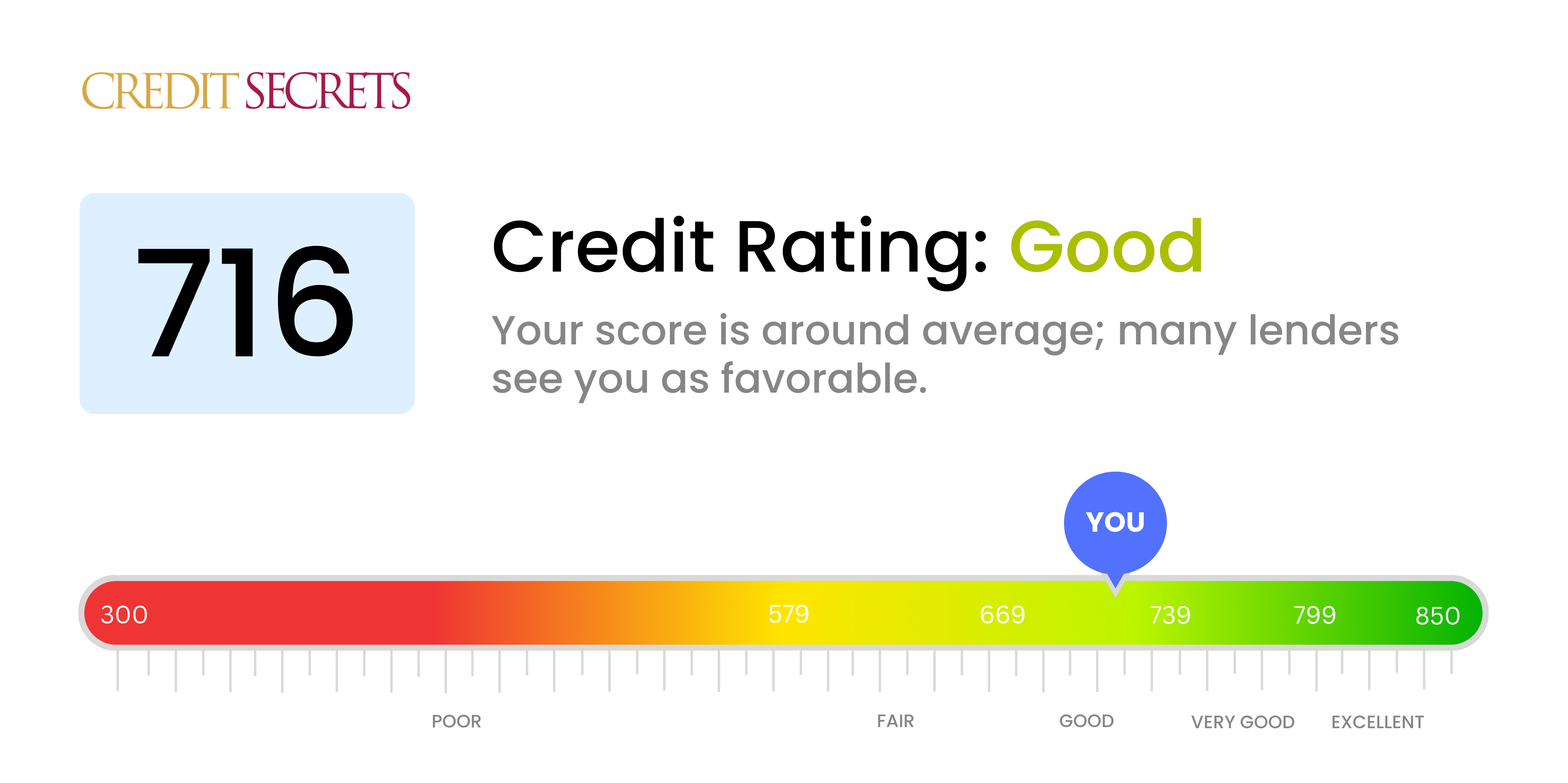

Is 716 a good credit score?

Your credit score of 716 is considered a good score. With a score like this, you can expect to get approved for credit cards and loans, often with decent interest rates, although these might not be as favorable as those offered to individuals with very good or excellent credit scores.

This score suggests that you've been responsible with your credit in the past, but there's also room for improvement. By keeping up with your current payments and avoiding high credit card balances, you have the opportunity to push your score into the very good or even excellent range. Your financial journey is within your control.

Can I Get a Mortgage with a 716 Credit Score?

With a credit score of 716, you're in a promising position for mortgage approval. This score is above the average and. indicates a history of responsible credit management. Most lenders see this as a good credit score, increasing the likelihood of favorable terms and conditions offered to you.

This, however, doesn't mean the mortgage approval process will be without scrutiny. Lenders will examine your credit report for any red flags like late payments or evidence of excessive debt. Also, be aware that while a score of 716 is considered good, securing the best possible interest rates typically requires a score in the excellent range, which starts at 720 and above. If you're on the brink of this threshold, even small steps to improve your credit further could result in substantial savings over the life of your mortgage. It's worth the effort to strive for the highest score possible.

Can I Get a Credit Card with a 716 Credit Score?

With a credit score of 716, the likelihood of being approved for a credit card is much higher. A credit score in this range reflects a good record of financial responsibility, typically indicating regular, on-time payments and balanced use of available credit. Although it's not the highest score, this should still be considered as a positive position in your financial journey.

While you may not qualify for the most premium travel cards, which often require excellent credit, a handful of credit card options are suitable for a score of 716. You could explore regular credit cards that offer reward programs or cash-back on purchases. These cards can provide added value for ordinary expenses and purchases. It's important to remember that while your credit score allows you access to these options, always consider the interest rate associated with the card before applying, as some cards may have higher rates in exchange for their benefits.

With a credit score of 716, the chances of being approved for a personal loan are fairly solid. This score is a reflection of your prudent financial habits and lenders will likely see you as a reliable borrower. However, it's important to remember that while your credit score is a key factor, lenders may also consider your income, employment status and debt-to-income ratio when assessing your loan application.

When you decide to apply for a personal loan, be prepared for the lender to conduct a hard inquiry into your credit report, which could have a minor, temporary impact on your credit score. The loan's interest rates can vary, but with a score of 716, you're more likely to be offered a competitive interest rate compared to applicants with lower scores. Stay confident but cautious, ensuring you read all terms thoroughly before agreeing to a loan.

Can I Get a Car Loan with a 716 Credit Score?

Having a credit score of 716 puts you in a strong position to secure a car loan. Most lenders consider scores over 660 as reliable, and your score is well above this threshold. This means you're viewed as a lower risk and more likely to receive favorable terms when it comes to acquiring a loan for a car.

When it comes to the car purchasing process, your admirable credit score can translate to lower interest rates and a broader choice of lenders. It's important to remember that your credit score is a significant factor, but loan approval also depends on your income and other debts. Nevertheless, a credit score of 716 should generally help smooth the path towards advantageous auto financing options. Keep in mind that it's still important to shop around and explore the best loan terms that suit your financial circumstances.

What Factors Most Impact a 716 Credit Score?

A credit score of 716 falls in the good category and shows responsible credit behavior. However, for better financial opportunities, you could aim at improving this score further. Here are a few elements likely impacting your current credit score.

Payment Timing

Your payment history has a significant influence on your credit score. Even a single late payment could have a moderate impact on your score.

How to Check: Scrutinize your credit report for any late or missed payments.

Credit Card Utilization

Another crucial factor is your credit utilization ratio. Even if you are regularly paying your bills but are closer to your credit limit, it may have impacted your score.

How to Check: Check your recent statements. Aim to maintain your credit balances at 30% or less of your total credit limit.

Length of Credit History

The age of your credit history can be an influencing factor. If most of your accounts are relatively new, it could have played a role in your score.

How to Check: Look at your credit report for the average age of your accounts.

Recent Credit Applications

Applying for multiple new credits recently can negatively impact your score. Lenders may interpret it as a sign of risk.

How to Check: Review your credit report for recent loan or credit card applications.

Public Records

Although less likely at your current score, public records like bankruptcies can significantly lower your credit score.

How to Check: Review your credit report for any public records that could hurt your score.

How Do I Improve my 716 Credit Score?

A credit score of 716 is quite impressive, yet there’s a room for improvement to achieve an excellent rating. Here are some accessible next steps you can consider:

1. On-Time Bill Payments

One impactful way you can boost your score is to ensure that all your bills are paid on time. This showcases responsible financial behavior and affects about 35% of your credit score. Setting up automated payments can ensure you never miss a deadline.

2. Lower Your Credit Utilization

Your credit score greatly depends on the amount of credit you are currently using. Try to use less than 30% of your available credit. This shows lenders that you handle your credit responsibly and not living off borrowed money. Regularly check your utilization rate and prepay some of the balance if it exceeds the recommended level.

3. Maintain Old Credit Lines

Keep your oldest credit cards open and in use to showcase a longer history of credit use. Longer credit history can demonstrate consistent responsibility over time.

4. Limit Hard Credit Inquiries

Only apply for new credit when it’s necessary. Each time you apply for a loan or a credit card, it results in a hard inquiry which can hurt your credit score.

5. Watch Your Credit Reports

Regularly review your credit reports to spot any mistakes or fraudulent activity and solve them promptly. A short discrepancy can lead to a big dip in your score.