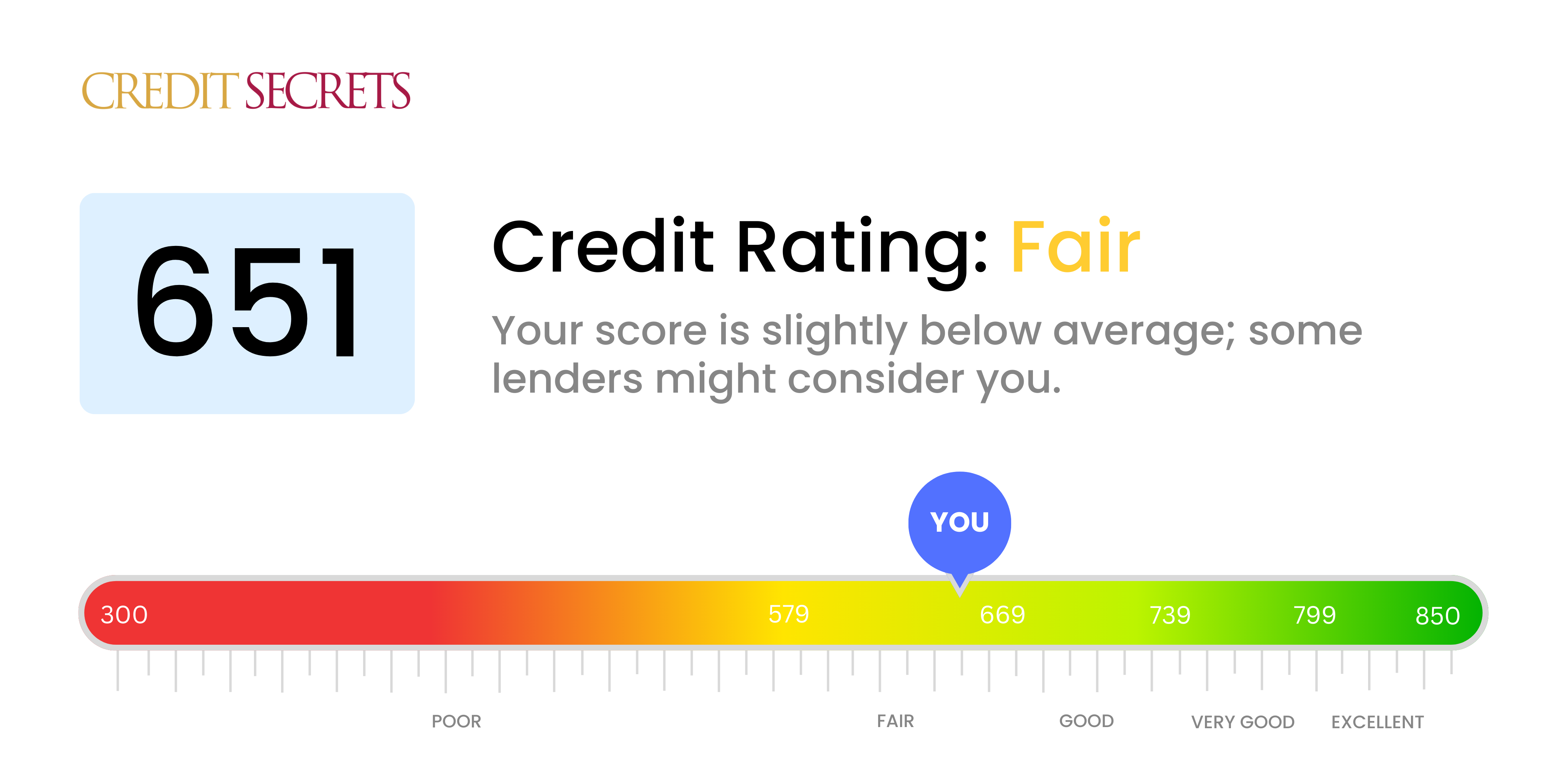

Is 651 a good credit score?

Your credit score of 651 falls into the 'Fair' category. This might not be the ideal score, but it's a stepping stone to improving your credit health.

While you might face some limitations, like potentially higher interest rates or less favorable terms on credit cards and loans, it certainly doesn't mean that you are out of options. There are many ways to enhance your credit score, and with persistent efforts, you can move up into the 'Good' or even 'Very Good' range. Remember, a blend of responsible credit management and healthy financial habits can play an instrumental role in boosting your creditworthiness.

Can I Get a Mortgage with a 651 Credit Score?

If your credit score is at 651, it may prove difficult for you to attain approval for a mortgage. Facing this score means you are on the border between poor and fair credit, which can make lenders hesitant. Many traditional lenders prefer scores over 700, ensuring they lend to borrowers who demonstrate a consistent history of sound financial decisions, timely payments, and responsible credit usage. This does not mean securing a mortgage is impossible, but it may involve a more challenging process and potentially higher interest rates due to the increased lending risk.

In confronting this situation, your focus should be on making consistent and timely payments on current credit and reducing debt. This will not deliver instant results, but over time, it will construct a stronger credit history and gradually improve your score. Also, while you work on improving your score, you might consider investigating alternative financing options such as FHA loans, which typically have more flexible credit requirements. Endeavor to be patient and tenacious as you aim for your financial goals.

Can I Get a Credit Card with a 651 Credit Score?

A credit score of 651 is considered fair; you might be approved for some credit cards, but it can be a bit of an uphill climb. Lenders are often cautious about these scores as they suggest occasional difficulties managing credit. Embracing this reality can be challenging, yet it's crucial to remember, gaining awareness of your financial situation is an important step on the path to healthier financing.

Given you may have a harder time being approved for top-tier credit cards, research cards that cater to fair or average credit. Secured credit cards are a possible option, where a security deposit acts as your credit limit, providing an opportunity to strengthen your credit score over time. Alternatively, consider starter cards that have lower credit requirements but often higher interest rates due to the lender's perceived risk. Patience and perseverance are going to be your best allies towards improving your financial standing.

With a credit score of 651, your chance of securing a personal loan is on the edge. Generally, a score above 670 is considered 'good' by many lenders. However, don't feel disheartened. This does not automatically preclude you from loan approval; it just means the path forward may be slightly more challenging. You'll likely face stricter requirements and potentially higher interest rates, as lenders view a score below 670 as a sign of potential risk.

The personal loan application process for someone with a credit score of around 651 may involve a more thorough examination of your financial background and history. Lenders will scrutinize your repayment capacity, other debts, and income sources more closely. Expect to see slightly higher interest rates than those with better credit scores. Looking at options and lenders thoroughly can help you find the best terms and rates available to you. Remember, every lender is different and has its own criteria, so don’t get discouraged. It's not easy, but it is achievable.

Can I Get a Car Loan with a 651 Credit Score?

With a credit score of 651, the chances of getting approval for a car loan are not as bright as you might hope. Alternately, it's also not the end of the road for your car dreams. Lenders usually prefer scores above 660 for ideal interest rates. A score of 651 falls just shy of this desired range, indicating a higher risk for potential lenders, which may result in higher interest rates or even loan denial.

Nonetheless, a credit score of 651 doesn't strictly close all avenues for securing a car loan. There are lenders out there who cater to applicants with slightly lower credit scores. Bear in mind, these loans may carry steeper interest rates due to the increased perceived risk. It's important to scrutinize the loan terms thoroughly, looking out for any potential pitfalls. Careful planning and understanding of terms can navigate your way to securing a car loan despite a less-than-perfect credit score.

What Factors Most Impact a 651 Credit Score?

Navigating a credit score of 651 is a crucial step on your path to financial progress. Identifying and rectifying the elements impacting your score can open the doors to stronger and healthier financial habits. Remember, every individual's financial journey is distinct, with potential for growth and learning at every step.

Prior Payment Patterns

Your history of paying bills on time has a significant influence on your credit score. Any late or missed payments could be key factors to your current score.

Guidance on Checking: Scrutinize your credit report for any delinquencies or defaults. Think about any instances where payments may not have been made on time, which could impact your score.

Credit Utilization Ratio

Your score can get negatively impacted with high credit utilization. If you're consistently maxing out your credit cards, it could be hurting your score.

Guidance on Checking: Review your credit card statements. Are you consistently nearing your credit limit? Strive to keep your balances low to improve your score.

Duration of Credit History

Holding credit accounts for shorter periods can bring down your score.

Guidance on Checking: Check your credit report to determine the age of your accounts. Also consider if you have recently opened new credit lines, which can impact your score.

Credit Mix and Accessibility to New Credit

Scoring well on your credit range requires a balanced assortment of credit and responsibly maintaining new credit.

Guidance on Checking: Assess the different types of credit you hold such as credit cards, installment loans, and mortgages. Understand if you have been prudent while applying for new credit.

Credit Inquiries and Public Records

Too many hard inquiries or public records such as bankruptcies could dent your score.

Guidance on Checking: Look at your credit report for any public records or recent inquiries. If you find any discrepancies, work towards rectifying them.

How Do I Improve my 651 Credit Score?

A credit score of 651 is not ideal, but don’t worry, improvement is entirely possible. Below are some immediate steps you can take to start increasing your score:

1. Catch Up on Late Payments

Payments that are late or missed have a considerable negative impact on your credit score. Make these a top priority, and discuss a possible payment plan with your creditors if necessary.

2. Work Towards Lower Credit Utilization

Your credit utilization ratio—how much of your available credit you are using—significantly influences your score. Strive to use less than 30% of your available credit, and work slowly towards achieving a utilization rate below 10%.

3. Consider a Secured Credit Card

A secured credit card, which requires a refundable deposit, might be a good choice for your current score. Use this responsibly, maintaining a low balance and making timely payments, to begin establishing a positive credit history.

4.Request to Be an Authorized User

Being an authorized user on the credit card of a trusted person with good credit can give your score a boost. Check to ensure the card issuer shares authorized user data with the credit bureaus.

5. Explore Different Credit Types

Having a mix of credit types—like a car loan, mortgage, or retail card—in addition to a credit card can help your score. Remember to manage any new credit responsibly.