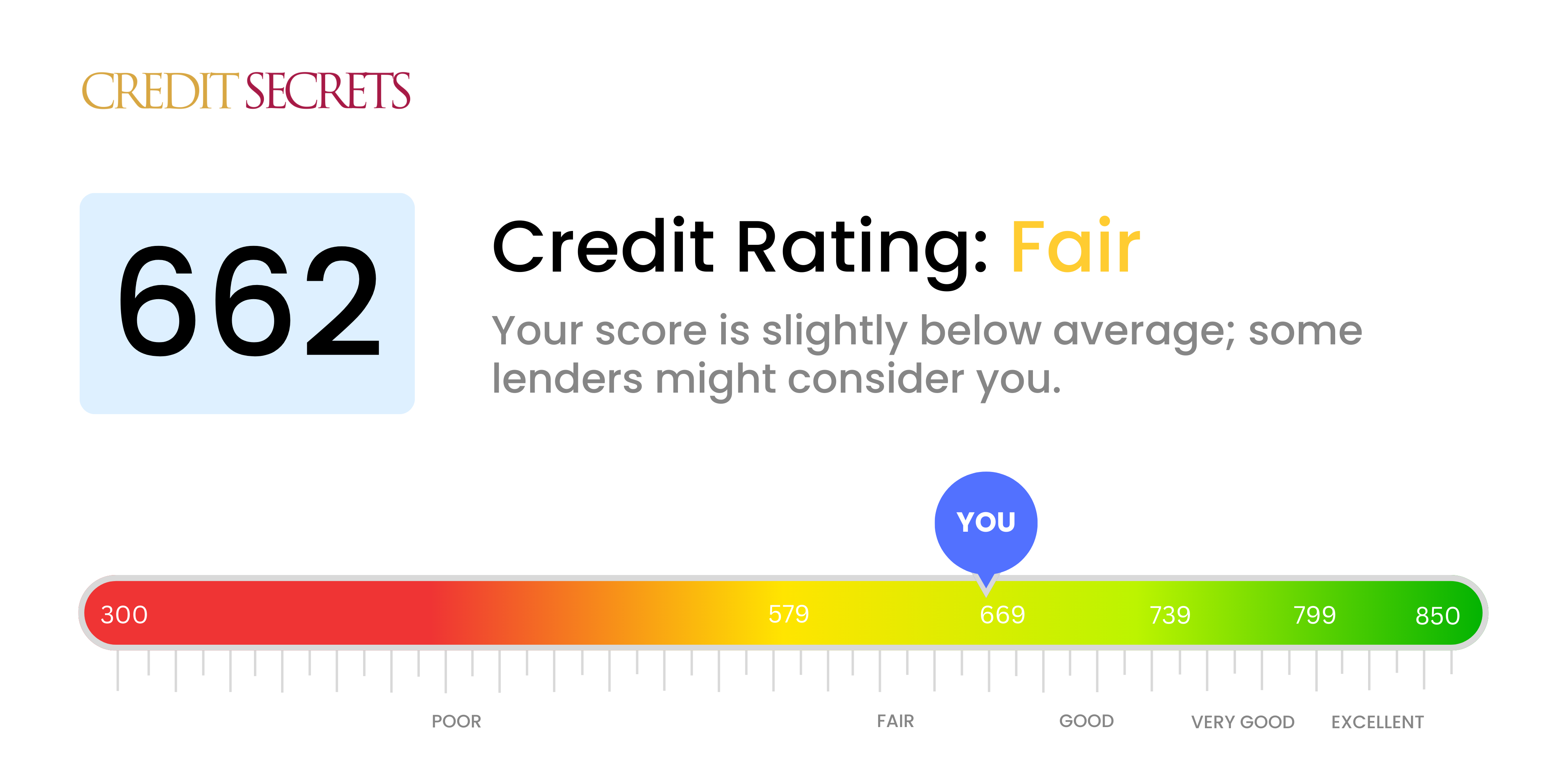

Is 662 a good credit score?

Your credit score of 662 falls into the "fair" category. While this isn't a bad score, it means there's certainly room for improvement, especially if you're aiming for a lower interest rate on loans or more favorable terms from creditors. With this score, you'd likely qualify for certain types of credit, but may not receive the best interest rates or terms. Nevertheless, it's a starting point and there are strategies that can help improve your score over time.

Improving your credit score involves understanding how the scoring process works and making smart decisions that can positively impact your future financial situation. Being consistent in making payments on time, keeping credit card balances low, and limiting new credit applications can contribute towards a better score. While it might take time, every step you take towards improving your credit score can create a more secure financial future.

Can I Get a Mortgage with a 662 Credit Score?

When it comes to a credit score of 662, you're in what's often referred to as the "fair" range. This is a middle-ground credit score: it's not poor, but it's also not exceptionally good. While this range may be deemed acceptable by some mortgage lenders, it's far from a guarantee.

You may encounter some challenges during the mortgage process. The interest rates offered to you might be higher than those with excellent credit, and this could significantly impact your long-term financial plans. Additionally, lenders may require a larger down payment. However, this shouldn't discourage you. Remember, there are mortgage programs available tailored for individuals with a fair credit score. Each lender sets its own credit score requirements, so it's essential to shop around and understand all your options. Continue to make all payments on time and commit to responsible credit use to gradually improve your credit score.

Can I Get a Credit Card with a 662 Credit Score?

With a credit score of 662, you're on the brink of what's typically termed as a 'good' credit score. While it's not quite there yet, there are still many credit card providers who could be willing to approve you. However, it's important to note that each lender has different requirements and therefore it's not a guarantee. But with a little persistence, you should be able to find a fair deal. This is nothing to be discouraged about, instead, view it as an opportunity to better understand your financial situation.

While you might not qualify for premium credit cards just yet, there are several other options that could still work well for you. Starter credit cards and secured credit cards are both potentially viable options. Starter credit cards, in particular, may have lower credit requirements and are designed to help you build credit. Secured credit cards require a deposit, but they often have lower credit requirements. Lastly, be aware, the interest rates for these cards tend to be a bit higher due to the slightly lower score. So, it's advised to fully pay off your balance each month to avoid paying extra interest.

With a credit score of 662, it's not guaranteed you'll be approved for a traditional personal loan. This score is categorized as fair, falling right on the brink to being considered 'good'. While it's not the worst, lenders might view it as somewhat risky. However, this doesn’t mean approval for a personal loan is out of the question, the probability of gaining approval sits in a mediocre zone.

If approved, you could possibly face higher interest rates due to the perceived risk that comes with a fair credit score. The personal loan application process could require more thorough financial checks, and you might need to provide additional documentation compared to those with higher scores. However, taking on a loan responsibly, despite higher interests, can provide opportunities to build a healthier credit score over time.

Can I Get a Car Loan with a 662 Credit Score?

With a credit score of 662, the prospect of securing a car loan is quite promising. This is because many lenders generally seek scores of 660 or above for approval. A credit score in the 660s shows that you've been mostly responsible with your credit, which reassures lenders of your likelihood to handle your car loan diligently.

However, it's crucial to understand that while your credit score is an essential factor, the final approval and terms of the loan - such as the interest rate - still depend on the individual lender's policies. That said, you can generally expect more favorable terms than someone with a lower score. You might also enjoy a smoother and quicker car purchasing process. This is because lenders might consider you as a lower-risk customer, owing to your relatively high credit score of 662. But remember, always read and understand the terms of the loan before signing the agreement. It's the smart way to ensure your car buying experience is a positive one.

What Factors Most Impact a 662 Credit Score?

With a credit score of 662, your credit worthiness falls into the 'Fair' category. It's essential to comprehend the elements impacting your score to allow for strategic moves towards financial empowerment. Your credit journey will be filled with learnings and opportunities for development. These likely factors could be impacting your score:

Payment History

Your 662 score might be impacted by inconsistent payment history. Late or missed payments can cause your score to decrease.

How to Check: Survey your credit report for missed or late payments, particularly any that have become defaults.

Credit Utilization

Keeping your credit utilization rate low is important. Utilizing a large part of your available credit might be affecting your score.

How to Check: Scrutinize your credit card statements. Are your balances high in relation to your limits? Strive to keep balances low relative to your limit for optimal effect.

Length of Credit History

If your credit history is not long enough, it might be impacting your score. The duration of your credit history accounts for a significant portion of your credit score.

How to Check: Check the age of your oldest and latest accounts and the average duration of all your accounts in your credit report.

Type of Credit

Having and responsibly handling a diverse array of credits, including credit cards, retail accounts, installment loans, and mortgage loans helps in boosting your score.

How to Check: Inspect your credit report for your mix of credit accounts. Evaluate if you've been applying for new credit judiciously.

Public Records

Public records such as bankruptcies or financial liens could significantly affect your score negatively.

How to Check: Verify your credit report for any public records. Make a note of any listed items that require addressing.

How Do I Improve my 662 Credit Score?

With a credit score of 662, you’re not far from attaining fair credit status. To achieve this, there are some practical and tailored steps you can take based on your current financial circumstance.

1. Monitor Your Credit Report

Regularly reviewing your credit report can help you identify any errors that may impact your score. If you notice any inaccuracies, report them immediately to the related credit bureau for rectification.

2. Minimize Credit Inquiries

Too many hard inquiries can dent your credit score. If you’re applying for new credit, try to do it sparingly, considering whether it’s really necessary, and, if so, shop around for the best conditions.

3. Maintain Old Accounts

Older accounts can show a longer history of credit use, potentially benefiting your score. Consider keeping such accounts open and active for a healthy length of credit history, but remember to manage them responsibly.

4. Establish Payment Reminders

Setting up payment reminders or automatic payments can be effective in ensuring you make payments on time. This is one important way to improve your credit score over time.

5. Manage Your Debt Efficiently

Responsible debt management is crucial for credit health. This includes timely payment of loans and limiting the use of your credit card to manageable amounts.