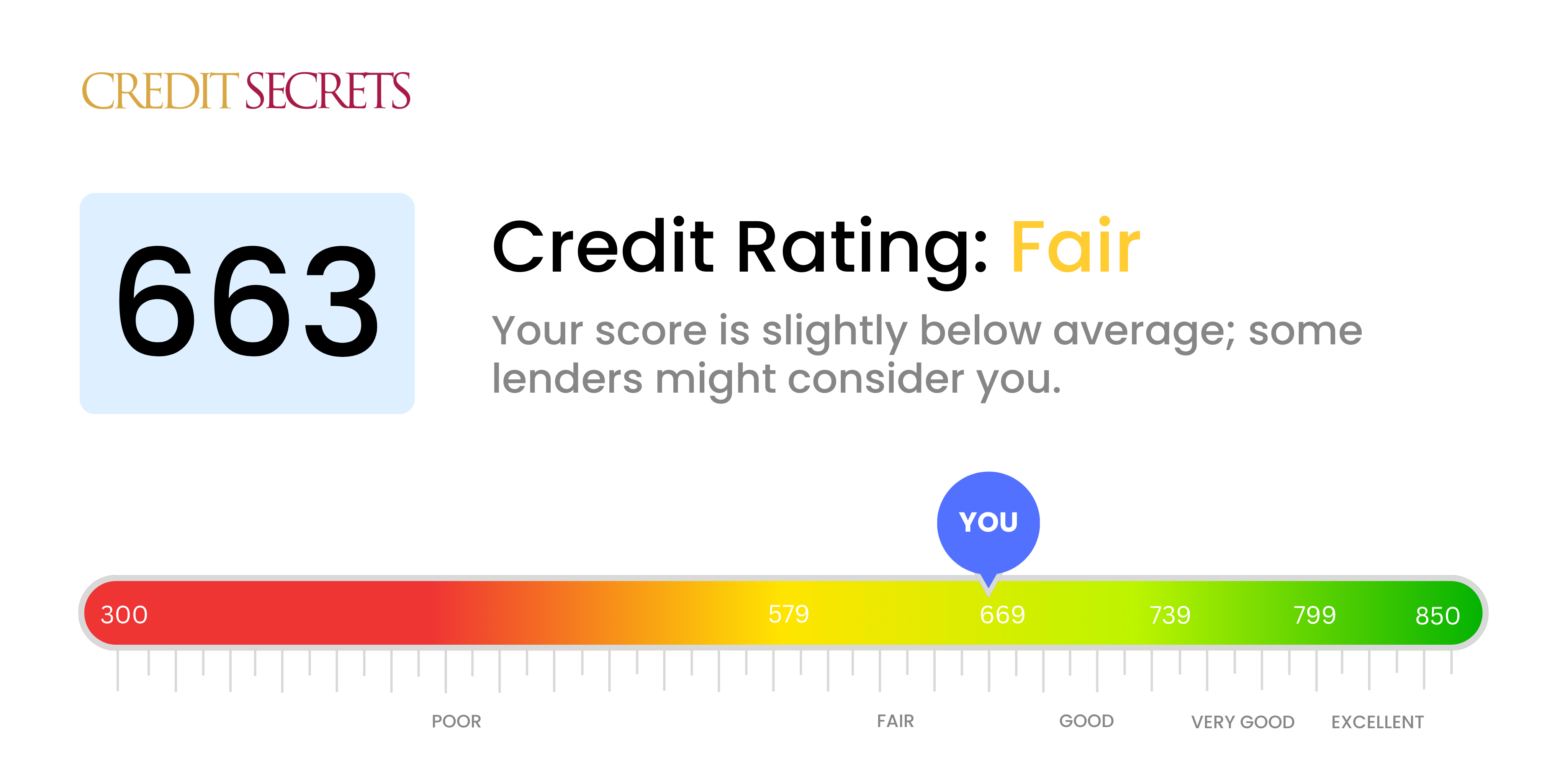

Is 663 a good credit score?

With a credit score of 663, you're in the "Fair" range of the credit spectrum. This is not a bad score, but it could definitely be improved. Creditors may view your score with a bit of caution, and might not offer you the most favorable interest rates or terms.

Yet, you're not far off from entering the "Good" category, just a few steps could markedly improve your situation. By making consistent, timely payments and by keeping your credit utilization low, you stand a good chance of strengthening your credit health. Remember, every step towards a better score is a move towards achieving your financial goals. Stay positive and persistent!

Can I Get a Mortgage with a 663 Credit Score?

If you have a credit score of 663, you are in the 'fair' credit bracket. While this is not a poor score, it's also not among the top scores that lenders prefer to see. The higher your credit score, the more likely you are to be approved for a loan with a favorable interest rate. You may still be able to secure a mortgage with your current score, but it could come with a higher interest rate.

Securing a mortgage involves more than just your credit score. Lenders also take into account your income, employment history, and the size of your down payment. Having a stable job and a decent income can improve your chances. But keep in mind, different lenders have different lending criteria, so while one may accept your application, another may not. It may be helpful to research and compare different lenders to find a mortgage product that best suits your circumstances.

Can I Get a Credit Card with a 663 Credit Score?

With a credit score of 663, it's possible to be approved for a credit card, though the types of cards available might be somewhat limited. This score is firmly in the "fair" category, meaning lenders might see you as a moderate risk. However, it's a good starting point on the journey towards financial stability, and understanding your credit standing is a significant first step.

The focus should be on cards designed to help build credit. Secured credit cards, which require a deposit that serves as your credit limit, could be a strong option. These types of cards tend to have higher approval rates for individuals with fair credit scores. There's also the option of cards that cater specifically to those with fair credit, which may have lower interest rates and benefits like cash back or travel points, though they may also include annual fees. Remember, the right credit card can be a useful tool in improving your credit score over time.

In having a credit score of 663, your borrowing options could be somewhat limited. Often, many lenders would perceive a score such as this as a potential financial risk. Put simply, the lower the credit score, the more unlikely approval for a traditional personal loan becomes. It's surely a tough stance to be in, but understanding this reality is the first step towards making improvements.

Yet, that doesn't mean all hope is lost. Possibilities such as applying for a secured loan, where you offer something valuable as collateral, or opting for a co-signed loan, with a person who has stronger credit standing, do exist. Another option that may not necessitate a higher credit score is peer-to-peer lending platforms. Even though these alternatives often have higher interest rates and less accommodating terms, due to the increased risk for the lender, they present a route to financial support that you might be seeking.

Can I Get a Car Loan with a 663 Credit Score?

With a credit score of 663, you might be wondering what your chances are of securing a car loan. Good news! Your score is hovering towards the edge of what is typically considered fair, which means you may have a good shot at getting approved. Remember, your credit score is one of the factors lenders use to gauge the risk associated with loaning you money. A score of 663 indicates the ability to manage and repay debt, which lenders like to see.

Expect to get fair terms when shopping for a car loan, as your credit score is just below what is considered good. You might still end up having a higher interest rate than someone with a higher score, but that shouldn't deter you from pursuing your car-purchasing dreams. It's a good idea to shop around to compare rates before making a decision, as terms can vary between lenders. As you make consistent payments on your car loan, it could help to boost your credit score even further in the future.

What Factors Most Impact a 663 Credit Score?

Understanding where you stand is the first step on your financial journey. With a score of 663, it's important to identify key factors affecting your score and take necessary actions for improvement.

Payment Habits

Regularly making full, on-time payments is crucial for maintaining a good credit score. Any potential late payments or defaults could be negatively impacting your score.

How to Check: Analyze your credit report; look for instances of late or missed payments that could have affected your score.

Credit Utilization

Keeping your credit card balances lower than their limits is beneficial for your score. If your utilization rate is high, it could be dragging down your score.

How to Check: Check your credit card statements. Are your balances high compared to your credit limits?

Credit History

A relatively short credit history might be affecting your score negatively.

How to Check: Check your credit report's age including the old and new accounts and the average age of all your accounts. Have you recently opened new accounts?

Diversity of Credit

Having diverse types of credit and handling them responsibly contributes to a higher score.

How to Check: Look at your mix of credit accounts. Are you managing various types of credit accounts responsibly and not applying for new credit excessively?

Public Records

Public records such as bankruptcies or tax liens can drastically impact your score.

How to Check: Scrutinize your credit report for any public records. Are there any unresolved items listed?

How Do I Improve my 663 Credit Score?

With a credit score of 663, you are in the fair range. There’s room to grow and boost your score into a good or even excellent rating. Here are some personalized steps to consider with a 663 credit score:

1. Correcting Credit Report Errors

Examine your credit reports from all three bureaus to ensure there are no inaccuracies. If you notice any errors, dispute them right away. Clearing up inaccuracies can give your score an immediate nudge upwards.

2. Pay Bills on Time

Consistently paying all of your bills on time forms the backbone of a positive credit score. Your payment history significantly impacts your credit score, so don’t let any bills slip through the cracks.

3. Deter Over Borrowing

Utilize just a fraction of the credit available to you. High debt-to-credit usage (above 30%) hurts your score. Keep your debts low and, if you have high balances, make a repayment plan to reduce them.

4. Grow Account’s Age

The length of your credit history is also important. Maintain your older accounts open and in good standing to ensure a longer credit history and show stability to potential creditors.

5. Judicious Loan Applications

Don’t apply for too many new loans or lines of credit at once. Each application results in a hard inquiry into your credit report, which can decrease your score.

Please, adopt these strategies thoughtfully to improve your credit health and increase your score significantly over time.