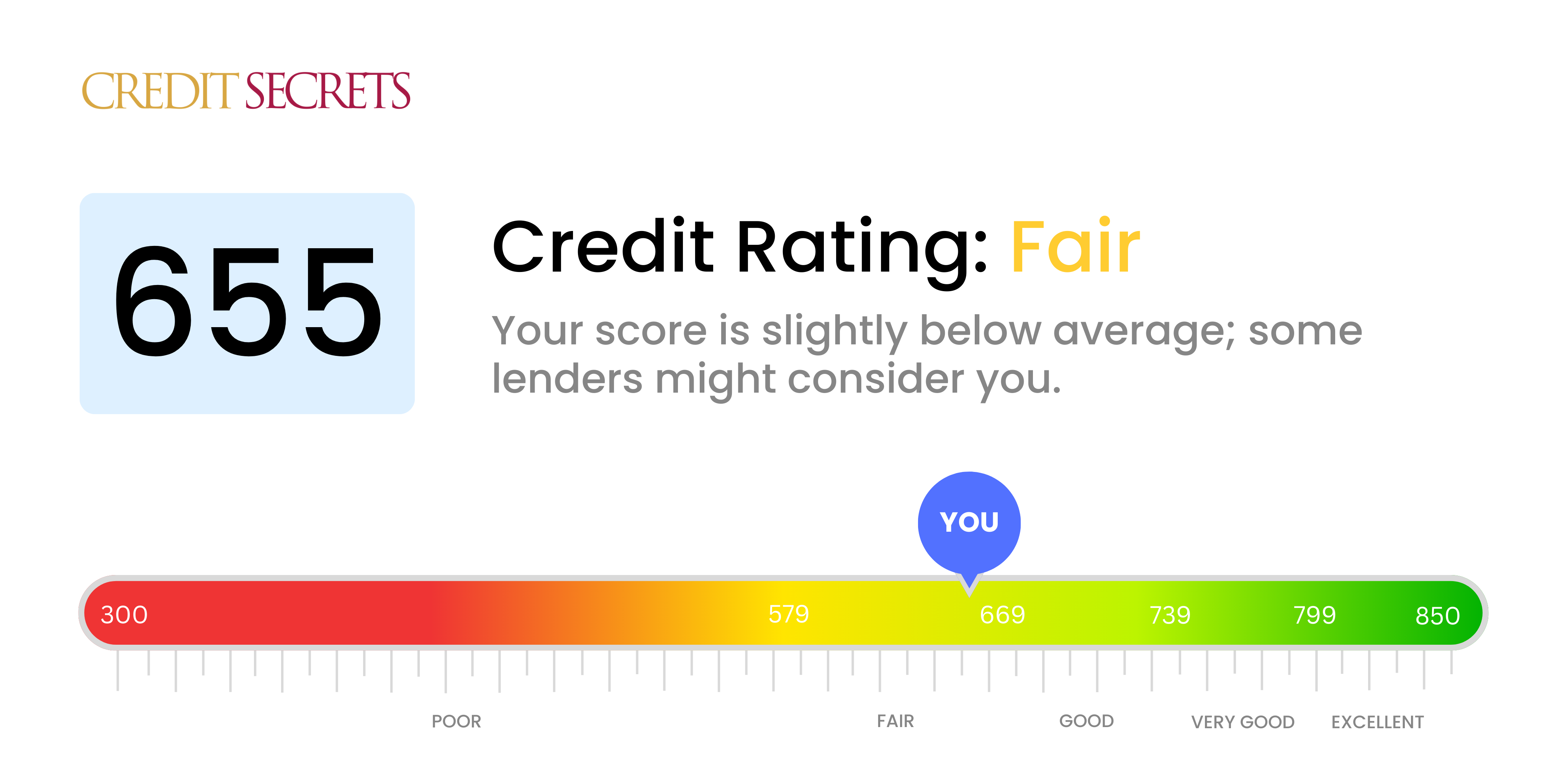

Is 655 a good credit score?

Your credit score of 655 falls into the 'Fair' category. With this score, you may face somewhat challenging conditions when seeking new credit or loans, but don’t lose hope—there are paths to improve your score and progress towards your financial goals.

Typically, a score of 655 may mean you're hit with higher interest rates and less favorable terms for new credit. However, there are numerous resources and strategies available that can help you increase this score over time. Be sure to always make payments on time, reduce your debt, and avoid applying for new credit frequently. Lowering your credit utilization can greatly enhance your score; you're on your way to the 'Good' credit category, and that's something to look forward to!

Can I Get a Mortgage with a 655 Credit Score?

With a credit score of 655, you may encounter some challenges in the process of seeking a mortgage approval. This score is a bit lower than what most lenders typically prefer, implying that your credit history might have a few blemishes. This does not, however, mean that you are ineligible for a mortgage.

Your options might be more limited, and lenders might offer you higher interest rates compared to individuals with excellent credit scores. Therefore, it's crucial to shop around and compare different mortgage options to find the most favourable rates. It's also important to remember that your credit score isn't the only factor lenders consider. A steady income and a low debt-to-income ratio can significantly boost your chances of mortgage approval despite having a lower credit score.

In the meantime, continue making timely payments on any outstanding loans and be mindful of your credit utilization. The journey to a better credit score can be a slow and steady race, but every bit of progress improves your chances of obtaining a more favorable mortgage in the future.

Can I Get a Credit Card with a 655 Credit Score?

With a credit score of 655, chances of securing a credit card approval is fairly achievable. This score is viewed as fair or average by most lenders, which means you're more likely to be eligible for a credit card compared to someone with a lower score. Nevertheless, this does not mean all types of credit cards will be in your reach. It's crucial to remain realistic about your options while maintaining optimism about your financial progress.

Given this credit score, considering a secured credit card or a basic unsecured credit card is a good option. A secured card requires a deposit that serves as your credit limit and can aid in strengthening your credit over time, while an unsecured card will generally have higher interest rates but doesn't require any deposit. Prudent usage of these cards—meaning, keeping balance low and paying on time—can further improve your credit score and open doors for more premium card options in the future. Always remember, every step taken now towards enhancing your credit health is a move in the direction of great financial success.

With a credit score of 655, your chances of being approved for a personal loan will depend largely on the lender. Many lenders consider a score below 670 to be subprime, which signals to them that you may present a higher risk. This is neither a guarantee of rejection or approval, but it can make the application process more challenging.

If approved, lenders typically compensate for this risk by issuing loans with higher interest rates or less favorable terms. These terms could include a shorter repayment period or additional fees. Further, the loan application process may require more documentation, such as proof of stable income, to bolster your case for loan approval. Always make sure to read and understand all of the terms of your loan agreement before signing, to avoid any future surprises.

Can I Get a Car Loan with a 655 Credit Score?

With a credit score of 655, securing approval for a car loan might not be a walk in the park, but it doesn't mean it's impossible. Ideally, lenders gravitate towards scores above 660 to ensure a satisfactory borrowing experience. A score of 655 falls just below this benchmark, which potentially translates to higher interest rates or in some cases, a denial of the loan. This heightened interest rate occurs because a lesser score indicates a potential risk to lenders based on your past credit history.

Don't lose hope, though. There are lenders who specialize in handling cases with less-than-perfect credit. However, bear in mind these loans usually come with elevated interest rates to offset the lenders' risk. It's definitely not a dead-end, but expect a slightly bumpier road when negotiating terms for your car loan. Keep in mind to carefully assess the fine print, and secure terms that suit your financial situation, making sure your car purchasing plan remains viable.

What Factors Most Impact a 655 Credit Score?

Understanding a credit score of 655 is key to establishing a plan to increase your credit rating. There may be a few elements that contributed to this score, and understanding them can assist you in forging a healthier financial path.

Credit Utilization

Your credit utilization ratio, or the amount of credit you're using relative to your total available credit, could be influencing your score. If the balances on your credit cards are high, this could be a factor in your score.

How to Check: Review your credit card statements. Are your balances approaching the maximum limits? The lower your credit utilization, the better it is for your credit score.

Payment History

Your payment history can have a significant impact on your credit score. If you've consistently had late payments, this may have lowered your score.

How to Check: Examine your credit report for any late payments or defaults. Reflect on any past delayed payments as they could significantly affect your score.

Length of Credit History

The length of your credit history might be affecting your score. Sometimes, a shorter credit history can lead to lower scores.

How to Check: Look at your credit report to evaluate the age of your oldest and newest accounts. Contemplate on whether you've recently opened multiple new accounts which could affect your score negatively.

New Credit Inquiries

Constant applications for new lines of credit might adversely impact your credit score. Each credit inquiry can lower your score by several points.

How to Check: Review your credit report for recent credit inquiries. Minimize the number of inquiries and avoid applying for new credit unless absolutely necessary.

Credit Mix

A balance between revolving credit (like credit cards) and installment loans (like car loans) can improve your credit score.

How to Check: Evaluate your mix of credit types. Are you overly reliant on one type of credit? Diversifying can have a favorable impact on your score.

How Do I Improve my 655 Credit Score?

A credit score of 655 is in the fair range, which means there may be some limitations to the financial opportunities available to you. However, by taking planned actions, you can enhance it to a good range. Here are some specific strategies catered to a score at your level:

1. Scrutinize Credit Report Mistakes

Minor mistakes in your credit report can impact your credit score. It’s important to ensure your outstanding debts, payments, credit limits, and personal information are accurate. If you spot any errors, petition for a dispute immediately.

2. Maintain Low Credit Utilization

Continually utilizing a high percentage of your available credit can negatively influence your credit score. Making an effort to keep your utilization below 30% of your credit limit will signal responsible credit usage to lenders and positively affect your score over time.

3. Opt for Installment Loans

Installment loans like personal, auto, or home loans can enrich your credit mix and show lenders your capability to manage different types of credit responsibly. Aim for loans with manageable terms and make certain to make timely payments.

4. Make Timely Payments

Your payment history plays a crucial role in your credit score computation. In order to boost your credit score, focus on making all your bill payments on time.

5. Limit Credit Inquiries

Each new credit application results in a hard inquiry, which may lower your credit score. Whether you are applying for a credit card, auto loan or home loan, try to limit new applications and inquiries.