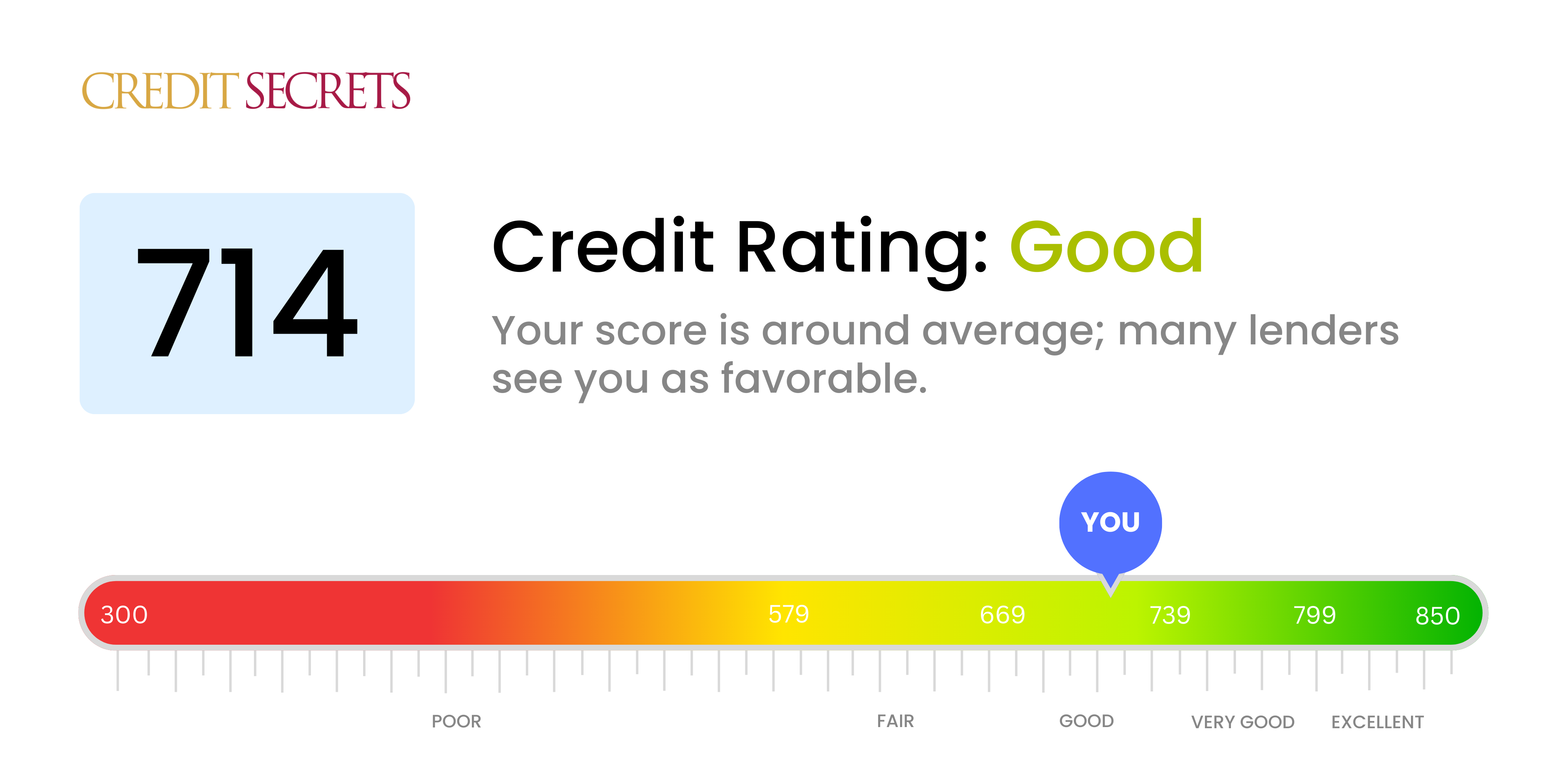

Is 714 a good credit score?

Yes, a credit score of 714 is definitely a good score. This means you're quite responsible with your financial obligations, keeping up with them reasonably well. If you have a score of 714, lenders are more likely to see you as a safer bet, meaning you'll usually qualify for loans and credit, potentially with better rates. However, aiming for a higher score could give you access to even more benefits and opportunities.

With a score in this range, you're right on the cusp of being in the 'very good' credit score range. By continuing your responsible credit habits and possibly fine-tuning some actions, you could potentially raise your score and open up even more financial doors. Keep in mind, different lenders have different criteria, but overall, this score is likely to work in your favor. Keep up the good work and strive towards an even stronger credit history.

Can I Get a Mortgage with a 714 Credit Score?

If you have a credit score of 714, you are in fairly good shape to be considered for a mortgage. This score falls within the "good" range in the credit spectrum and shows to lenders that you have a history of managing borrowed money sensibly. However, keep in mind that a myriad of factors determine mortgage approval, not just credit score alone.

While a credit score of 714 can open doors for mortgage approval, it doesn't necessarily guarantee the best interest rates. To make sure your loan terms are as favorable as possible, you may want to work further on your credit score, even before you start the mortgage application process. Remember, every small improvement can make a big difference in long-term savings. Yet, overall, having a score of 714 puts you ahead of many applicants and closer to your goal of homeownership.

Can I Get a Credit Card with a 714 Credit Score?

Having a 714 credit score is a favorable position when seeking approval for a credit card. This score shows that you have a solid credit history, which lenders interpret as a sign of financial responsibility. It sends a signal that you're likely reliable at managing debt obligations, increasing your chances of obtaining a card. However, like any financial matter, it isn't a certainty but is rather a good indication.

A 714 credit score may enable you to qualify for a wide array of credit cards. Secured cards that require a safety deposit might be unnecessary, and you could consider starter cards or even premium travel cards. The latter often provides attractive perks such as travel points, cash back, or sign-up bonuses. Also, look for cards that offer a reasonable interest rate. Remember, while having a 714 credit score is typically seen as a positive, it's crucial to continue responsible financial habits to maintain or improve this score. While your situation looks encouraging, always approach every application objectively and with realistic expectations.

With a credit score of 714, you stand a good chance of being approved for a personal loan. This score falls within the "good" credit range and is usually viewed positively by lenders. This doesn't mean the process will be without scrutiny, but your credit score should not be a major obstacle.

During the application process, lenders may look at other factors beyond your credit score, such as your income and employment history. They do this in order explore your ability to repay the loan. Now, having a good score like 714 often means you'll have access to more favorable interest rates. Remember, lower interest rates mean the loan will cost less over time. While the procedure might seem rigorous, keep in mind that it's all part of the process to secure a loan that fits your financial circumstances.

Can I Get a Car Loan with a 714 Credit Score?

If your credit score is 714, you're likely to be greenlit for a car loan. Lenders typically seek scores that exceed 660, and yours is well above that threshold, which portrays you as a less risky borrower from lenders' perspective. This makes it easier for you to secure a favorable car loan. But by no means does this imply that it will be plain sailing.

During the car purchasing process, you may still have to face certain obstacles. Remember, your credit score also impacts the interest rate you will be offered. While your score of 714 is higher than average, it may not necessarily qualify for the lowest interest rates available. The exact rates and terms you'll receive can also depend on many other factors including the loan amount, the length of the loan, and your current income. It's important to consider all these factors as you navigate the car purchasing process.

What Factors Most Impact a 714 Credit Score?

Understanding your credit score of 714 is a vital first step towards improving your financial health. Contextualizing potential contributors to this score can aid you in shaping a prosperous financial future. It's essential to remember that each financial journey is distinctive, filled with possibilities and learning experiences.

Credit Utilization

Credit utilization is a major factor that affects your current score. If your credit ratio is high, meaning that your balances approach or are at their limits, it may be pulling down your score.

How to Check: Analyze your credit card balances. If they're high relative to your limits, it's worth aiming to significantly lower them.

Length of Credit History

A credit history that's not sufficiently long may be influencing your score negatively.

How to Check: Review your credit report to determine the age of your oldest and most recent accounts, and the average age of all your accounts. Reflect on whether opening recent accounts could have impacted your score.

Credit Mix

A diverse mix of credit types tends to favor your credit score. The absence of diversity might be impacting your current score.

How to Check: Evaluate your credit portfolio. Maintaining a balance of different types of credit, such as retail accounts, credit cards, mortgage loans, and installment loans, can improve your score.

New Credit

New credit applications, when made sparingly, can add to a good credit score, but excess applications could potentially lower your current score.

How to Check: Understand your recent credit applications. If there are many, this might have influenced your current score.

Payment History

Your payment history plays a crucial role. Any late or missed payments could be affecting your score.

How to Check: Examine your credit report for any late or missed payments. It's worth focusing on maintaining a consistent payment record.

How Do I Improve my 714 Credit Score?

A credit score of 714 is decent, but there’s always room for growth. Here are some attainable, impactful strategies specifically tailored for this score level:

1. Regular Credit Monitoring

Keep a close eye on your credit report so you’re consistently aware of all the factors affecting your score. If there are any inaccuracies, contest them immediately with the credit bureaus. This maintains a clean credit profile, which is crucial at your current score range.

2. Maintain Low Credit Utilization

It’s always good to keep your credit utilization – the percentage of your available credit that you’re using – lower than 30%. The lower this ratio, the better. Even at a score of 714, this rule still applies.

3. Consistently On-Time Payments

Consistent, on-time payments are one of the most powerful factors in credit score calculation. It’s essential to continue paying bills, loans, and credit cards on schedule to keep strengthening your payment history.

4. Age of Credit

The longer you responsibly manage your credit, the more likely it is to positively impact your score. Therefore, keep your oldest credit card open and in good standing. However, resist the urge to open several new accounts at once as this can negatively impact your credit age.

5. Focus on Credit Mix

Banks like to see that you can deal with different types of credit responsibly. Thus, maintaining a mix of revolving credit (like a credit card) and installment credit (such as a car loan) can prove beneficial.