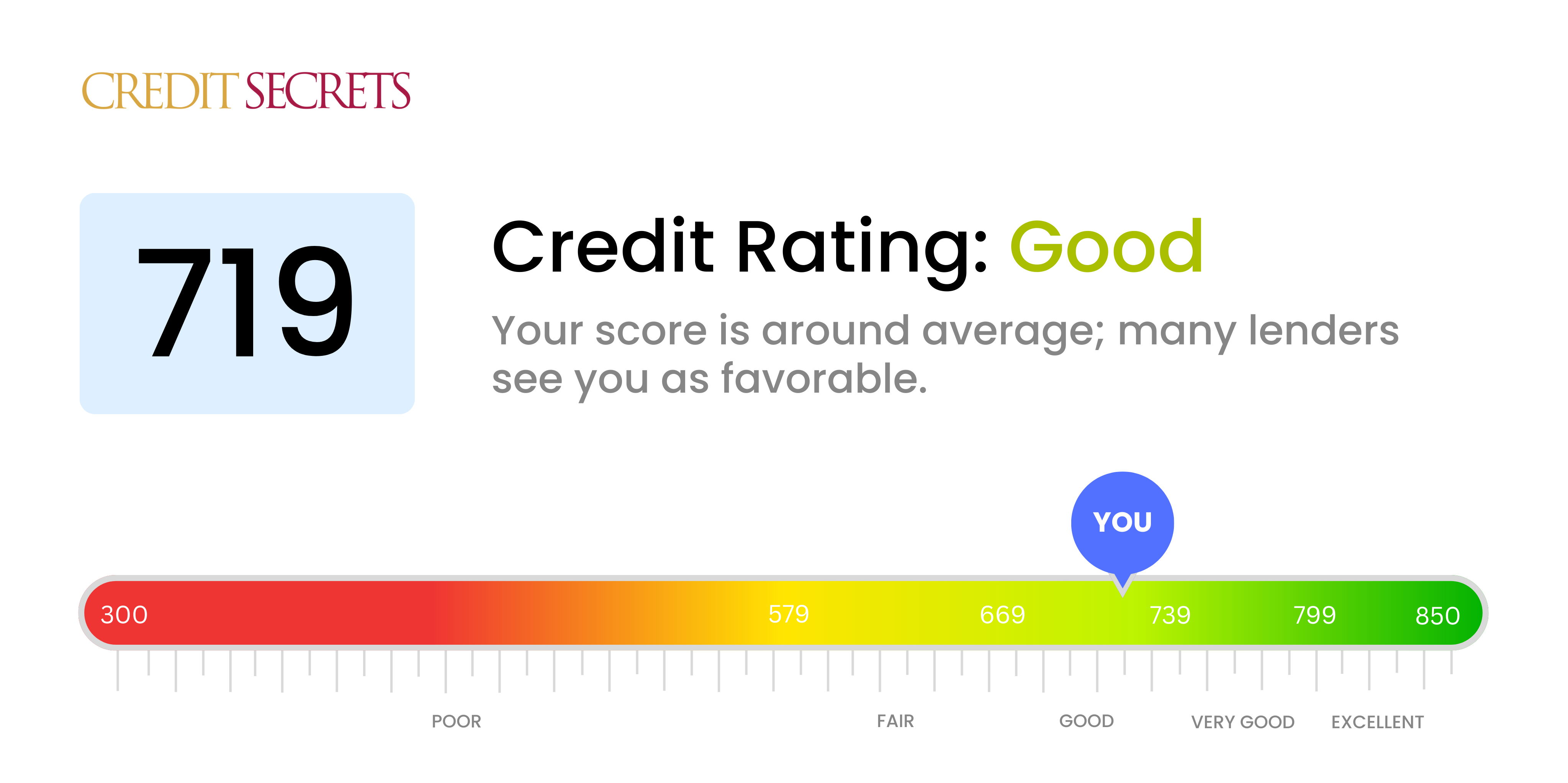

Is 719 a good credit score?

Having a credit score of 719 definitely puts you in a good place. This is considered to be a 'Good' score on most credit scale range, which means you've demonstrated responsible financial behavior. You are typically likely to receive favorable interest rates, be approved for credit cards, or secure loans. It's not the top bracket, but it’s definitely a score that can open doors.

However, there's always room for improvement. A higher credit score can lead to even better opportunities like lower home loan interests, increased credit limit allowances, and more favorable loan terms. Cultivating good financial habits can help raise your score even further, closer to the 'Very Good' or 'Excellent' categories. Remember, credit scores are simply measurements of creditworthiness and pursuing higher scores should always be part of your ongoing financial goals.

Can I Get a Mortgage with a 719 Credit Score?

With a credit score of 719, you are in a favorable position when it comes to applying for a mortgage. This score is typically seen as 'good' by many lenders and thus, may increase your chances of approval. However, this doesn't guarantee approval as lenders also consider other financial factors.

You can expect a fairly smooth mortgage approval process. Bear in mind that even though your score is good, different lenders offer different interest rates and terms based on your credit risk. It's certainly to your advantage to shop around for the most favorable rates and terms based on your financial situation. Remember, maintaining timely bill payments and responsible financial behaviors can help keep your credit score stable and may even improve it over time.

Can I Get a Credit Card with a 719 Credit Score?

Bearing a credit score of 719, you stand a high chance of getting approved for a credit card. This score is deemed as good by lenders and it typically suggests a positive credit history. Don't rest easy, though. It's equally crucial to comprehend the type of credit cards ideal for your financial situation.

With your score, you could confidently apply for a range of credit cards, from starter cards suitable for those new to credit, to premium rewards cards offering travel benefits and cash back. However, make sure to compare their interest rates, which could be a significant factor depending on your spending habits. While this is a significant triumph towards achieving solid financial health, always remember that maintaining this score involves responsible financial behavior – consistently paying bills on time and keeping your credit balances low. This way, you'll not only hold onto your good credit score but possibly even improve it over time.

With a credit score of 719, you're well-positioned to be approved for a personal loan. This score falls within the "good" range, indicating to lenders that you have reliably managed your credit in the past. As a borrower, this demonstrates a lower level of risk compared to those with lower scores, which the lenders take into account when considering your application.

Though the personal loan application process can vary among lenders, a score like yours often simplifies matters. You can certainly expect thorough evaluations of your credit and financial history, but a successful review could potentially result in lower interest rates and more favorable terms. Nevertheless, keep in mind that while a 719 credit score improves your chances, approval isn't guaranteed and will depend on other factors such as income and debt levels. Maintain your optimism but remain prepared for various outcomes during this process.

Can I Get a Car Loan with a 719 Credit Score?

If you have a credit score of 719, your chances of being approved for a car loan are quite high. Lenders often view scores amongst this range as representative of responsible financial behavior. This score reveals to them that you have a history of paying back borrowed money in a timely manner, thus, reducing the risk they'd be taking in lending to you.

As you embark on the car purchasing journey, you can expect to be met with favorable financing terms thanks to your strong credit score. Lenders often offer lower interest rates to applicants with high credit scores because these individuals are less likely to default on the loan. Ultimately, a credit score of 719 puts you in a good position to secure a car loan. However, be sure to review all terms and conditions thoroughly before making a commitment. Bear in mind that while your credit score is a critical factor, other aspects like your income and existing debt could also be considered by lenders.

What Factors Most Impact a 719 Credit Score?

Deciphering a credit score of 719 is vital to establishing a concrete financial improvement strategy. Acknowledging and tackling core factors impacting your score opens pathways to strong financial health. No two journeys are identical, and every minor fluctuation offers room for learning and betterment.

Credit Utilization

Your credit utilization ratio significantly affects your credit score. Your score might be impacted if you're using a high percentage of your available credit.

How to Check: Scrutinize your credit card statements. Are your balances nearing the credit limits? Striving to maintain a low balance compared to your overall credit limit can boost your credit score.

Credit History Length

Having a shorter credit history could potentially be lowering your score. This is important, even if you maintain timely payments and low balances.

How to Check: Peruse your credit report to comprehend the age of your oldest and newest accounts, and the average age of all your accounts. Reflect on whether you recently opened any new accounts, as they could reduce the average account age.

Diversity of Credit

A balanced mix of various credit types and responsible management of new credit are factors that can greatly influence your score positively.

How to Check: Assess the diversity of your credit accounts. This can range from credit cards, retail accounts, installment loans, to mortgage loans. It’s also worth looking into whether you have been applying for new credit judiciously.

Negative Financial Events

Even with a score of 719, negative financial events like defaults, bankruptcies or tax liens can pull down your score, even if they were events from years ago.

How to Check: Review your credit report for any such negative financial records. Resolving these issues, if any, could uplift your credit score.

How Do I Improve my 719 Credit Score?

With a credit score of 719, you’re on the right track. But there’s still room for improvement. Here are your next, score-specific steps for financial empowerment:

1. Consistent, On-Time Payments

Make sure to make all your payments on time. Your payment history impacts your credit score greatly. Setting up automatic payments can help ensure you don’t miss any deadlines, leading to an improved credit score.

2. Monitoring Your Credit Utilization

Credit utilization, or how much of your available credit you use, also plays an important role in your credit score. Try to keep it below 30% to show lenders that you handle your credit responsibly.

3. Minimize Hard Inquiries

Try to reduce the number of hard inquiries on your credit report. These can temporarily lower your credit score and stay on your report for up to 2 years. Only apply for new credit when necessary.

4. Don’t Close Unused Credit Cards

As long as they’re not costing you money in annual fees, hold onto your unused credit cards. Closing an account may increase your credit utilization by decreasing your overall available credit.

5. Review Your Credit Reports

Regularly check your credit reports to ensure they’re accurate. If you find any errors, dispute them immediately. This helps to protect your score from inaccuracies that could be pulling it down. And remember, you can request a free report every year from each of the three credit bureaus.