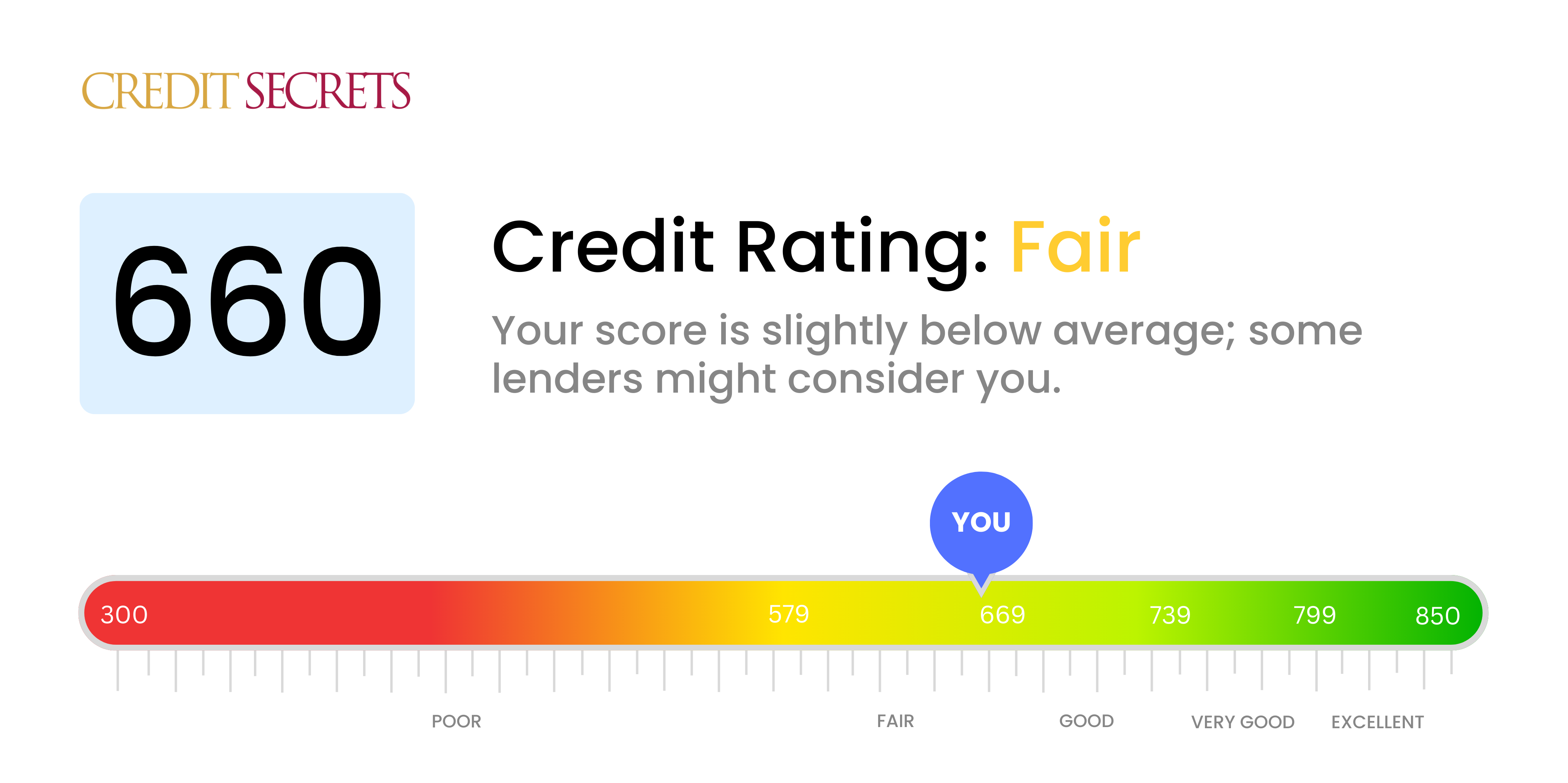

Is 660 a good credit score?

Your credit score of 660 falls into the "Fair" category. This isn't necessarily the perfect score but it's not terrible either, it simply means that you still have room for improvement and more opportunities for better credit possibilities.

With a 660 credit score, you might find that some lenders may offer you credit, but it may not be at the most favorable terms. You may face higher interest rates or could need a larger down payment for things like auto loans or mortgages. However, don't let this worry you, there are always steps you can take to improve your credit score. Remember, credit building is a journey, not a sprint. Stay positive!

Can I Get a Mortgage with a 660 Credit Score?

Having a credit score of 660 indicates that you possess fair credit, which often falls on the threshold for certain lenders when it comes to mortgage approval. You might face some difficulty getting approved for the most competitive mortgage rates since your score suggests a moderate risk to lenders. However, your chances of being approved are not entirely slim, as many lenders could still consider granting you a mortgage loan.

With a fair credit score, the mortgage approval process might become complicated and expensive. Since you pose a moderate risk, interest rates on your offered loans could be higher. Nevertheless, it's important to note that a variety of factors, not just your credit score, would be factored into a loan approval decision, such as your income and employment history. Be prepared to thoroughly discuss these aspects of your life with your lender, and don't be discouraged - there are home loan products out there for all kinds of financial circumstances.

Can I Get a Credit Card with a 660 Credit Score?

Having a credit score of 660 puts you in a somewhat favorable position when applying for a credit card. This is often regarded as a fair credit score. While it may not grant access to the most sought-after cards with the most rewarding perks, it does open doors to several reliable, functional credit cards. It's crucial to remember that each lender's judgement varies, and some may see your 660 score differently from others.

Secured credit cards or starter cards could be an ideal option at this stage. These types of cards are designed to help raise your score by reporting responsible usage to the three major credit bureaus. Other credit cards tailored towards fair credit scores offer reasonable interest rates and annual fees. However, it's always essential to keep a close eye on interest rates, as they may be somewhat higher due to the perceived risk linked to a fair credit score. Navigating this score bracket isn't always easy, but every step forward, no matter how small, brings you closer to your financial goals.

Having a credit score of 660 puts you in a so-called fair or average credit range. This might slightly complicate the process of getting approved for a personal loan, but it doesn't necessarily prevent it. Different lenders have different criteria, and some may be willing to approve a loan with an average credit score. The key point to remember here is that your borrowing options might not be as broad as they would be with a higher score.

Applying for a personal loan with a credit score of 660 involves careful consideration. Some lenders may approve your loan, but the terms might not be ideal. For example, you might face higher interest rates due to the increased risk to the lender. It's essential to shop around and compare loan terms from different providers before making a decision. However, keep in mind that multiple hard inquiries could potentially lower your credit score further, so tread carefully and ensure each application is a realistic possibility.

Can I Get a Car Loan with a 660 Credit Score?

With a credit score of 660, you're on the right track to being approved for a car loan. Most lenders generally look for scores of 660 or higher to consider you a 'prime' candidate. This puts you into a category that lenders view as typically reliable for repaying borrowed money. Therefore, your score could open doors to favorable loan terms.

Keep in mind that the auto financing process takes your score into account to determine the terms of your loan. This includes the interest rate and the repayment period. Typically, possessing a 'prime' score such as yours translates to moderately low interest rates. However, each lender can vary greatly in their terms. It's crucial to thoroughly read over loan terms when moving forward with the car buying process. While there's room to improve your score, a 660 credit rating can put you in a decent position when seeking a car loan.

What Factors Most Impact a 660 Credit Score?

Analyzing a credit score of 660 is crucial to devise a plan to improve your financial situation. Identifying the factors affecting this score can lead to better financial health. Here's what might be impacting your score:

Credit Utilization Ratio

Your usage of credit greatly influences your score. If you use all or most of your available credit, this could be a significant factor behind your score of 660.

How to Check: Take a look at your credit card statements to see if your balances are close to your credit limit. Always remember, maintaining a low credit utilization rate improves your score.

Debt-to-Income Ratio

Your income vs. the ratio of your debt can also impact your credit score. Lenders prefer lower ratios, indicating you aren't overloaded with debt.

How to Check: Calculate your debt-to-income ratio by dividing your total recurring debt by your gross income. A ratio above 40% could be impacting your score negatively.

Credit History

A scattered or inconsistent credit history may affect your score. Consistent, responsible credit use over time helps improve your score.

How to Check: Review your credit report, focusing on the age and consistency of various accounts. Recent account openings or closures could be impacting your score.

Credit Type Diversity

A diverse mix of credit assists in building a healthy score. If your credit is predominantly from one source, your 660 score could be affected.

How to Check: Evaluate the types of credit accounts you being managed, like credit cards, installment loans, and retail accounts.

Delinquencies

Delinquencies play a role in your score. Unpaid or late bills can cause your score to drop.

How to Check: Inspect your report for any unpaid bills or late payments. Addressing these promptly can boost your score.

How Do I Improve my 660 Credit Score?

Having a credit score of 660 places you in the fair credit range. With diligence and the right steps, it’s attainable to enhance your credit standing. Here are the most feasible and effective steps for your current situation:

1. Manage Outstanding Debt

Begin by paying down outstanding debt as its significant impact affects your score. Make a systematic plan to tackle this. Address the debt with the highest interest rate first.

2. Credit Utilization Rate

Try to maintain your credit utilization rate below 30% ratio of your overall credit limit. Having a lower rate has a positive effect on your score as it shows that you’re not over-reliant on credit.

3. Opt for a Secured Loan

If you’re finding it difficult to get unsecured credit at your current score, consider a secured loan. It’s the type of credit where you provide an asset as collateral, and it can help demonstrate responsible debt management to credit bureaus.

4. Seek to Become an Authorized User

Enquire from a loved one with strong credit if you could be an authorized user on their credit line. This could help improve your credit score as your profile will also share in their credit history.

5. Explore Diverse Credit Types

Once you’ve established a consistent payment history, consider diversifying your credit types like a credit builder loan or an installment loan, and manage them responsibly to show lenders your capability in handling different forms of credit.