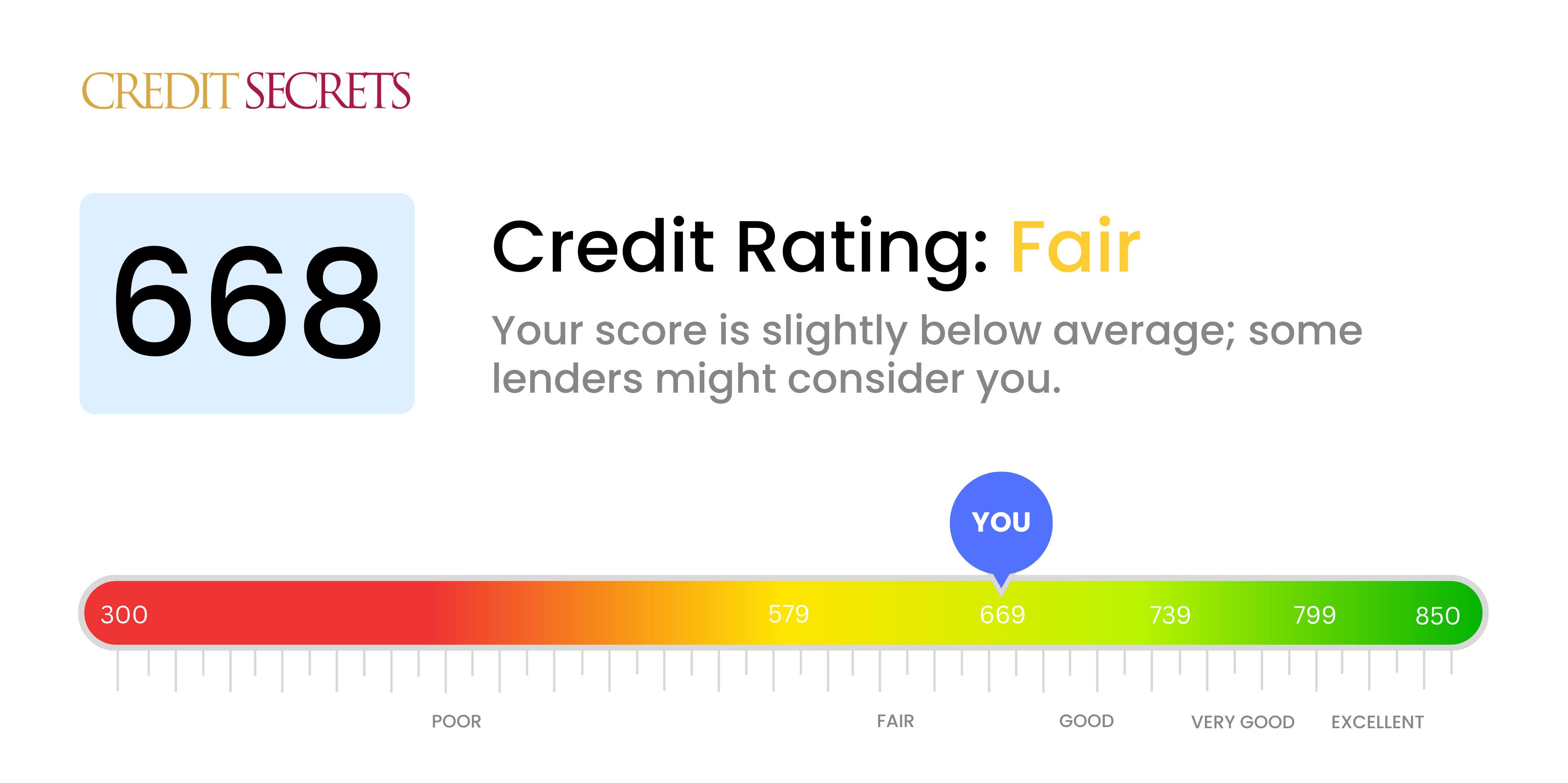

Is 668 a good credit score?

Your score of 668 is classified as a 'Fair' credit score. It's not directly in the 'Good' category, but it's not far from it and with patience and careful actions, you can work towards improving it.

With a 668 credit score, you may face slightly higher interest rates and possibly more scrutiny while applying for loans or credit cards. But remember, this is not detrimental and is just a starting point. Following the right methods, like timely payments, and maintaining lower credit utilization, can help boost your score up to the next bracket.

Can I Get a Mortgage with a 668 Credit Score?

Having a credit score of 668 positions you in a fair credit range. While it's not a guarantee, there's a reasonable chance that you could be approved for a mortgage, but conditions may vary. Lenders often evaluate factors beyond credit scores, such as income and employment history. However, it's worth noting that with this credit score, you may face higher interest rates compared to applicants with higher credit scores.

Even though potential challenges may lie ahead, the mortgage approval process is manageable and there's room for improvement in your situation. Mortgage lenders will want to see evidence of consistent income and that you can manage your financial obligations responsibly. Be prepared for possible higher interest rates or more stringent requirements. But remember, obtaining a mortgage with a fair credit score is not an impossibility. It would be in your best interest to keep working on improving your credit score as you navigate through the homebuying journey.

Can I Get a Credit Card with a 668 Credit Score?

With a credit score of 668, it's fair to say that approval for a credit card is within reach. This score reflects a relatively solid history of handling credit and paying bills on time. However, it might prevent the possibility of availing the most premium credit cards with extravagant rewards and perks. This situation might not be perfect, but remember that having a moderate credit score offers you many opportunities to improve.

Cards suited for your score could include secured cards or even certain cash-back cards. These options often come with decent interest rates and rewards, providing an excellent opportunity for well-managed borrowing and spending. Also, by showing responsible use, you could gradually improve your credit score and access better financial products. Bear in mind, however, it's crucial to always read terms and conditions and aim to pay the balance in full each month to avoid high interest costs.

A credit score of 668, while not ideal, is not the end of the world. You may still have opportunities to secure a personal loan, though it may not be as straightforward as for those with higher scores. In the eyes of creditors, this score falls in the 'fair' category suggesting moderate risk. Consequently, it's possible a loan approval might be coupled with a relatively high-interest rate. Nevertheless, there's still hope.

When applying for a personal loan with a credit score of 668, expect a more thorough review of your financial state. Lenders will typically delve into your income level, job stability, and debt-to-income ratio. They're attempting to assess whether you're capable of repaying the loan. Keep in mind, the impact of your credit score can vary from lender to lender, as some may weigh other factors more heavily. While you might face steeper interests rates, consider this as stepping stone to achieving your financial goals.

Can I Get a Car Loan with a 668 Credit Score?

With a credit score of 668, getting approval for a car loan is already within reach. This score, while not exceptionally high, is usually seen as fair by most lenders. The score illustrates a decent credit history, giving lenders a degree of confidence in your ability to largely meet your financial obligations. However, aiming for a score over 700 can provide even better loan terms and interest rates.

As you begin the process of obtaining a car loan, prepare to face relatively moderate interest rates with your credit score of 668. Interest rates and specific loan terms tend to depend on the lender and your overall credit picture. Be aware of several important factors, such as your income, the length of the loan, the type of car you plan to purchase, and the existing market rates. By understanding these details, you can better navigate the car purchasing process and work towards fulfilling your automobile dreams. Remember, it's less about the credit score number and more about the whole picture of your financial stability.

What Factors Most Impact a 668 Credit Score?

With a credit score of 668, understanding the key factors influencing your credit can help you to elevate your financial standing. The main factors likely impacting your score are:

Payment History

Timely repayment is crucial for your credit score. Delayed or missed payments toward your credit could be dragging down your score.

How to Check: Scrutinize your credit report for any missed or late payments. Think about any times you may have paid late and consider developing a more consistent payment schedule.

Credit Utilization Ratio

Your credit score could be affected if you're utilizing a large portion of your credit limit. High utilization often suggests financial risk and can lower your score.

How to Check: Look at your current credit card balances. Are they considerably close to hitting their limits? If they are, consider reducing them to below 30% of the provided limit.

Length of Credit History

If you have a relatively short credit history, this could be affecting your score.

How to Check: Analyze your credit report for the duration of your oldest active account and your newest opened ones. Are the accounts fairly recent? If so, this could be impacting your score.

Credit Mix

Another element that can impact your credit score is the types of credit in your report, including credit cards, auto loans, mortgages, etc.

How to Check: Evaluate the diversification in your active credits. Are there multiple types of credit present? A balanced blend of installment and revolving credits can be beneficial.

Derogatory Marks

Any presence of derogatory marks – like bankruptcies, foreclosures or tax liens – can have a big influence on your credit score.

How to Check: Scan your credit report for any derogatory marks that might need addressing.

How Do I Improve my 668 Credit Score?

A credit score of 668 indicates a fair credit standing. It’s not poor, but there’s room for improvement. Here are crucial actions for you to consider at this score level:

1. Review Your Credit Report

Order your free yearly credit reports and scrutinize them for errors – an incorrectly listed late payment can hurt your score. Pursue any degradation for removal.

2. Handle Late Payments

If you’ve recently missed a payment, contact the creditor right away. The sooner you handle delayed payments, the smaller the impact on your credit score.

3. Get Up-To-Date with Bill Payments

Ensure all your bill payments are current. Late payments, even if minimal, can significantly affect your credit score.

4. Regulate Credit Card Use

Maintain your credit card balances below 30% of your limits, lower if you can. High credit utilization hurts your score and gives the impression of credit dependency to potential lenders.

5. Keep Old Accounts Open

Long-standing accounts show a foreign history which contributes positively to your credit score. Even if you don’t use these accounts, it may be beneficial to keep them open.

6. Balance Your Credit Portfolio

Strive to have a mix of credit types (credit cards, retail accounts, installment loans, mortgage) as lenders like to see that you can handle a variety of credit responsibly.

7. Avoid Unnecessary Credit Inquiries

Avoid applying for new credit unless it’s absolutely necessary. Each hard inquiry can drop your score by a few points.