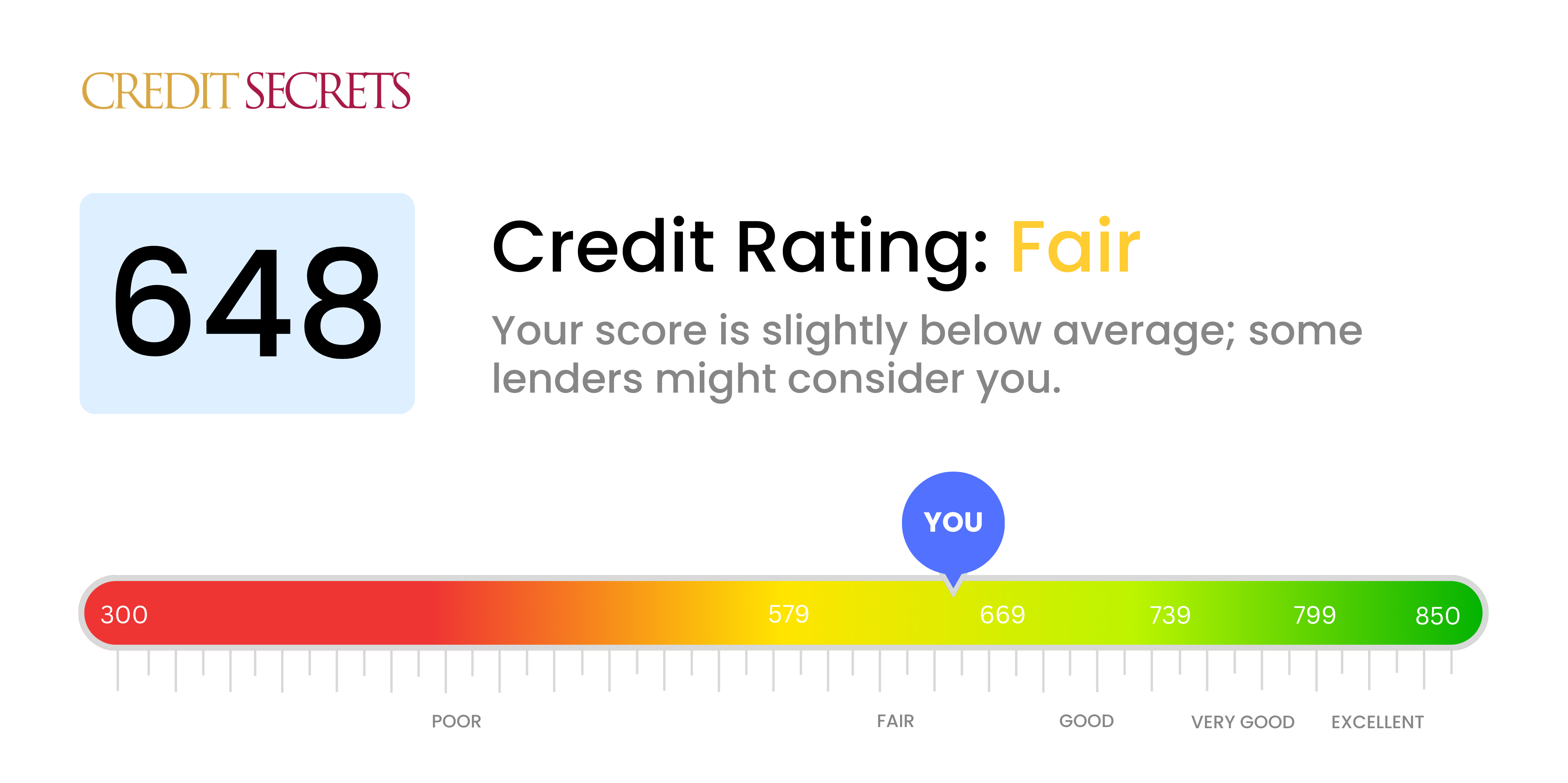

Is 648 a good credit score?

Having a credit score of 648 puts you in the 'fair' category. This isn't the highest tier, but you can still access a reasonable range of financial options, although the terms might not be as ideal as with a higher credit score.

With a 648 credit score, it's likely you'll qualify for some types of credit, such as car loans and credit cards, but you might not get the most favorable interest rates. It's a good time to focus on steps to improve your score, from paying bills on time, to carefully managing debt levels, and regularly checking your credit reports for errors. Remember, improving your credit score is a journey, and every step you make towards financial health is a step in the right direction.

Can I Get a Mortgage with a 648 Credit Score?

With a credit score of 648, obtaining a mortgage can be challenging, though not impossible. This score is considered fair, but it does fall short of what most lenders categorize as good or excellent. Your credit score is a reflection of your financial history, and this mid-range score may suggest you've had some past difficulties in managing your credit.

The implications of this score extend beyond mortgage approval, affecting your interest rates as well. Typically, the lower your credit score, the higher the interest rate on your mortgage. However, do not feel discouraged. There are options such as FHA loans, specifically designed for individuals with lower credit scores. These loans often come with competitive rates and more lenient approval criteria. Persist in maintaining timely payments and conscientious credit usage. Through diligent effort, you can elevate your credit rating and improve your financial opportunities. Remember, every effort toward better financial health counts, no matter how small.

Can I Get a Credit Card with a 648 Credit Score?

With a credit score of 648, it's possible but not guaranteed that you'll get approved for a credit card. Lenders typically view this as a fair credit score, which means there may have been some financial mishaps in the past. It's important to handle this reality with understanding and patience as awareness is always the first step towards improvement.

While there could be some limitations with this credit score, you're not entirely out of options. Some potential options are secured credit cards, which require a security deposit that typically determines your credit limit. Starter credit cards might also be accessible as they are designed for those seeking to build or improve credit. Just bear in mind that interest rates may on the higher side as lenders compensate for the risk they are taking on. Keep in mind, these options don't offer an instant solution, but they're valuable stepping-stones towards attaining your financial goals.

A credit score of 648 falls into the 'fair' category, and may present some challenges when applying for a personal loan. Lenders typically favor scores over 700 and might see a score below that as somewhat risky. This could mean it may be more difficult for you to receive loan approval from traditional lenders. It's a tough pill to swallow, but it's important to comprehend the impact this score can have on your loan application.

If you are unable to secure a loan via traditional means, some alternative options could be available. You may wish to explore secured loans, which involve offering collateral, or finding a co-signer with a significantly higher credit score to vouch for you. Peer-to-peer lending platforms could be another possibility, though they might come with higher interest rates, given that they represent a higher risk to the lender. Nonetheless, it is a commendable step to think about your credit score and how it impacts your borrowing abilities.

Can I Get a Car Loan with a 648 Credit Score?

With a credit score of 648, there is potential for getting approved for a car loan, however, it might be a little challenging. Most lenders ideally prefer scores above 660 as they consider this threshold a safer lending bet. Your score, being below this, may fall into a category commonly referred to as 'subprime'. This suggests to the lender that there could be a higher risk, mostly based on past credit behavior and repayment habits.

Nevertheless, this score doesn't necessarily mark the end of your car buying journey. There are lenders who can consider lending to individuals with less than perfect scores, but bear in mind these loans may come with higher interest rates. These rates reflect the calculated risk that lenders consider when loaning to lower scoring individuals. Although it can seem daunting, with diligent assessment of the loan conditions and commitment to the repayment terms, owning a car is still very much a realistic ambition.

What Factors Most Impact a 648 Credit Score?

Gauging the implications of a 648 credit score is an essential step on your path to financial well-being. Recognizing and dealing with the factors causing this score can set the groundwork for a more robust financial future. Remember, each financial path is unique, brimming with opportunities for growth and learning.

Consistency of Payments

Consistency in payment is a major influencer of your credit score. Frequent tardy payments or non-payments may very likely be a crucial element that's impacting your score.

How to Verify: Examine your credit report for any inconsistent or late payments. Revisit any occasions of missed or delayed payments, they are likely having an impact on your score.

Credit Utilization Ratio

High utilization of your available credit can adversely affect your score. If you are consuming a major chunk of your credit limits, this might be a contributing factor.

How to Verify: Review your credit card statements. Are your balances nearing the limits? It's advisable to maintain balances that are low relative to your credit limit.

Duration of Credit History

A limited credit history may negatively impact your score.

How to Verify: Check your credit report to determine the duration of your oldest and newest accounts and the average duration of all your accounts. Contemplate if you've recently opened fresh accounts.

Variety in Credit and New Credit Accounts

Holding and managing a range of credit types responsibly is crucial for a solid score.

How to Verify: Assess your blend of credit accounts such as credit cards, installment loans, retail accounts, and mortgage loans. Reflect on whether you've been careful in seeking new credit.

Public Records

Public records like bankruptcies or tax liens can heavily impinge on your score.

How to Verify: Review your credit report for any notable public records. Address any listed items that may require attention.

How Do I Improve my 648 Credit Score?

A credit score of 648 is near the border of fair and poor ratings, but with focused effort, you can lift it into the good range. Here are the most relevant and impactful strategies for improving your score from this level:

1. Pay Attention to Payment Due Dates

Timely bill payments play a crucial role in moving your credit score upwards. Ensure that none of your payments are late. Set reminders or automate your payments if it helps. Even paying a few days late can have a negative impact.

2. Keep a Check on Credit Card Usage

Using too much of your available credit on your credit cards can drag down your credit score. Try to keep your card utilization below 30% of your total credit limit, and ideally, aim for less than 10%.

3. Seek a Credit-Builder Loan

If you’re finding it tough to get a regular credit card, a credit-builder loan might be an option. These loans are specifically designed to help build credit, with loan amounts typically held in a deposit account until you’ve made all your payments.

4. Consider Being an Authorized User

Ask a friend or family member with a good credit history if you can be added as an authorized user to their account. This can positively impact your credit score as their responsible usage reflects into your credit report.

5. Explore a Variety of Credit

Your credit mix can have an impact on your score. Once you’ve established a solid payment history, consider different types of credit, such as an installment loan or a retail card, as long as you can manage them responsibly.