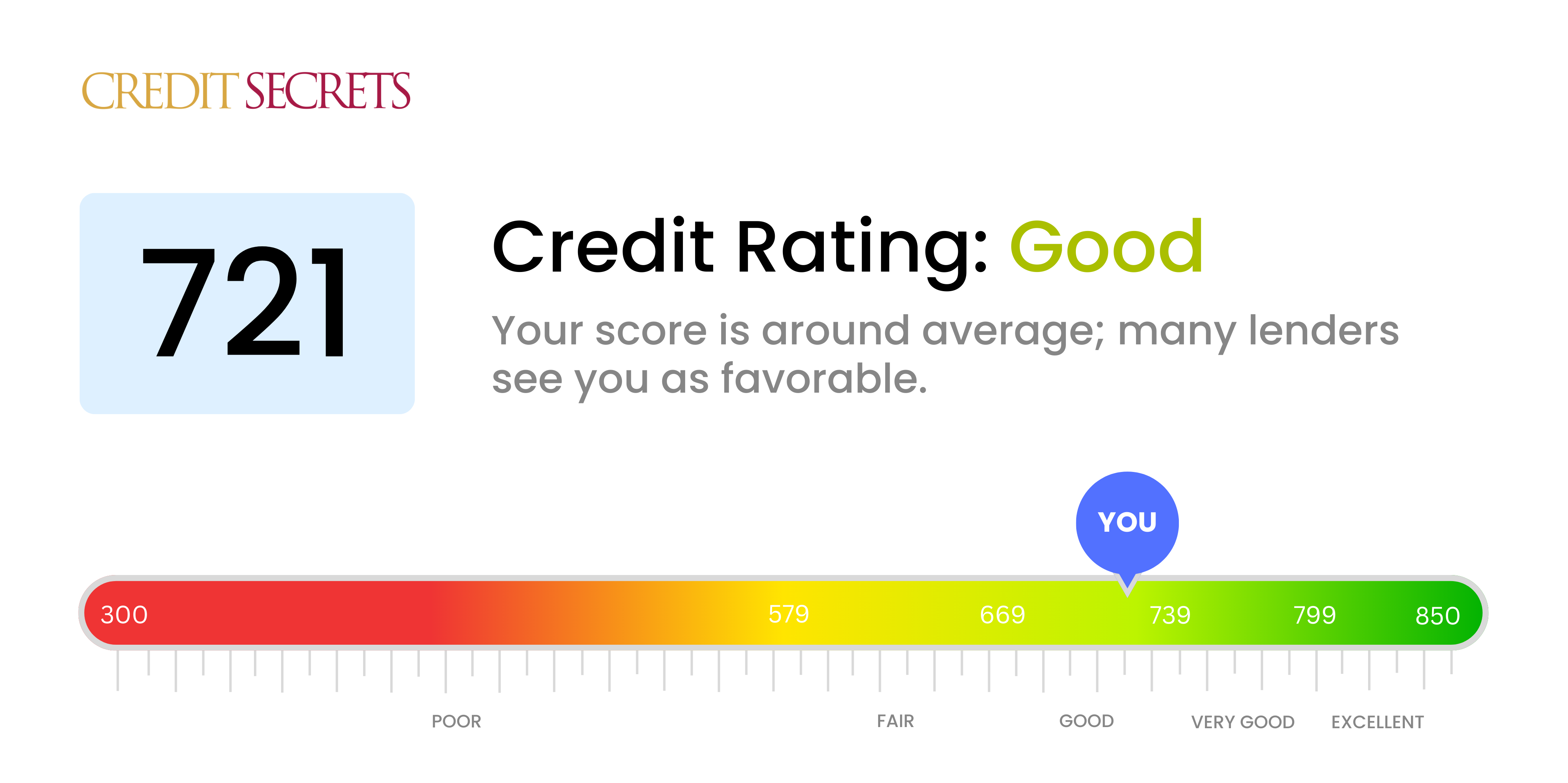

Is 721 a good credit score?

Your credit score of 721 sits comfortably within the 'Good' category. With this score, it's likely that you'll receive favorable terms on loans and credit requests, although competition for the best rates can be stiff. Maintaining your current habits and striving for even better financial health can help you reach a 'Very Good' score, broadening your financial opportunities.

A score of 721 indicates to lenders that you're generally reliable. Many lenders view this as an acceptable credit score, and you might find the range of loan products available to you more varied than for those with lower scores. Continue your responsible financial behavior and you're on your way toward the next tier: a 'Very Good' credit score.

Can I Get a Mortgage with a 721 Credit Score?

With a credit score of 721, you're in a fairly strong position when it comes to mortgage approval odds. This score indicates that you've made wise financial decisions in the past, as it is well above the threshold that most lenders require. It's a positive reflection of your reliability when it comes to repaying borrowed funds in a timely manner.

When you start the mortgage application process, be prepared for credit inquiries and additional documentation requests. Remember, while a 721 credit score is likely to open the door to mortgage offers, the exact interest rates available to you will depend on other factors that lenders consider. These may include your debt-to-income ratio, your income stability and the size of your down-payment. Getting a mortgage involves more than just a good credit score, but having a 721 is a commendable start for the journey.

Can I Get a Credit Card with a 721 Credit Score?

With a credit score of 721, chances are good for obtaining a credit card. This score is seen favorably in the eyes of lenders as it suggests a history of responsible credit use and reliable repayment. Still, it's crucial to keep a level-headed perspective while making financial decisions.

In terms of the type of credit card to apply for, a varied range of options should be available. From cash back cards giving a percentage back on purchases to rewards cards that allow for points to be earned and redeemed, each with its own set of benefits. Furthermore, there could be an opportunity to look into travel cards that offer mileage or other travel-related rewards. Remember, while opportunities are plenty with a solid credit score like 721, interest rates on different cards can still vary. Staying informed about the rates and terms of a card is key in maintaining a healthy financial lifestyle.

With a credit score of 721, your likelihood of being approved for a personal loan is quite high. This score is considered to be in the "good" range, meaning most lenders would see you as a responsible borrower based on your past credit history. This positive perception can streamline the loan application process and increase your chances of approval. However, remember that a good credit score doesn't guarantee approval, as lenders also consider other factors such as your income and current debts.

In terms of the personal loan application process, a credit score of 721 can pave way for a smoother experience. Your score can qualify you for a wider range of loan products, with potentially lower interest rates compared to those with lower credit scores. Take the time to explore different lenders and loan types to find the best fit for your financial situation. While it's good news that your credit score can support your borrowing plans, always borrow responsibly to maintain or even improve your credit standing

.Can I Get a Car Loan with a 721 Credit Score?

With a credit score of 721, you're definitely in a good position when it comes to applying for a car loan. Lenders generally favor scores above 660 for the most advantageous loan terms, and your score certainly fits this criterion. Your score of 721 indicates to lenders that you're a responsible borrower, which can open the door to a smoother car purchasing process.

In fact, with this credit score, you can expect more competitive interest rates from lenders. This is because a higher credit score minimizes the risk lenders take which directly influences the interest rates offered. So, having a credit score of 721 not only increases the likelihood of your car loan application being approved, but may also lead to lower borrowing costs. However, it's still very important to shop around before deciding on a lender, as rates and terms can vary between different institutions.

What Factors Most Impact a 721 Credit Score?

Unlock the power within your financial journey starting with understanding your score of 721. It's vital to decipher the factors impacting your score in order to solidify your financial foundation. Remember, each financial path has its own lessons to learn and progress to make.

Payment Milestones

Being punctual with your payments significantly shapes your credit score. Overdue or missed payments can drastically decrease your score.

How to Gauge: A critical look at your credit report for overdue or missed payments can provide clarity. Reflect on any unmet payment deadlines that may have impacted your score.

Credit Consumption

Keeping your credit utilization low positively affects your score. If your credit balances are extensively used, it may lower your score.

How to Gauge: Review your credit card records. If your credit balances are nearly maxed out, it may be a contributing factor. Aim to keep the credit balance as low as possible relative to your limit.

Credit Age

A shorter credit history may have a negative influence on your score.

How to Gauge: Check your credit report to investigate the age of your oldest and most recent accounts and the overall average age of your accounts. Consider if you have opened any new accounts lately.

Credit Variety and Fresh Credit

Maintaining a diverse mix of credit products and careful handling of new credit is crucial to building a healthy score.

How to Gauge: Take a look at the different types of credit you have, such as credit and retail cards, installment loans, and possibly a mortgage. Think about your approach to acquiring new credit.

Legal Records

Legal concerns like bankruptcy or tax penalties can drastically alter your score.

How to Gauge: Look at your credit report for any legal records. Deal with any listed items needing resolution.

How Do I Improve my 721 Credit Score?

Boasting a 721 credit score, you’re in a good position, but there’s always room for growth. Implementing these specially tailored steps, you can potentially see a meaningful improvement for your financial profile.

1. Maintain Low Balances on Credit Cards

Keeping your credit card balances low, ideally below 30% of your credit limit, is pivotal in improving your credit score. Work towards reducing balances on the cards with the highest utilization rates for maximum effect.

2. Keep Track of Payment Deadlines

Staying mindful of your payments deadlines helps retain your credit score health. Late payments can leave a negative mark. Setting up reminders or automating your payments could be a beneficial strategy for you.

3. Good Credit Standing Family or Friends

Request a trustworthy family member or friend with good credit to include you as an authorized user for their card. It affords you the chance to benefit from their positive credit history. Make sure the card issuer reports your activities as an authorized user to the credit bureaus.

4. Mix Up Your Credit Types

Familiarize yourself with credit diversification. A blend of credit accounts like a mortgage, auto loan, and credit cards, managed responsibly, can work in your favor. But remember, only take on debt you’re confident in managing.

5. Understand Your Credit Report

Stay updated about your credit report. Dispute any errors you see as they can drag down your credit score. Most bureaus offer free copies of your credit report annually.