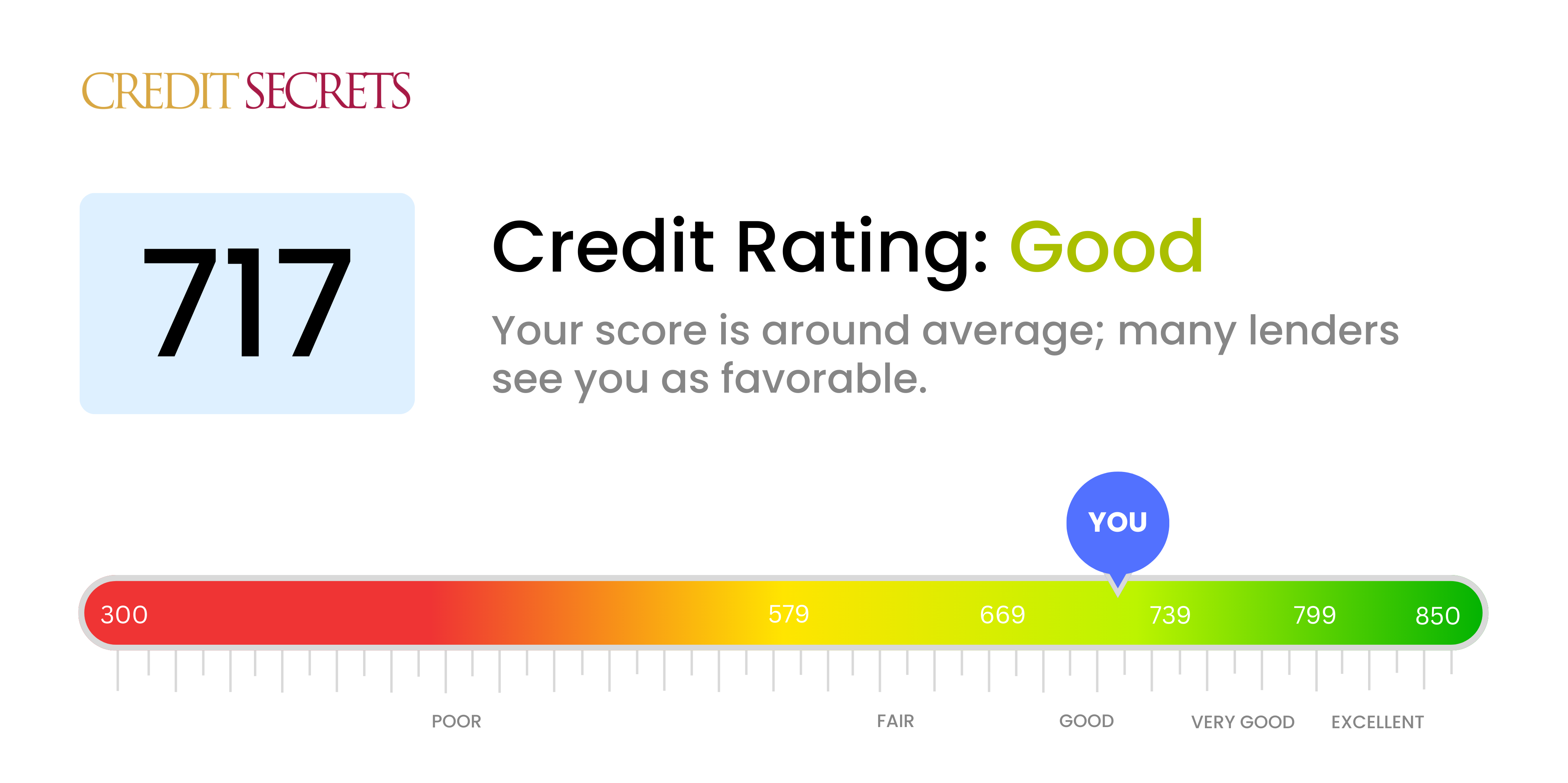

Is 717 a good credit score?

A score of 717 lands comfortably within the 'Good' category of credit ratings. This credit score means you're generally approved for loans and credit cards, however, you may not be eligible for the most appealing interest rates, compared to those with 'Very Good' or 'Excellent' scores.

With some regular attention and good financial habits, adjustments can be made to boost this credit score. Remember, timely payments and responsible credit management are key to improving financial health and achieving higher credit scores.

Can I Get a Mortgage with a 717 Credit Score?

With a credit score of 717, you stand a good chance of being approved for a mortgage. This score is significantly above the minimum threshold most lenders look for, suggesting a history of responsible credit use and consistent, on-time payments. Yet, remember, a score alone does not guarantee approval, as lenders also consider factors like income and employment stability.

As you navigate the mortgage approval process, understand that it's a comprehensive examination of your financial health. While your good score will likely result in more favorable interest rates, it's vital to consider other aspects of mortgage affordability, like down payment, monthly payment, and loan term. By continuing your responsible financial habits, you'll be well-positioned to move forward with your homeownership goals.

Can I Get a Credit Card with a 717 Credit Score?

With a credit score of 717, you're in good standing to get approved for a credit card. This score speaks volumes about your financial prudence and lenders see you as a trustworthy borrower. It's natural to feel relieved knowing you're on track towards achieving your financial goals. But remember, maintaining this creditworthiness requires ongoing commitment.

Given your solid credit score, you have the liberty to choose from a range of credit cards. Starter cards are ideal for those new to credit, but with a score like yours, you might prefer Cards that offer generous cash back rewards or premium travel cards if you are a frequent traveler. The interest rates are typically lower for individuals with higher credit scores like yours. However, always ensure to read the fine print, understand the terms and conditions, and choose a card that aligns with your financial habits and plans. With responsible usage, a credit card can serve as a great tool to keep building upon your credit success.

If you have a credit score of 717, you are in a great position to be approved for a personal loan. This score is generally seen as 'good' and indicates to lenders that you are a responsible borrower. Having a score in this range can open up more favorable options for you in terms of interest rates and loan terms.

When applying for a personal loan with a score of 717, it's crucial to understand that each lender may have its own specific requirements and processes. Additionally, while your score is a significant factor in the loan approval process, lenders may also consider your income and other financial obligations. However, with a good credit score like 717, you can expect possibly lower interest rates and better terms than someone with a lower credit score. Make sure to compare different personal loan options to ensure you choose the one that is best for you.

Can I Get a Car Loan with a 717 Credit Score?

Navigating the realm of car loans with a credit score of 717 can feel intimidating, but rest assured, this is a solid score. Most lenders prefer credit scores above 660, so your score places you in a favorable position. You're in a league considered by lenders as deserving of fair interest rates and terms. This is because your credit score implies less risk, suggesting a history of dutifully repaying borrowed money.

As you proceed with the car purchasing process, expect a smoother ride due to your credit score. You're likely to be approved for a car loan once you complete the necessary paperwork. However, it's crucial to conduct your own research too. Compare interest rates, read the fine print and ensure you understand the terms before agreeing to any car loan. The journey of buying your dream car should be an exciting one, and your credit score of 717 is poised to make this process smoother.

What Factors Most Impact a 717 Credit Score?

Analyzing a score of 717 is essential for your financial well-being. Recognizing the factors influencing this score allows for smoother progress towards better fiscal stamina. Keep in mind, each individual's financial journey is distinct, opening opportunities for development and knowledge.

Credit Utilization

Credit utilization can impact your score. If you're frequently near your credit limit, this could be one of the factors affecting your score.

How to Check: Go through your credit card records. If the balances are often close to the limit, this might need attention. Aim to keep the balance lower than the limit.

Length of Credit History

A credit history's length can alter your score. A shorter history may count against your score.

How to Check: Look at your credit report and ascertain the age of your newest and oldest accounts, as well as the average age of all accounts. Think about whether you've made any recent credit inquiries.

Credit Mix

Holding different types of credit and responsibly managing it can enhance your score. If you only have one type of credit, diversity might improve your score.

How to Check: Assess your range of credit accounts; this could be a credit card, retail account, installment loans, or mortgage loans. Reflect on your recent credit applications.

Public Records

Certain public records such as bankruptcies or tax liens can heavily affect your score.

How to Check: Scan your credit report for any public records. Encourage resolution of any listed items if necessary.

How Do I Improve my 717 Credit Score?

With a credit score of 717, you’re doing great! However, to enter the “excellent credit” domain, consider these strategic steps feasible for your current situation:

1. Monitor Your Credit Report

Ensure accuracy in your credit report by scrutinizing it for any incorrect information. Prompt dispute of any inaccuracies can help raise your credit score with all three credit bureaus – Experian, TransUnion, and Equifax.

2. Pay off Installment Loans

If you have any personal, student, auto, or mortgage loans, prioritize minimizing these installment loan balances. The faster you’re able to pay these off, the more likely your credit score is to rise.

3. Avoid New Debt

Avoid taking out any new debt or applying for additional credit cards. Every new credit application can lead to hard inquiries, potentially impacting your credit score negatively.

4. Maintain Old Credit Card Accounts

Retain your old credit card accounts and keep them active, as a long credit history can improve your credit score. Utilize these cards for small regular purchases to keep them dynamic.

5. Limit Credit Usage

Keep your credit usage to a minimum. Implement a habit of using below 10% of your credit limit. This low credit utilization ratio demonstrates responsible credit management, enhancing your credibility, and ultimately your credit score.