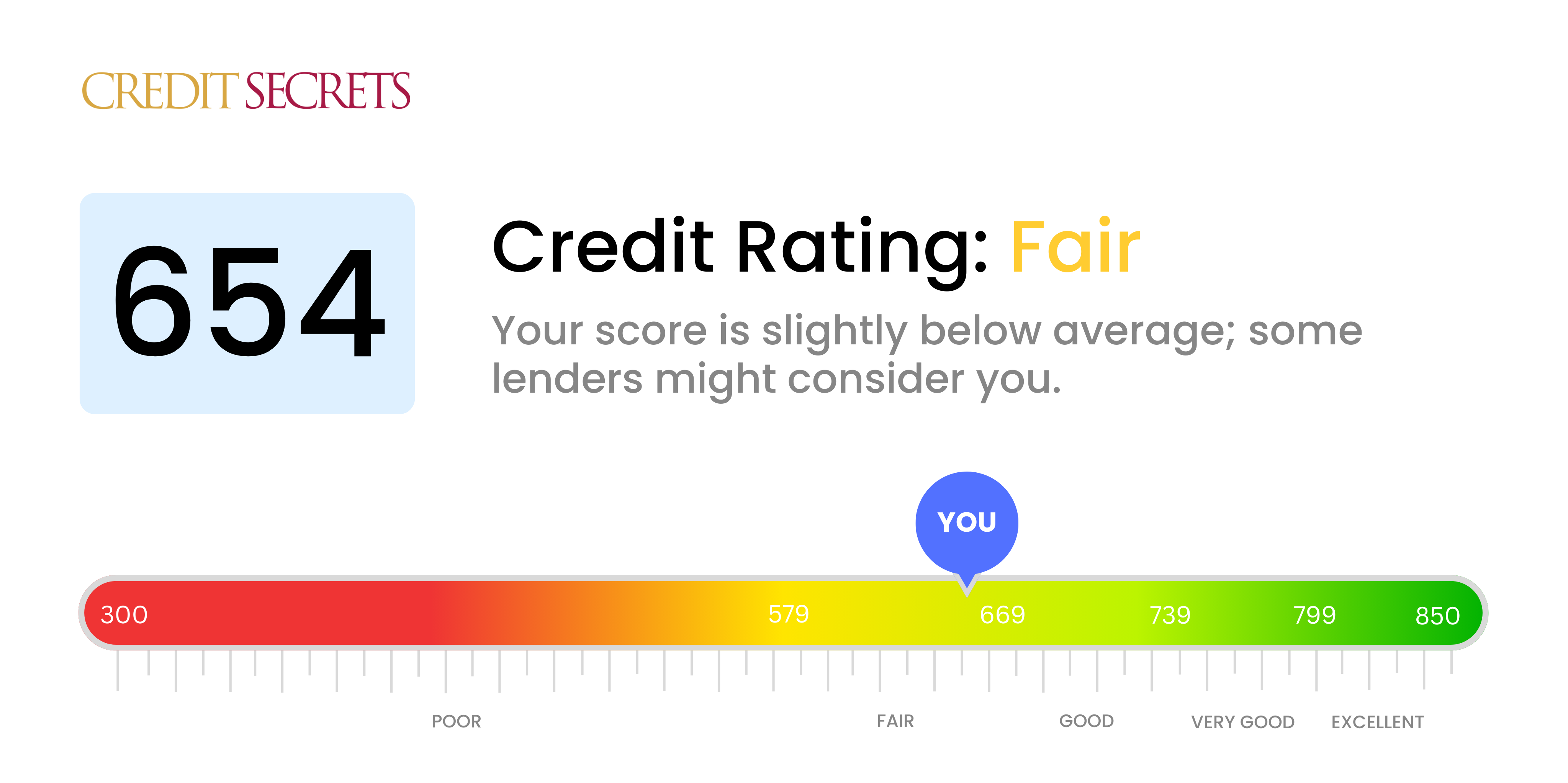

Is 654 a good credit score?

With a credit score of 654, you're in the 'Fair' category. This isn't the best position to be in, but don't be discouraged; there are steps you can take to improve your score.

What this means is that some lenders may consider you as having moderate risk. You may experience difficulty being approved for loans and credit cards and, if you are approved, be prepared to pay higher interest rates. Maintaining consistent and timely payments, carrying low balances and refraining from applying for unnecessary credit can help boost your score gradually. Remember, financial success isn't beyond your reach, it just takes time and dedication.

Can I Get a Mortgage with a 654 Credit Score?

Having a credit score of 654 puts you on the lower end of the 'fair' category. It's possible to obtain a mortgage with this score, but it's not guaranteed and it may come at a higher cost. Most lenders prefer applicants with 'good' to 'excellent' credit, which typically means scores above 700. They might be cautious about lending to borrowers with 'fair' credit due to the perceived risk.

If approved, you may face higher interest rates compared to those with stronger credit scores, as lenders often charge more to offset the potential risk. This could significantly increase the cost of your mortgage over the long run. However, remember that there are many others factors which are considered in a mortgage application beyond your credit score, such as income and employment stability. Your credit score is definitely an important factor, but not the only one. Remain hopeful and consider all options as you continue on your journey to homeownership. And remember, your current credit score isn't permanent. With responsible financial behavior, you can work toward improving it over time.

Can I Get a Credit Card with a 654 Credit Score?

A credit score of 654 is generally considered 'fair' and while it may not completely close the door to obtaining a credit card, it does make the process a little more challenging. Many lenders view this score as slightly risky, indicative of some past credit troubles. It's always crucial to accept your credit, even if it feels uncomfortable and disheartening initially. Remember, understanding your credit status is the beginning of a better financial future.

Although various card options may not be readily offered, looking into secure credit cards or starter credit cards could be a good start. These options often cater to those trying to rebuild their credit and require either a deposit or lower credit lines to lessen the risk for lenders. However, it's important to be prepared for potentially higher interest rates due to the perceived risk associated with a fair credit score. As you use these tools wisely and consistently over time, they can help boost your credit score and improve your financial health gradually. Stay patient, stay optimistic, and remember, every journey begins with a single step.

Having a credit score of 654 means that your chances of getting approved for a traditional personal loan may be slim. Your score is below what most lenders usually expect, and as a result, they perceive you as a high-risk borrower. It's tough to accept, but understanding the implications of such a score on your loan application options is critical.

As direct loans from lenders may not be feasible, you might need to explore other avenues. One option could be secured loans, which involve you providing an asset as collateral. Another possibility is to apply for a loan with a co-signer – someone with a higher credit score who agrees to repay your loan if you can't. Peer-to-peer lending is also an alternative, as they might have less stringent credit requirements. Be aware though, these alternatives often carry higher interest rates and terms that aren't as favorable, due to the higher risk involved for the lender.

Can I Get a Car Loan with a 654 Credit Score?

In the world of credit and lending, a score of 654 is considered fair; not bad, but not excellent either. This being said, getting approved for a car loan can be a bit of a balanced act. Most lenders prefer a score of 660 or higher, viewing it as indicative of a strong credit history. However, the door isn't completely closed to you with a credit score of 654, although you may face slightly higher interest rates.

These elevated rates correlate to the perceived risk lenders take on when providing a car loan to someone with a lower than preferred credit score. Your credit score tells lenders how reliable you've been in the past when it comes to repaying borrowed money. With a credit score of 654, some lenders might see potential risk, hence the increased interest rates. But remember, while the process might be more challenging, obtaining a car loan with a fair credit score is not impossible. Be aware, careful, and thorough when exploring loan terms and conditions. Careful planning and prudent decisions will get you on the road.

What Factors Most Impact a 654 Credit Score?

Fathoming a score of 654 is of paramount importance. Uncovering and tackling the elements that have influenced this score will pave the path to a more sound financial future. Always keep in mind, each credit journey is unique with ample room for improvement and learning.

Payment Records

Your payment records play a crucial role in shaping your credit score. A history of overdue payments, or even worse, defaults, could be a significant factor responsible for this score.

How to Check: Take a close look at your credit report for any indicators of late payments or defaults. Give some thought to any events where you might have made delayed payments as they may have impacted your score negatively.

Percentage of Credit Used

High credit utilization percentages can lower your score. If you're consistently pushing your cards to their limits, this might be a key reason for your current score.

How to Check: Inspect your credit card statements. Are you frequently maxing them out? Strive to keep the balances low in relation to your limit to improve your score.

Age of Credit

A short credit history can potentially pull down your score.

How to Check: Scrutinize your credit reports to estimate the oldest, newest, and average age of your accounts. Reflect on whether you have recently inaugurated new accounts.

Credit Mix and Fresh Credit

Maintaining a diverse range of credit types and handling new credit responsibly contributes to a healthier credit score.

How to Check: Analyze your variety of credit accounts, such as credit cards, retail accounts, installment loans, and mortgages. Reflect on whether you have applied for new credit with a disciplined approach.

Public Records

Public records like bankruptcies, tax liens, or civil judgments can significantly lower your score.

How to Check: Inspect your credit report for any public records. Deal with any records that require addressing.

How Do I Improve my 654 Credit Score?

Having a credit score of 654 falls under the ‘fair’ category. While it’s not disastrous, there’s a clear path to improvement. Let’s look at the most effective steps specifically for your current situation:

1. Concentrate on Payment History

Ensure you’re making all your repayments on time. Creditors may not report a late payment to credit bureaus until it’s at least 30 days overdue, so take care of any late payments immediately.

2. Reduce Overall Debt

You need to decrease your ratio of credit card debt to credit limit. Target to reduce your balance to less than 30% of your limit. This will free up available credit and show creditors you’re not consistently maxed out.

3. Opt for a Secured Credit Card

If you’re not approved for a regular credit card, consider a secured credit card. It demands a cash collateral deposit, and responsible use of the secured card can help in boosting your credit.

4. Pursue Credit-Cardholder Status

See if someone you know with good credit would be comfortable adding you as an authorized user to one of their existing credit cards. This would attribute their credit habits to your credit history, thereby potentially improving your credit score.

5. Mix Your Credit Usage

Having a mix of different types of credit, like credit cards, retail accounts, or loans can improve your credit score. As your score improves, consider diversifying your credit portfolio by responsibly opening and managing new credit accounts.