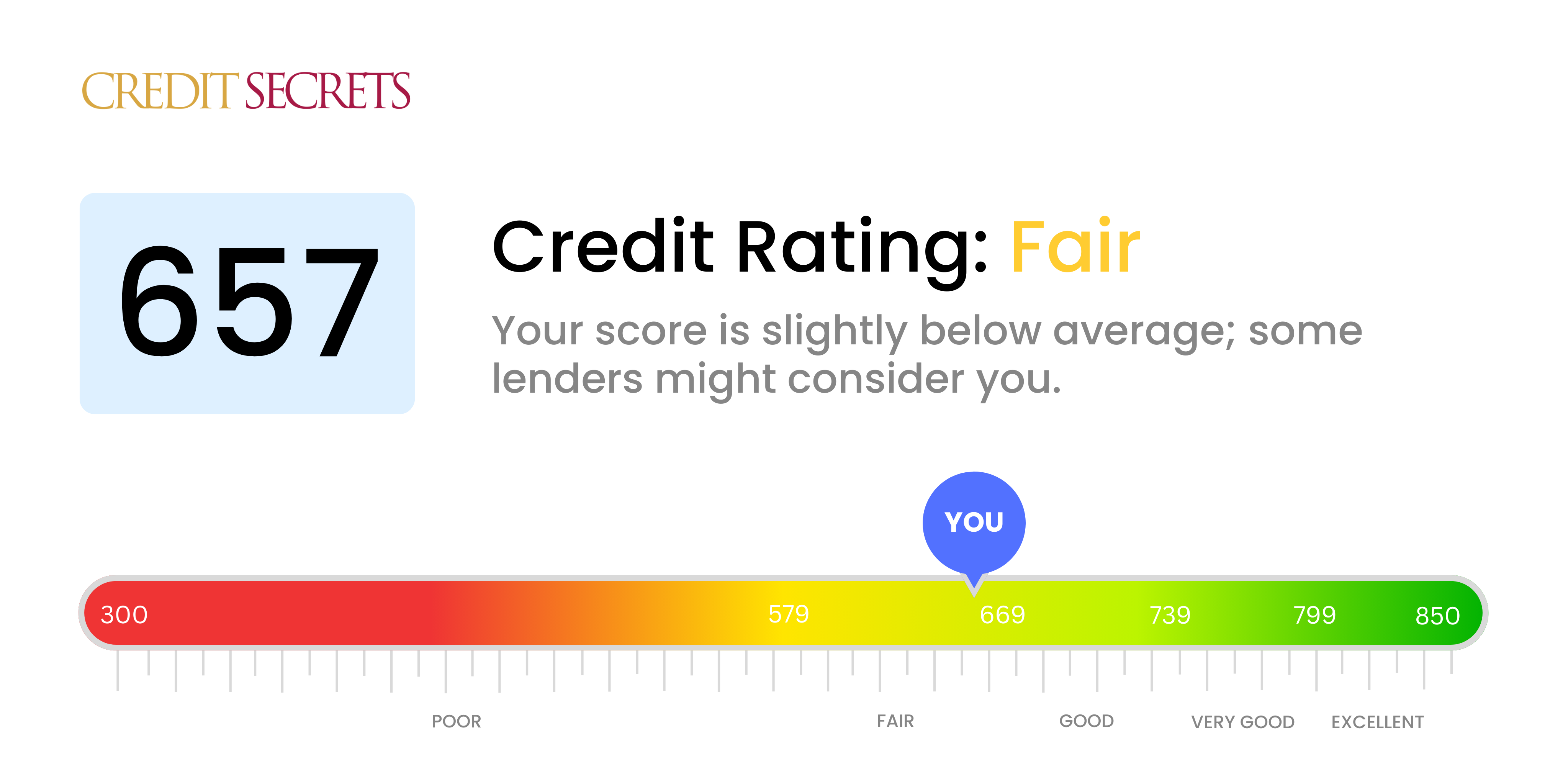

Is 657 a good credit score?

Your credit score of 657 falls into the 'Fair' credit category. While it's not regarded as a particularly strong rating, it's far from being the lowest. With thoughtful management and responsible financial choices, there's good potential to improve it over time.

A 'Fair' credit score can sometimes be a bit limiting. It may prove challenging to get approved for high credit limits, get low interest rates, or even get credit at all from some lenders. However, remember, it's still possible to get credit, it just might not be as easy or as favorable as if you had a higher score. The important thing is not to feel discouraged. Your score isn't permanent and with some effort, over time, you can potentially raise your score into the 'Good' or even 'Very Good' categories.

Can I Get a Mortgage with a 657 Credit Score?

With a credit score of 657, your chances of obtaining approval for a mortgage may be somewhat limited. A credit score in this range is typically considered 'fair', meaning that while not the lowest, it still indicates some financial challenges in the past like late payments or debt collections.

Despite these challenges, don't let this dissuade you. There are lenders who offer loans to individuals with fair credit scores, albeit often with higher interest rates and with stricter terms to offset the potential risk. A potential route to explore could be government-insured loans, such as FHA loans, which are typically more lenient in their credit score requirements. However, it should be stressed that a better credit score generally grants better conditions for borrowing, including more competitive interest rates.

Improving your credit score is a diligent process that involves prompt payments, sustaining a low credit balance, and prudent management of your finances. With time and effort, a better credit score is within your reach, and thus, a more favorable mortgage deal.

Can I Get a Credit Card with a 657 Credit Score?

With a credit score of 657, it's somewhat challenging to be approved for certain types of credit cards. Lenders might see this as a moderate-risk score mirroring past fiscal difficulties or perhaps a lack of credit history. It's important to face the facts but keep a positive attitude. Knowing where you stand credit-wise may not be easy, but it's a fundamental step in the journey towards financial stability.

A score of 657 might limit the kinds of credit cards you have access to. Secured credit cards, which require a deposit matching your credit limit, can be easier to acquire and could potentially help rebuild your credit over time. It's also recommended to research beginner credit cards designed specifically for those aiming to improve their credit score, albeit with a catch of generally higher interest rates due to the perceived risk posed to lenders. Remember, these credit card alternatives aren't a quick fix but they could build the path towards better credit and sound financial footing.

With a credit score of 657, you fall into the "fair" category in the eyes of most lenders. This means you have a decent chance of obtaining approval for a personal loan, although it may not come with the most favorable terms. While you have shown some responsible financial behavior, this score suggests there may have been some past difficulties. Lenders may see you as a potentially higher risk compared to someone with a higher score.

You can fully expect lenders to closely evaluate your credit history during the application process. The interest rate you receive on the loan is also highly likely to be influenced by your credit score. Typically, a score of 657 might lead to slightly elevated interest rates compared to those granted to applicants with scores in the 'good' or 'excellent' ranges. It's suggested that you fully explore your options, read the fine print, and choose the loan terms that will best serve your financial needs and abilities.

Can I Get a Car Loan with a 657 Credit Score?

Having a credit score of 657 might make the process of applying for a car loan a bit more challenging, but not impossible. Generally, lenders tend to favor credit scores that are above 660. With a score of 657, you're just shy of that benchmark and fall into a category deemed marginal risk by lenders. This is due to the perception that your credit score might suggest a higher risk of not being able to repay the loan, which could result in less favorable terms such as higher interest rates.

That being said, don't be discouraged. While it might not be a walk in the park, there are lenders who are willing to work with borrowers who have less-than-golden credit scores. Just be aware that this might mean dealing with higher interest rates. Remember, it's crucial to thoroughly understand the loan terms to avoid any surprises down the line. While the journey to securing a car loan might be a bit more demanding, it is still very much achievable with careful and thoughtful planning.

What Factors Most Impact a 657 Credit Score?

A score of 657 is neither bad nor excellent; it's categorized as 'fair'. Tracking down the factors influencing this score is a step towards enhancing your financial health. Everyone's financial journey differs, and every step provides an opportunity to learn and grow.

Payment Patterns

Your payment habits majorly affect your credit score. Late payments or continuous defaults could be primary reasons for your score.

How to Check: Analyze your credit report thoroughly for any late or missed payments. Consider any period when you had issues with timely payments, as those instances potentially impacted your score.

Debt Usage

People with a high debt utilization ratio might encounter a low credit score. If you often utilize the complete credit limit of your cards, it might be causing the problem.

How to Check: Check your credit card declarations. Are the balances reaching their maximum limit regularly? Endeavor to keep the limits low to maintain a healthy score.

Age of Credit

A brief credit history can negatively affect your score.

How to Check: Scan your credit report to calculate the age of your oldest and recent accounts plus the average lifespan of all your accounts. Reflect if you have been opening multiple new accounts lately.

Type of Credit

Maintaining a mix of credit types and new loans responsibly can contribute to a better score.

How to Check: Assess your variety of credit accounts, like credit cards, retail accounts, different loans, etc. Evaluate if you manage new credit effectively.

Legal Actions

Legal actions such as bankruptcies or tax liens can considerably dampen your credit score.

How to Check: Carefully look at your credit report for any legal actions. Prioritize resolution of these for an improved score in the future.

How Do I Improve my 657 Credit Score?

A credit score of 657 is not an ideal one, but don’t worry, it can be improved with the right approach. This step-by-step guide is specifically designed to help you navigate your current situation.

1. Identify and Rectify Credit Report Errors

Your credit report might contain errors which could lead to a lower credit score. You have the right to request a free copy of your credit report once every year from each of the three major credit bureaus. If you find any discrepancies, file a dispute immediately.

2. Pay More Than the Minimum

You’re probably making minimum payments on your credit card balances. Try to pay more than that. This will not only reduce your overall debt faster, but it can also result in a lower credit utilization ratio, helping improve your score.

3. Handle Delinquent Accounts

Address any accounts that are overdue and make bringing them up to date your top priority. Contact your creditors and arrange to pay the outstanding balance or, if needed, establish a repayment plan.

4. Consider a Credit-Builder Loan

A credit-builder loan, where your payments are reported to credit bureaus, might be a good option for you. Making timely repayments will demonstrate your reliability to future lenders and can help increase your score.

5. Limited Credit Requests

Each time you apply for credit, a hard query is made, which can lower your score. So, be discerning when it comes to new credit applications.