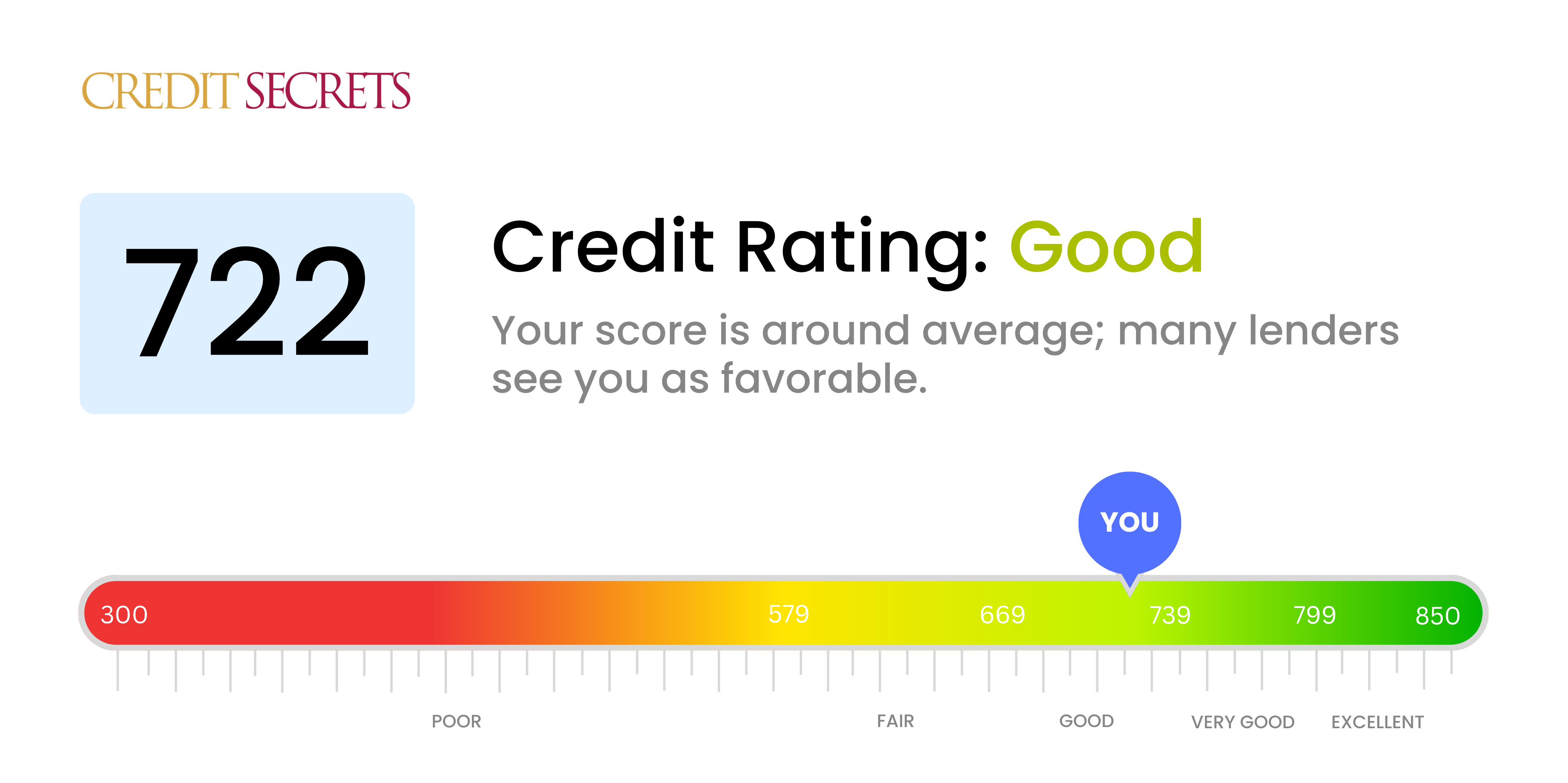

Is 722 a good credit score?

With a credit score of 722, you're doing well and fall into the 'Good' category. Acquiring loans and credit should not pose a big challenge for you due to your favorable credit history, although rates might not be as optimum as those offered to people with 'Very good' or 'Excellent' scores.

You've worked hard to maintain a solid credit score, and that determination has paid off. Keep going and you will see even greater benefits, like more favorable loan terms and lower interest rates. It's all part of your journey to financial wellness and success.

Can I Get a Mortgage with a 722 Credit Score?

With a credit score of 722, your chances of being approved for a mortgage are rather promising. This score suggests a pattern of responsible credit usage and dependable repayment history, which mortgage lenders find appealing. It's well above the threshold that most lenders typically expect, offering you a favorable outlook.

As you embark on the mortgage approval process, prepare for in-depth reviews of your financial history and current income status. It's not solely about your credit score. Lenders will consider your employment stability, debt-to-income ratio, and overall financial reliability before they grant you a mortgage. A credit score of 722 might also qualify you for better interest rates, potentially lowering your future mortgage payments. The journey might seem daunting, but remember: your credit score of 722 has already positioned you on the right track.

Can I Get a Credit Card with a 722 Credit Score?

If your credit score is 722, chances are high that you could be approved for a credit card. A credit score in this range indicates you have demonstrated responsible credit habits, and lenders may view you as a trustworthy borrower. However, this does not guarantee approval, as lenders consider other factors as well like income and existing debts.

Given your solid credit score, a wide range of credit cards could be suitable. If you handle credit responsibly, a rewards card could be beneficial, providing perks like cash back, points, or miles that you earn by using the card. Alternately, if you have a balance on another card, a balance transfer card could save you money on interest. Just remember, the interest rates, fees, and credit limits vary between cards, so choose one that fits your needs. Continue practicing good financial habits like paying your bills on time and keeping your credit card balances low. Doing so can help maintain, or even improve, your credit score.

A credit score of 722 is generally considered good and falls within a range that most lenders may find acceptable for a personal loan. This suggests that your history of debt repayment and financial management has been largely successful. Although credit score is not the only factor, it plays a substantial role in a lender's decision-making process.

As you venture into your personal loan application process, keep in mind that your credit score won't guarantee approval, but it can significantly improve your chances. Owing to your fairly good credit status, you would likely be offered loans with lower interest rates compared to someone with a lower credit score. However, ensure to read the loan terms very carefully before making a decision. Remember, while a good credit score increases your chances, lenders also consider your income, employment status and other factors in the approval process.

Can I Get a Car Loan with a 722 Credit Score?

With a credit score of 722, you're in good shape to be accepted for a car loan. This score is generally deemed to be good by lenders and signifies a lower risk to them. It indicates a strong history of managing and repaying the money you've borrowed, and lenders like to see that in their clients.

Being in the 'good' credit range gives you a better chance at favourable loan terms, which might include lower interest rates and more flexible repayment schedules. However, keep in mind that your credit score is only one factor that lenders consider. They also look at things like your income and employment history. A good credit score of 722 certainly puts you in a strong position in the car purchasing process, but be sure to research your options thoroughly and understand the terms of any loan you're offered.

What Factors Most Impact a 722 Credit Score?

Unlocking the factors influencing a 722 credit score can empower you to reach your financial goals. Diving deep into your financial habits will undeniably lead to a healthier and stronger credit score.

Credit Utilization Rate

Your credit utilization rate, or how much of your total credit you're using, can significantly sway a credit score of 722. You can stay on top by maintaining a low balance.

How to Check: Scrutinize your credit card statements. Are you using a high percentage of your available credit? Aim to keep the utilization rate under 30% to support your score.

Length of Credit History

Longer credit histories generally mean higher credit scores. How long you've been a credit user could be causing your score of 722.

How to Check: Analyze your credit report for the age of your accounts. Have you been credited recently? Remember, mature accounts are better for your score.

New Credit Inquiries

Frequently applying for new credit can lower your credit score. One-off applications need not be a worry, but don't make it a habit.

How to Check: Take a look at your report for new inquiries or accounts. Have you applied for any credit recently? If so, this might be impacting your credit score.

Existing Credit Mix

Having a mixed bag of credit types, from credit cards to auto loans to mortgages, could be a valuable asset in strengthening your credit score.

How to Check: Go through your credit report to see your variety of credit types. Having different types of credit accounts and handling them responsibly is good practice.

How Do I Improve my 722 Credit Score?

With a credit score of 722, you’re in the good credit range but there’s room for improvement. Below are some impactful steps you can take:

1. Regularly Monitor Your Score

Regularly checking your credit score will help you spot any sudden drops or inconsistencies. This can be an early way to detect fraudulent activity or incorrect details on your account, which can be disputed and improved. Please ensure you are using FICO score tracking for this purpose.

2. Keep Credit Utilization Low

Maintain a credit utilization ratio around 30% or less. This means you’re effectively managing and not maxing out your available credit, which is positively reflected in your score. Monitor your usage and pay off more, if required.

3. Maintain Old Open Credit Accounts

If you have old credit accounts with good payment history, maintain them open. The length of your credit history carries weight in your credit score, so closing old accounts may have negative impact.

4. Timely Payments

Prompt and full payments of your bills are fundamental. Delayed payments can negatively impact your credit score. Set up automatic payments to ensure your bills are always paid on time.

5. Limit Requests for New Credit

Limit the number of new credit applications as these require a ‘hard inquiry’ which can temporarily lower your credit score. Only apply for new credit when it’s necessary.

By following these specific steps, you can work towards an excellent credit score.