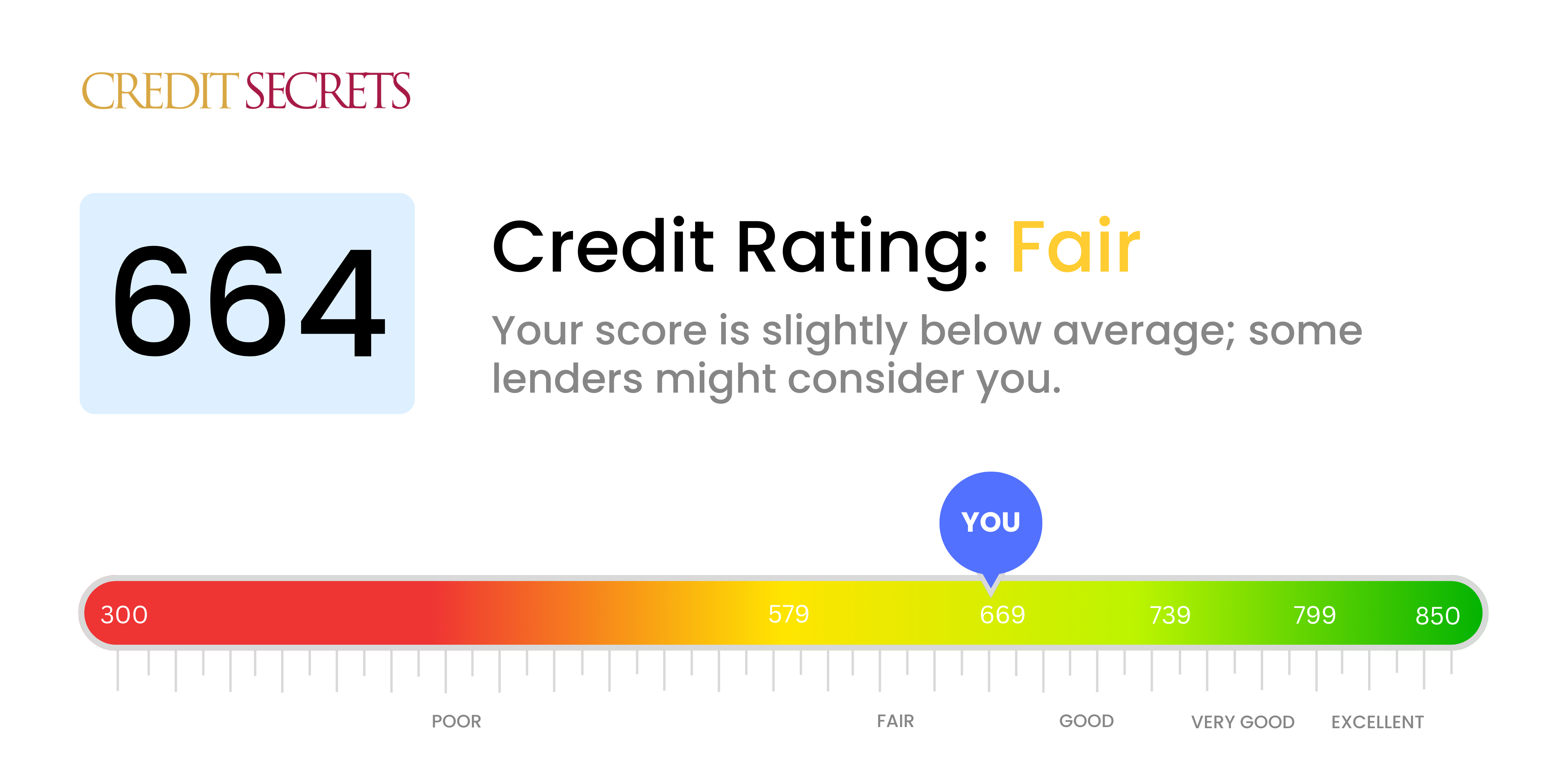

Is 664 a good credit score?

A credit score of 664 is regarded as fair. Although this might not be the score you were hoping for, it is not a poor one, neither.

With this score, you can still qualify for credit at moderate interest rates, but they won't be as favorable as those offered to people with good or excellent scores. Remember, this is not an end point and with commitment and a strategic approach, this score can be improved significantly, helping you unlock better financial possibilities.

Can I Get a Mortgage with a 664 Credit Score?

With a credit score of 664, you stand on the edge of what many lenders consider 'fair' credit. This score level may qualify you for a mortgage, but it won't guarantee the best interest rates or terms. Lenders may view a 664 credit score as a potential risk, which could translate to higher costs for you in the form of steeper interest charges.

Knowing where you stand is the first step. If you're still contemplating a mortgage and can afford to wait, it may be beneficial to work towards improving your credit score. Simple steps like paying bills on schedule, not maxing out credit cards, and addressing any outstanding debts can gradually boost your score. These positive actions can ultimately enable you to secure better mortgage terms in the future.

On the other hand, if you're eager to proceed now, shopping around for the best mortgage rates specific to your credit range is a practical move. Some lenders are more lenient to 'fair' scores than others. Remember, achieving financial success is about finding the right pathways and making informed decisions.

Can I Get a Credit Card with a 664 Credit Score?

With a credit score of 664, chances are quite good that you'll be approved for a credit card. This score reflects a reasonable credit history that lenders are likely to view as promising. Your chances of approval are not guaranteed, but weigh more in your favor compared to those with lower scores. It's crucial to be aware of your credit status and understand what it implies about your financial habits.

For a score of 664, a secured credit card or a starter credit card could be ideal. Secured credit cards demand a deposit that serves as your credit limit, and starter cards are crafted to help build credit from scratch or repair damaged credit. Both types can help bolster your credit score if used wisely. However, be mindful of the interest rates! It's probable that with your score the interest rates might be a bit higher than average, reflecting the mild risk perceived by lenders. Always remember though, every prudent step is a positive push towards better financial health.

With a credit score of 664, your ability to be approved for a personal loan falls into a gray area. This score is close to the average range, meaning some lenders might view this as fair or subprime credit. However, others may still view it as slightly too risky. Your approval is not guaranteed, but don't lose hope. Every lender is different and there may be more flexible options available to you.

When it comes to the personal loan application process, prepare for some potential hurdles due to your credit score. You might be offered higher interest rates due to the perceived risk, requiring more out-of-pocket expenses over the life of the loan. Or, you may be asked to provide more documentation to secure your loan. Remember to thoroughly research any loans and the associated terms before signing, to ensure you're making the best financial decision for your situation. Optimistically, with smart financial decisions and time, your score can improve, offering more favorable loan opportunities in the future.

Can I Get a Car Loan with a 664 Credit Score?

Navigating the world of car loans with a credit score of 664 may feel a bit daunting, but there's good news. This score is not far from what most lenders consider a 'good' rating. You stand a fair chance of approval for a car loan. However, you need to be prepared for the possibility of not getting the most favorable terms.

You may encounter higher interest rates compared to someone with a higher credit score. The reason for this is that lenders might consider you a touch more risky and as a result, apply higher rates as a way to protect their investment. While this isn't ideal, know that this situation is not permanent. As you work on improving your credit score over time, better terms will become available to you for future loans.

What Factors Most Impact a 664 Credit Score?

Knowing how your score of 664 has been calculated is key in improving your financial stability. This situation is likely shaped by a range of factors about your credit history, which each impacting differently. Understanding these influences are vital to advancing your credit health.

Credit Card Balances

Large credit card balances can reduce your credit score. This element might be influential in your current situation.

How to Check: Scrutinise your credit card statements. Are their balances near to the limit? Reducing these could help increase your score.

Length of Credit History

Having a shorter credit history may harm your credit score. This might be a contributing factor to your current score.

How to Check: Assess your credit report. The age of your oldest account, your newest one, and the average age of all your accounts can provide insights about your credit history length.

Credit Variety

Having a diverse range of credit options and handling new credit responsibly is key for a healthier credit score.

How to Check: Review your credit profiles, like credit cards, retail accounts, mortgage loans, and installment loans. Note whether you've recently been applying for new credit.

Public Records

Public documents, like tax liens or bankruptcies, can hurt your credit score in a significant way.

How to Check: Inspect your credit report for any public records. Attend to any items that may require resolution.

How Do I Improve my 664 Credit Score?

A credit score of 664 falls into the “fair credit” category. There’s definite room for improvement and with focused strategies, you can raise your score and shift into the “good credit” range. Below are the most effective steps tailored for your current credit score:

1. Pay Bills on Time

Punctual bill payment plays a vital role in improving your credit score. Make sure you developed a system for timely payment of all bills. This could mean setting automatic payments or reminders to avoid missing due dates.

2. Maintain Low Card Balances

Keeping your credit card balances low boosts your credit score. Aim at using less than 30% of your credit limit. A useful strategy is to make multiple small payments throughout the month rather than building large balances and paying them off at once.

3. Monitor your Credit Report

Keep a close watch on your credit report to spot any errors. Dispute them promptly if they occur since inaccuracies can drag down your score unnecessarily.

4. Avoid new Debts

Resist taking on new debts. Applying for multiple credit cards or loans within a short duration can lower your credit score due to hard inquiries. Stick to your existing credit for now.

5. Reconsider Closing Old Accounts

Older accounts with good payment history can boost your credit score. Even if you’re no longer using these accounts, think twice before closing them as they can contribute to a longer credit history and lower credit utilization rate.