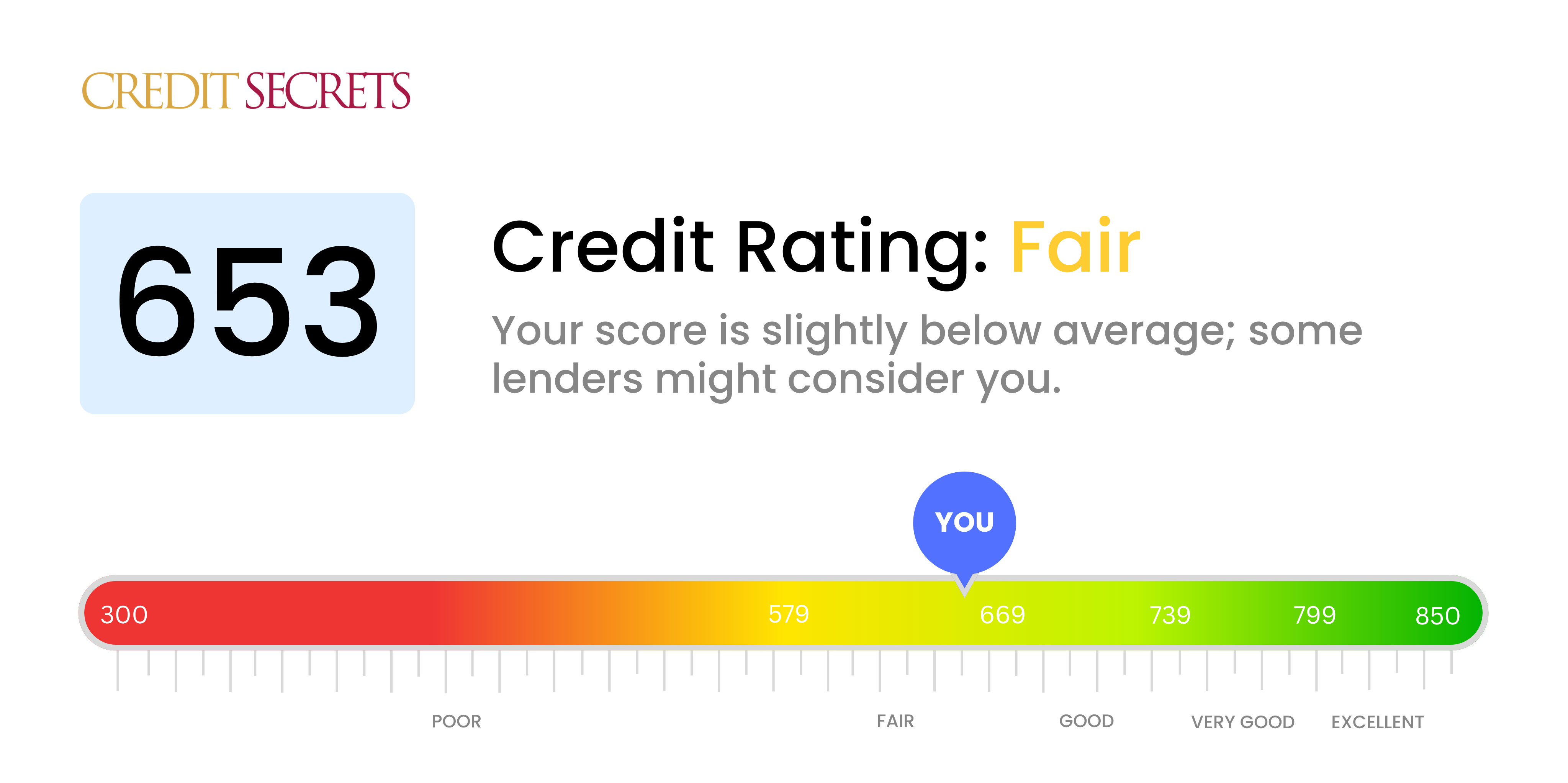

Is 653 a good credit score?

Your score of 653 falls into the 'Fair' category of credit scores. It isn't considered bad per se, but there's definitely room for improvement.

With this score, it's possible you might face slightly higher interest rates or have fewer credit options when compared to those with scores in the 'Good' to 'Excellent' range. But don't get disheartened! By following proven strategies, you could improve your credit score over time and move towards a stronger financial future.

Can I Get a Mortgage with a 653 Credit Score?

If your credit score stands at 653, securing a mortgage approval may prove a bit challenging. While this score isn't extremely low, it's often considered "fair" - a few steps below the "good" and "excellent" ranges that most lenders prefer. Usually, lending institutions look for scores above 700. Your chances of approval inherently aren't zero, but they might be lower than for someone with a higher score.

Your score of 653 might result in higher interest rates than those offered to borrowers who have better credit. This is because lenders may think you represent a higher risk of default. It is critical for you to understand the full financial picture before making a decision to apply for a mortgage. Consider alternatives like waiting and improving your score, or exploring programs that assist borrowers with fair credit. Remember, your current score is only temporary and certainly capable of improvement.

Can I Get a Credit Card with a 653 Credit Score?

Having a credit score of 653 may strike you as less than ideal, but don't get disheartened quite yet - you may still have a pretty decent chance of being approved for a credit card. Keep in mind, though, that the types of cards you're eligible for may be more restricted. The higher the score, the more options you have.

With your current score, it's reasonable to aim for standard credit cards. Avoid aiming too high for premium travel cards just yet, as they typically require higher scores. Secured cards or starter cards could be solid options to consider, as they are designed for those with less-than-stellar credit and can help foster responsible credit habits. An important factor to take into account is the interest rate. It's highly possible that the rates offered to you may be on the higher side due to your score, so it's crucial to stay mindful of this. Remember, each credit journey is unique, and the goal is progress, not perfection.

With a credit score of 653, your chances of being approved for a traditional personal loan may be limited. This score falls below the range which many traditional lenders regard as a minimum requirement. From a lender's perspective, a credit score of 653 represent a higher lending risk. However, every situation is unique, and it's important to understand the ramifications of your current credit score.

While traditional loan options may be limited, other alternatives could be explored. Secured loans may be an option, where you can back up your loan with a form of collateral, or you could opt for a co-signed loan, which would require someone with a stronger credit score to cosign on your loan. Additionally, peer-to-peer lending platforms may offer more lenient credit requirements. It's essential to understand that these alternative options often mean dealing with higher interest rates and perhaps less favorable terms, as lenders adjust for the increased risk.

Can I Get a Car Loan with a 653 Credit Score?

With a credit score of 653, you're on the border when it comes to securing a car loan approval. Most lenders typically consider a score above 660 as favorable, and scores below this threshold may be seen as more risky. Your score of 653 narrowly falls below this line, and this might cause you to face less favorable loan terms, such as higher interest rates.

That said, you should remember that this does not mean a car loan is out of reach. Some auto loan lenders specialize in working with individuals whose credit scores may be just below the standard benchmark. Proceed carefully, however, as these loans often carry higher interest rates due to the additional risk perceived by the lenders. It always pays to thoroughly understand the terms before taking on a loan. Despite your current credit score, owning a car is still a viable possibility with careful financial planning.

What Factors Most Impact a 653 Credit Score?

Comprehending a credit score of 653 is essential for making informed financial decisions and enhancing your credit health. Here are some factors that could be impacting your credit score.

Credit Card Utilization

How much of your available credit you're using can hugely influence your score. Higher ratio might lower your score. Your 653 score may suggest that your cards are frequently near their limits.

Action to Take: Analyze your credit card statements and check whether your balances are nearing your credit limits. Try to keep them low to improve your score.

Payment Track Record

Paying bills on time is paramount for a good score. If there are late or missed payments, they could be the reason for your current 653 score.

Action to Take: Check your credit report for any late payments and strive to ensure all future payments are timely.

Credit History Length

The duration of your credit history might be affecting your score. Brief history often results in lower scores.

Action to Take: Assess your credit report to gauge the length of your credit history. Resist closing old accounts, as they contribute to your history.

Diversity in Credit Types

Only having one type of credit, such as credit cards only, might affect your score. Diverse credit types can better your score, indicating to lenders that you can handle different forms of credit.

Action to Take: Investigate your credit mix to see if it lacks diversity, but remember to borrow responsibly.

Public Records

Public records such as defaults or bankruptcies can play a significant role in lowering your score.

Action to Take: Review your credit report to identify and address any public records that could be impacting your score.

How Do I Improve my 653 Credit Score?

A score of 653 is considered “fair,” but there’s room for improvement. Tailored actions will certainly help boost your score. Let’s review the most suitable actions you can take:

1. Timely Payments

Making timely bill payments is essential. If you’ve missed payments, make a plan to catch up as soon as possible. Your payment history greatly influences your credit score.

2. Limit Unnecessary Credit Inquiries

Each time you apply for a new credit, your score drops a few points. Limit your applications for new credit lines, and only inquire for credit when it’s absolutely necessary.

3. Get a Credit-Builder Loan

You could consider a credit-builder loan. These are loans made with the specific purpose of building credit. Your consistent, on-time payments to this loan will be reported to credit bureaus, positively impacting your credit score over time.

4. Limit Credit Card Utilization

High balances on credit cards can indicate risk, thereby affecting your credit score negatively. Try to keep your credit card balances below 30% of the credit limit.

5. Review Your Credit Report

Ensure the accuracy of your credit report. Mistakes happen and something as minor as a reporting error can affect your score. If you find inaccuracies, dispute them directly with the credit bureau.

Rest assured, consistent application of these steps will help improve your score over time.