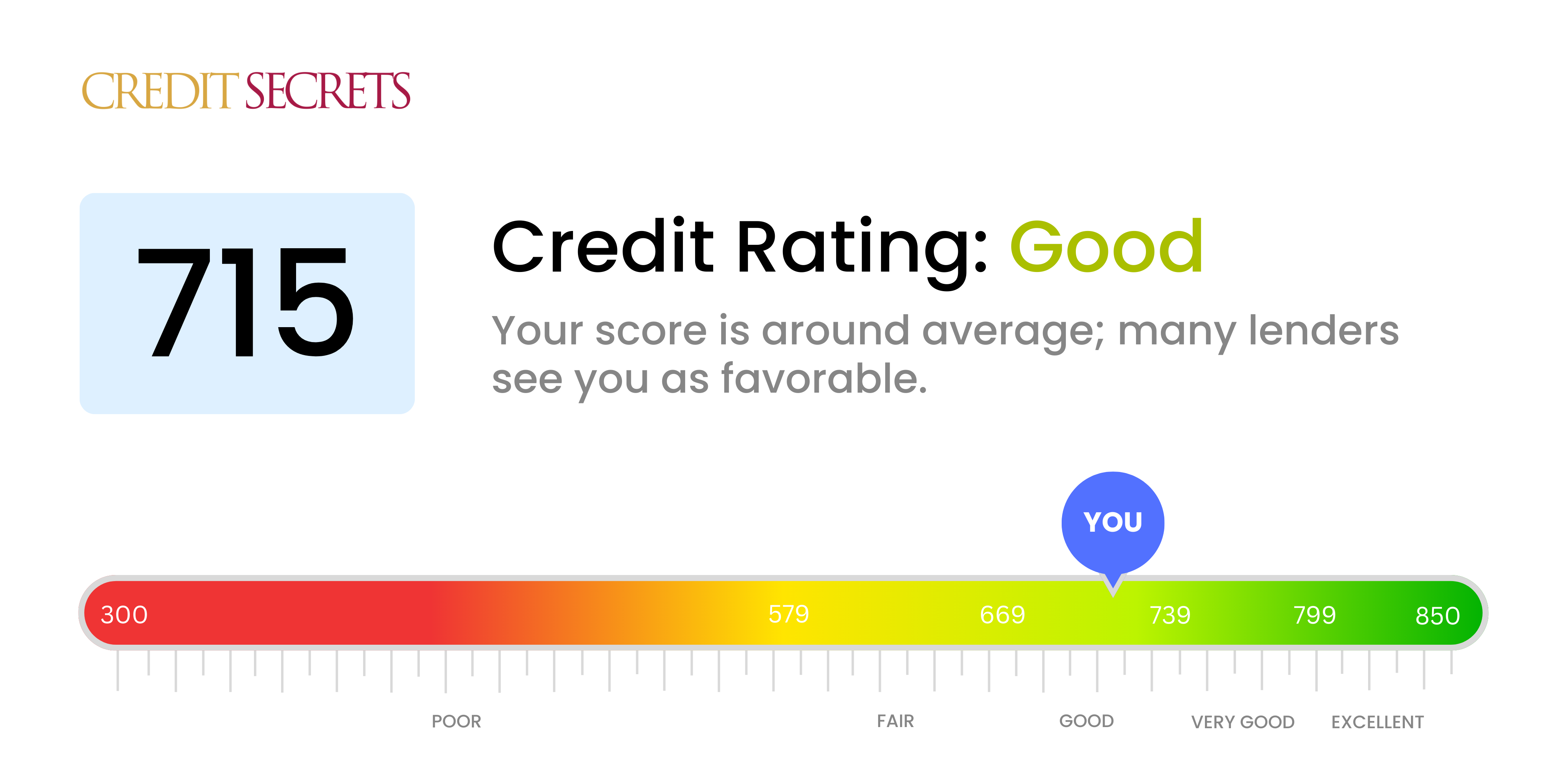

Is 715 a good credit score?

With a credit score of 715, you're doing pretty well! This score is considered to be "good" on the credit rating scale.

This means that financial institutions see you as a reliable borrower who usually makes payments on time. With this score, you can qualify for most loans and credit cards, often with reasonably low interest rates. However, keep in mind that you're not far from a "very good" score, so consider ways to continue improving your credit status.

Remember, careful management of your credit can help you go even further in your financial journey.

Can I Get a Mortgage with a 715 Credit Score?

If your credit score sits at 715, the possibility of you getting approved for a mortgage is quite high. This score is considered to be in the "good" range by many lending institutions, indicating you have a responsible track record with credit use. However, remember that credit score is just one of many factors influencing mortgage approval, and not a guarantee.

During the mortgage approval process, lenders will look at other aspects of your financial profile, such as your income, employment stability, and overall debt. They will also determine the initial terms of your mortgage, including your interest rate. While a 715 is a good score, it might not qualify you for the absolute best interest rates. Those are typically reserved for "excellent" scores, which start around 740 and up. Nonetheless, with a score of 715, you can still expect competitive mortgage terms that will help to make homeownership an achievable goal.

Can I Get a Credit Card with a 715 Credit Score?

With a credit score of 715, there's a good chance to get approved for a credit card. This score suggests that financial responsibilities have been managed well in the past, painting a picture of a reliable candidate to potential lenders. Don't lose sight of the fact that a good credit score is a stepping stone to achieving financial goals.

In terms of card selection, a score of 715 opens up a range of attractive options. You may want to consider starter credit cards, which can help continue to build credit history. On the other hand, premium travel cards can provide valuable perks and rewards for frequent travelers, while saving on international transaction fees. Remember to consider interest rates, as they can vary between different cards. Higher credit scores often lead to lower interest rates, and with a 715 score, it's likely you'll be offered competitive rates. It's essential, however, to always pay attention to each card's terms and conditions before making a choice.

A credit score of 715 is generally seen as good in the eyes of most lenders. This score reflects a history of responsible credit usage and timely payments, characteristics which lenders look for in prospective borrowers. It's likely that you'll see approval if you apply for a personal loan.

Bearing in mind your credit score, anticipate the loan application process to question your credit history in detail. This is to confirm your capability of managing loan payments in the future. However, having a good score means you have a better chance of securing lower interest rates, which can make your loan more affordable over its lifespan. Remember, every lender has different criteria—some might offer even more favorable rates for applicants with a 715 score, while others may still see some room for improvement. Stay positive, your good credit score is a solid foundation for your financial aspirations.

Can I Get a Car Loan with a 715 Credit Score?

If you have a credit score of 715, chances are high that you'll get approved for a car loan. The typical threshold to secure favorable terms with lenders is a credit score above 660. Your score of 715 not only surpasses this minimum requirement but also portrays you as a reliable borrower. Lenders view this score as an indication of a borrower who can comfortably repay any borrowed funds.

When it comes to purchasing a car, a comfortable credit score like yours can open up a new range of possibilities. You can expect relatively low-interest rates due to the reduced risk you present to the lenders. A lower interest rate can significantly reduce the amount you'll spend on the car over the life of the loan, providing additional room in your budget for other important expenses. However, remember to carefully read through the loan terms before making any commitment. Lenders might vary in their offers and some might be more beneficial than others.

What Factors Most Impact a 715 Credit Score?

Recognizing your credit score of 715 is crucial for guiding you towards financial growth. A primary factor that could contribute to this score is your payment history.

Payment History

One late payment or default may massively impact your score. Make a point of keeping up with this aspect.

How to Check: Scrutinize your credit report, checking for any late payments or defaults that could have affected your score.

Credit Utilization

This score could be affected if your credit card balances are maxed out. Maintaining a low balance relative to your credit limit is beneficial.

How to Check: Look at your credit card statements, are the balances near the limit? If so, this could be negatively impacting your score.

Length of Credit History

A shorter credit history may influence your score adversely. Avoid opening too many new accounts.

How to Check: Assess your credit report's age and the average age of all your accounts. Have you opened new accounts recently?

Credit Mix and New Credit

This score can also be influenced by the lack of variety in your credit types and holding too much of new credit.

How to Check: Examine your mix of credit accounts. Are you moderately applying for new credit?

Public Records

Public records such as bankruptcies or tax liens could significantly lower your score, rectify any such conditions if possible.

How to Check: Look into your credit report for any public records. Resolve any items that need attention.

How Do I Improve my 715 Credit Score?

With a credit score of 715, you’re in a good position, but there are ways to strengthen your credit further. Here are the most effective and applicable strategies for your current situation:

1. Regularly Check Your Credit Report

Ensure there are no errors damaging your score by getting free annual credit reports from each of the three major credit bureaus via AnnualCreditReport.com. Dispute any inaccuracies immediately to prevent them from pulling down your score.

2. Maintain Low Credit Card Balances

Even though your score is healthy, it’s vital to keep your credit utilization low to prevent negative impacts. Strive to keep your balances below 20% of your credit limit across all credit cards.

3. Pay Bills Before Their Due Date

Paying bills early enhances your payment history, which makes up 35% of your FICO score. Automatic payments help avoid missed deadlines and late fees.

4. Limit Credit Applications

Applying for new credit can trigger a hard inquiry on your credit report, which can temporarily lower your score. Be selective about applying for new credit to keep your inquiries to a minimum.

5. Strive for Credit Diversity

If you only have credit cards, considering a mix of credit can contribute to your credit score by showing that you can handle different types of debt responsibly. This may include auto loans, mortgages, or student loans.