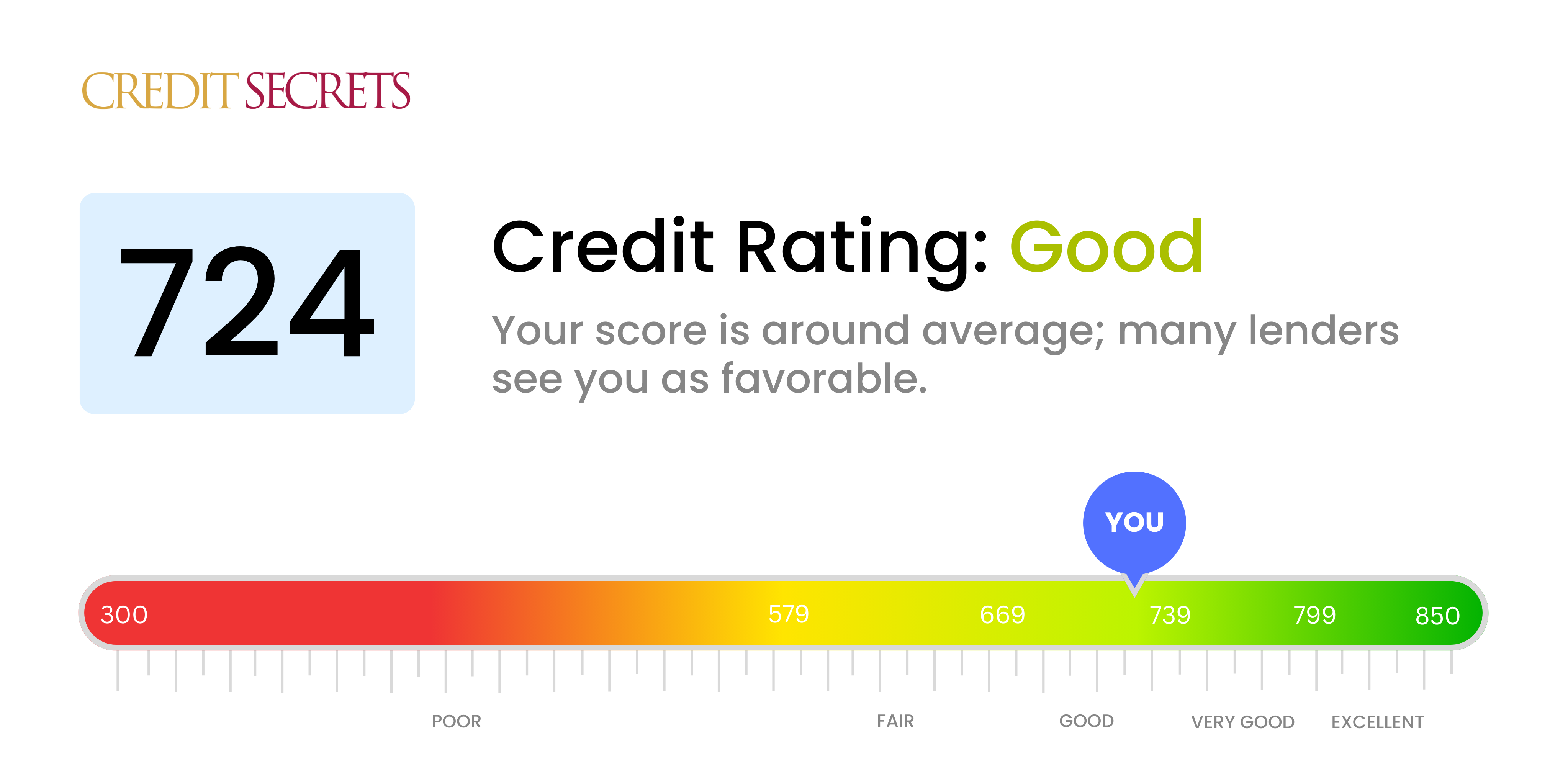

Is 724 a good credit score?

Your score of 724 falls into the 'good' category on the credit score scale. This typically means that most lenders will consider you as a lower risk borrower, which could provide you with easier access to credit or loans, potentially with lower interest rates. However, improving your score could open even more financial doors such as obtaining premium rewards credit cards or negotiating for better loan terms.

It's important to remember that maintaining and improving a credit score is an ongoing process, paying attention to your financial habits can help. While a score of 724 is something to be proud of, there are always ways to improve, ensuring the best chances of financial success in the future. Keep paying your bills on time, limit inquiries, and reduce debt to continue progressing on your financial journey.

Can I Get a Mortgage with a 724 Credit Score?

With a credit score of 724, you stand a good chance of being approved for a mortgage loan. This is because a score in this range is typically seen as "good" and therefore less of a risk to lenders. It indicates that you have a history of responsibly managing your credit and making payments on time.

In the mortgage approval process, you can generally expect lower interest rates compared to those with lower credit scores. This is a benefit of maintaining a good credit score as it can save you a significant amount of money over the life of your loan. However, keep in mind that many factors influence the mortgage approval process, and a good credit score doesn't guarantee approval. The lender will review other aspects such as employment status, income, and debt-to-income ratio during the approval process. Also, each lender may have different standards. Always strive to maintain or improve your credit score as it continues to play a vital role.

Can I Get a Credit Card with a 724 Credit Score?

Holding a 724 credit score is quite favorable when it comes to credit card approvals. This reflects a history of responsible credit usage and reliable payment behaviors. Persons with such scores have typically demonstrated commitment and consciousness in managing their finances. Recognizing this significant accomplishment in your financial journey is crucial.

With this score, you have the opportunity to explore a variety of credit card options. This can extend to premium travel cards that offer attractive rewards for regular spenders, as well as cards that provide cash back on everyday purchases. The interest rates on these cards are often competitive, mirroring your lower-risk status to lenders. Remember, the credit card market is wide and varied. Prioritize cards that align with your financial habits and goals, carefully considering aspects such as annual fees and reward structures. Clarity and cautious thought in this stage will pave the way for beneficial credit decisions.

If you possess a credit score of 724, you're in fairly good standing and should generally qualify for a personal loan. It's typically considered a good credit score from lenders' perspective and suggests you've been responsible with your credit in the past, providing you with more favorable terms when it comes to obtaining a loan.

During the personal loan application process, your credit score of 724 will likely lead to a lower interest rate and more flexible repayment terms than someone with a lower score. Remember, though, it's not the only factor lenders consider. Your income, employment status, and debt-to-income ratio can also affect approval and the terms of your loan. Always ensure you're comfortable with the outlined conditions before signing any loan agreement. Being proactive and understanding the terms of your loan can help you successfully manage your debt and maintain your good credit standing.

Can I Get a Car Loan with a 724 Credit Score?

With a credit score of 724, you're in a great position to secure a car loan. Lenders view credit scores above 700 as a positive sign of creditworthiness. This score typically shows lenders that you have a history of responsibly managing borrowed money and making your payments on time. This is something they look for when considering you for a car loan.

When it comes to the car purchasing process, having such a strong credit score means you'll likely have access to better lending terms. It's not uncommon for lenders to offer lower interest rates to those with higher credit scores, which can result in significant savings over the life of your car loan. While the terms still depend on other factors such as income and existing debt, a credit score of 724 puts you in a good place to negotiate favorable conditions. Proceed with confidence, but make sure to get all the details of potential loans clearly laid out before making a decision.

What Factors Most Impact a 724 Credit Score?

An understanding of your credit score of 724 is the initial step toward maintaining or improving your financial health. Analyzing the elements contributing to this score subsequently allows you to identify areas for improvement or habits to maintain. Each financial trajectory is unique, with constant opportunities to expand your financial understanding and skills.

On-Time Payments

Punctual payment of bills greatly influences your credit score. Let's examine whether prompt payments have boosted your score to 724.

Way to Verify: Inspect your credit report for evidence of on-time payments. Regular, timely payments could have played a major part in achieving your current score.

Credit Utilization

Utilizing less than 30% of your available credit is seen favorably in the context of credit scores. This might be one reason behind your current score.

Way to Verify: Compare your current balances with your overall credit limit. If your balances are low relative to your limit, this may have positively affected your score.

Length of Credit History

A long credit history is beneficial, offering proof of financial stability over time.

Way to Verify: Check your credit report to ascertain the age of your oldest and newest loans and calculate the average length of all your credit accounts. A prolonged, well-maintained credit history can uplift your score.

Credit Mix

A mix of credit types such as auto loans, credit cards, mortgages, etc. can boost your score.

Way to Verify: Scrutinize your credit report and look for a variety of different credit types. A balanced credit mix might be one of the factors contributing to your current score.

Low Inquiry Count

Frequent applications for new credit can lead to a hard inquiry on your credit report, which can reduce your score.

Way to Verify: Check your credit report for recent inquiries. Minimizing applications for new credit could have assisted in maintaining your current score.

How Do I Improve my 724 Credit Score?

With a current score of 724, you fall into the good credit range, which opens a lot of attractive financial possibilities for you. However, with specific actions, you can raise this score to excellent, further enhancing your borrowing power. Here are the most effective strategies at your score level:

1. Monitor Your Credit Report Regularly

It’s essential to continuously be in the loop about your credit status. Mistakes happen, and erroneous information could be holding your score back. By frequently reviewing your credit report, you can contest any inaccuracies promptly.

2. Be Mindful of Hard Inquiries

Try to avoid applying for new credit unless necessary. Each time you apply for credit, a “hard” inquiry is placed on your report, potentially lowering your score.

3. Maintain Low Credit Card Balances

Always keep your credit card balances low. Aim for usage well below your credit limit. This utilization rate significantly affects your credit score. A great goal is maintaining your usage below 10% of your credit limit.

4. Build a Mix of Credit

Strive to have a good mix of credit. Different types of credit—like mortgage loans, auto loans, and credit cards—handled responsibly can boost your credit appeal.

5. Avoid Late Payments

Punctual payments play a massive role in calculating your credit score. Make sure you pay your bills on time, every time. Set reminders on your phone or automate your payments if you find it challenging keeping track.