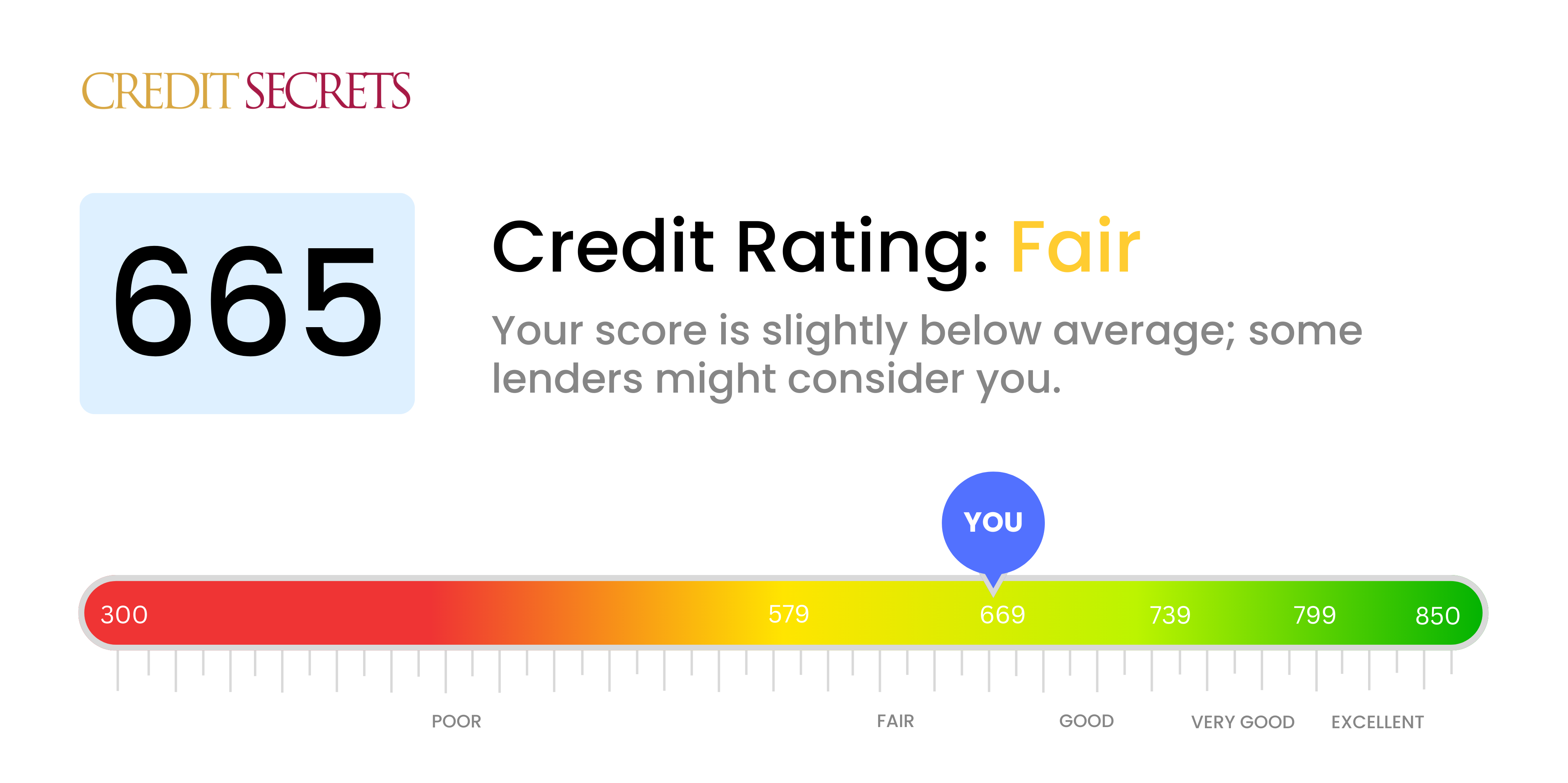

Is 665 a good credit score?

Your score of 665 is leaning towards fair rather than officially being termed as good. This score indicates that you pose a moderate risk to lenders which could impact availability, approval odds, and interest rates for loans and credit resources.

Despite the current score, you possess the potential to elevate your credit standing to an even stronger position. Through consistent smart financial decisions like timely bill payments, reducing overall debt, and limiting new credit applications, your score can gradually creep up to the 'good' and even 'very good' categories, opening up better financial opportunities for you in the future.

Can I Get a Mortgage with a 665 Credit Score?

If your credit score sits at 665, you might find yourself straddling the line between a fair and good credit rating. This score is not inherently bad, but it might limit your options when it comes to securing a mortgage. Traditional lenders may be hesitant to provide a loan due to the risk associated with this score. However, don't lose hope just yet, as other lenders might consider more than just your score when making a decision.

Lenders generally prefer applicants with credit scores above 700 as these are perceived to be low risk. With a score of 665, you fall short of that threshold. This might lead to higher interest rates or more comprehensive checks of your financial history, thus making the mortgage approval process more challenging. It can be a good idea to consider alternatives like government-backed loans such as FHA or VA loans, which often have more flexible credit requirements. This way, you can still explore the possibility of securing a mortgage while working on improving your credit score.

Can I Get a Credit Card with a 665 Credit Score?

Having a credit score of 665 puts you in a fair credit range, making your odds of getting approved for a credit card reasonable, although not guaranteed. Your score suggests an adequate history of handling credit, but it could also reflect some financial challenges from the past, such as late payments or high credit usage. Lenders would consider you a moderate risk and, consequently, may offer you credit with higher interest rates.

For someone with a credit score of 665, a secured credit card or starter credit card could be a promising option. Secured credit cards require a cash deposit, which usually sets your credit limit, while starter credit cards are designed for those new to credit or working on improving their score. These cards often come with educational tools that can guide you on how to better manage your credit. It's crucial to remember that while these won't necessarily boost your score drastically, they can be an essential part of your journey towards improved credit.

A credit score of 665 indicates a fair credit history. While not in the poor or bad range, this score might pose some challenges when applying for a personal loan. Most traditional lenders may find this score a bit risky and could hesitate to approve your application without stringent terms and possibly higher interest rates. However, this shouldn't discourage you, as every lender has different standards and you may still qualify for a personal loan with some institutions.

Depending on the lender's discretion, if your loan application is approved, you might face higher interest rates due to your score. This is because lenders mitigate their perceived risk by charging higher interest rates to borrowers with lesser credit scores. It's crucial to be well informed about the terms of your loan and ensure that it aligns with your financial reality before accepting their offer. By consistently making on-time repayments, you can gradually improve your credit score and gain access to loans with more favourable terms in the future.

Can I Get a Car Loan with a 665 Credit Score?

With a credit score of 665, you are teetering on the brink of what's generally considered acceptable credit for a car loan. Many lenders like to see scores of 680 or above to offer the most favorable loan terms. A score of 665 tends to fall into a gray area; it's not bad, but it's not exceptional either.

Approval for a car loan is not out of the question, but keep in mind, the terms might not be ideal. You may find that the interest rates offered are somewhat elevated compared to those with higher credit scores. The increased rates are due to lenders protecting themselves against potential risks. Given your score of 665 is relatively close to the favored range, it would be a good idea to really scrutinize the loan terms before commitment. Nonetheless, with a bit of careful navigation through the loan application process, purchasing a car is still a realistic goal.

What Factors Most Impact a 665 Credit Score?

Interpreting a score of 665 can be essential in your pursuit of financial wellness. Paying attention to and improving factors influencing your score can lead towards a more stable financial future. It is important to remember that each financial journey is an educational experience tailored to your unique circumstances.

Credit Utilization

Your credit utilization could have a major role in your 665 score. High utilization is usually seen as a risk, and could be dragging down your current score.

How to Check: Examine your credit card debts and your credit limits. If your balances are high compared to your limits, this could be the reason your score is not higher.

Payment History

Payment history plays an integral role in your credit score. If you have a history of delayed payments, this might have contributed to your score.

How to Check: Look over your credit report for any late payments. Think about any times you’ve missed or delayed payment, as these could be impacting your score.

Credit History Length

Having a shorter credit history, especially with recent accounts, might be affecting your credit score.

How to Check: Evaluate your credit report to determine the age of your oldest, newest, and the average of all your accounts. Newer accounts may be influencing your score.

Credit Inquiries

Multiple credit inquiries, particularly if you have been applying for new credit lines recently, can possibly harm your credit score.

How to Check: Inspect your credit report for recent inquiries. Frequent applications for new credit can negatively impact your score.

Credit Mix

Having a variety of credit types can affect your score. If your credit mix is unbalanced, this could be pulling down your score.

How to Check: Take a look through your credit report and notice what types of credit you have. Too many of one type, or not enough diversity, could be affecting your score.

How Do I Improve my 665 Credit Score?

With a credit score of 665, you’re on the edge of fair credit, and taking actionable steps can help lift your score for improved financial opportunities. Here are the most appropriate measures for someone at this credit score bracket:

1. Regularly Monitor Your Credit Report

Ensure to regularly check your credit report for inaccuracies. Even a small error can considerable impact your credit score. If you spot an error, dispute it with the credit bureau.

2. Limit New Credit Inquiries

Each time you apply for credit, your credit score may take a minor hit. Try to minimize new credit inquiries, especially while you’re working on improving your score.

3. Pay More Than the Minimum Payment

Where possible, always endeavor to pay more than the minimum balance on your credit accounts. Over time, this will help reduce your overall credit utilization ratio, which is beneficial for your credit score.

4. Set Payment Reminders

Payment history significantly influences your credit score. Set up automated payments or reminders to ensure you pay on time. Even a single late payment can impact your credit score.

5. Keep Unused Credit Cards Open

Consider keeping old, unused credit cards open as long as they are not costing you unnecessary fees. Closing an account may increase your credit utilization ratio and negatively affect your score.