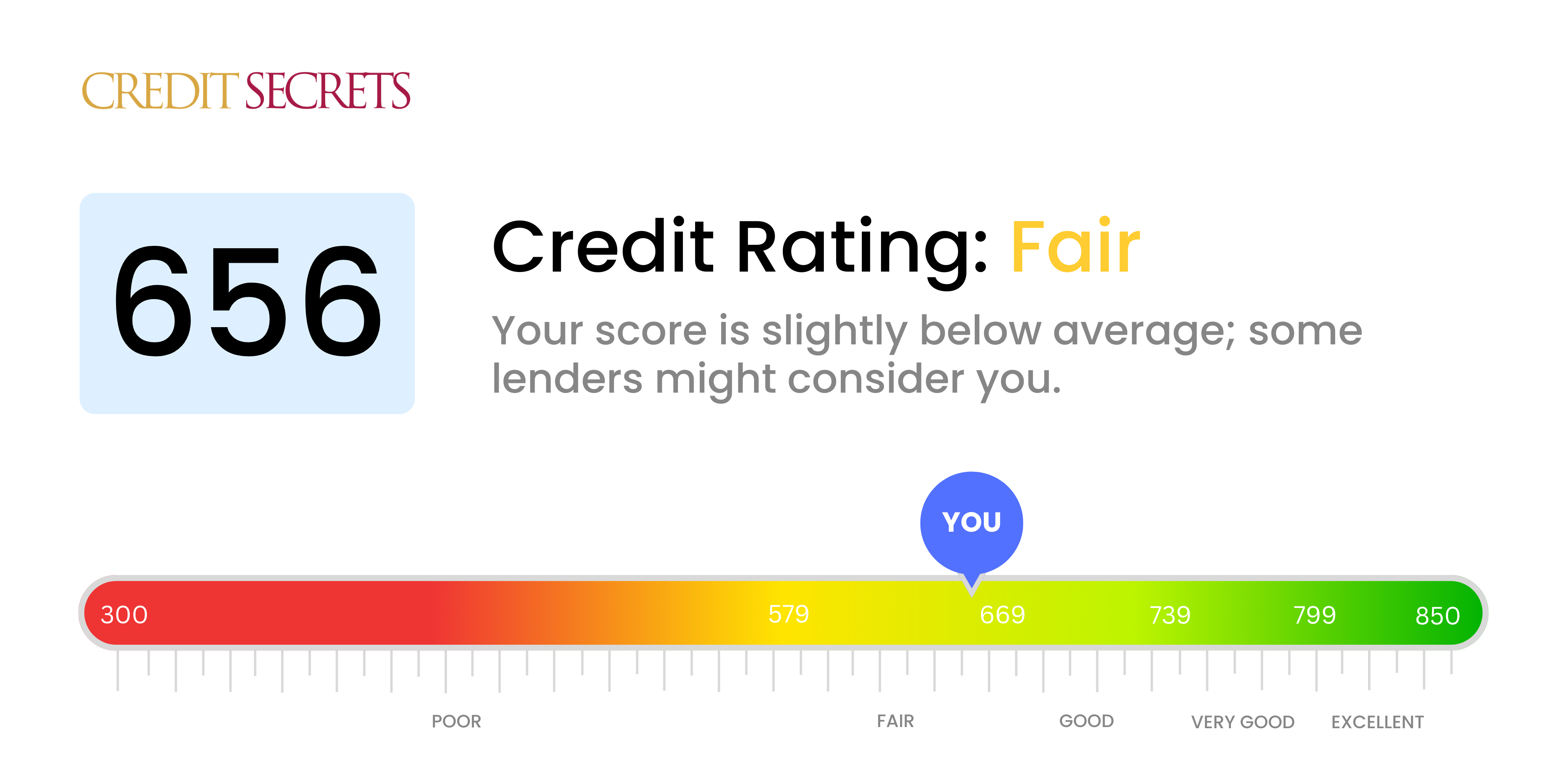

Is 656 a good credit score?

Your score of 656 is considered as a fair credit score. While it isn't in the lowest range, it still leaves room for improvement in order to access better loan terms and credit offerings.

With this fair score, you may find it somewhat challenging to get approved for certain loans or credit cards, and when you do, you may face higher interest rates compared to those with good or excellent scores. Treating your credit with care and making a consistent effort to improve it can open up opportunities for better financial options. Keep in mind, enhancing your score is a journey, so take one step at a time and stay hopeful.

Can I Get a Mortgage with a 656 Credit Score?

A credit score of 656 places you in the category of "fair". This means you may be approved for a mortgage, but likely don't qualify for the best interest rates or terms typically offered to higher-scoring borrowers. This can equate to a higher cost over the life of the loan. Even though this score is not in the "good" or "excellent" range, you're not necessarily out of luck.

Taking action to improve your credit before applying for a mortgage can improve your chances of better loan terms. Focus on timely payments and minimizing your credit card balances, which could provide a relatively quick boost to your score. Try exploring different mortgage options too. Certain lenders or programs, such as FHA loans, might have more flexible credit requirements which could be an alternative for you.

Can I Get a Credit Card with a 656 Credit Score?

With a credit score of 656, credit card approval is entirely possible, though it may not be as straightforward as with higher scores. This score is considered fair, and although it may indicate some past financial struggles, it doesn't necessarily mean that you're viewed as a high-risk borrower. But remember, every bit of honesty is crucial as you move forward and seek to improve your financial situation.

For a score like this, you may want to consider a secured credit card or a starter credit card. Both might be more attainable than premium travel cards or rewards cards. Secured cards require a deposit that becomes your credit limit, while starter cards are designed for those building or rebuilding credit. These cards often come with higher interest rates, reflecting a slightly higher risk to the lender, but they can be excellent steps on your journey to a stronger financial position. Keep in mind that it's a progress and improvements will take time. Stay optimistic and persistent in your financial journey.

A credit score of 656 is considered fair by most lenders but may not meet the criteria certain lenders have for personal loan approvals. This score shows lenders that there is a certain degree of risk in lending to you, so it may be slightly more challenging to secure a loan. Still, remember that while this situation may be difficult, it's important to understand what this credit score means for your loan possibilities.

If standard loan applications are less successful, you could explore other routes such as secured loans, which require collateral, or co-signed loans, where a more creditworthy individual guarantees your loan. Another alternative could be peer-to-peer lending platforms, which may have more flexible credit score requirements. Be advised though, these alternatives might entail higher interest rates and possibly less favorable conditions due to the increased perceived risk for the lenders.

Can I Get a Car Loan with a 656 Credit Score?

With a credit score of 656, it might be slightly more difficult to secure a car loan. Loan providers generally favor applicants with credit scores of 660 and above. A score of 656 while on the borderline, might not guarantee the most favorable terms due to it being on the lower end of the scale. This score can be seen as a minor risk by lenders, hinting at possible issues with returning the money borrowed in the past.

Yet, having a 656 credit score doesn't mean the end of the road for your car ownership aspirations. There are lenders who cater specifically to those with scores similar to yours. But, fair warning, the loans they offer usually carry substantially higher interest rates, as a precaution against the perceived risk. Even though it might be a little more challenging, obtaining a car loan remains a viable option. You just need to carefully scrutinize the terms and be well-informed about the potential increased rates.

What Factors Most Impact a 656 Credit Score?

Comprehending your score of 656 is vital for your financial progress. By pinpointing the elements impacting this score, you can lay the groundwork for improved financial health. Your unique financial trajectory is filled with valuable lessons and opportunities for growth.

Payment History

Your score is likely influenced by your payment history. Timely payments enhance your credit score, while late payments do the opposite.

How to Check: Look through your credit report for any late payments. Think about any situations that led to delayed payments, as they could negatively affect your score.

Credit Usage

Excessive use of your available credit could be another contributory factor to your current score. The lower your credit card balances in comparison to your limits, the better for your score.

How to Check: Scrutinize your credit card statements. If your balances are nearly maxed out, it's wise to aim lower to improve your credit score.

Credit History Length

If you have a shorter credit history, it may be influencing your score. The length of time you've had credit can positively or negatively affect your score.

How to Check: Check your credit report to determine the age of your oldest and newest accounts, as well as the average age of all your accounts. Have you opened any new accounts recently?

Type of Credit

Having an assortment of credit types and managing them responsibly is key to a healthier score.

How to Check: Inspect your range of credits, like credit cards, retail accounts, and loans. Have you been cautious in applying for new credit?

Public Records

Public records such as bankruptcies or tax liens can have a significant impact on your score.

How to Check: Look into your credit report for any public records. Resolve any existing records that may need your attention.

How Do I Improve my 656 Credit Score?

With a credit score of 656, you’re on the brink of moving from a fair to good credit rating. Carefully targeted actions can help you reach that next level. Let’s examine the most impactful and manageable steps you can take right now:

1. Update Outstanding Bills

If you have any accounts that are overdue, addressing them should be a key priority. Settle the oldest dues first as they may be weighing down your score the most. Contact your loan providers for help, their assistance can be beneficial in negotiating a payment arrangement.

2. Keep Credit Utilization Low

Maintaining your credit card balances below 30% of your credit limit contributes positively to your score. Set a goal to keep it under 10% for an even better impact. Focus on cards that are closest to their limit.

3. Opt for a Secured Credit Card

Considering your score, a regular card might be tricky to get. Try for a secured credit card – it’s backed by a cash deposit which becomes your credit line for that account. It’s an effective way to display steady, reliable payment patterns.

4. Seek to Become an Authorized User

Explore whether a close friend or relative who has a good credit score would let you become an authorized user on their account. This would allow their positive credit habits to reflect on your credit report. Do ensure that their card provider reports user activity to the credit bureaus.

5. Expand Your Credit Portfolio

A diverse range of credit types can strengthen your credit standing. As you display solid payment history with your secured card, consider credit builder loans or store credits cards to diversify.