, so don't rush the process. Take the time to thoroughly understand your loan terms so you can make an informed decision that suits your financial situation best.

What Factors Most Impact a 712 Credit Score?

A credit score of 712 indicates you're on the right path towards a strong credit profile. Let's focus on the factors likely contributing to your score, and how you can continue to improve it.

Payment History

Efficient payment history is crucial. A single late payment can cause a slight dip in the score. Review your credit report for any late or skipped payments.

How to Check:Revisit your credit card statements and financial records for any payment inconsistency.

Credit Utilization Ratio

A reasonable credit utilization ratio – the percentage of your credit usage to credit limits – can affect your score. It is ideal to remain below 30%.

How to Check:Survey your credit card allowances. If your balances are near the limit, it's advised to reduce them.

Length of Credit History

The age of your credit history can contribute to your score directly. A lengthy and positive credit history helps boost your score.

How to Check:Analyze your credit report for the lifespan of your oldest and newest accounts, and the average maturity of all your accounts.

Credit Mix

A diverse credit mix of credit cards, installments loan, retail accounts, and mortgage loans can improve your score.

How to Check:Review your credit portfolio. As much as possible, manage different types of credit accounts efficiently.

Credit Inquiries

Too many recent credit inquiries can potentially affect your score.

How to Check:Check your credit report for recent inquiries. Frequent applications for new credit can indicate financial instability to lenders.

How Do I Improve my 712 Credit Score?

With a credit score of 712, you’re in the good range, but there’s always room for growth. Here’s a blueprint for success designed specifically for your current credit situation:

1. Precise Payment Timing

Payment history significantly influences your credit score. Avoid late payments by setting up automatic payments or sending reminders. Paying a few days before your statement closing date can also lower your credit utilization ratio, which will be beneficial for your score.

2. Establish Credit Card Discipline

Strive to keep your credit card balances under 30% of your total credit limit. Aim to pay your balance in full each month, but if that’s not possible, at least make the minimum payment before the due date.

3. Consider Credit Boost Programs

Some utilities and telecom companies allow reporting of monthly payments to major credit bureaus. This on-time payment reporting can be a small but effective booster to your credit score.

4. Revisit Your Credit Report

Monitoring your credit report for errors can also prove beneficial. If an error is identified and removed, it could lead to an immediate score improvement.

5. Variety of Credit

A diverse credit profile can be healthy for your score. If you don’t have an installment loan and can afford one, it could help diversify your profile and boost your score.

Stay motivated, stay disciplined, and remember, better financial future is within your reach.