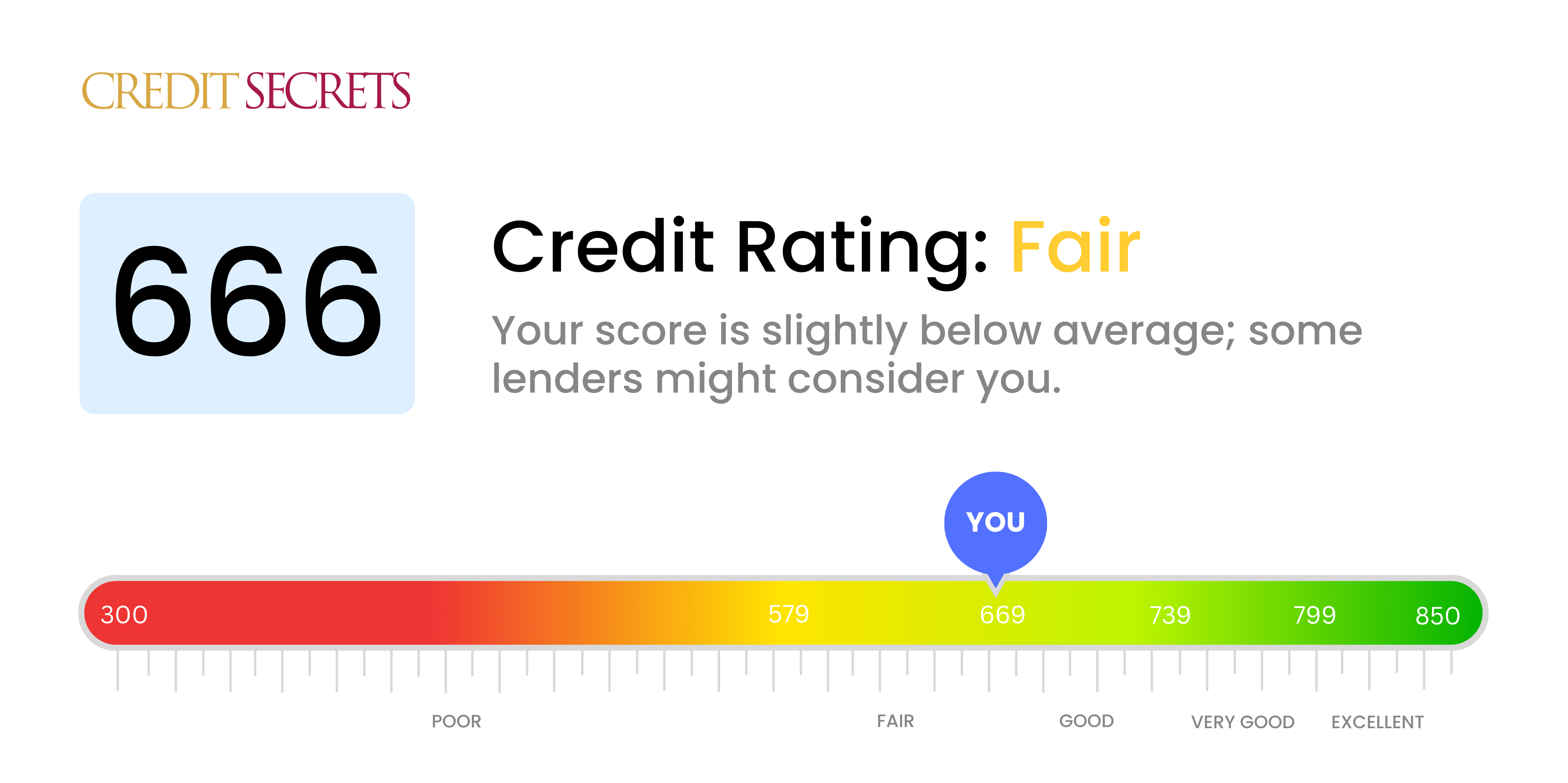

Is 666 a good credit score?

Your score of 666 falls into the 'Fair' category of credit ratings. While not disastrous, this score could limit your access to certain financial opportunities and you may encounter higher interest rates than those with higher scores.

Improving your credit score can open doors for you. Typically, with a score of 666, you'll likely face higher interest rates on loans and credit cards, and may find it more challenging to get approved for larger lines of credit. However, it's certainly not all bad news - you have taken the first step by acknowledging your score, and with some strategic focus, you can take steps to build and improve your score.

Can I Get a Mortgage with a 666 Credit Score?

With a credit score of 666, securing a mortgage could prove challenging. Most lenders prefer applicants to have a credit score of at least 700. While you're not drastically off the mark, a score of 666 may be viewed as more of a risk, meaning lenders may charge higher interest rates or require a larger down payment as a form of compensation.

Luckily, a credit score isn't the only factor lenders consider. Steady employment history, income stability, and low debt-to-income ratio can also influence the lender's decision. However, if you want to have more options and potentially enjoy lower interest rates, you might want to work towards improving your credit score. Paying down debts, disputing any inaccuracies on your credit report, and maintaining a history of timely payments can gradually elevate your score. Remember, each small step towards a better credit score could lead to more financial opportunities in the future.

Can I Get a Credit Card with a 666 Credit Score?

A credit score of 666 might seem ominous, but don't let superstition cloud your judgment. In fact, this score sits at the higher end of the "fair" category in the credit scale. It's true, getting a credit card with this score isn't a walk in the park, but it isn't impossible either. With the right approach, you can certainly secure a credit card suitable for your needs. Remember, your credit score is a reflection of your credit history, so don't be disheartened. Acknowledge your current situation as it's the first step towards financial improvement.

At this score level, you are likely to be approved for certain types of credit cards, such as starter credit cards and some secured credit cards. Starter cards are designed for people who have little to no credit history or for those rebuilding their credit. Secured cards, on the other hand, require a security deposit but often come with the benefit of lower interest rates. These cards can serve as stepping stones to improve your credit score over time. Bear in mind, though, the interest rates may be slightly higher. So, it's crucial to conscientiously manage any card you do obtain to ensure on-time payments and to gradually increase your credit score over time.

It's apparent that a credit score of 666 may pose some hurdles when you're seeking approval for a personal loan. Traditional lenders often view this as an indicator of elevated risk, making it challenging to secure a loan on regular terms. This score, however slight it may seem, holds significant weight in your lending options. It's critical to recognize what this means for you.

Don't lose hope. There could still be other pathways open for you, such as secured loans, where you have to put up collateral like your home or car. Co-signed loans may be another viable choice if you know someone with a good credit score who can vouch for you. In addition, peer-to-peer lending platforms might offer more flexibility. Do bear in mind however, these alternatives often come with higher interest rates because they represent heightened risk for lenders. Even in tough situations, it's important to stay educated, informed, and optimistic.

Can I Get a Car Loan with a 666 Credit Score?

Having a credit score of 666 might set few limitations when considering a car loan. Typically, lenders consider credit scores above 660 to be decent, meaning you are right on the boundary line. This might mean the loan terms could be slightly less favorable, and you may face slightly higher interest rates than someone with a flawless credit score. This occurs as lenders might see you as somewhat of a risk and attempt to protect their investment through increased rates.

On the brighter side, a 666 score doesn't close all doors when it comes to securing a car loan. It's worth remembering that all lenders have unique considerations and thresholds for loan approvals. Some might be more forgiving than others, especially if other signs point to your reliability. Therefore, while there might be some obstacles, obtaining a car loan at decent terms is achievable with a credit score of 666. Steer wisely, do ample research about potential lenders and their terms to maximise your chances.

What Factors Most Impact a 666 Credit Score?

Grasping what a score of 666 entails is vital for forging your path toward financial betterment. Uncovering and challenging the causes behind this score can set the stage for a prosperous financial future. Remember, your financial journey is entirely yours and filled with various learning experiences.

Payment history

Your payment history greatly influences your credit score. Any late payments or defaults on your account may play a prominent role in why your score is lower.

How to Check: Thoroughly peruse your credit report for any indicators of late payments or defaults. Think about whether you've had payment delays as these circumstances might have impacted your score.

Outstanding Balances

Carrying high amounts of debt can negatively affect your credit score. If your outstanding balances are high, this might be a developmental factor.

How to Check: Scrutinize your credit card and loan statements. Are the balances elevated? Working towards reducing these amounts can be beneficial to your score.

Credit History Length

Inadequate credit history can unfavorably affect your score.

How to Check: Evaluate your credit report to ascertain the age of your oldest and newest credit accounts and the average age of all your accounts. Ponder if you've opened multiple new accounts recently.

Variety of Credit and New Credit Applications

Maintaining a diverse collection of credit types and handling new credit responsibly are essential for a healthy credit score.

How to Check: Review your list of credit accounts such as credit cards, retail accounts, personal loans, and home loans. Consider if you've been mindful when applying for new credit.

Public Records

Public records notably bankruptcy or tax liens can cause a severe dip in your score.

How to Check: Inspect your credit report for any public records. Deal with any items listed that require resolution.

How Do I Improve my 666 Credit Score?

Don’t fret over a credit score of 666. It’s not an ideal score, but you certainly can take strategic measures to improve from here. These are the best, most relevant moves specifically for your current credit situation:

1. Regularize your payments

Bills that are still in the past due stage might have a negative effect on your credit score. Look at your accounts and prioritize on bringing the most overdue ones up to date. Negotiating a customized payment schedule with your creditors may help in this process.

2. Lower Outstanding Debt

Your credit utilization rate is an important factor in determining your credit score. If possible, strive to keep your credit card balances below 30% of your respective limits, eventually aiming to keep them below 10%. Pay off the cards with the highest utilization first.

3. Consider a Secured Credit Card

With your present score, obtaining a standard credit card could be tough. As an alternative, think about applying for a secured credit card. This card will require a cash deposit that acts as your credit line for the account. Use it wisely to establish a responsible payment history.

4. Seek to Be an Authorized User

You could consider asking someone with strong credit to add you as an authorized user on their credit card. This strategy may improve your credit score as you will inherit their good payment behavior. Confirm that the card issuer reports authorized users to the credit bureaus.

5. Broaden Your Credit Portfolio

Once you’re comfortable managing a secured card, consider branching out to other types of credit like credit builder loans or retail credit cards. By responsibly handling a mix of credit types, you can make a positive impact on your credit score.