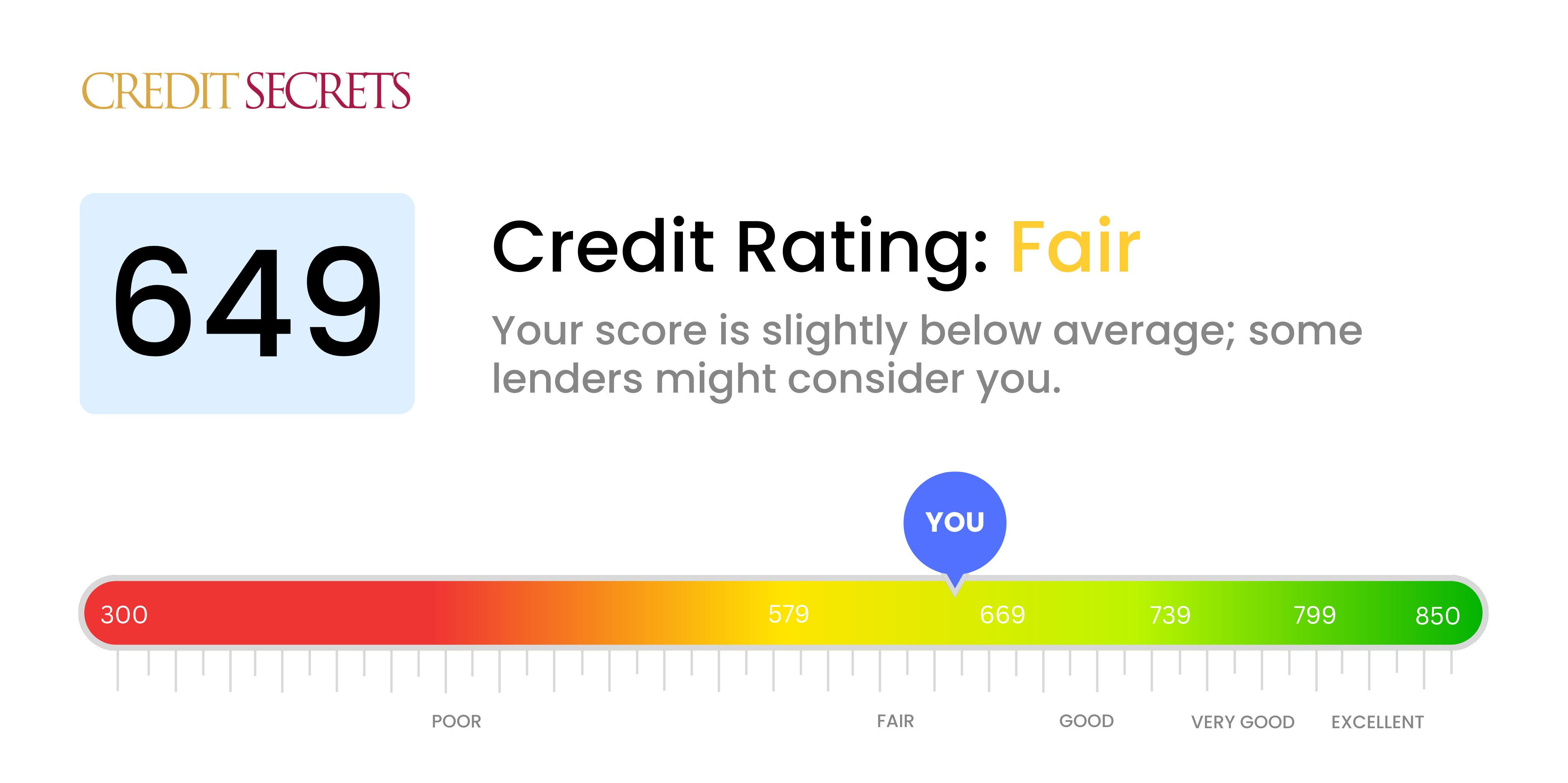

Is 649 a good credit score?

With a score of 649, your credit falls into the 'Fair' category. It's not in the desirable 'Good' range, but it's certainly not the lowest either, so while there's definitely room for improvement, you're not starting from the bottom.

If you wish to apply for credit or loans, a score of 649 may not secure you the best rates going, but you won't be completely locked out of borrowing opportunities. It's worth noting that small, consistent actions can help strengthen your credit score over time. You're on the right path, and with careful management and responsible credit habits, you can elevate your score from 'Fair' to 'Good' or even 'Very good'.

Can I Get a Mortgage with a 649 Credit Score?

Having a credit score of 649 may present some challenges in securing a mortgage. Lenders generally prefer scores above 700 as it reflects a more reliable credit history. However, don't lose heart just yet. Having a score in this range doesn't automatically exclude you from getting a mortgage, but the terms of your mortgage might be less favorable.

A lower credit score often equates to higher interest rates on your mortgage. The reasoning behind this is that lenders consider borrowers with lower scores a greater risk. While this may seem daunting, you do have alternatives at your disposal. Government-backed loans, like an FHA loan, are often an option for those with lower credit scores. Their requirements are usually more flexible, but they do come with their own stipulations. Stay positive, continue making timely payments to bolster your credit score and explore all available mortgage options, as the ideal one may still be within reach.

Can I Get a Credit Card with a 649 Credit Score?

Having a credit score of 649 may place a slight barrier in your path to securing a traditional credit card. Although it's not the lowest, lenders might still perceive a certain level of risk associated with this score. Being aware of this reality is crucial and represent a step forward in your journey towards financial betterment. It's not an easy truth to face, but understanding your financial situation is important.

To overcome this hurdle, consider other types of credit cards suited for your score. Secured credit cards can be a good option, as they require a deposit that acts as your credit limit and are easier to get. Exploring options with a cosigner or looking at prepaid debit cards can also provide opportunities. These don't fix your credit immediately, but can aid in its gradual improvement. Do be aware, credit options available to those with this score often carry higher interest rates due to the potential risk lenders face. Remember, these alternatives can be stepping stones in your financial journey towards a stronger credit score.

Having a credit score of 649 might limit your options for a traditional personal loan. In lenders' eyes, it doesn't necessarily convey the greatest creditworthiness, hence, leaving your loan approval chances on shaky grounds. This rating is viewed as a riskier proposition by many banks and credit unions. It's an inconvenient situation, but it's important to be upfront about how this score impacts your borrowing possibilities.

Fortunately, several alternatives are within reach even with this credit score. You might look into secured loans, which require collateral, or co-signed loans where someone with a better score stands as your surety. Platforms offering peer-to-peer lending could be another avenue, as they may have more flexible credit requirements. Bear in mind, these alternatives generally carry higher interest rates and less attractive terms due to the increased risk perceived by lenders. Despite the challenges, there are still options available to help you achieve your financial goals.

Can I Get a Car Loan with a 649 Credit Score?

A credit score of 649 is just on the brink of the fair credit range. It's not a hopeless scenario, but it might bring some challenges when seeking approval for a car loan. Typically, lending institutions tend to favor credit scores of 660 and above, considering them a safer bet for timely repayment. Your score of 649 is just a little below this range, which may result in higher loan interest rates or stricter lending terms, because for lenders, this score indicates a slightly higher risk of repayment.

That being said, don't let this deter you from pursuing your goal of car ownership. There are a number of lenders who offer loans to those with mid-range credit scores like yours. These deals may carry higher interest rates to offset the potential risk, but car ownership is by no means out of your reach. The process may be a bit more complicated, and necessitate close scrutiny of the loan terms, but with a careful approach, purchasing that car is entirely achievable.

What Factors Most Impact a 649 Credit Score?

Demystifying a credit score of 649 is a vital step towards financial progression. Unravelling the factors behind your score can lead the course to a promising financial horizon. Remember, monetary growth is a personal and unique journey filled with lessons.

Credit Utilization

Your credit utilization could be one of the factors influencing your credit score. High credit utilization can bear heavy on your score. If your credit utilization is near its peak, it could be the reason behind your 649 score.

How to Check: Inspect your credit card statements. If your balances are nearly touching the limits, it could be a key issue. Try to maintain balances as low as possible against the credit limit.

Outstanding Debts

Any outstanding debts can pose a significant impact on your credit score. If you have any unpaid loans or bills, it might be negatively affecting your score.

How to Check: Look into your financial history and analyze if any outstanding debts exist. Address these debts to progressively improve your credit score.

Recent Credit Inquiries

Frequent credit inquiries can lower your score. If you have recently applied for several loans or credit cards, this could explain your score of 649.

How to Check: Review your credit report and take note of any recent credit applications. Try to limit frequent credit inquiries for a better score.

Length of Credit History

A short credit history might be pulling your credit score down. The age of your oldest and newest accounts and the average age of all your accounts can influence your score.

How to Check: Assess your credit report carefully to understand the length of your credit history. Try not to open new credit accounts frequently.

How Do I Improve my 649 Credit Score?

Your credit score of 649 is deemed fair, but don’t worry—there are several tactical steps you can take to enhance your score:

1. Clear Outstanding Balances

Firstly, center your attention on clearing any outstanding balances. Chipping away at overdue debts can have a positive effect on your credit score. If possible, negotiate with your lenders for a feasible payment plan to help you slowly dissolve debts.

2. Keep Utilization Rate Low

Keeping a low balance on your credit cards compared to the credit limit greatly optimizes your credit score. Aim to keep your utilization rate below 30%, and even further towards 10% if you can manage, focusing on those cards with the largest utilization rates.

3. Opt for a Secured Credit Card

Your current score could make it challenging to obtain a regular credit card. A secured credit card could be a practical solution, as it sets your credit line to the amount of cash deposit you put down.

4. Enlist as an Authorized User

Find a friend or relative with a solid credit score and ask if you can become an authorized user on their credit card. This can aid your credit score, as their good payment history will reflect on your credit report.

5. Explore Different Credit Types

Diversifying the types of credit you avail can contribute to a positive credit score. Once you’ve established a dependable payment pattern with a secured card, consider other credit accounts like retail credit cards.