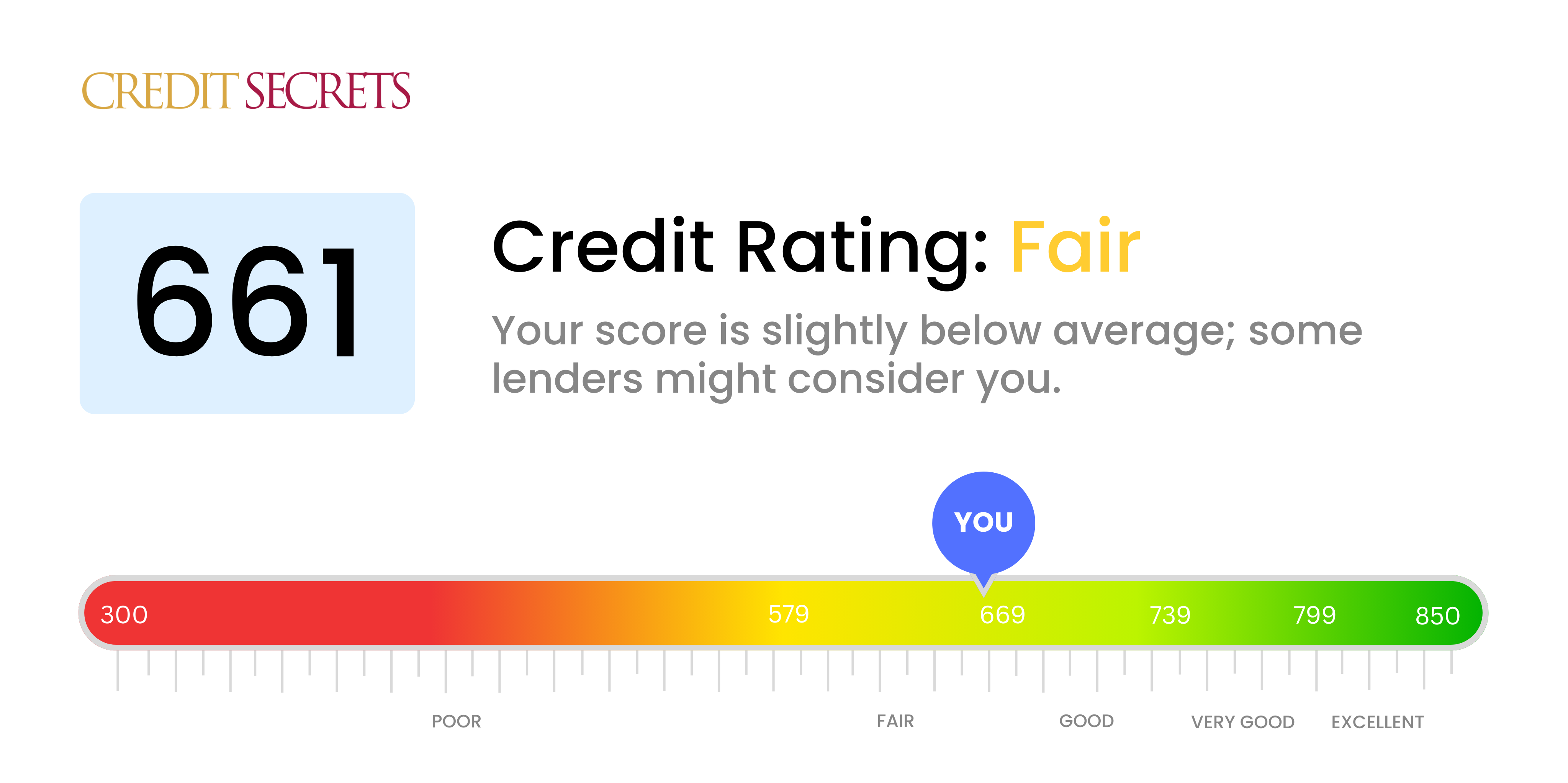

Is 661 a good credit score?

Your credit score of 661 falls into the 'fair' category. It's not dangerously low, but it's also not in the best range either.

With this score, you're likely to face some challenges when applying for credit or loans, and you may not be offered the best interest rates. But don't lose hope, there's room for improvement! A few smart decisions and consistent efforts can help boost your score into the 'good' or even 'very good' range. Remember, every step you take towards improving your score is a step closer to achieving your financial goals.

Can I Get a Mortgage with a 661 Credit Score?

With a credit score of 661, you may find a few challenges in securing a mortgage loan approval. This score is seen as fair and might not meet the credit expectation of some mortgage lenders, which typically look for a score of 670 or above. The higher risk your score represents, the tougher it could be for you to get approved.

However, not all hope is lost. There are lenders who consider more factors in addition to your credit score, such as your employment history and income. Furthermore, government-backed loans like FHA loans are an alternate route, which often have more flexible credit requirements. Having this score may also mean that you might face higher interest rates as compared to those with healthier credit scores. Nevertheless, don't despair, keep in mind that this is just one part of the equation. A holistic understanding of your financial situation is key in your journey towards a mortgage approval.

Can I Get a Credit Card with a 661 Credit Score?

With a credit score of 661, you have a fair chance of getting approved for a credit card. While this score isn't considered excellent, it's certainly above average and it does indicate a decent credit history. Be encouraged and remember, it's an achievement to maintain credit health in this range, especially considering the complexities of financial management.

Given your credit score, it's wise to explore card options that align with your credit standing. You would be considered a good candidate for mainstream credit cards with reasonable interest rates. Try looking into credit cards that offer reward programs, like cash back or air miles. But remember, regardless of the attractive offers, always strive to pay your balances in full each month. Staying within your credit limit and managing your card responsibly can increase your credit score over time. Interest rates with this credit score would usually be moderate, reflecting the reasonable risk lenders perceive. Nonetheless, always read through the terms and conditions before making a decision.

A credit score of 661 lands on the lower end of the "fair" range. This particular score suggests that you may have faced some financial difficulties in the past. Traditional lenders might be hesitant to approve a personal loan due to the perceived risk associated with this score. However, it doesn't inevitably mean that a personal loan is out of reach; every lender has different requirements and measures risk differently.

You could still have options for obtaining a loan. Some lenders might be willing to approve a personal loan, but the interest rates could be higher, and the terms might not be as favorable due to your lower credit score. Alternatives such as secured loans or co-signed loans could be considered. Peer-to-peer lending are also avenues to explore as these platforms sometimes have lower credit score requirements. Remember, these alternatives often involve higher interest rates or additional risk to you. Navigating through this may not be easy but facing the situation head-on is a step in the right direction. Keep up your courage; there's always a way forward.

Can I Get a Car Loan with a 661 Credit Score?

With a credit score of 661, you're on the edge of what lenders typically consider for good terms on a car loan. This score is above the subprime category, which is excellent news. However, it's still lower than the golden standard of 700, which might affect the interest rates you're offered. This score says to lenders that there might have been a few hiccups with repaying past debts, but overall, you handle your credit responsibly.

So, what does this mean for you? This score will likely allow you to secure a car loan. However, be prepared for the interest rates to be a bit higher than for those with excellent credit. This is the lender's way of balancing the risk they're taking. Nevertheless, owning a car is still an achievable dream, and the approval of your car loan could very well be on the horizon. Shrewdly review your potential agreements and make sure you understand all your financial commitments before signing on the dotted line. Indeed, the road to car ownership may be closer than you think!

What Factors Most Impact a 661 Credit Score?

Decoding a credit score of 661 is a key step towards fiscal well-being. The reasons behind this score will enlighten you on your financial habits and provide a blueprint for improvements. Remember, your financial journey is exclusive to you, brimming with chances for betterment.

On-time Payments

The primacy of on-time payments in shaping your credit score cannot be underestimated. Any missed or late payments could be dragging your score down.

To Verify: Look through your credit report for any missed or late payments. Think about any recent instances of unpaid bills, as these could have lowered your score.

Credit usage

Healthy credit usage is critical for a strong rating. If your balances on credit cards often approach their limits, this could be hurting your score.

To Verify: Assess your credit card statements. Does the amount owed creep close to the credit limit? Trying to keep balances below 30% of your available credit is good practice.

Credit Lifespan

Having shorter credit tenure may negatively impact your rating.

To Verify: Take a peek at your credit report to evaluate the age of your oldest and newest accounts. Have you opened multiple new accounts recently?

Types of Credit and Recent Credit Inquiries

Maintaining a diverse range of credit types and applying for new credit sparingly plays a crucial role in turbocharging your score.

To Verify: Review your variety of credit accounts, i.e., credit cards, personal loans, vehicle loans, etc. Have you been applying for new credit judiciously?

Financial Records

Public records like foreclosures or unpaid taxes can remarkably impact your rating.

To Verify: Inspect your credit report for public records. Resolve any issues that need addressing at the earliest.

How Do I Improve my 661 Credit Score?

A credit score of 661 lies right at the cusp of ‘Fair’ and ‘Good’. Improving this to a solid ‘Good’ credit score is not that daunting a task. Here are a few actionable steps tailored to your specific score range:

1. Scrutinize Your Credit Reports

You must ensure that all information in your credit reports is correct. Incorrect negative information can pull your score down. If there are any discrepancies, have them corrected at the earliest.

2. Keep Your Credit Card Balances Low

Your credit utilization ratio significantly influences your credit score. Aim to maintain it below 30%, ideally under 10%, of your overall credit limit. Clear balances on the cards with the highest utilization first.

3. Focus on Timely Payments

Your payment history greatly impacts your credit score. Staying on top of due dates for all credit accounts plays a crucial role in enhancing your score. Set alerts for payment dates to avoid any delays.

4. Limit New Credit Inquiries

Avoid unnecessary hard inquiries on your credit report by applying for new credit only when essential. These inquiries can lower your score.

5. Maintain a Mix of Credit Types

Having a variety of credit types such as a mortgage, auto loan, and credit card, all managed responsibly, reflects positively on your credit score. However, remember to not apply for credit you do not need.